One of the employees of Davenport Corporation recently was involved in an accident with one of the corporation's delivery vans. The corporation is either going to repair the damaged van or sell it as is and buy a comparable used van. Information related to this decision is provided below:

Initial cost of the damaged van $ 30,000

Accumulated depreciation to date on van $ 18,000

Salvage value of van immediately before crash $ 9,000

Salvage value of van immediately after crash $ 1,000

Cost to repair damaged van $ 5,000

Cost of a comparable used van $ 10,000

Based on the information above, Davenport would be financially better off:

Answers

Answer:

Therefore, Davenport would be financially better off by repairing the damaged van for $4,000.

Explanation:

According to the given data in order to calculate how Davenport would be financially better off we would have to calculate the Benefit from repairing damaged van with the following formula:

Benefit from repairing damaged van=Cost of comparable used Van- Repair cost-salvage value before repair after crash

Benefit from repairing damaged van=$10,000 -$5,000 -$1,000

Benefit from repairing damaged van= $ 4,000

Therefore, Davenport would be financially better off by repairing the damaged van for $4,000.

Related Questions

Describe how sales and consumer-related legislation and regulations affect the delivery of customer service

Answers

Health and safety legislation affects customer service delivery as it requires staff in an organization to ensure the safety of themselves and others, and act responsibly.

There are many perspectives like Changes to tax regulations and rates can have a significant impact on a business. For example, a fall in the rate of corporation tax reduces the amount of tax that corporations have to pay on their profits.

Customer service staff who deal with customers should know about the impacts and effects of legislation and regulations that protect the consumer when buying goods and services.

Governments issue regulations related to environmental practices, employee practices, advertising practices, and much more.

Government regulations affect how companies structure their businesses, where companies decide to locate, how they classify their employees and thousands of other things.

Environmental regulations, intended to protect human health and the environment, generally result in higher production costs and lower productivity in firms, which can lead them to shift investment and production to less stringent locations.

Learn more about how sales and consumer legislation and regulations affect the delivery of customer service at,

https://brainly.com/question/16692763

2. Write a paragraph that explains how credit cards work, including the following

details:

• Who issues credit cards

Why and how they're used

Whether they're secured or unsecured debt

The impact of paying and not paying a credit card balance on time

Answers

1) Credit cards are issued to qualifying applicants by credit card issuers such as banks, credit unions, and financial institutions.

2) Credit cards are popular for making purchases or paying for services because they provide ease and flexibility.

3) Credit cards can be secured, which means they are backed by a deposit, or unsecured, which means they are not.

4) If a credit card amount is not paid in full on time, the borrower may be charged late fees and interest. If the debt is paid on time, the borrower's credit score may increase.

What is a credit card?A credit card is a type of payment card that allows the cardholder to pay a merchant for products and services depending on the cardholder's accumulated debt.

A credit card, in its non-physical form, is a payment method that supports both consumer and commercial business activities, such as purchases and cash advances. A credit card is typically used to replace cash or checks and offers an unsecured revolving line of credit.

Learn more about Credit Cards;

https://brainly.com/question/27350251

#SPJ1

When you make an ATM withdrawal, when does the money come from your account ?

A. Within 12 hrs

B. within 24 hrs

C. Within 48 hrs

D. Immediately

Answers

Answer: immeditely.

Explanation:

AcerWare Inc. manufactures external hard disks for $32 per unit, and the maximum price customers are willing to pay is $47 per unit. Data Driver Inc. is a competitor of AcerWare Inc. that produces external hard disks for $37 per unit, and customers are willing to pay a maximum price of $50 per unit. What does this imply? Multiple Choice AcerWare and Data Driver share differentiation parity. Data Driver has a competitive advantage over AcerWare in terms of perceived value. AcerWare creates a greater economic value than Data Driver. Data Driver is a cost-leader when compared to AcerWare.

Answers

Based on the price and amount that customers are willing to pay, Data Driver has a competitive advantage over AcerWare in terms of perceived value.

Why does Data Driver have this competitive advantage?A company is said to have a competitive advantage in perceived value over another company if customers are willing to pay more for its goods than the competitors.

DataDriver has a willingness to pay of $50 and AcerWare has a willingness to pay of $47. DataDriver therefore has a competitive advantage here.

In conclusion, option B is correct.

Find out more on competitive advantage at https://brainly.com/question/26514848.

hester (age 17) is claimed as a dependent by his parents, charlton and abigail. in 2022, hester received $10,120 of qualified dividends, and he received $13,120 from a part-time job. what is his taxable income for 2022?

Answers

The taxable income for 2022, given the amount that Hester received from his part time job, and qualified dividends, would be $10, 290

How to find the taxable income?To find the taxable income for Hester, you need to add up his income for the period and then deduct his deductions. If he claims no itemized deductions, then the standard deduction will apply.

Based on the fact that Hester is dependent on his parents, he should receive a different type of deduction but based on his income, he will receive the standard deduction for single filers in 2022.

The standard deduction that single filers get in 2022 is $12,950 which means that the taxable income to Hester for 2022 is:

= Qualified dividends + Income from part time job - Standard deduction

= 10, 120 + 13, 120 - 12, 950

= $10, 290

Find out more on taxable income at https://brainly.com/question/23508749

#SPJ1

The part of the market that a specific product is focusing on is called a____.

industrial market

consumer market

target market

niche

Answers

Answer:

niche

Explanation:

Question Content Area

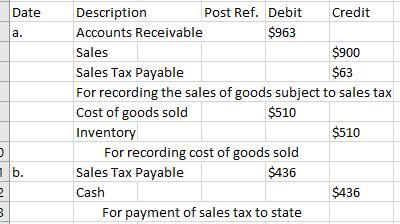

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

The Money Order Transaction log must be completed for all money

order transactions.

True

False

Answers

The statement that the Money Order Transaction log must be completed for all money order transactions is FALSE.

When should the Money Order Transaction log be completed?The regulations of the United States Treasury Department states that the Money Order Transaction log should be filled for money order transactions that are either valued at $3,000 or above.

This means that money orders that are less than $3,000 need not be filled in the Money Order Transaction log.

Find out more on the Money Transaction log at https://brainly.com/question/13244561

#SPJ1

When you are looking for a used car, this resource will help you best determine the value of a particular make and model:

Answers

A counterfeit id is intended to an official document, but is not authentic

Answers

Answer:

If this is the case then it is not valid.

Explanation:

Any counterfeit id is illegal and should never be rendered to be used for any purpose in relation to official documents.

The brand changes form part of a strategic plan the group conceived in September last year called Ekuseni (the Zulu word for “dawn”)”

“Pick n Pay and its new CEO are taking the fight to competitors in a strategy..”

“Pick n Pay yesterday launched a new strategic plan…”

Evaluate the proposed strategy that Pick n Pay is planning to implement, including in your evaluation, the potential risks attached to the proposed new strategy

Answers

Pick n Pay's proposed strategy, known as Ekuseni, aims to implement changes in their brand and take the fight to competitors. The strategy, conceived in September last year, focuses on strategic planning and was launched recently. While the strategy holds potential for success, there are risks associated with its implementation.

1. Pick n Pay's proposed strategy, called Ekuseni, includes changes to their brand and a competitive approach to rivals. This strategic plan was conceived in September last year, with the term Ekuseni referring to "dawn" in Zulu.

2. The strategy aims to revamp the brand image and position Pick n Pay as a strong competitor in the market. By taking the fight to competitors, the company intends to gain a competitive edge and attract more customers.

3. The launch of the new strategic plan indicates that Pick n Pay is committed to implementing this strategy and achieving its goals. It demonstrates the company's intention to adapt and stay relevant in the evolving market.

4. However, like any strategic plan, there are potential risks associated with its implementation. These risks include customer resistance to changes in the brand, increased competition from rivals, and potential financial strains due to the cost of rebranding and marketing efforts.

5. Customer resistance is a common risk when brands undergo significant changes. If the proposed strategy doesn't resonate with Pick n Pay's target market, it could lead to a decline in customer loyalty and affect sales.

6. Additionally, taking the fight to competitors may trigger retaliatory actions from rival companies. This could result in intensified competition, price wars, and potential market share loss for Pick n Pay.

7. Finally, implementing a new strategic plan involves financial investments. The cost of rebranding, marketing campaigns, and operational changes may strain the company's resources, potentially impacting its financial stability.

In conclusion, while Pick n Pay's proposed strategy holds promise for the company's growth and competitiveness, there are risks involved. Proper planning, market research, and effective execution will be crucial to mitigating these risks and ensuring the success of the strategy.

For more such questions on strategy, click on:

https://brainly.com/question/28561700

#SPJ8

Strong _______ skills influence hiring decisions and job performance, while at the same time promoting good relations in your personal life.

Answers

use the following information to answer this question: bayside, incorporated 2021 income statement ($ in thousands) net sales $ 6,270 cost of goods sold 4,790 depreciation 415 earnings before interest and taxes $ 1,065 interest paid 52 taxable income $ 1,013 taxes 213 net income $ 800 bayside, incorporated 2020 and 2021 balance sheets ($ in thousands) 2020 2021 2020 2021 cash $ 165 $ 270 accounts payable $ 1,810 $ 1,910 accounts received 1,210 1,050 long-term debt 920 720 inventory 1,885 2,170 common stock 3,460 3,390 total $ 3,260 $ 3,490 retained earnings 990 1,240 net fixed assets 3,920 3,770 total assets $ 7,180 $ 7,260 total liabilities

Answers

The information provided contains the 2021 Income Statement and Balance Sheets for Bayside, Inc. for the years 2020 and 2021.

In Income Statement, we can see that:

Net sales for Bayside, Inc. were $6,270,000 in 2021

Cost of goods sold was $4,790,000, leaving an earnings before interest and taxes (EBIT) of $1,065,000

After paying $52,000 in interest, the taxable income was $1,013,000 and the net income was $800,000

In Balance Sheets, we can see that:

Cash for Bayside, Inc. increased from $165,000 in 2020 to $270,000 in 2021

Accounts receivable decreased from $1,210,000 in 2020 to $1,050,000 in 2021

Inventory increased from $1,885,000 in 2020 to $2,170,000 in 2021

Total assets increased slightly from $7,180,000 in 2020 to $7,260,000 in 2021

Long-term debt decreased from $920,000 in 2020 to $720,000 in 2021

Retained earnings increased from $990,000 in 2020 to $1,240,000 in 2021.

To know more about Income Statement here

https://brainly.com/question/28035395

#SPJ4

Which one of the following statements about national income is correct?

Answers

Answer:

Pyruvate can be converted to PEP by a combination of reactions that use energy from two different types of nucleotide triphosphate.

Explanation:

An increase in income is always possible with out increasing expenses.

O True

False

Answers

Advise business on the role of intermediaries in the distribution process.

Answers

Intermediaries, in business and marketing, are those that act as a middleman between the producer and the consumer. The role of intermediaries in the distribution process of goods and services is to ensure that products and services are moved from the producer to the consumers.

There are several types of intermediaries in the distribution process, including wholesalers, retailers, agents, and brokers. They play a crucial role in the distribution process in the following ways:

Assist in Sorting and Selection: Intermediaries help producers to sort and select their products, which saves time and money for producers.Assist in Breaking Bulk: Intermediaries buy goods in large quantities from producers and then break them into smaller quantities. This makes it possible for producers to sell their products in smaller quantities, making it possible for consumers to afford them.Helps in Transporting Goods: Intermediaries help in transporting products from producers to consumers by offering transportation services at lower costs. They also assist in the warehousing of goods, which helps in the storage and protection of goods.Assist in Financing: Intermediaries play an important role in financing. They buy goods from producers, hold them, and then sell them to consumers. This helps to reduce the risk of loss for producers by providing cash up front for goods sold. They also offer credit facilities to consumers, which makes it possible for them to buy goods without having to pay cash upfront.Help in Providing Information: Intermediaries help to provide information about products and services to consumers, making it easier for them to make informed decisions. They also help to provide feedback to producers about the quality of their products and services.For more such questions on marketing

https://brainly.com/question/25369230

#SPJ8

what are the 5 basic seating arrangements used for small group meetings

Answers

Answer:

Family Style Seating.

Classroom Style Seating.

U-shape / Horse Shoe Style Seating.

Explanation:

5. Fill the range C6:G10 with the formatting from the range B6:B10 to use a consistent number format for the sales data.

Answers

One of the most beneficial number formats is the proportion (%) format. It shows values as percentages, such as 20% or 55%. This is specially useful when calculating matters like the value of income tax or a tip.

What is a sales tax number?A income tax ID is a range supplied to you through your country tax authority after you register with them to gather taxes. This number is issued by using states to permit you to cost taxes there. You want a sales tax ID variety solely if you determine that you want to cost taxes in a unique state.

GSTIN is the Goods and Services Tax Identification Number. It is a tax registration range that comes under the Goods and Services Tax (GST). This is a 15-digit number that is assigned state-wise to every taxpayer.

Learn more about sales data here:

https://brainly.com/question/28485799#SPJ1How to Prevent Services costs?

Answers

An oligopolistic market structure is distinguished by several characteristics, one of which is either similar or identical products. Which of the following are other characteristics of this market structure?

a. Market control by many small firms

b. Difficult entry

c. Mutual interdependence

d. Market control by a few large firms

e. Mutual dependence

Answers

Answer:

The correct option is d. Market control by a few large firms.

Explanation:

An oligopolistic market structure can be described as a market structure in which there is a small number of large firms, and none of the large firms can prevent the other large firms in the market from wielding great power.

An oligopolistic market structure is there a market that is dominated and controlled by by a few large firms.

Therefore, the correct option is d. Market control by a few large firms.

In which situation would a person pay a higher property tax than he or she did

the year before?

O A. The value of the person's home increased.

B. The amount the person spent on electronics increased.

O c. The number of dependents the person had increased.

O D. The salary the person earned increased.

Helppp

Answers

Answer:

The answer is A: The value of the person's home increased.

Explanation:

Keywords here are property tax indicating that the answer would most likely mention a piece of land or a house.

Refer to the table. If demand is represented by columns (3) and (1) and supply is represented by columns (3) and (4), equilibrium price and quantity will be.(The graph and answers for the question is in the picture below)

$9 and 60 units.

$10 and 60 units.

$8 and 80 units.

$8 and 60 units.

$9 and 70 units.

Answers

If demand is represented by columns (3) and (1) and supply is represented by columns (3) and (4), equilibrium price and quantity will be option A: $9 and 60 units.

Why is the above at equilibrium price and quantity?Demand and supply forces are balanced at an equilibrium price. Prices have a propensity to return to this equilibrium unless certain demand or supply characteristics alter. When demand, supply, or both move or change, the equilibrium price will be altered.

Therefore, The quantity supplied exceeds the quantity required when the price is above the equilibrium market price because suppliers will be willing to supply more at that price and consumers will be willing to buy less at that price.

Looking at the table, you will see that the quantity demanded at $9 was the quantity supplied (60 units), hence it is at the equilibrium.

Learn more about equilibrium price from

https://brainly.com/question/22569960

#SPJ4

In San Francisco, city regulations cap taxi licenses at 1500, creating a system in which demand for taxis exceeds supply and customer service is inadequate. Group of answer choices Strength Weakness Opportunity Threat

Answers

Answer: Opportunity

Explanation:

SWOT simply stands for the strengths, the weaknesses, the opportunities, and the threats that a particular business may face. Strengths are the attributes that are necessary to achieve organizational goals and to be successful.

Weaknesses are the attributes that re detrimental to the success of the company or achieving organizational goals.

Opportunities are the external factors that are favorable which can give a competitive advantage to an organization or allow the organization achieve its goals. Threats could hinder the success of the company.

Based on the analysis, the answer is Opportunity.

Identify different ways of interpreting the Constitution. (Site 1)

Answers

Answer:

1. Living Constitution: Many authors claims that law can be interpreted on this way , which is to believe that Constitution has many meanings and that changes with the contemporary societies , when found main constitutional phrases to interpret.

Originalism: On this kind of interpretation, many authors says that Constitution and all its statements have to be interpreted on the way that originally all the people at the time did back in 1776.

Textualism: Here several authors claims that no one can give other meaning that one that stands in the statement on the law. Its a formalism form of interpretation and the main interpretation is based on the meaning of the legal text.

Purposive Approach: Many Authors like Aharon Barak claims that common law courts can interpret a statute, part of a statute, or a clause of a constitution within the context of the law's purpose.

Strict Constructionism: Strict constructionism claims that has to give a narrow, or strict, interpretation to a legal text, like the U.S. Constitution to any judge. It means that a judge can interpret a text ONLY as it is written.

2.It is called a "living document " because no law can be passed that would contradict its principles but it also allows for changes.A living document is a document that can be changed as new things come up.

3.The Constitution has laid out four paths for amendments.ratification by state legislatures. They describe the path that has been used for most amendments.

Explanation:

Answer:1. Living Constitution: Many authors claims that law can be interpreted on this way , which is to believe that Constitution has many meanings and that changes with the contemporary societies , when found main constitutional phrases to interpret.

Originalism: On this kind of interpretation, many authors says that Constitution and all its statements have to be interpreted on the way that originally all the people at the time did back in 1776.

Textualism: Here several authors claims that no one can give other meaning that one that stands in the statement on the law. Its a formalism form of interpretation and the main interpretation is based on the meaning of the legal text.

Explanation:

Hope this helps ;}

select all the reasons to keep your money in a financial institution

Answers

The reasons to keep your money in a financial institution are:

Safety - To keep your money safe from burglars.

Convenience - Its easy to get your money out of the ATM when you need it.

Growth - If you put your money in a savings account you can collect interest.

Security - Leaving your money in the bank will make sure that even if your money is stolen you can get it back

What are financial institution?Financial institutions are organizations that provide financial services to individuals, businesses, and governments. These institutions include banks, credit unions, investment companies, insurance companies, and other financial intermediaries.

Banks are perhaps the most well-known financial institutions. They provide a range of financial services, including checking and savings accounts, loans, mortgages, and credit cards. Credit unions are similar to banks, but are typically smaller and owned by their members.

Investment companies, such as mutual funds and exchange-traded funds (ETFs), allow individuals to invest in a variety of assets, such as stocks, bonds, and real estate, without directly owning those assets. Insurance companies offer various types of insurance, such as life insurance, health insurance, and auto insurance, to help individuals and businesses manage risk.

learn more about financial institution: https://brainly.com/question/29630223

#SPJ1

select all the reasons to keep your money in a financial institution

Safety - To keep your money safe from burglars.

Convenience - Its easy to get your money out of the ATM when you need it.

Growth - If you put your money in a savings account you can collect interest.

Security - Leaving your money in the bank will make sure that even if your money is stolen you can get it back

None of the above

Customer service personnel typically need at least:

A. a high school diploma

B. a vocational school certificate

C. a community college degree

D. a four-year degree

Answers

Answer:

a

Explanation:

Refer to table 7-5. If the market price of an orange is $0.70, then the market quantity of oranges demanded per day is

Answers

On average, 7 oranges are required each day if an orange costs $0.70 on the open market.

Assume there are only three orange consumers—Alex, Barb, and Carlos—and that there are only three oranges that can be produced each day.

If an orange costs $0.70 on the open market, then 7 oranges are needed on average per day. The table shows how much each of the three possible orange buyers is willing to spend on the first 3 oranges of the day

If the price of one orange, P, satisfies the $0.75 < P < $0.80 market demand for exactly five oranges each day.

To know more about the Market table, click on the link below.

https://brainly.com/question/28710159

The complete question is.

If the market price of an orange is $0.70, the market quantity of oranges demanded per day is

a. 5.

b. 6.

c. 7.

d. 9.

#SPJ1

Minor Electric has received a special one-time order for 1,100 light fixtures (units) at $9 per unit. Minor currently produces and sells 8,500 units at $11.00 each. This level represents 85% of its capacity. Production costs for these units are $8.50 per unit, which includes $6.50 variable cost and $2.00 fixed cost. To produce the special order, a new machine needs to be purchased at a cost of $1,200 with a zero salvage value. Management expects no other changes in costs as a result of the additional production. Should the company accept the special order

Answers

Answer:

Minor Electric

The company should accept the special order. It makes a unit contribution of $1.41, which amounts to $1,551 in total.

Explanation:

a) Data and Calculations:

Special order received for light fixtures = 1,100 units

Price of special order = $9 per unit

Production and sales units = 8,500 = 85% capacity

Total capacity = 10,000 units (8,500/0.85)

Selling price at production and sales units = $11.00 each

Production costs per unit = $8.50

Variable cost per unit = $6.50

Fixed cost per unit = $2

Cost of new machine required for special order = $1,200

Special order costs:

Variable cost per unit = $7,150 ($6.50 * 1,100)

Cost of new machine = 1,200

Total relevant costs = $8,350

Unit cost = $7.59 ($8,350/1,100)

Selling price = $9.00

Contribution per unit = $1.41

What role does the government play in the economy’s circular flow ?

Answers

Recycling is Primarily an example of a issue facing businessess.

a. human resource

b. natural resource

c. ethical

d. social