Answers

The VAT that should be added to the invoice price, given the inventory amount is R3 552.63.

How to find the VAT ?The VAT rate in South Africa is currently 15% which means that the VAT on the inventory is:

VAT value = 15/100 x inventory price (VAT exclusive)

VAT value = 15/100 x R23 684.21

VAT value = R3 552.63

The total invoice price, including VAT, would be:

Total invoice price = inventory price (VAT exclusive) + VAT value

Total invoice price = R23 684,21 + R3 552,63

Total invoice price = R27 236.84

Find out more on VAT at https://brainly.com/question/30984967

#SPJ1

Related Questions

Assume the MPC is 0.6. If government were to impose $10 billion of new taxes on household income, consumption spending would initially decrease by

Answers

Answer:

$6 billion

Explanation:

Calculation to determine what consumption spending would initially decrease by

Using this formula

Decrease in Consumption spending=MPC * New taxes on household income

Let plug in the formula

Decrease in Consumption spending=0.6*$10 billion

Decrease in Consumption spending=$6 billion

Therefore consumption spending would initially decrease by $6 billion

Tìm một thí dụ thực tế để minh chứng cho sự thay đổi của chính sách pháp lý tác động đến chính sách bán hàng của doanh nghiệp.

Answers

Explanation:

Ans. (1) For preparing vaccines, in olden days,microbes were injected in the bodies of horses ormonkeys. These laboratory animals used to makeantibodies to defend these microbes. Antibodies areproteins which can act against the disease-causinggerms. These antibodies were extracted from theblood of these animals and were used as vaccines.(2) Now-a-days with the advent of biotechnology,the vaccines are manufactured in laboratories withthe help of bacteria. For this purpose, a detailedstudy of the disease causing germ is undertaken.The genes and the DNA of such microbes arethoroughly explored. Then based on thisinformation, proteins which can act against suchmicrobes are synthetically prepared in thelaboratories. The safe vaccine is produced in such away which can defend the body against infections.3) Some types of vaccines are prepared from theextracts of germs. These germs or microbes aredeactivated and made dormant. When they areinjected in the body of a person, they initiate thedefending action. The body of such vaccinatedperson, already develops the antibodies in his or herbody. When in future, this person is again attackedby similar germs the defence starts immediately andthe person does not become sick.

A lot of designer clothing companies will send free clothes to celebrities with hopes that the celebrities will wear their clothing in public and attract more customers to the brand. what mode of end?

Answers

Answer:

Celebrity endorsement.

Explanation:

The complete question is...

A lot of designer clothing companies will send free clothes to celebrities with hopes that the celebrities will wear their clothing in public and attract more customers to the brand. what mode of end? What mode of endorsement are these clothing companies trying to achieve?

Celebrity endorsement uses a celebrity's fame or social status to promote a product, brand or service. It is mostly associated with the fashion and beauty brands, and the goal is that the positive image of the celebrity be reflected onto the product or the brand. Celebrity endorsement has been used by some brands to promote their businesses into a multi-billion dollar company, and is also very lucrative for the celebrity, whose contract deals can run into hundreds of millions of dollars.

Q1. A. Briefly explain the following accounting concepts and principles.

(i)Going concern concept

(1)Business entity concept

(iii) Accrual concept

(lv) Duality concept

(V)Money measurement concept

(vi) Historical cost concept

(vii)Prudence concept

(viii)Materiality concept

(viii) Periodicity concept

(ix)Consistency concept

(x) Substance over form concept

Answers

Here's a brief explanation of each of the accounting concepts and principles listed:

1. Going-concern theory: According to this theory, a company will continue to run indefinitely without being obliged to close its doors or sell off its assets anytime soon. It has an impact on how assets and liabilities are evaluated and reported, thus it is crucial to take into account while creating financial statements.

2. Business entity concept: According to this notion, a business is a distinct legal entity from its owners, and as such, its financial transactions ought to be documented separately from those of those parties or of any other entities.

3. Accrual idea: According to this concept, regardless of when payment is actually received or made, revenue and costs must be recorded in the accounting period in which they are earned or spent.

4. The duality principle: According to this principle, every financial transaction contains both a debit and a credit. These two elements must have equal worth and be diametrically opposed.

5. Money measurement concept: According to this theory, financial accounts should only contain transactions that can be described in monetary terms.

6. Historical cost concept: Under this concept, assets and obligations must be documented at the price they originally paid, not their current market value.

7. Prudence concept: This concept demands accountants to use caution and discretion when making estimates and judgements in financial reporting in order to avoid overstating assets or income or understating liabilities or expenses.

8. Materiality idea: According to this notion, financial statements should only include information that is material, or significant enough to affect the decisions of statement users.

9. Periodicity Concept: The idea of periodicity requires financial statements to be prepared at regular intervals, for as monthly, quarterly, or annually.

10. Consistency concept: This concept states that in order to preserve the comparability of financial accounts, accounting processes and procedures must remain constant over time.

11. Substance over form concept: The substance over form notion states that transactions should be recorded based on their economic substance rather than their legal form. By doing this, even when a transaction's legal framework is complicated or odd, financial statements are guaranteed to accurately reflect a company's economic reality.

What types of information do we disclose to others when forming a relationship? (site 1)

Answers

Answer:

self disclosure

Explanation:

The Talbot Company uses electrical assemblies to produce an array of small appliances. One of the assemblies, the XOminus01, has an estimated annual demand of 12 comma 000 units. The cost to place an order for these assemblies is $650, and the holding cost for each assembly unit is approximately $30 per year. The company has 260 workdays per year.

Required:

What are the annual inventory holding costs if Talbot orders using the EOQ quantity?

Answers

Answer:

$1,975 per year

Explanation:

The first step is to calculate Economic order quantity using the following formula:

Economic Order Quantity = √2DO / H

Here

A is Annual Demand which is 12,000 Units.

O is Ordering Cost per order $650 per order.

H is Holding or Carrying Cost per unit per year is $30 per unit per year.

By putting values, we have:

Economic Order Quantity = √(2 * 12,000 * $650) / 30 = 131.66 units

Now annual inventory holding costs can be calculated using the following formula:

Inventory Holding Cost = Average Inventory * Holding Cost

Here,

Average Inventory = EOQ /2 = 131.66 / 2 = 66 units

By putting values we have:

Annual Inventory Holding Cost = 66 * 20 = $1,975 per year

Beckett Rice submitted a new Form W-4 for 2022 as presented below. If Beckett is paid gross wages of $3,000 for the semimonthly period, determine Beckett’s income tax withholding using the percentage method and the wage bracket method.

Answers

For the semimonthly period, Beckett Rice's federal income tax withholding is zero according to the wage bracket approach.

What justifies the response given above?We can determine Beckett Rice's income tax withholding using the data given using both the percentage technique and the pay bracket method:

Using a percentage-

Step 1: Multiply the semimonthly salaries by the quantity of pay periods in a year to arrive at the annual wages.

Annual salaries are $3,000 multiplied by 24 to equal $72,000.

Step 2: To determine the taxable income, deduct the annual withholding allowances from the annual pay.

$72,000 - ($4,000 x 2) = $64,000 is the taxable income.

Step 3: Calculate the annual federal income tax withholding using the IRS tax tables. The annual federal income tax withholding for a married taxpayer filing jointly with $64,000 in taxable income is $8,392.

Step 4: To calculate the semimonthly federal income tax withholding, divide the yearly federal income tax withholding by the number of pay periods in a year.

federal income tax withheld on a bimonthly basis = $8,392 / 24 = $349.67

Learn more about income tax withholding visit:

brainly.com/question/11233097

#SPJ1

Suppose that the production of plastic creates a social cost which is depicted in the graph above. Without any government regulation, how much plastic will be produced?

Answers

Suppose that the production of plastic creates a social cost which is depicted in the graph above. Without any government regulation, the way that much plastic will be produced is option C: 650

What is the production about?Without some government managing, the production of plastic would likely resume until the private costs of result equal the private benefits of production.

However, because plastic result generates a social cost, the private costs of result do not reflect the brimming cost to society. Therefore, in the absence of management regulation, the result of plastic would likely continue at a level that surpasses the socially optimum level, resulting in overdone pollution and harm to wildlife.

Learn more about production from

https://brainly.com/question/16755022

#SPJ1

In the price range where demand is inelastic, a decrease in price will result in a decrease in total revenue. True or False?

Answers

Explanation: N/A

Drag the tiles to the correct boxes to complete the pairs. Match the transactions to their relevant posting in the ledger.

Answers

2nd one: furniture account credited

3rd one: loan account debited

4th: loan account credited

Matching the transactions to their relevant posting in the ledger are;

Business purchases furniture: furniture account debited

Business sells furniture: furniture account credited

Business takes a loan from the bank: loan account debited

Business pays off the loan: loan account credited

The three primary categories of ledgers are;

1) General ledger: This is where accounts are kept that match the income statement and balance sheet they are intended for.

2) Sales ledger or debtor's ledger: This displays the current balance of money owed by clients to you and your business.

3) The purchase ledger, often known as the creditor's ledger, is a list of the goods and services a business has purchased, together with the amounts that have been paid and still need to be paid.

To know more about ledger:

https://brainly.com/question/30449784

#SPJ2

Question Content Area

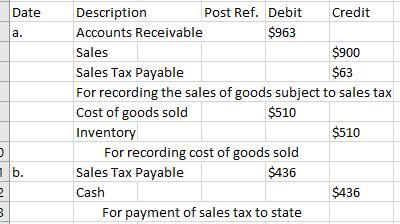

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

Explain the positive and negative aspects of entrepreneurship. Draw evidence to support your claim from two other sources.

Answers

Answer:

Advantage #1: A flexible schedule – both in terms of when and where you work. ...

Advantage #3: It's exciting and fulfilling. ...

Advantage #4: The salary makes sense. ...

Disadvantage #1: You wear a lot of hats. ...

Disadvantage #2: You are always at work.

Explanation:

The positive (advantages) and negative aspects (disadvantages) of entrepreneurship are enumerated below:

Control: Entrepreneurship offers the entrepreneur a sense of being in charge and being the captain of the ship. With freedom of control comes increased risk of business failure.Responsibility: The entrepreneur is responsible for her income for life sustenance. There is no more reliance on a period paycheck. The entrepreneur can decide to delight her customers or to scare them away.Flexibility: The entrepreneur enjoys flexibility in work schedule. She works at her own pace. The downside is that your customers dictate when you work. The workload may increase more than your capacity to handle. Thus, flexibility does not happen always until you have established the business properly.Profit-making: As the business makes profits, the entrepreneur is entitled to receive all. When it makes losses, the entrepreneur similarly bears all.Thus, there are numerous benefits in being an entrepreneur. But there are also negative aspects of entrepreneurship.

Read more about entrepreneurship at https://brainly.com/question/21012374 and https://brainly.com/question/24497797

What are the 7 steps of a business plan?

Answers

Executive Summary

Company Description

Products and Services

Market analysis

Strategy and Implementation

Organization and Management Team

Financial plan and projections

Corporation is estimating its WACC. The company has collected the following information:

Its capital structure consists of 40 percent debt and 60 percent common equity.

The company has 20-year bonds outstanding with a 9 percent annual coupon that are trading at par.

The company’s tax rate is 40 percent.

The risk-free rate is 5.5 percent.

The market risk premium is 5 percent.

The stock’s beta is 1.4.

What is the company’s WACC?

Answers

After analyzing the calculations, the weighted average cost of capital (WACC) = 10%. The weight of equity is added to the multiplication of the cost of debt and the weight of debt in order to calculate WACC, and the debt figure is then multiplied by (1-tax rate).

What is the weighted average cost of capital?The average rate a company pays to finance its assets is known as the weighted average cost of capital (WACC). It is determined by taking the average rate of all of the company's capital sources (debt and equity), weighted by the percentage of each component.

It is a crucial financial principle that is frequently applied in the financial industry to determine if a return on investment may be more than or equal to the cost of capital (equity plus debt) put in an asset, project, or firm.

Learn more about the weighted average cost of capital, here:

https://brainly.com/question/28561354

#SPJ1

Class Work (2 individuals)

1. Rama company issues 120000 10% debentures of $ 10 each at a premium of 10%.

The costs of floatation are 4%. The rate of tax applicable to the company is 55%.

Complete the cost of debt capital.

Answers

The cost of debt capital for Rama company is 5.2%.

To calculate the cost of debt capital for Rama company, we need to consider the interest paid on the debentures, the premium received on the debentures, and the costs of floatation.

Firstly, we can calculate the total amount of funds raised by issuing the debentures:

120,000 debentures * $10 face value = $1,200,000

Since the debentures are issued at a premium of 10%, the company receives an additional amount of:

$1,200,000 * 10% = $120,000

However, the cost of floatation is 4%, which means that the company has to pay:

$1,200,000 * 4% = $48,000

Therefore, the net amount of funds raised by the company is:

$1,200,000 + $120,000 - $48,000 = $1,272,000

Next, we need to calculate the interest paid on the debentures. The debentures carry an interest rate of 10%, which means that the annual interest payable by the company is:

$1,200,000 * 10% = $120,000

However, since the debentures are issued at a premium, the interest paid is tax-deductible. Therefore, the after-tax cost of debt can be calculated as follows:

Interest paid on debentures * (1 - tax rate)

= $120,000 * (1 - 55%)

= $120,000 * 0.45

= $54,000

Finally, we can calculate the cost of debt capital using the following formula:

Cost of debt capital = (interest paid - tax shield) / net amount raised

= ($120,000 - $54,000) / $1,272,000

= $66,000 / $1,272,000

= 0.052 or 5.2%

For more such questions on debt visit:

https://brainly.com/question/29749046

#SPJ11

These are sets of opinions, thoughts, and feelings an audience member might have on a topic that are not necessarily deeply held, and are therefore subject to change.

Answers

The definition corresponds to the concept of prejudice, because it involves a set of opinions, thoughts, and feelings.

A prejudice is a concept from the Latin praeiudicium that refers to an opinion, thought, or feeling (usually negative) that a person has formed about something or someone in advance and without prior knowledge.

Prejudice is the action and effect of establishing a definition or a meaning for something before the opportune time, that is, before knowing it in depth.

Note: This question is incomplete because the question is missing. Here is the complete question:

What concept does this definition correspond to?Learn more in: https://brainly.com/question/6997476

One of Shanice's team members is not happy with their performance review and refuses to accept the rating she gave. What should Shanice do?

Answers

Shanice should aim to resolve the issue through open communication, active listening, and a willingness to address the team member's concerns.

Listen and understand: Shanice should create an open and safe space for the team member to express their concerns. She should actively listen and seek to understand their perspective. This demonstrates empathy and shows that she values their input.

Provide clarity: Shanice should provide a clear explanation of the performance review process, including the criteria used to evaluate performance and the specific examples that led to the assigned rating. This can help address any misunderstandings or misconceptions.

Address concerns and offer feedback: Shanice should address the team member's specific concerns and provide constructive feedback. She can highlight areas for improvement and offer guidance on how to enhance performance. It's important for Shanice to focus on specific behaviors and outcomes rather than personal attacks or generalizations.

Seek input and involve the team member: Shanice can ask the team member for their suggestions on how to improve their performance or address their concerns. Involving them in the process can foster a sense of ownership and encourage collaboration.

Consider a reevaluation: If Shanice believes there may have been an oversight or if the team member presents compelling evidence, she can consider a reevaluation of the performance review. This may involve gathering additional feedback or revisiting the evaluation criteria.

For more such questions on communication visit:

https://brainly.com/question/25020821

#SPJ8

help pls i do not understand this question

Answers

Answer:

5...............................

The domestic demand (QD) for wheat in the United States is estimated to be

QDD = 1430 - 55P

where the quantity of wheat is measured in millions of bushels per year. Suppose China also demands U.S. wheat (QDC) and that its demand is given by

QDC = 2100 - 100P

What is the total demand for U.S. wheat, assuming the only two sources of demand are domestic and Chinese?

The total demand for U.S. wheat is:____.

A. QD = 3530 - 155P for all P.

B. QD = 1430 - 55P for all P.

C. QD = 3530 - 155P for P < or = to $26 and QD = 2100 - 100P for P > $26.

D. QD = 3530 - 155P for P < or = to $21 and QD = 2100 - 100P for P > $21.

E. QD = 3530 - 155P for P < or = to $21 and QD = 1430 - 55P for P > $21.

Answers

Answer:

E. QD = 3530 - 155P for P < or = to $21 and QD = 1430 - 55P for P > $21.

Explanation:

United States domestic demand function is QDD = 1430 - 55P

Demand for wheat in China is QDC = 2100 - 100P.

The total demand function for U.S. wheat will be given by function:

QD = 3530 - 155P

Imagine there is a town where the equilibrium quantity of workers is 20, and the equilibrium wage is $60. Given the demand for workers is proportional to wages, and that the demand for workers decreases by 5 persons if wages increase by $10, which of the following statements is correct if the town authorities make a policy of raising the equilibrium wage by 50% as the town’s minimum wage?

(A) The unemployment rate is 83%.

(B) 15 workers experience unemployment.

(C) This policy is welcomed by firms from the perspective of firms’ surplus.

(D) This policy is welcomed by workers from the perspective of workers’ surplus.

Answers

The policy of raising the equilibrium wage by 50% as the town's minimum wage would increase the equilibrium quantity of workers from 20 to 30. Hence option (D), this policy is welcomed by workers from the perspective of workers’ surplus is correct.

What is the equilibrium wage?The supply and demand of labor in a labor market are closely correlated with equilibrium wages. The point at which the supply and demand are equal is known as the equilibrium wage rate. Demand and supply play a role in setting wages in a market that is competitive.

The equilibrium wage will rise with either an increase in demand or a decrease in supply. The equilibrium wage will decline due to changes in supply or demand. The intersection of labor supply and demand is where the equilibrium market wage rate is located.

To learn more about equilibrium wage, visit:

https://brainly.com/question/15044855

#SPJ1

Don and Kristen are a married couple. Don works as an engineer bringing home

$50,000 per year and Kristen is a teacher bringing home $30,000 per year. They both

have monthly college loans of $425 each. They rent a one-bedroom apartment for $825

per month. They have not done any financial planning – for current needs or looking to

the future.

1) Explain to Don and Kristen 3 Marco factors they should take into account when

personal finance planning. (Chapter One).

2) Describe to Don and Kristen the 11 steps of the financial planning process.

(Chapter One)

3) Describe to Don and Kristen how using personal financial statements (Chapter

Three) on a regular basis, will help them with their finances.

4) Explain to Don and Kristen how an income and cash flow statement (Chapter

Three) will help them on a monthly basis with their finances.

5) Create a conservative budget with at least 8 budget categories for Don and

Kristen (Chapter Five).

6) Give two examples of micro factors and two example of macro factors that could

effect Don and Kristen’s budget (Chapter Five).

7) Give an example when using a cash budget and cash flow timing would benefit

Don and Kristen (Chapter Five).

8) Explain to Don and Kristen the difference between progressive and regressive

taxes (Chapter Six).

9) Describe to Don and Kristen the different tax strategies for different life stages

(Chapter Six).

10)After reviewing the differences between tax deductions and tax credits (Chapter

Six), give two suggestions to Don and Kristen as they file their tax forms for

2020. You must include a Reference Page citing any sources used in your answers.

Answers

Answer:

1. Three macro factors that Don and Kristen should take into account when personal finance planning are:

Economic factors: changes in interest rates, inflation, and economic growth can affect their income, expenses, and investments.Political factors: changes in tax laws, government policies, and regulations can impact their finances.Societal factors: shifts in demographics, cultural attitudes, and social trends can affect their job opportunities, earning potential, and lifestyle choices.2. The 11 steps of the financial planning process are:

Determine your current financial situationDevelop financial goalsIdentify alternative courses of actionEvaluate alternativesCreate and implement a financial planReview and revise the planEvaluate progress and revise the planDefine your personal and financial goalsDetermine your net worthDevelop a budgetManage your cash flow3.Using personal financial statements on a regular basis will help Don and Kristen with their finances by allowing them to:

Track their income, expenses, and net worth over timeIdentify areas where they can cut back on spending or increase their incomeEvaluate their progress towards their financial goalsPlan for major purchases or expensesPrepare for unexpected events or emergencies4. An income and cash flow statement will help Don and Kristen on a monthly basis with their finances by providing a detailed breakdown of their income and expenses, and how much cash they have on hand. This will allow them to:

Identify areas where they can cut back on spending or increase their incomePrioritize their expenses and plan for upcoming bills or paymentsEvaluate their cash flow situation and adjust their spending accordinglyTrack their progress towards their financial goalsA conservative budget for Don and Kristen could include the following eight categories:

Rent/mortgageUtilities (gas, electric, water, internet)Transportation (car payment, insurance, gas)Groceries/foodEntertainment (eating out, movies, hobbies)Health (insurance, copays, prescriptions)Savings (emergency fund, retirement, investments)Debt repayment (student loans, credit cards)Two micro factors that could affect Don and Kristen's budget are:

Changes in their income (such as raises or bonuses)Changes in their expenses (such as unexpected bills or changes in interest rates)Two macro factors that could affect Don and Kristen's budget are:

Changes in the national economy (such as a recession or changes in the job market)Changes in tax laws or government regulations that impact their income or expensesUsing a cash budget and cash flow timing would benefit Don and Kristen in situations where they have irregular or unpredictable income, such as freelancers or commission-based jobs. By tracking their income and expenses on a cash basis, they can better plan for upcoming bills and adjust their spending based on their cash flow.\Progressive taxes are taxes that take a larger percentage of income from higher-income earners, while regressive taxes take a larger percentage from lower-income earners. For example, income tax is a progressive tax because the tax rate increases as income increases. Sales tax is a regressive tax because everyone pays the same percentage regardless of income.Different tax strategies for different life stages could include:In the early career stage, focus on maximizing retirement contributions and taking advantage of employer benefits like health insurance and tuition reimbursement.In the mid-career stage, consider additional investments and savings for major expenses like college tuition or a down payment on a house.In the late career stage, focus on retirement planning and minimizing taxes on retirement income.10. Two suggestions for Don and Kristen as they file their tax forms for 2020 are:

Consider taking advantage of tax credits: Tax credits directly reduce the amount of tax owed, while tax deductions reduce taxable income. Don and Kristen should review the available tax credits for which they may qualify, such as the Earned Income Tax Credit, the Child Tax Credit, and the American Opportunity Tax Credit for education expenses. By claiming these tax credits, they can reduce their overall tax bill.

Be sure to claim all eligible deductions: Don and Kristen should review the list of available tax deductions and be sure to claim all the ones for which they are eligible. This may include deductions for charitable donations, student loan interest, and health care expenses. By claiming all eligible deductions, they can reduce their taxable income and ultimately lower their tax bill.

Explanation:

what is the difference between the total account value using compound interest and the amount earned using simple interest

Answers

__________ is not a technology company but used technology to revamp the business process of renting movies.

Answers

Answer:

Netflix

Explanation:

Netflix is a company that uses streaming service where viewers can watch varieties of documentaries, popular films etc on their network . This type of service enables users to access latest films, TV shows, offered by Netflix over the internet. Although users get to watch and enjoy these services through a paid subscription, there are quite unlimited films that can be watched and downloaded for offline viewing.

Unlike a conventional method where people can watch and download films, documentaries online, Netflix provides a platform that warehouses collections of films, documentaries, TV shows hence revamp the business methods of renting movies.

Derek is a high school student who is currently taking a course in personal

finance. He knows that he should be managing his money from his part-time job

better. He has learned about saving and budgeting, but he continues to spend all

of his money on his car and going out with friends. He knows that someday he'll

have to be more responsible, but right now he thinks he should just enjoy being a

carefree teenager. Why is it important for Derek to manage his money well now

instead of waiting until he's older?

Answers

Answer:

If he starts practicing saving money and budgeting while he is young, it will help him in the future when he is trying to save up for a house or trying to make a budget for how much he wants to spend on his future house. If he spends all of this money as a teenager, he won't have any money saved up for things that he needs.

An employee:

works for someone else

O takes the risk of a business venture

sets financial goals for the business

sets nonfinancial goals for a business

Answers

Answer:

works for someone else

Explanation:

An employee is someone hired to offer labor services to their employers. The employers may be an individual, a private organization, or the governments. Employees earn wages, salaries, and other benefits provided by the employer in exchange for their labor services.

Employees do not assume any risks as the business owners do. Their role is to fulfill their mandate as instructed by the employers. Employees assist the employer in accomplishing their business vision.

design an approach that your team would recommend for Joseph and Nicholas to cover one area each that you deem necessary to aid in the planning and controlling functions

Answers

The combines strategic planning, performance measurement, effective communication, and continuous improvement to support Joseph and Nicholas in their planning and controlling functions. It ensures a well-defined direction, data-driven decision-making, collaboration, and a focus on growth and adaptability.

In order to aid in the planning and controlling functions, the following approach can be recommended to Joseph and Nicholas:

1. Establish Clear Objectives and Goals: The first step in planning is to establish clear objectives and goals for the team. It is important to have a clear understanding of what needs to be accomplished and what the team's priorities are.

2. Assign Responsibilities: Assigning specific responsibilities to team members helps to ensure that everyone is working towards a common goal. Joseph and Nicholas should each be assigned to cover one area that is necessary for planning and controlling functions. This will help to ensure that all aspects of the project are covered and that there is no overlap or duplication of efforts.

3. Develop a Schedule: Developing a schedule that outlines the key milestones and deadlines for the project is essential to effective planning and control. This will help to ensure that the project stays on track and that deadlines are met.

4. Monitor Progress: Regularly monitoring progress against the schedule and objectives is necessary to ensure that the project is progressing as planned. This will help to identify any issues or problems that arise and allow for corrective action to be taken.

5. Communicate: Effective communication is critical to the success of any project. Joseph and Nicholas should establish a regular communication schedule to ensure that everyone is up-to-date on the project's progress, any issues or problems that arise, and any changes to the schedule or objectives.

6. Make Adjustments: Finally, it is important to be flexible and make adjustments as needed. If the project is not progressing as planned, adjustments may be necessary to the schedule or objectives to ensure that the project stays on track and that goals are met.

for more question on adaptability

https://brainly.com/question/26810727

#SPJ8

Answer ASAP

Which word best describes the international banking system?

O A. Decentralized

O B. Unimportant

O C. Nonexistent

D. Controlled

Answers

Which stage of the product development cycle first involves a deep look into whether the demand is high enough to make the product profitable? A. test market B. financial analysis C. commercialization D. idea evaluation

Answers

Answer:

b

Explanation:

[The following information applies to the questions displayed below.]

On January 1, 2024, Splash City issues $320,000 of 8% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year.

Assuming the market interest rate on the issue date is 9%, the bonds will issue at $293,938.

2. Record the bond issue on January 1, 2024, and the first two semiannual interest payments on June 30, 2024, and December 31, 2024.

(Interest Expense does not equal 12800)

Answers

To record the bond issue on January 1, 2024, and the first two semiannual interest payments on June 30, 2024, and December 31, 2024, we need to consider the issuance of the bonds and the accrual of interest expense.

1. Bond Issue on January 1, 2024:

Date Account Debit Credit

--------------------------------------------------------

January 1, 2024 Cash $293,938

Bonds Payable $320,000

To record the issuance of $320,000 face value bonds at a discounted price of $293,938.

2. Semiannual Interest Payment on June 30, 2024:

Date Account Debit Credit

--------------------------------------------------------

June 30, 2024 Interest Expense $14,400

Cash $14,400

To record the semiannual interest payment ($320,000 * 8% / 2 = $12,800) for the period from January 1, 2024, to June 30, 2024.

3. Semiannual Interest Payment on December 31, 2024:

Date Account Debit Credit

--------------------------------------------------------

December 31, 2024 Interest Expense $14,400

Cash $14,400

To record the semiannual interest payment ($320,000 * 8% / 2 = $12,800) for the period from July 1, 2024, to December 31, 2024.

Please note that the interest expense amount mentioned in the question might be incorrect. Based on the information provided, the interest expense should be $12,800 for each semiannual interest payment, resulting in a total of $25,600 for the year 2024.

Two new companies start to produce HDTVs. This results in _____ in the _____ HDTVs.

an increase, supply of

an increase, demand for

no change, supply of

no change, demand for

Answers

Answer:

an increase, supply of

Explanation:

Answer:

AN INCREASE SUPPLY OF

Explanation:

trust me bro