Answers

The federal government sets a catch limit (per person or per boat) for the species and imposes a tax on any extra fish that are caught is the best example of an economic approach to reduce overfishing for a fish species with a declining population

The economic approach to the PPI starts at the establishment level rather than at the industry level. According to the CPI theory, an establishment is the PPI equivalent of a family. An establishment is a business that carries out production or other productive activity in a particular area of the nation and is able to provide basic accounting data on the costs and quantities of the outputs it generates.

Annual catch restrictions and catch level monitoring assist minimize the risk of overfishing and guarantee the long-term biological and economic sustainability of American fisheries. A catch limit is determined annually through a multistep process.

To learn more about economic approach refer here:

https://brainly.com/question/14370305

#SPJ4

Related Questions

Suppose the price level for the country above was 110 in 2014 and 115 in 2015. Also, suppose nominal GDP in 2014 was $13,974

billion and nominal GDP in 2015 was $17,937 billion. Which of the following statements is not correct?

Answers

The incorrect statement is : The inflation rate was almost 8% from 2014 to 2015

Gross domestic product is the sum of final goods and services produced in a country in a given period within a given period

Nominal GDP is GDP calculated using current year prices

Real GDP is GDP calculated using base year prices.

Inflation is the persistent increase in the price levels in an economy

Nominal GDP increase = ($17,937 / $13,974) - 1 = 0.2836 = 23.86%

The economy grew because nominal GDP increased.

Percentage increase in inflation = (115 / 110) - 1 = 0.0455 = 4.6%

To learn more, please check: https://brainly.com/question/9201016?referrer=searchResults

Expenses payable always treated as current/ fixed assets. Is it true or false?

Answers

Answer:

False

Explanation:

This is an example of a current liability and not assets.

To explain this , assets are anything owned as a result of past activities that result into inflow of economic benefits while liabilities are obligation that arose as a result of pat activities that result into outflow of economic benefit.

Current assets or liabilities are expected to be settles within twelve months / a normal operating cycle of the business activities while the non - current are for a longer period.

Expenses payable are liabilities that are current in nature as it is expected to be settled within a business year.

Fickel Company has two manufacturing departments—Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $19.00 per direct labor-hour and $15.00 per direct labor-hour, respectively. The company’s direct labor wage rate is $21.00 per hour. The following information pertains to Job N-60: Assembly Testing & Packaging Direct materials $ 375 $ 39 Direct labor $ 168 $ 84 Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job?

Answers

The total manufacturing cost assigned to Job N-60 is $ 696. If Job N-60 consists of 10 units, the unit product cost for this job is $111.00.

How to find the manufacturing costs ?Direct materials (Assembly + Testing & Packaging) = $375 + $39

= $414

Direct labor (Assembly + Testing & Packaging) = $168 + $84

= $252

Overhead applied (Assembly + Testing & Packaging) = $19 * 168 + $15 * 84 = $316 + $126

= $442

Total manufacturing cost = $414 + $252 + $442

= $1110

Unit product cost = Total manufacturing cost / Number of units

= $1110 / 10

= $111.00

Find out more on manufacturing costs at https://brainly.com/question/24171150

#SPJ1

Submission Requirements Hurry Pls Help ASAP!!!

Nine hundred word response.

When submitting written assignments, please remember to:

Submit the assignment question(s) and your responses.

Proofread for spelling, grammar, and punctuation.

Remember complete sentence structure.

Paragraphs need to have minimum of six sentences.

Submit your E.T.H.I.C.S. model of one of the provided scenarios.

Answers

When submitting written assignments, please remember to Proofread for spelling, grammar, and punctuation. Hence, option B is correct.

What is meant by Proofread?Proofread is the double-checking of the written assignment or the work that is being already done to the person. It helps the person to identify the little mistakes that they have made during the making of the assignment.

Proofread is always a better solution to understand the work and makes the work complete and perfect. After Proofread, one can identify their mistakes and make them correct.

Thus, option B is correct.

For more details about Proofread, click here:

https://brainly.com/question/11845575

#SPJ1

Precision Systems manufactures CD burners and currently sells 18,500 units annually to producers of laptop computers. Jay Wilson, president of the company, anticipates a 15 percent increase in the cost per unit of direct labor on January 1 of next year. He expects all other costs and expenses to remain unchanged. Wilson has asked you to assist him in developing the information he needs to formulate a reasonable product strategy for next year.

You are satisfied that volume is the primary factor affecting costs and expenses and have separated the semivariable costs into their fixed and variable segments. Beginning and ending inventories remain at a level of 1,000 units. Current plant capacity is 20,000 units. The following are the current-year data assembled for your analysis.

Sales price per unit $100

Variable costs per unit:

Direct materials $10

Direct labor $20

Manufacturing overhead and selling and administrative expenses 30 60

Contribution margin per unit (40%) $40

Fixed costs $390,000

Required:

a. What increase in the selling price is necessary to cover the 15 percent increase in direct labor cost and still maintain the current contribution margin ratio of 40 percent?

b. How many units must be sold to maintain the current operating income of $350,000 if the sales price remains at $100 and the 15 percent wage increase goes into effect?

c. Wilson believes that an additional $700,000 of machinery (to be depreciated at 20 percent annually) will increase present capacity (20,000 units) by 25 percent. If all units produced can be sold at the present price of $100 per unit and the wage increase goes into effect, how would the estimated operating income before capacity is increased compare with the estimated operating income after capacity is increased? Prepare schedules of estimated operating income at full capacity before and after the expansion.

Answers

a. An increase of $20 per unit is necessary to cover the 15 percent increase in direct labor cost and maintain the desired contribution margin ratio.

b.The fixed costs and desired operating income remain the same, so the contribution margin per unit of $40 is used. The required sales volume is 18,500 units.

c. The estimated operating income after capacity expansion can be determined by increasing the production and sales volume by 25 percent, i.e., 23,125 units

a. To maintain the current contribution margin ratio of 40 percent, the selling price per unit needs to be increased by 20 percent [(15 percent wage increase) / (current contribution margin ratio)].

Therefore, an increase of $20 per unit is necessary to cover the 15 percent increase in direct labor cost and maintain the desired contribution margin ratio.

b. To maintain the current operating income of $350,000, the number of units that must be sold can be calculated using the contribution margin ratio.

The fixed costs and desired operating income remain the same, so the contribution margin per unit of $40 is used. The formula for calculating the required sales volume is:

(Number of units) = (Fixed costs + Desired operating income) / Contribution margin per unit

Plugging in the values, we have:

(Number of units) = ($390,000 + $350,000) / $40 = 18,500 units

c. Before the capacity expansion, the estimated operating income can be calculated using the current production and sales volume of 18,500 units.

The estimated operating income after capacity expansion can be determined by increasing the production and sales volume by 25 percent, i.e., 23,125 units.

The schedules of estimated operating income at full capacity before and after the expansion can be prepared by multiplying the respective sales volumes with the contribution margin per unit and subtracting the fixed costs and the wage increase.

for such more questions on margin

https://brainly.com/question/9797559

#SPJ8

If an increase in the price of good E leads to a large decrease in the demand for good F, what is the relationship between the two goods? Relationship between the Two Goods The goods are complements and the cross- price elasticity of demand is positive and large The goods are complements and the cross- price elasticity of demand is negative and large The goods are substitutes and the cross- price elasticity of demand is negative and large. The goods are complements and the cross- price elasticity of demand is negative and small. Not a Relationship between the Two Goods

Answers

The items are complementary, and the cross-price demand elasticity is negative and substantial. When the price of product E rises, the demand for good F falls dramatically.

indicating that the two goods are complementary. When one product is utilized in combination with another, the relationship between the two commodities is termed as complimentary goods. The cross-price elasticity of demand between the two items is negative in this situation, which means that when the price of one commodity (E) rises, so does demand for the second good (F). This negative cross-price elasticity of demand is thought to be strong, implying that a change in price causes a significant change in demand for good F. This sort of link between two items is frequent in consumer goods, where a consumer's desire for one thing drops dramatically if the price of another product they use in tandem with it rises.

learn more about goods here:

https://brainly.com/question/29426090

#SPJ4

Question 7 of 10

Fred obtained a balloon mortgage and made regular payments for the period

of the loan. Which of the following is an unlikely option for him once the

balloon payment becomes due?

A. Foreclosure

B. Pay balloon payment in full

C. Sell the home

D. Refinance the balloon payment

Answers

Answer:

foreclosure

Explanation:

Organizations refers to _____. demographics communication competition possible customers

Answers

Answer:

Organizations refers to demographics

Explanation:

explain the changing nature of public administration

Answers

The nature of public administration has undergone significant changes over the years. Traditional public administration was characterized by hierarchical structures.

However, with the increasing complexity of modern society, new challenges have emerged that require a more flexible and responsive approach to public administration.

One of the key changes in public administration has been the shift towards more participatory and collaborative approaches. This has been driven by a growing recognition of the importance of engaging citizens and stakeholders in decision-making processes, and the need to build trust and legitimacy in government institutions.

Another important change has been the adoption of technology in public administration. From e-government initiatives to data-driven decision-making, technology has transformed the way that government organizations operate and interact with citizens.

At the same time, there has been a growing emphasis on performance management and accountability in public administration. This has involved the development of performance metrics, the use of benchmarking and evaluation, and a focus on outcomes rather than inputs.

Overall, the changing nature of public administration reflects the broader shifts in society towards greater complexity, interdependence, and accountability. While there are still many challenges to be addressed, the evolution of public administration offers hope for more effective and responsive governance in the years to come.

For more such questions on administration visit;

https://brainly.com/question/1276995

#SPJ11

A company wants to analyze the following investment option using its rate of return. They use a MARR of 15% to determine whether something might be a good investment in this category. Calculate the accurate internal rate of return for the given cash flow as precisely as possible, interpolating as necessary. The MARR is a good starting point. Decide if the investment should be made

Answers

Remainder Part of Question:

Cash Flow

Initial Costs $365,000

Annual Benefits $90,000

Operation and Maintenance $15,000

Salvage Value $25,000

Lifetime in years 10 Years

Answer:

As the IRR > MARR, hence the investment is financially viable.

Explanation:

Find the attachment below:

Elana has opened a new aerobics studio in her area. How might Elana use social media as a market to spread the word about her new studio?

Answers

Elana can use social media as a marketplace to promote her new studio in a variety of ways such as:

Creating social media adsCreating valuable content for your target audienceStrengthening the relationship with your consumersHow does social media help a business grow?Social networks are easy-to-use and inexpensive platforms for sharing ideas, advertising, etc. It is a medium where potential consumers can be found who can engage with valuable content posted by a company and be interested in it.

Therefore, social media can help Elana develop her business through direct advertising and reaching a wider audience.

Find more about social media at:

https://brainly.com/question/3653791

#SPJ1

In 2022, Landon has self-employment earnings of $206,000.

Required:

Compute Landon's self-employment tax liability and the allowable income tax deduction of the self-employment tax paid.

Note: Round your intermediate computations and final answers to the nearest whole dollar value.

Total self-employment tax liability

Self-employment tax deduction

Answers

The amount of the self-employment tax Landon is eligible to deduct from his taxable income is $14,999.

What do self-employment net earnings mean?You must disclose your net income to Social Security and the Federal Revenue Service if you are self-employed (IRS). Your trade or firm's gross earnings less all legal business expenses and depreciation equals your net earnings for Social Security purposes.

To calculate Landon's self-employment tax liability:

Self-employment tax = (Net self-employment income x 0.9235) x 0.153

Where 0.9235 is a factor to adjust for the deduction for half of the self-employment tax.

Net self-employment income = $206,000

Self-employment tax = ($206,000 x 0.9235) x 0.153 = $29,998

Therefore, Landon's total self-employment tax liability is $29,998.

To calculate Landon's allowable income tax deduction for the self-employment tax paid:

Self-employment tax deduction = (Self-employment tax paid ÷ 2)

Self-employment tax paid = $29,998

Self-employment tax deduction = ($29,998 ÷ 2) = $14,999

To know more about income visit:-

https://brainly.com/question/14732695

#SPJ1

what are fixed expenses

A. all expenses that change depending on various factors, such as the number of customers in a given period of time

B. the amount of money the retailer spends to buy each item from the wholesaler or producer

C. the amount of money received per the sale of each item

D. All expenses that are the same fixed amount on a recuring basis, such as rent

Answers

The amount of money received per the sale of each item are fixed expenses. The answer is OPTION C.

Numerous expenses fall under the category of fixed costs, such as mortgage and rent payments, various types of salary, insurance, property taxes, interest fees, depreciation, and some utility bills. For instance, a new business owner would probably start off with fixed costs like rent and managerial salary.

Fixed expenses: Expenses that must be paid on a regular basis and usually have a set price, such as bills. Utility bills are an example of fixed expenses that can also be variable because the monthly cost varies based on usage. The frequency of fixed expenses can be weekly, monthly, quarterly, or yearly.

To learn more about expenses, click here.

https://brainly.com/question/29842871

#SPJ1

Steven runs a small company that manufactures VCRs. In recent years, his sales and profits have been suffering. Steven knows that people are buying DVD players more than VCRs nowadays. However, he does not understand why people do not continue to purchase VCRs as well. After all, Blockbuster still rents VHS tapes and people still own VHS tapes. Steven refuses to begin manufacturing DVD players. He insists that his specialty lies in the production of VCRs. Steven is suffering from which of the following?

a. Slide-rule syndrome

b. Majority Fallacy

c. Marketing myopia

d. SWOT

e. Product champion

Answers

Answer:

c. Marketing myopia

Explanation:

Marketing myopia occurs when a company focuses only on its needs and capabilities and not on the needs of their customers. Obviously, this will result in decreasing sales volumes and lower profits, and could eventually result in a business failure. In this case, Steven doesn't want to realize that VCRs are no longer wanted by consumers (nor DVDs nowadays).

Based on the information given, Steven is suffering from marketing myopia.

Marketing myopia simply means when a company focuses only on its needs and not what the customers need.

Based on the information given, Steven focuses on his needs alone. Thus brought about the reduction in sales and revenue. Therefore, Steven is suffering from marketing myopia.

Read related link on:

https://brainly.com/question/23863404

PLS HELP!!!!

1. Based on the profit-loss statement, does Rings and Things have a positive or negative cash flow?

Why?

Based on the profit loss statement rings and things has a negative cash flow because they're not

operating activities is not breaking even and they are losing money.

2. Based on the profit-loss statement, name two ways Janet and Omar can improve their cash flow.

3. Omar and Janet decide to revise their budget for Rings and Things. What suggestions about labor

costs would you make, if the goal is to improve the business's cash flow?

4. Omar and Janet are also trying to forecast what their federal and state income taxes will at the end

of the year. If Rings and Things had a negative cash flow of $150.00 per month from January

through April, but a positive cash flow of $1,000.00 per month (after expenses) from May through

December, on what dollar amount will they determine their income taxes? What expenses could be

used for tax deductions?

Answers

Answer:

1. They have a negative cash flow.

Because their net operating activities is not breaking even, in other words, they are losing money.

2.Omar and Janet should reduce the budget for labor

The labor budget for Janet and Omar is $1000, approximately 57 percent of their total cost. Labor costs are 62 percent of the total income earned. This indicates that Janet and Omar's labor budget is on the upper side.

As a rule of thumb, labor should range between 25 to 35 percent of the totals costs. Another school of thought suggests that labor should not exceed 30 percent of total revenue. For Janet and Omar to be profitable, they must revise their budget downwards. The ideal labor cost should be below $400.

3. Review labor costs downwards.

4. They will determine their income taxes based on their positive cash flow of $1,000.00 per month. This is because this cash flow spans across more months than their negative cash flow of -$150.00 per month. Expenses that could be used for their tax deductions is sales tax.

Answer:They have a negative cash flow.

Because their net operating activities is not breaking even, in other words, they are losing money

Explanation:

hope this helped!

The profit margin of Nickelly Corporation was 17.3% in 2020 and 15.2 % in 2021. What does the profit margin measure and Changes, if any, would be recommended for the financial direction of the organization?

Answers

The decrease in profit margin is a cause for concern, there are various steps that Nickelly Corporation can take to improve its financial direction.

The profit margin is a key financial metric that calculates a company's profitability by measuring its revenue in relation to its expenses. It is calculated by dividing the net income by revenue. A high-profit margin indicates that the business is earning more than it is spending, while a low-profit margin indicates that it is spending more than it is earning. In this case, the Nickelly Corporation's profit margin decreased from 17.3% in 2020 to 15.2% in 2021, indicating a decline in profitability.

To improve the financial direction of the organization, some changes can be made, which are as follows:

1. Increase revenue by focusing on marketing and sales to improve customer acquisition and retention.

2. Reduce costs by cutting down on unnecessary expenses or finding more cost-effective suppliers.

3. Improve efficiency by streamlining processes, implementing technology, and optimizing resource allocation.

4. Diversify product offerings to reduce dependence on a single product or service and open up new revenue streams.

5. Expand into new markets to increase market share and revenue.

In conclusion, while the decrease in profit margin is a cause for concern, there are various steps that Nickelly Corporation can take to improve its financial direction. By focusing on revenue growth, cost reduction, efficiency improvement, diversification, and expansion, the company can turn its financial situation around and improve profitability.

Know more about Profit margin here:

https://brainly.com/question/28180283

#SPJ8

Recall that an exchange rate is the price of one currency in another. For example, it may take US $1.35 to buy 1 British Pound. Also recall the interest rates affect exchange rates. What do you predict will happen to the foreign exchange rate if interest rates in the United States increase more than in the UK? (In other words, which currency will become stronger?) How would such a change affect US exports to the UK? Would it be less expensive for an American tourist to take a vacation to London after the interest rate change? Be sure to clearly explain and justify your reasoning.

Answers

Answer:

Exchange Rate and Interest Rate

1. If interest rates in the United States increase more than in the UK, the exchange rate of the US dollars will increase relative to the UK pounds, thus causing the UK pounds to become stronger than the US dollars.

2. US exports to the UK would become cheaper in UK.

3. It would be more expensive for an American tourist to take a vacation to London after the interest rate change because they would need more money to handle the differences.

Explanation:

Generally, higher interest rates in an economy offer investors some higher returns when compared to other countries. These higher interest rates attract foreign capital and cause the exchange rate to rise. When this happens, the cost of goods and services in the country with the higher interest and exchange rates. The opposite becomes the case when the interest and exchange rates are lower relative to other countries.

If interest rates in the United States increase more than in the UK, the United states currency would become stronger or appreciate against the British Pound.

As a result of the increase in the value of the US currency, export to the UK would decline because export would become more expensive. It would be less expensive for American tourist to take a vacation to London.

Exchange rate is the rate at which one currency is exchanged for another currency.

If interest rates in the United States increase more than in the UK, there would be an increase in foreign investments in the US. As a result, the demand for the dollar would increase and this would lead to an appreciation of the dollar against the GBP.

As a result of the appreciation of the dollar, export goods to the UK becomes more expensive and imports to the US from the UK becomes cheaper.

To learn more, please check: https://brainly.com/question/14039990

What do workers in the law, public safety, corrections, and security field do?

A. They ensure that people are happy with their life experiences.

B. They help people realize their full potential.

C. They look for transportation patterns for delivering goods.

D. They seek to protect people and their property.

Answers

Answer: D ←←←←←←←←←←←←←←←←←←←←←←←←←←←←←←←

According to our textbook, mass media have at least six functions. Which function involves media providers affecting or controlling which information is transmitted to their audiences?

Answers

According to our textbook, mass media have at least six functions. The function involves media providers affecting or controlling which information is transmitted to their audiences is called "Information and Education"

What is Mass Media?

The term "mass media" refers to a wide range of media technologies that reach a broad audience through mass communication.

The technology used for this communication include a range of channels. Broadcast media, which includes cinema, radio, recorded music, and television, disseminate information electronically.

The six functions of Mass Media are:

Education and informationInteraction.Recreation.Political SensitivityTransmission of Cultural ValuesDevelopment CatalystLearn more about Mass Media:

https://brainly.com/question/17658837

#SPJ1

The liabilities of Wildhorse Company are $113,000 and the owner’s equity is $235,000. What is the amount of Wildhorse Company’s total assets?

Answers

Answer:

$122,000

Explanation:

i dont know i just subtracted ¯\_(ツ)_/¯

In cell D13, use the keyboard to enter a formula that uses the SUM function to calculate the total of the values in range D4:D11

Answers

To add in Excel we must use the following formula =SUM (cell name: cell name).

How to add in Excel?In the Microsoft Excel computer program we have the possibility to add the values of different cells using a formula. To perform a sum we can use the following formulas:

We must put the equal symbol (=), then write "SUM" and put in parentheses the names of the cells that we want to include in the sum, for example:=SUM(A2:A10), with this formula we will add the values of cells A2:10.On the other hand, we have the possibility of adding the cell values of different rows with the following formula:

=SUM(A2:A10, C2:C10) Sums the values in cells A2:10, as well as cells C2:C10.Learn more about Excel in: https://brainly.com/question/23501096

#SPJ1

Stepsis is doing laundry today, but the machine is not working, she crawls in and sees whats wrong, she fixes it but shes stuck, she calls StepBro.

What should StepBro do?

A. Call Jamal

B. Pull her out

C. Dice Roll Dance And Bunny Hop Dance

D. I like ya cut G her

Answers

Answer:

b or d

Explanation:

because pulling her out might get the problem done faster , but I like ya cut g her could resolve in even more action . um I go with d

Answer:

B

Explanation:

Be a decent human being boys

Form ________ ? is a short tax return form designed for single and joint filers with no dependents or itemized deductions.

Answers

Answer:

IRS

Explanation:

internal revenue service

A(n) ________ involves a firm in one country agreeing to operate facilities for a firm in another country for an agreed fee.

Answers

Complete Question:

A(n) ________ involves a firm in one country agreeing to operate facilities for a firm in another country for an agreed fee.

Group of answer choices

A) franchising agreement

B) licensing agreement

C) management contract

D) indirect investment

Answer:

C) management contract

Explanation:

A management contract involves a firm in one country agreeing to operate facilities for a firm in another country for an agreed fee.

In Business, management contract can be defined as a legal or legitimate written agreement which enables a separate business, as well as perform the necessary managerial functions such as coordination and oversight functions on its behalf but in return for an agreed upon fee.

Which of the following quotes from a new-product adopter would signal the need for a firm to counteract a psychological barrier?

Answers

The psychological barrier may become an obstacle for a company to run its operations effectively.

The correct answer to the given question is :

" But it might make fat"

What is Psychological Barrier?

This quote is a psychological barrier for a company's new product, because it already states that it may cause a person to become fat.

Usually people follow healthy diet and they avoid consuming such products which make them fat.

Learn more business at https://brainly.com/question/27028468

For most consumers, term life insurance is considered to be the:

O worst option

O same cost as term

O most expensive

O best value

Answers

For most consumers, the term life insurance is considered to be worst option.

What is a term life insurance?A sort of death benefit that pays the policyholder's heirs over a predetermined length of time is term life insurance, commonly referred to as pure life insurance. The owner of the term life insurance policy has three options after the term has ended: renewing it for a new term, changing it to permanent protection, or letting the policy lapse. The premium for term life insurance is established by the insurance provider based on the value of the policy (the payout amount), as well as your age, gender, and general health. A medical examination could be necessary in several situations. Your driving history, current medications, whether you smoke, your work, your hobbies, and your family history may all be requested by the insurance provider.

To learn more about insurance, visit:

https://brainly.com/question/24034584

#SPJ1

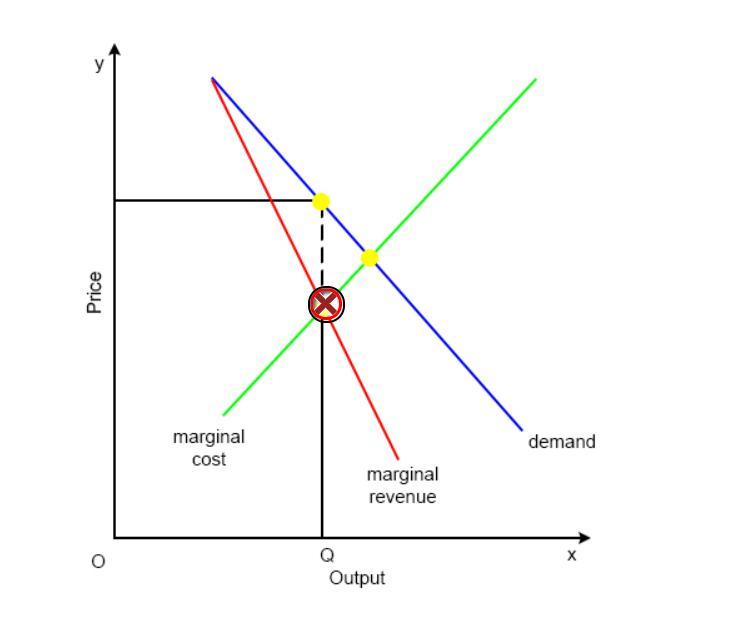

Select the correct location on the graph.

Indicate the point where a monopoly will set its price.

Answers

Got it right on Edmentum! Hope it helps.

The point where a monopoly will set its price is indicated in the attached image.

What is a monopoly?A corporation has a monopoly when it is the sole manufacturer of a given industry's product with no real competition. A monopoly has complete market power and is able to establish prices above the marginal cost of the company.

The increase in total cost necessary to create an additional unit of the product is known as the marginal cost; the company can achieve positive economic gain by manufacturing more of the commodity and selling it for less.

Since it can satisfy everyone's needs, a producer in a natural monopoly holds influence over the market. When a producer has a government monopoly, commercial production is prohibited and the producer has complete control over the market.

Learn more about Monopoly, here:

brainly.com/question/13113415

#SPJ5

Why is having a long credit history with a few blemishes that were corrected better than a short history that is clear? edg

Answers

The textile industry of Autarka advocates a ban on the import of wool suits. Describe five arguments its lobbyists might make. Give a response to each of these arguments.

Answers

The textile industry of Afghanistan advocates a ban on the import of wool suits, and the related arguments should be regarding environmental pollution, the local community, quality control, national security, and domestic production.

What is the significance of the textile industry?The textile industry has many negative consequences, including environmental pollution caused by its chemicals, the ending of domestic jobs, the quality of the product differing from handmade, and so on.

Hence, the textile industry of Afghanistan advocates a ban on the import of wool suits, and the related arguments should be regarding environmental pollution, the local community, quality control, national security, and domestic production.

Learn more about the textile industry here.

https://brainly.com/question/26709632

#SPJ1

Caitlin's lawyer suggests that she name a(n).

assets in the event of her death.

to receive her assets in the event of her death

Answers

Caitlin's lawyer suggests that she name someone, to receive her assets in the event of her death. Thus, option B is correct.

Who is a lawyer?A lawyer can be defined as a person who has gone to school to get a degree regarding the same and passed the bar exam. A lawyer helps the person in the matter which are related to the court

The lawyer recommended to Caitlin that in case she dies or in case of, she should name someone to whom the assets would be transferred after her death or demise. it can be transferred to a person, or organization for a charity fund. Therefore, option B is the correct option.

Learn more about a lawyer, here:

https://brainly.com/question/18883275

#SPJ1

Answer:

b

Explanation: