suppose that you will receive annual payments of $15,600 for a period of 15 years. the first payment will be made 8 years from now. if the interest rate is 11.00%, what is the value of the annuity in year 7, what is the current value of this stream of cash flows? (do not round intermediate calculations. round your answer to 2 decimal places.)

Answers

The value of the annuity in year 7 is $97,475.74 and the current value of the stream of cash flows is $53,139.35.

To find the value of the annuity in year 7, we need to discount the cash flows back to that year. Since the first payment will be made 8 years from now, we need to find the present value of the payments for the remaining 7 years, assuming a 15-year annuity with payments of $15,600 per year at an interest rate of 11%.

Using the formula for the present value of an annuity, we can calculate the value of the annuity in year 7 as follows:

PV = (PMT/i) x (1 - 1/(1+i)^n),

where PMT is the annual payment, i is the interest rate, and n is the number of periods.

PV = ($15,600/0.11) x (1 - 1/(1+0.11)^7) = $97,475.74

To find the current value of the stream of cash flows, we need to discount the payments to their present value using the same interest rate. Since the first payment is made 8 years from now, we need to find the present value of the payments for the next 15 - 8 = 7 years, and then discount that amount back to the present.

Using the same formula as above, we can calculate the present value of the annuity as:

PV = ($15,600/0.11) x (1 - 1/(1+0.11)^7) x (1+0.11)^-8 = $53,139.35

To learn more about payments click on,

https://brainly.com/question/31357879

#SPJ4

Related Questions

which of the following statements regarding the investment advisers act of 1940 and the adviser's brochure is correct? a) each client must receive the brochure no later than 48 hours after entering into the advisory contract. b) annual delivery of a summary of material changes relieves the adviser of the obligation to deliver a brochure. c) each client must receive the brochure no later than the entry into the advisory contract. d) advisers must deliver the brochure to clients for whom they offer impersonal advisory service only when the annual charge does not reach $500.

Answers

Each client must receive the brochure no later than the entering into the advisory contract.

When must a current investment adviser client receive an updated brochure?According to the brochure rule, new clients must receive the necessary information at least 48 hours before signing an advice contract. Advisors must annually distribute a new brochure to their current clients. The failure to deliver the brochure is seen as fraudulent activity.

What main objective did the Investment Advisers Act of 1940 serve?The Investment Advisers Act (IAA) was created in 1940 to regulate persons who, in exchange for payment, offer investment advice to individuals, pension funds, and organizations.

Learn more about Investment Advisers Act here:

https://brainly.com/question/14311679

#SPJ4

If real economic growth is 3%, the inflation rate is 5%, and the nominal interest rate is 7%, then the real rate of interest is:

Answers

Based on the information given the real rate of interest is:2%.

Real rate of interestUsing this formula

Real rate of interest=Nominal interest rate-Inflation rate-

Where:

Inflation rate=5%

Nominal interest rate=7%

Let plug in the formula

Real rate of interest=7%-5%

Real rate of interest=2%

Inconclusion the real rate of interest is:2%.

Learn more about real rate of interest here:https://brainly.com/question/25877453

How does specialization affect voluntary exchange between countries?

Answers

Answer:

It increases voluntary exchange by encouraging other countries to be less self-sufficient

Explanation:

Yakov just graduated from college and is now in the market for a new car. he has saved up $4,000 for a down payment. he's deciding between a super and a duper. the super is priced at $23,599, and the duper is priced at $18,999. after agonizing over the decision, he decides to buy the duper. he writes the dealership a check for $4,000 and takes out a loan for the remainder of the purchase price.

identify what role money plays in each of the following parts of the story. (medium of exchange, unit of account, or store of value)

a. sean writes a check for $4,000.

b. sean can easily determine that the price of the super is more than the price of the duper.

c. sean has saved $4,000 in his checking account.

Answers

Identify the part that money plays in each of the following tale elements. a store of wealth, a unit of account, and a medium of trade

What sort of business is that?

a brief, heated conversation that lasts barely a few phrases. The exchanges between the two sides have occasionally been tense. An exchange of fire, for example, is a situation in which people fire guns or missiles at one another.

How does trade operate?

The trading of stocks, bonds, commodities, options, futures, and other assets takes place on an exchange. By giving data on recent transaction prices, current bid and ask prices, and trading volumes, public exchanges assure fair transactions between buyers and sellers.

To know more about exchange visit:

https://brainly.com/question/26407800

#SPJ4

The direct materials required to manufacture each unit of product are listed on a ________.

Answers

Explanation:

the direct materials required to manufacture each unit of product are listed on a record book

Which of the following is an output device? DVD-ROM Touchpad Hard drive Printer

Answers

The printer should be considered an output device.

The following information should be considered for an output device:

The output device is the device that transforms the information into a human-readable form. The example of the output devices includes monitor, printer, plotters, speakers, etc.Therefore we can conclude that the printer should be considered an output device.

Learn more about the printer here: brainly.com/question/4455685

In an equipment capital budgeting decision, recovering the original investment means that the Blank______. Multiple choice question. equipment was returned and the funds used to pay for the equipment were taken back

Answers

In an equipment capital budgeting decision, recovering the original investment gives an idea that the investment has gained cash inflows to completely cover the cost of the equipment.

What do you mean by Capital budgeting?The manner of creating funding selections in long-time assets is called as Capital budgeting. It is the manner of finding out whether or not or now no longer to spend money on a specific venture as all of the funding opportunities might not be rewarding.

Thus, The correct statement is the investment has gained cash inflows to completely cover the cost of the equipment.

Learn more about Capital budgeting here:

https://brainly.com/question/24347956

#SPJ1

Metion three ways in which a surplus or credit balance in the combined current and capital account can be used up

Answers

The balance of repayments (BOP) is the approach by means of which nations measure all of the international financial transactions inside a positive period. The BOP consists of three most important accounts: the cutting-edge account, the capital account, and the financial account.

What can cause a surplus in the present day account of the balance of payments?The currency price depreciates with admire to a country that has decrease inflation. Thus, when inflation is high, it is beneficial for exporters to export more. This creates a surplus in a current account. Domestic demand- Sometimes, due to vulnerable home demand, a united states may additionally have modern-day account surpluses.

This helps to generate capital to fund its domestic productions. With a surplus in its BoP, a u . s . a . can also lend dollars outside its borders. A surplus in BoP can help to boost the short time period financial growth of a country.

Learn more about balance of payments here:

https://brainly.com/question/30080233#SPJ1Can someone help me with these questions please

Answers

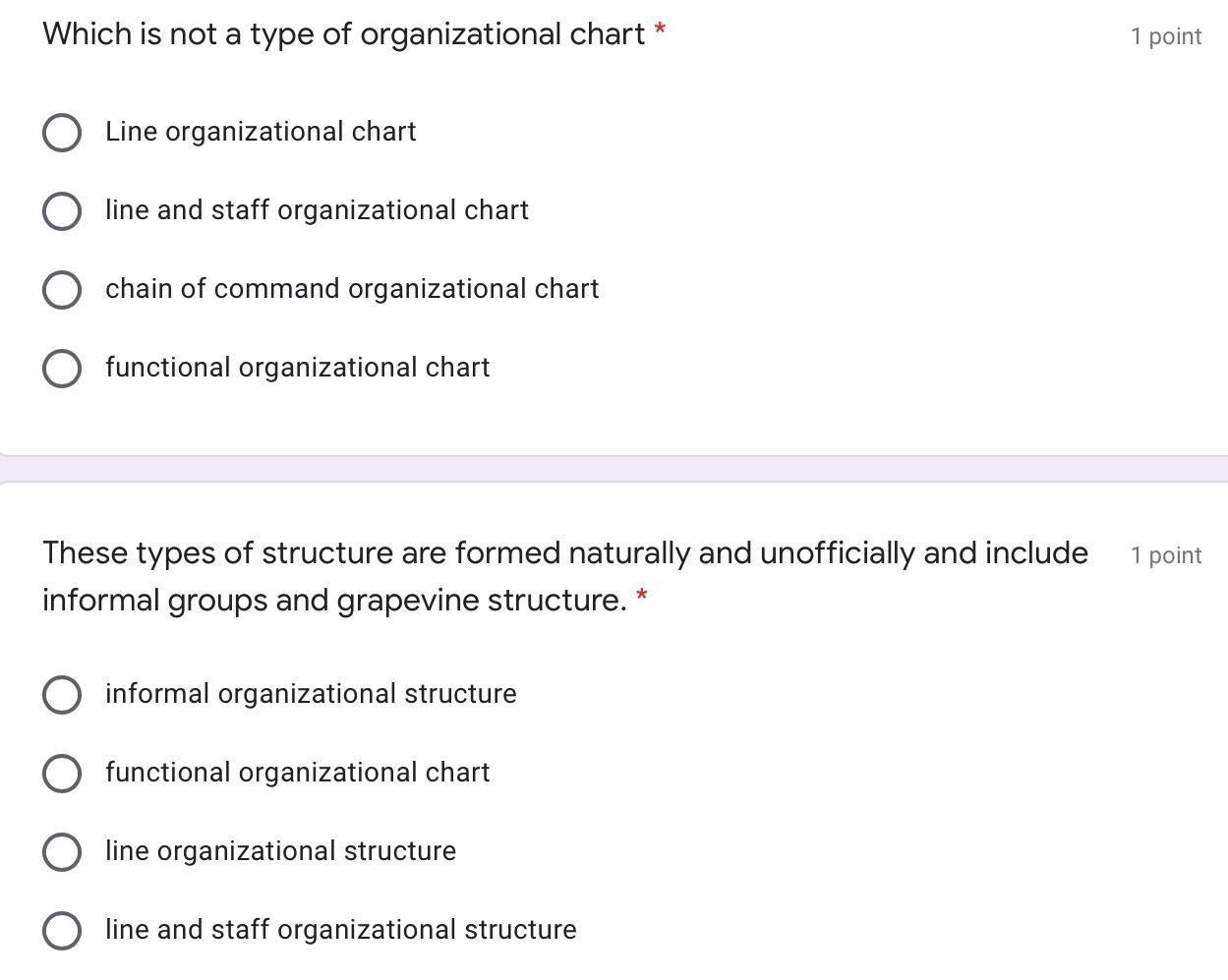

Answer:1. for the first one is functional 2.

Explanation:

does qualified nonrecourse debt increase tax basis?

Answers

Yes, qualified nonrecourse debt can increase tax basis.

Tax basis refers to the owner's investment in a property for tax purposes. It is used to calculate various tax-related matters such as gain or loss on the sale of the property and depreciation deductions.

When a property is purchased using qualified nonrecourse debt, the debt is considered part of the owner's investment in the property.

Qualified nonrecourse debt is a type of debt for which the lender's only recourse in case of default is to foreclose on the property securing the debt. It is typically used in real estate transactions.

When an owner acquires a property using qualified nonrecourse debt, the amount of the debt is added to the owner's tax basis in the property.

The tax basis is increased because the owner is considered to have made an investment equal to the amount of the qualified nonrecourse debt.

This increased tax basis can have implications for various tax calculations, such as determining the owner's basis for depreciation deductions or the calculation of gain or loss when the property is sold.

It's important to note that the specific rules and treatment of qualified nonrecourse debt may vary depending on the tax jurisdiction.

It is recommended to consult a tax professional for specific guidance and advice related to your situation.

Learn more about tax basis at: https://brainly.com/question/29345069

#SPJ11

Chloe enjoys her math classes, and she would like to find a career that will allow her to continue to use her math skills. Which career would be a good fit for her? A. accountant B. purchasing agent C. commercial carpenter D. human resources manager

Answers

Answer:

Just give

PhysicsGirl brainiest

NEED HELP ASAP

Complete the following sentence.

Chronological, functional, and targeted are just a few of the many formats for writing a _____.

Answers

Answer:

I think it's a story/book

Explanation:

because it's the only thing I can think of when I think of the words chronological, functional, and targeted.

Tax rates in which the percentage of tax is the same regardless of the level of income is MOST LIKELY a

Answers

Answer:

Proportional tax system

Explanation:

A proportional tax system levies an equal tax rate on everyone regardless of their income level. It is also known as the flat-rate tax because it treats the wealthy, middle class, and low-income earners equally. The proportional tax system simplifies tax filing as the same tax rate will apply to everyone.

The proportions tax system contrasts with the progressive tax system, which bases the tax rate on the taxpayer's income.

how do well-financed groups, such as the u.s. chamber of commerce, influence public opinion?

Answers

Well-financed groups like the U.S. Chamber of Commerce can influence public opinion in a number of ways.

Firstly, they can fund media campaigns, such as advertisements or social media posts, that promote their views and shape public opinion on certain issues.

Additionally, they can use their financial resources to hire lobbyists and engage in direct advocacy efforts to persuade politicians to support their interests.

This can also indirectly influence public opinion as politicians are often seen as representatives of their constituents. They can also use their resources to commission studies or polls that support their positions, which can then be cited in debates and discussions to bolster their arguments.

Overall, the financial power of these groups gives them a significant platform to shape public opinion and influence policy decisions.

To know more about U.S. Chamber of Commerce refer here:

https://brainly.com/question/6692483

#SPJ11

A recent annual report for PepsiCo contained the following information for the period (dollars in millions): Net income & $ 6,462 Depreciation and amortization & 2,737 Increase in accounts receivable & 666 Increase in inventory & 331 Increase in prepaid expense & 27 Increase in accounts payable & 520 Decrease in taxes payable & 340 Increase in other current liabilities & 589 Cash dividends paid & 3,157 Treasury stock purchased & 2,489 Required:

(b) Compute the quality of income ratio.

Answers

(b) The quality of income ratio is approximately 1.6.

To compute the quality of income ratio, we need to divide the net cash provided by operating activities by the net income. The formula is as follows:

Quality of Income Ratio = Net Cash Provided by Operating Activities / Net Income

From the information provided, we can determine the net cash provided by operating activities by making adjustments to the net income. The adjustments include adding back non-cash expenses such as depreciation and amortization and considering changes in working capital accounts.

Net Cash Provided by Operating Activities = Net Income + Depreciation and Amortization + Increase in Accounts Receivable - Increase in Inventory - Increase in Prepaid Expense + Increase in Accounts Payable + Decrease in Taxes Payable + Increase in Other Current Liabilities

Net Cash Provided by Operating Activities = $6,462 + $2,737 + $666 - $331 + $27 + $520 - $340 + $589

Net Cash Provided by Operating Activities = $10,340

Now we can calculate the quality of income ratio:

Quality of Income Ratio = $10,340 / $6,462

Quality of Income Ratio ≈ 1.6

The quality of income ratio is approximately 1.6. This ratio indicates how much of the reported net income is backed by actual cash flows from operating activities. A higher ratio suggests higher quality earnings, as it indicates a stronger correlation between net income and cash generated from operations.

Therefore, the quality of income ratio for PepsiCo is approximately 1.6, indicating a relatively good quality of earnings and a reasonable correlation between reported net income and cash flows from operating activities.

Learn more about income ratio visit:

https://brainly.com/question/30899814

#SPJ11

If the Cambrian College soccer team makes the championship game and a t-shirt vendor prints off 200 shirts to sell at the game, what category of inventory models is being used? O a. Fixed order quantity model O b. Single period model Oc: Hungry student model O d. Fixed-time period model. O e Traveling salesman model

Answers

Fixed-order quantity model is one of the two most common inventory models and is also known as the Economic Order Quantity (EOQ) model.

The category of inventory models that are being used if the Cambrian College soccer team makes the championship game and a t-shirt vendor prints off 200 shirts to sell at the game is fixed-order quantity model. The fixed-order quantity model is an inventory management model that establishes an inventory ordering point, or reorder point, when inventory falls to a certain threshold, and a fixed order quantity is ordered at that point. It is critical to order the optimal amount of inventory and to have it in stock when it is required for production or consumer requirements, as holding too little or too much inventory can be expensive.

To learn more about inventory click here https://brainly.com/question/32670221

#SPJ11

A credit card had an Apr of 12.87% all of last year and compounded interest daily. What was the credit card's effective interest rate last year?

Answers

Answer:

13.73%

Explanation:

Effective annual rate = (1 + APR / m ) ^m - 1

M = number of compounding = 365

\((1 + \frac{0.1287}{365} )^{365} - 1\)

\((1.000353)^{365} - 1\) = 0.1373 = 13.73%

which of the following is not one of the lease classification tests?a)collectibility b)transfer of ownership c)purchase option d)lease term

Answers

The lease classification test that is not included is transfer of ownership. The correct answer is b) transfer of ownership.

The transfer of ownership is not one of the lease classification tests. The classification tests typically include criteria such as collectibility (whether the lease payments are reasonably assured), the existence of a purchase option, and the lease term (duration of the lease agreement). These tests help determine whether a lease should be classified as an operating lease or a finance lease based on the extent of control and risks associated with the leased asset. However, transfer of ownership is not a specific test used in lease classification.

To know more about finance lease visit:

https://brainly.com/question/28099518

#SPJ11

Which are functions of money? Select the three correct answers.

A store of value

B. producer of resources

C. unit of account

D. medium of exchange

DE record of finances

F. unit of output

Answers

Answer:

A store of value

C. unit of account

D. medium of exchange

Explanation:

Money has four main functions. They are

The medium of exchange: It the most widely used and accepted instrument for the exchange of goods and servicesUnit of account: Money provides a standard measure of the value of goods and services being exchanged. Store of value: Money is known to keep its value for some period. this enables other commodities, both perishable and non-perishables, to be assigned monetary values Standard of future payments: This function allows for trade to be done on credit terms.which trade organization is responsible for 90% of the worlds trade ?

The EU

ASEAN

The WTO

NAFTA

Answers

Answer: The WTO

Explanation:

I don’t understand this and need help

Answers

Definition: Biproduct - something that is produced because of making something else. “Profits are a biproduct of successfully solving a problem’’ what does this mean ?

Answers

The statement "profits are a byproduct of successfully solving a problem" means that when a company or individual solves a problem, it can result in generating profits as a secondary outcome.

How to define byproduct ?Profits are not the primary objective but rather a natural consequence of creating value and solving problems for others.

For example, if a company creates a product that solves a problem for its customers, such as a more efficient way of doing something, then customers may be willing to pay for that product, and the company can make a profit as a byproduct of solving the problem. In this sense, the profit is not the ultimate goal but rather a reward for creating value and solving a problem for others.

Find out more on biproducts at https://brainly.com/question/14835213

#SPJ1

American General offers a 13-year annuity with a guaranteed rate of 9.54% compounded annually. How much should you pay for one of these annuities if you want to receive payments of $700 annually over the 13 year period? How much should a customer pay for this annuity? $ (Round to the nearest cent.)

Answers

A customer should pay approximately $6,037.53 for this annuity.

By using the given parameters of the annuity, including the number of years (13), annual payment ($700), and interest rate (9.54% compounded annually), we can calculate the present value of the annuity using the present value formula. After performing the calculation, we find that the customer should pay approximately $6,037.53 for this annuity. This amount ensures that they will receive annual payments of $700 over the 13-year period. To calculate the amount that should be paid for the annuity, we can use the present value formula for an annuity.

Given:

Number of years (n) = 13

Annual payment (PMT) = $700

Interest rate (r) = 9.54% (convert to decimal: 0.0954)

The present value (PV) can be calculated using the formula:

PV = PMT * (1 - (1 + r)^(-n)) / r

Substituting the given values into the formula:

PV = $700 * (1 - (1 + 0.0954)^(-13)) / 0.0954

Using a calculator, we find that the present value (amount to be paid for the annuity) is approximately $6,037.53.

Therefore, a customer should pay approximately $6,037.53 for this annuity in order to receive annual payments of $700 over the 13-year period.

learn more about annuity here:

https://brainly.com/question/23554766

#SPJ11

where is oregon unemployment department

Answers

The Oregon unemployment department has several offices throughout the state, including its headquarters in Salem.

The Oregon Unemployment Department, also known as the Oregon Employment Department, is the state agency responsible for managing unemployment benefits and workforce development programs in Oregon, USA.

Here are the addresses of some of the main Oregon Employment Department offices,

Headquarters: 875 Union St. NE, Salem, OR 97311

Portland Metro Workforce Office: 30 N Webster St, Portland, OR 97217

Bend Workforce Office: 1645 NE Forbes Rd., Suite 100, Bend, OR 97701

Medford Workforce Office: 119 N Oakdale Ave., Medford, OR 97501

Eugene Workforce Office: 2510 Oakmont Way, Suite 200, Eugene, OR 97401

It is recommended to visit the official website of the Oregon Employment Department for more information, including office hours and contact information for each office.

To learn more about Oregon here:

https://brainly.com/question/10904078

#SPJ4

The acme global corporation needed to hire 30 new advertising sales agents. the applicant pool consisted of 100 african-american males and 100 white males. of the 200 applicants, acme global hired 10 of the african-american males and 20 of the white males. is there evidence of disparate impact?

Answers

Answer:

Yes, because it doesn't comply with the four-fifths rule.

Explanation:

First we must establish the selection rate for both groups:

whites = 20 / 100 = 20% selectedAfrican American = 10 / 100 = 10% selectedthe four-fifths rule establishes that at least 20% x 4/5 = 16% of all African American candidates should have been selected, but only 10% were selected.

a company paid $37,800 plus a broker's fee of $525 to acquire 8% bonds with a $40,000 maturity value. the company intends to hold the bonds to maturity. the cash proceeds the company will receive when the bonds mature equal:

Answers

When bonds are redeemed at maturity, they are always redeemed at face value since by then any bond discount or premium would have become zero, plus the last interest payment.

What are bonds?

Bonds are fixed-income securities that reflect loans from investors to borrowers (typically corporate or governmental). A bond can be compared to an agreement outlining the terms of the loan and the associated payments between the lender and borrower. Companies, municipalities, states, and sovereign governments utilize bonds to finance operations and initiatives. Bondholders are the issuer's debtors or creditors.

Bond specifications typically include the terms for variable or fixed interest payments made by the borrower, as well as the end date by which the principle of the loan is expected to be paid to the bond owner.

Bonds are tradable assets that are securitized versions of corporate debt issued by businesses.Since bonds historically paid debtholders a fixed interest rate (coupon), they are referred to as fixed-income instruments.Interest rates that fluctuate or float are also rather typical today.Interest rates and bond prices are inversely associated; when rates rise, bond prices decline and vice versa.Bonds have maturity dates, after which the full principal must be repaid to avoid default.Cash proceeds = Maturity amount + interest

= $40,000 + ($40,000 x 8% x 1/2) assuming semi-annual interest payments

= $40,000 + $1,600 = $46,000

Cash proceeds = Maturity amount + interest

= $40,000 + ($40,000 x 7%) assuming annual interest Payments

= $40,000 + $2,800 = $42,800

Learn more about Bonds from the link below

https://brainly.com/question/14244458

#SPJ4

Briefly describe the two types of marketing and operations models used by the insurance industry.

Answers

Answer:

The two dominant types of life/health marketing systems are the general agency and the managerial (branch office) system. General Agency System A general agent is an independent businessperson rather than an employee of the insurance company and is authorized by contract with the insurer to sell insurance in a specified territory.

Explanation:

Your welcome !

Drag each option to the correct location.

Match the scenarios to the factors that affect the labor market.

foreign direct investment

outsourcing

immigration

Answers

Each scenario should be matched to the factors that affect the labor market as follows:

Immigration: Carlos is moving from Mexico to the United States because he got a job in a bank. He had his interview last month, and the bank agreed to hire him because he was willing to work for 10% less than most American workers, even though he has the same qualifications.Foreign direct investment: A US supermarket chain is going to open a few supermarkets in Europe because a recent survey showed that the chain has a huge potential for profits in Europe.Outsourcing: A renowned US information technology firm has recently signed a contract with a company based in the Philippines. The Filipino company will handle the accounts of the US firm. The US firm made this decision to reduce labor costs.What is immigration?Immigration can be defined as the movement of a group of people from one geographical region to another geographical destination such as a city, especially in search of any of the following:

Good governanceSecurityBetter living conditions.WorkJobsSocial amenitiesWhat is a foreign direct investment?A foreign direct investment (FDI) simply refers to a type of investment which is made by an individual or business organization (investor) into an investment market that is located in another country.

In conclusion, an example of foreign direct investment (FDI) is a US supermarket chain that is planning to open a few supermarkets in a country in Europe.

Read more on immigration here: brainly.com/question/9809956

#SPJ1

Answer:

Post Test: Free Market and Businesses

Unit: 2

Economics

Question #12

__________________________________________________________

This is 100% right because I took the test

Go to explanation for picture with answers

l

l

∨

Explanation:

Here's the picture and I hope this helped!

Have a nice day!

In a two-state world, where there are only two possible payoffs on a share of stock at the end of a year, the stock payoffs can be exactly duplicated using a combination of a call option on the stock and _____.

Answers

"In a two-state world, where there are only two possible payoffs on a share of stock at the end of a year, the stock payoffs can be exactly duplicated using a combination of a call option on the stock and risk-free asset."

A risk-free asset is one with a guaranteed future return and almost little chance of loss.

Bonds, notes, and particularly Treasury bills are issued by the U.S. Department of the Treasury.

These are regarded as risk-free investments because they are backed by the "full faith and credit" of the American government.

The return on risk-free assets is very close to the present interest rate because they are so safe.

Therefore "In a two-state world, where there are only two possible payoffs on a share of stock at the end of a year, the stock payoffs can be exactly duplicated using a combination of a call option on the stock and risk-free asset."

Learn more about Risk:

brainly.com/question/3729664

#SPJ4

Marta is twenty eight years old, and she has no dependents. She has saved an emergency fund and an extra $1,500.

She would like to save or invest this money in hopes that it will grow fast. Marta does not mind taking risks with her

money. Which type of account or investment is best for her?

fifteen-year savings bond

IDA

mutual fund

basic savings account earning 1.3 percent Interest, compounded monthly

Answers

Answer:

Mutual Fund

Explanation:

Mutual fund is a type of investment where professionals managed a pooled sum money contributed by different investors. These funds are invested into buying stocks , bonds other securities towards profit making.

It has its advantages in professional management , shared risks, dividends reinvestment and convenience. However , the disadvantages include poor trade execution ,potential for management bias and high fees.

Answer:

The correct answer would be a basic savings account earning 1.3% interest, compounded monthly.

Explanation:

Taking into account that Marta does not like taking risks with her money and does not have an emergency fund she should not invest in stocks. She also wishes to use her money within 18 months, so a fifteen-year savings bond would not be a great choice.

A mutual fund is a collection of money from a group of investors to buy different investments. This choice will also not work well for Marta.

An IDA is an individual development account for low-income families to save towards a targeted amount usually used for building assets in the form of home ownership, post-secondary education and small business ownership. Not a great account for a single person with no dependants.

$1,500 at 1.3% interest, compounded monthly after 18 months equals about $1,520. Even though Marta won't be earning a huge amount of money, she will still earn some. Since she doesn't have an emergency fund and doesn't like risks, a basic savings account earning 1.3% interest, compounded monthly will be the right choice for her.