The following information applies to the questions displayed below.

The December 31, 2021, unadjusted trial balance for Demon Deacons Corporation is presented below.

Debit $ 8,400 13,400 5,280 2,400 Accounts Credit Cash Accounts Receivable Prepaid Rent Supplies Deferred Revenue Common Stock Retained Earnings Service Revenue Salaries Expense 1,400 11,000 4,400 39, 680 27,000 $56,480 $56,480 At year-end, the following additional information is available

1. The balance of Prepaid Rent, $5,280, represents payment on October 31, 2021, for rent from November 1, 2021,

2. The balance of Deferred Revenue, $1,400, represents payment in advance from a customer. By the end of the .

3. An additional $700 in salaries is owed to employees at the end of the year but will not be paid until January 4

4. The balance of Supplies, $2,400, represents the amount of office supplies on hand at the beginning of the year to April 30, 2022 year, $350 of the services have been provided. 2022 of $900 plus an additional $1,500 purchased throughout 2021. By the end of 2021, only $640 of supplies remains.

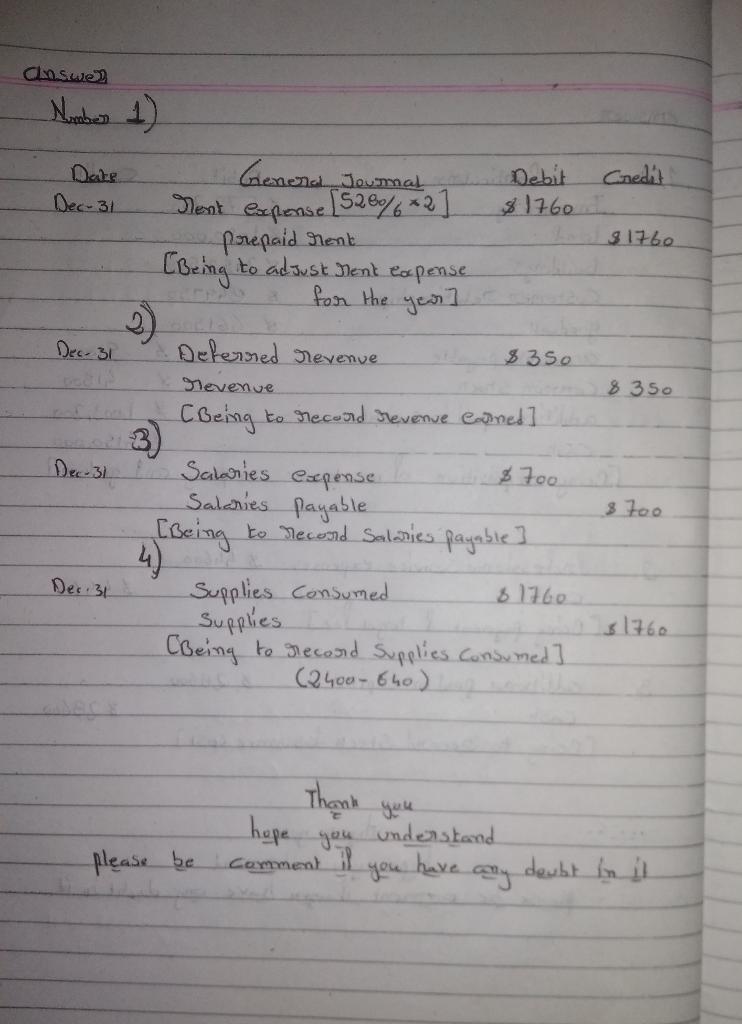

Answers

Find the given attachment

Related Questions

price an investor pays to purchase outstanding bond

Answers

The price an investor pays to purchase an outstanding bond is typically referred to as the "purchase price" or "transaction price." This price is determined by various factors, including the bond's face value, coupon rate, current market interest rates, and the remaining time to maturity.

When a bond is traded on the secondary market, its price may differ from its face value. If the bond's coupon rate is higher than the prevailing market interest rate, the bond may be sold at a premium, meaning the purchase price will be higher than the face value. Conversely, if the coupon rate is lower than the market interest rate, the bond may be sold at a discount, and the purchase price will be lower than the face value.

The purchase price of a bond is influenced by supply and demand dynamics, credit rating changes, economic conditions, and investor sentiment. It is important for investors to consider these factors when determining the price they are willing to pay for an outstanding bond in order to achieve their desired yield or return on investment.

For more such answers on price

https://brainly.com/question/27815322

#SPJ8

Headquartered in San Francisco, California, Fruit Guys delivers fresh, organic fruits and other specialty food items to businesses, schools, and homes. The company was founded in 1998 by Chris Mittelstaedt, and prides itself on promoting a healthy lifestyle and a sustainable business model. The Fruit Guys realized early on that human resources would be a valuable contributor toward their overall success. In developing the business model for Fruit Guys, which set of skills were most important for Chris Mittelstaedt to employ in order to obtain, interpret, and apply information?

Answers

Answer:

The right approach will be "Conceptual skills".

Explanation:

Those would be the skills needed for the creation of critical as well as effective strategies to consider challenging or dynamic scenarios.There is the need to comprehend certain topics such as human resources, economics, logistics, marketing as well as risk assessment enough for fruit guys to develop the corporate structure. By learning these principles, a corporation model was constructed.Thus, Conceptual abilities or abilities are important.

7. Adverse selection is a problem associated with equity and debt contracts

arising from

Answers

Adverse selection is a problem associated with equity and debt contracts arising from. (a) the lender's relative lack of information about the borrower's potential returns and risks of his investment activities

Cost Concept

On February 3, Clairemont Repair Service extended an offer of $87,000 for land that had been priced for sale at $100,000. On February 28, Clairemont Repair

Service accepted the seller's counteroffer of $95,000. On October 23, the land was assessed at a value of $143,000 for property tax purposes. On January 15

of the next year, Clairemont Repair Service was offered $152,000 for the land by a national retail chain.

At what value should the land be recorded in Clairemont Repair Service's records?

Answers

The land should be recorded at the purchase price of $95,000, as that is the amount that Clairemont Repair Service ultimately paid for the land.

What criteria determines the recorded purchase price of the land?Even though the property tax assessment of $143,000 may seem like a relevant valuation, it is not directly related to the purchase price or market value of the land. The property tax assessments are often based on different criteria and methodologies than market valuations.

Similarly, the subsequent offer of $152,000 from a retail chain is not relevant to the value that Clairemont Repair Service should record the land at, as it was made after the purchase and does not reflect the actual value at the time of purchase. Therefore, the most appropriate value to record the land at in Clairemont Repair Service's records is the purchase price of $95,000.

Read more about land cost

brainly.com/question/29608145

#SPJ1

In September, 65,000 units were produced. Prepare the budget report using flexible budget data, assuming (1) each variable cost was 10% higher than its actual cost in August, and (2) fixed costs were the same in September as in August. (List variable costs before fixed costs.)

Answers

Compared to the budget, actual net income is not favorable. Looking at it does not reveal why the differences arose. As an illustration, were more units sold Was the sale price different from what was anticipated Costs increased. Or did it involve everything said previously

Management needs solutions to questions of this nature. An examination of this budget report reveals that sales were really 17,500 pickup trucks rather than the 17,000 pickup trucks anticipated; the average selling price was $14.80 rather than the anticipated $15.00; and the cost per truck was $11.25 as intended.

What does a Flexible Budget's primary goal entail?An essential management tool is a flexible budget. It aids in determining the anticipated costs, earnings, and profitability of the company.

The flexible budget can also be updated to reflect the actual activity level at the conclusion of the accounting period and utilized for variance analysis because it is not rigid.

Learn more about Flexible Budget , from:

brainly.com/question/16017304

#SPJ1

Polychromasia Company sold inventory costing $30,000 to its subsidiary, Simply Colorful, for double its cost in 2009. Polychromasia owns 80% of Simply Colorful. Simply resold $50,000 of this inventory for $60,000 to outsiders in 2009. How much unrealized profit exists at the end of the year?

a) $20,000

b) $8,000

c) $10,000

d) $5,000

Answers

Answer:

D.

Explanation:

30000 x 2 = 60000

60000 - 50000 = 10000

10000/2

= 5000

What are the primary advantages to choosing a sole proprietorship?

Answers

The primary advantages to choosing a sole proprietorship is that there is no separate legal entity from the ownership.

What is sole proprietorship?Asole proprietorship serves as a type of business which is been owned and controlled by single entity, in this type of business, there is no partnership.

In this type of business, the ownership is the same with the legal identity.

Learn more about sole proprietorship at;

https://brainly.com/question/4442710

#SPJ1

Which of these will cause aggregate demand to shift to the right?

a.

Reducing the spending of the government

b.

Increasing tax rates on salaries and income of consumers

c.

Lowering down interest rates

d.

Importing more products from other countries

Answers

Answer:

B

Consumers will be more likely to boost spending if the change in tax ... For instance, a reduction in income tax rates or increase ... One possibility is that households may not pay full.

Explanation:

Can i have brainliest

The data related to Shunda Enterprises Inc.'s factory overhead cost for the production of 50,000 units of product are as follows:

IVE INCLUDED PHOTOS OF THE FULL PROBLEM

Answers

The total overhead rate is $6

The variable overhead rate is $3.5

The fixed overhead rate is 2.5 per hour

How to solve1. Variable factory overhead controllable variance = standard variable overhead - actual variable overhead

(standard hours x standard rate of variable overhead) - actual overhead

= (76,000 x 3.5) - 263,300

= 2,700 favorable

2. Fixed factory overhead volume variance = absorption rate of fixed overhead x (standard hours - actual hours)

2.5 (76,000 - 75,000)

2500 favorable

3. Total factory overhead cost variance = actual overhead - standard overhead

= (263,300 + 188,800) - (456,000)

= 3900 favorable

Read more about overhead cost here:

https://brainly.com/question/26454135

#SPJ1

How can i make money while i sleep?

Answers

Answer: Start an online business or Start a blog .

Kando company incurs a $9 per unit cost

Answers

There is not enough information or context to solve the question.

Why does the bank generally print the address of the check writer on the upper left-hand corner of the check?

Maria V. Bowen’s Check for $42.92 is dated March 6, 2019. Pay to the order of Credit Card Company.

A. To prevent people from bouncing a check (i.e., a NSF transaction)

B. To contact the check writer if a check bounces.

C. To advertise its products on the front of a check.

D. To prevent people from stealing checks.

Answers

To contact the check writer if a check bounces the bank generally print the address of the check writer on the upper left-hand corner of the check.

Option B is correct

The bank generally prints the address of the check writer on the upper left-hand corner of the check to be able to contact the check writer if a check bounces or is returned due to non-sufficient funds (NSF). By having the check writer's address on the check, the bank can contact the check writer to inform them that the check bounced and to try to resolve the issue.

This also helps the bank to verify the identity of the check writer and to prevent check fraud.

Option B is correct

To know more about Credit Card . here

https://brainly.com/question/26857829

#SPJ1

The time it takes to travel to work is referred to as _____.

overtime

extra time

part time

commute time

(commute time)

Answers

Answer:

The time it takes to travel to work is referred to as commute time.

Explanation:

"Commute" most often means to travel from home to your place of your. So it means the amount of time it takes to go from your home to your job.

what does journalism have you do

Answers

Answer:

yas

Explanation:

Cullumber Company issues $315,000, 20-year, 6% bonds at 102. Prepare the journal entry to record the sale of these bom

2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Account Titles and Explanation

Debit

Credit

Answers

The journal entry to record the sale of the bonds would be:

Debit Cash $321,300

Credit Bonds Payable $315,000

Credit Premium on Bonds Payable $6,300

What is the journal entry?The selling of the bonds generated $321,300 in cash for the corporation [$315,000 x 102%]. The $315,000 face amount of the bonds is credited to the Bonds Payable account.

The Premium on Bonds Payable account is credited with the $6,300 difference between the face value and the total cash received since the bonds were sold at a premium.

So, the entry is:

Debit Cash $321,300

[$315,000 x 102%]

Credit Bonds Payable $315,000

Credit Premium on Bonds Payable $6,300

Learn more about journal entry here:https://brainly.com/question/28390337

#SPJ1

Selected year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31, 2016, were inventory, $51,900; total assets, $209,400; common stock, $81,000; and retained earnings, $54,682.)

CABOT CORPORATION Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income taxes 450,600 297,250 153,350 99,200 4,300 49,850 20,082 $ 29,768 Net income CABOT CORPORATION Balance Sheet December 31, 2017 Liabilities and Equity Assets Cash Short-term investments Accounts receivable, net Notes receivable (trade)* Merchandise inventory Prepaid expenses Plant assets, net Total assets $ 18,000 Accounts payable 18,500 4,600 3,600 9,400 Accrued wages payable 30,600 Income taxes payable 5,500 38,150 Long-term note payable, secured by 65,400 mortgage on plant assets 2,600 Common stock 153,300 Retained earnings 81,000 84,450 $ 257,550 $ 257,550 Total liabilities and equity

* These are short-term notes receivable arising from customer (trade) sales.

Required:

Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.)

Answers

Answer:

jjhujhhhvvvjbvcgyggcvjkj

use a well labelled group to explain why the introduction of maximum prices in the petrol industry will not be an ideal decision for the country's economy??

Answers

Implementing maximum prices in the petrol industry may not be an ideal decision for the country's economy.

Consumer Group:

Implementing maximum prices may initially benefit consumers as it could lead to lower fuel costs. However, it can have negative consequences in the long run. With lower prices, there may be increased demand for petrol, leading to shortages and long queues at gas stations. Additionally, if prices are kept artificially low, it can discourage investment in the industry, hampering exploration, production, and infrastructure development. This could result in limited supply and dependence on imports, potentially leading to fuel shortages and price fluctuations.Business Group:

For businesses in the petrol industry, maximum prices can restrict their ability to cover costs and maintain profitability. Fuel companies have various expenses such as exploration, refining, distribution, and employee wages. If prices are capped, it can lead to reduced profit margins, making it challenging for companies to invest in new technologies, research, and development, which are crucial for improving fuel efficiency and reducing environmental impacts.Government Group:

From a government perspective, implementing maximum prices can have adverse effects on tax revenues. Taxes on fuel sales contribute significantly to government revenue. If prices are capped, tax income will decrease, impacting the government's ability to fund public services and infrastructure projects. It can also limit the government's ability to incentivize renewable energy sources and reduce environmental pollution.Considering these factors, the introduction of maximum prices in the petrol industry may have unintended consequences such as supply shortages, reduced investment, profitability challenges for businesses, and decreased tax revenue for the government. It is crucial to strike a balance between consumer affordability, industry sustainability, and government revenue to ensure a stable and efficient petrol market.

For more questions on prices

https://brainly.com/question/30949914

#SPJ8

Write a short message/email/memo based on the following case scenario - As head of the occupational health and safety committee at your workplace, you are concerned about the practice of stocking employee kitchenettes with free coffee and cookies. Lately, you have begun to notice that stressed out employees routinely skip lunch and instead grab handfuls of cookies to eat at their desks. While you understand the necessity for the quick snacks, you feel that there is room in the budget to provide healthier alternatives to these high-fat, carbohydrate-laden snacks. In fact, your committee voted in favour of this but you feel some employees will resist this and be upset to lose the cookies and coffee. -- Now, write a short message/memo/email to all staff announcing that, effective next month, kitchenettes will be stocked with a selection of fresh fruit, whole-grain snacks, and spring water instead of the usual cookies and coffee. Consider which approach you should use -- direct or indirect -- before you write it.

Answers

Answer:

You know that your not supposed pile your home work on this program? It’s unconstitutional.

Explanation:

Some of the forklifts we use in the distribution centers will have to be replaced in the second quarter of the 2023 financial year, and we have to start thinking about it soon! We always purchased the forklifts outright from available cash resources or funded them by borrowing the required funding from the bank. We have recently learnt that many companies choose to lease their forklifts. These forklifts normally last a good ten years if we take good care of them. Prepare some relevant information that needs to be considered in a decision to lease or purchase?

Report on the following:

● Different options in the market

● Accounting treatment of the options

● Tax implications of the options

● Cost differentials and

● Cash flow implications

What would the correct decision be for the company.

Answers

Different options in the market:

The distribution center has two options when it comes to replacing its forklifts – leasing or purchasing. With leasing, the center would use the forklifts for a specified period, usually a few years, and then return them to the leasing company. On the other hand, purchasing the forklifts will give the center permanent ownership of the forklifts.

Accounting treatment of the options:

Leasing forklifts is treated as an operating expense that is reflected in the income statement. The lease payments are recorded as expenses over the life of the lease. However, purchased forklifts are treated as a fixed asset that is depreciated over their useful life. The depreciation expense is recognized over several accounting periods on the income statement.

Tax implications of the options:

Leasing forklifts can provide significant tax savings for the business as the lease payments are fully tax-deductible expenses in the financial year they are made. In contrast, depreciation and interest expense for purchased forklifts are deductible over several years, so tax deductions are delayed.

Cost differentials and cash flow implications:

Leasing forklifts would result in lower upfront costs and lower monthly payments compared to purchasing, but the total cost of leasing is typically higher over the long term. In contrast, purchasing requires a substantial upfront payment or a loan, but the total cost is lower over the long term. Cash flow implications of purchasing include funding the entire upfront cost of the forklifts and paying for any maintenance and repairs needed over the lifetime of the forklifts, while cash flow implications of leasing include lower upfront costs but higher monthly payments, which will reduce available cash flow in the short term.

What would the correct decision be for the company:

The company should decide based on its financial situation, long-term business planning, and cash flow requirements. If the company has a limited budget, a short-term need for the forklifts, or requires the latest models frequently, leasing may be a better option. But if the company values ownership, anticipates long-term use or higher utilization, and has the cash resources or access to financing, purchasing may be the more cost-effective option. The decision should consider the financial implications, tax considerations, and cash flow requirements of either option.

Basics Ltd reported current liabilities of R3 000 and a quick ratio of 1,2. The company has current assets of R6 000. If the company reports the cost of goods sold at R4 000 for the given year, what is the inventory turnover?

Answers

The inventory turnover for the given year is 3.33, calculated by dividing the cost of goods sold by the average inventory of R1200.

To calculate the inventory turnover, we first need to determine the inventory value. We can use the quick ratio formula to find the inventory amount.Quick ratio = (Current assets - Inventory) / Current liabilitiesRearranging the formula, we have: Inventory = Current assets - Quick ratio * Current liabilitiesSubstituting the given values, we have:Inventory = R6000 - 1.2 * R3000Inventory = R6000 - R3600Inventory = R2400The inventory value is R2400. To calculate the inventory turnover, we divide the cost of goods sold by the average inventory. In this case, the cost of goods sold is given as R4000. The average inventory is the sum of the beginning and ending inventory divided by 2. Since we don't have information about the beginning and ending inventory, we can assume they are equal, resulting in an average inventory of R2400/2 = R1200.Inventory turnover = Cost of goods sold / Average inventoryInventory turnover = R4000 / R1200Inventory turnover = 3.33Therefore, the inventory turnover for the given year is 3.33.For more questions on inventory

https://brainly.com/question/25947903

#SPJ8

how can I draw the circular flow of Income in an open economy?

Answers

The unending flow of goods and services, income, as well as expenditure in an economy is referred to as the circular flow. It depicts the circular redistribution of income between the production unit and households. Land, labour, capital, as well as entrepreneurship are examples of these.

The circular flow of diagram's outer loop depicts the flow of factor services from households to firms, as well as the corresponding flow of payments for factors from firms to households.

The inner loop depicts the flow of goods and services from firms to households, as well as the flow of consumer spending from households to firms. The entire amount of money paid by firms as factor payments is returned to the firms by the factor owners.

Learn more about household, here:

https://brainly.com/question/32373214

#SPJ1

How do taxes impact your weekly/monthly budget?

Answers

Answer:

it takes away your money so the liberals can give it to the lazy people who don't want to work

Explanation:

i literaly have 13% of my paycheck taken by the government

Why is a spending plan an important part of financial planning? Choose all that are correct. а b C Helps to manage your money in a positive manner Helps to set and reach goals Tells you what your net worth is Helps to analyze the opportunity costs of your trade-offs to maximize financial well-being Can help to Increase net worth

Answers

Answer:

- Helps to manage your money in a positive manner.

- Helps to analyze the opportunity costs of your trade-offs to maximize financial well-being.

- Can help to increase net worth.

Explanation:

Having a Spending plan is very crucial to ensure that you have a sufficient amount of money every time in order to use it in time of need or emergency. It helps in keeping control and management of the money you spend which promotes a managed financial future. This further enhances your net worth as an individual by preventing unnecessary expenses and also assist in attaining financial goals more effectively and efficiently.

Which statement describes a surplus in a market?

Answers

Answer:

A surplus describes a level of an asset that exceeds the portion used. An inventory surplus occurs when products remain unsold.Budgetary surpluses occur when income earned exceeds expenses paid.A surplus results from a disconnect between supply and demand for a product, or when some people are willing to pay more for a product than other consumers. A surplus causes a market disequilibrium in the supply and demand of a product.Learn more about it

https://brainly.in/question/4285458

Answer: a

Explanation:

Break-Even Sales

BeerBev, Inc., reported the following operating information for a recent year (in millions):

Sales $6,512

Cost of goods sold $1,628

Gross profit $4,884

Marketing, general, and admin. expenses 592

Income from operations $ 4,292

Assume that BeerBev sold 37 million barrels of beer during the year, that variable costs were 75% of the cost of goods sold and 50% of marketing, general and administration expenses, and that the remaining costs are fixed. For the following year, assume that BeerBev expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by $21.09 million.

Compute the break-even sales (in barrels) for the current year. Round your answer to two decimal places. Enter your answers in millions.

Answers

The break-even sales for the current year are 32.04 million barrels, rounded to two decimal places.

First, we need to calculate the total fixed costs for the current year

Fixed costs = Total costs - (Variable costs + Cost of goods sold x Variable cost % + Marketing, general, and admin. expenses x Variable cost %)

Fixed costs = $6,512 million - ($1,628 million + $1,221 million + $296 million)

Fixed costs = $3,367 million

Next, we can calculate the contribution margin per barrel:

Contribution margin per barrel = Price per barrel - Variable cost per barrel

We don't have the price per barrel, but we can use the gross profit and the number of barrels sold to calculate the average gross profit per barrel

Average gross profit per barrel = Gross profit / Barrels sold

Average gross profit per barrel = $4,884 million / 37 million barrels

Average gross profit per barrel = $132 per barrel

Assuming variable costs per barrel remain constant, we can use the variable cost % to calculate the variable cost per barrel

Variable cost per barrel = Cost of goods sold x Variable cost % / Barrels sold + Marketing, general, and admin. expenses x Variable cost % / Barrels sold

Variable cost per barrel = $1,628 million x 75% / 37 million barrels + $592 million x 50% / 37 million barrels

Variable cost per barrel = $27.03 per barrel

Therefore, the contribution margin per barrel is

Contribution margin per barrel = $132 - $27.03

Contribution margin per barrel = $104.97

Finally, we can calculate the break-even sales in barrels for the current year

Break-even sales (in barrels) = Fixed costs / Contribution margin per barrel

Break-even sales (in barrels) = $3,367 million / $104.97 per barrel

Break-even sales (in barrels) = 32.04 million barrels

To know more about break-even sales here

https://brainly.com/question/31649579

#SPJ1

Cori's Corporation, has a book value of equity of $14,130. Long-term debt is $8,150. Net working capital, other than cash, is $2,140. Fixed assets are $19,470 and current liabilities are $1,760.

How much cash does the company have?

Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.

What is the value of the current assets?

Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.

Answers

Answer: To calculate the amount of cash that the company has, we need to use the accounting equation:

Assets = Liabilities + Equity

We can rearrange this equation to solve for assets:

Assets = Liabilities + Equity

Assets = Long-term debt + Net working capital, other than cash + Fixed assets + Current liabilities + Book value of equity

Assets = $8,150 + $2,140 + $19,470 + $1,760 + $14,130

Assets = $45,650

Now, to find the amount of cash the company has, we need to subtract all the other assets from the total assets:

Cash = Assets - (Long-term debt + Net working capital, other than cash + Fixed assets)

Cash = $45,650 - ($8,150 + $2,140 + $19,470)

Cash = $15,890

Therefore, the company has $15,890 in cash.

To find the value of the current assets, we can add the net working capital, other than cash, to the current liabilities:

Current assets = Net working capital, other than cash + Current liabilities

Current assets = $2,140 + $1,760

Current assets = $3,900

Therefore, the value of the current assets is $3,900.

Select the correct terms to complete the following statement:

________ is processed to become ________.

Answers

Answer:ben

Explanation:ben

The US Senate overwhelmingly passed the 2022 Defense Authorization Act. The $768 billion "Defense Authorization Act" not only exceeds the defense spending proposed by the Biden administration by $25 billion, but also increases the US defense budget by about 5% compared to last year.

Answers

The US Senate passed the 2022 Defense Authorization Act, a $768 billion bill that surpasses the Biden administration's defense spending proposal by $25 billion and represents a 5% increase in the US defense budget compared to the previous year.

1. The US Senate passed the 2022 Defense Authorization Act.

2. The Defense Authorization Act is a bill that determines the budget and expenditures for the US defense sector.

3. The total amount allocated for the Defense Authorization Act is $768 billion.

4. The defense spending proposed by the Biden administration was exceeded by $25 billion in this Act.

5. The Act represents a 5% increase in the US defense budget when compared to the previous year.

6. This increase in the defense budget indicates a commitment to strengthening the country's defense capabilities.

7. The Act was passed overwhelmingly, indicating strong support from the Senate.

8. The Defense Authorization Act is an essential piece of legislation that ensures the funding and resources necessary for the US military to carry out its operations effectively.

9. The Act covers various aspects of defense spending, including military personnel, equipment, research and development, and strategic initiatives.

10. By passing the Defense Authorization Act, the US Senate has demonstrated its commitment to national security and defense preparedness.

For more such questions on Defense Authorization Act, click on:

https://brainly.com/question/29225501

#SPJ8

Purely commercial speech (speech with no political implications whatsoever) is entitled to Blank______ so long as the speech was truthful and concerned a lawful activity. Multiple choice question.

Answers

Purely commercial speech (speech with no political implications whatsoever) is entitled to Blank protection so long as the speech was truthful and concerned a lawful activity.

What is commercial speech?Commercial speech is any speech that is not political.

This speech may not be protected and can be regulated or controlled incase of any misleading information.

Examples of such speech is an advertisement or solicitations for help.

Therefore, Purely commercial speech (speech with no political implications whatsoever) is entitled to Blank protection so long as the speech was truthful and concerned a lawful activity.

Learn more on speech below

https://brainly.com/question/26157848

#SPJ1

16 Nadia intends to get married in eight years' time. She estimates that the cost

of the wedding will be RM20,000 then. She intends to save this amount by

making equal monthly deposits at the end of each month in a bank that pays

5% compounded monthly.

(a) How much will this monthly deposit be?

(b) After paying for two years, the estimated cost of the wedding has gone up

to RM30,000

(i) What should the new monthly deposits be?

(ii) Instead of making the additional monthly deposits, Nadia decides

to make a lump sum deposit RMX at the end of two years. Calculate

the value of X.

Answers

Answer:

Nadia

a. Monthly deposit = RM169.86.

b. New monthly deposit = RM309.48

c. The value of X = RM22,393.57

Explanation:

a) Nadia will need to contribute RM169.86 at the end of each period to reach the future value of RM20,000.00.

FV (Future Value) RM19,999.99

PV (Present Value) RM13,417.11

N (Number of Periods) 96.000

I/Y (Interest Rate) 0.417%

PMT (Periodic Payment) RM169.86

Starting Investment RM0.00

Total Principal RM16,306.76

Total Interest RM3,693.23

b) Contribution after two years = RM169.86 * 24 = RM4,076.64

Additional contribution required = RM25,923.36 (RM30,000 - 4,076.64)

Nadia will need to start contributing RM309.48 at the end of each period after two years to reach the future value of RM25,923.36.

FV (Future Value) RM25,923.34

PV (Present Value) RM19,216.00

N (Number of Periods) 72.000

I/Y (Interest Rate) 0.417%

PMT (Periodic Payment) RM309.48

Starting Investment RM0.00

Total Principal RM22,282.27

Total Interest RM3,641.08

c) Nadia will need to invest RM22,393.57 at the beginning to reach the future value of RM25,923.36.

FV (Future Value) RM25,923.36

PV (Present Value) RM22,393.57

N (Number of Periods) 3.000

I/Y (Interest Rate) 5.000%

PMT (Periodic Payment) RM0.00

Starting Investment RM22,393.57

Total Principal RM22,393.57

Total Interest RM3,529.79