Answers

Answer: B

Explanation:

Related Questions

Value stream mapping is used to identify all of the value-adding as well as non-value-adding processes that materials are subjected to within a plant.

a. true

b. false

Answers

If TOMS advertised its shoes differently

Answers

Answer:

it might have more sales <3

Explanation:

Lantana company has provided you with the transactions that occurred during its first month of operations. The controller has already recorded the transactions to the t-accounts and has asked you to prepare the classified balance sheet based on the t-account balances.

Answers

To prepare the classified balance sheet for Lantana Company based on the provided t-account balances.

What is T- Accounts ?We first need to organize the information into relevant categories. These categories typically include current assets, non-current assets, current liabilities, non-current liabilities, and equity.

For current assets, we can include cash, accounts receivable, and inventory, among others. Non-current assets may include property, plant, and equipment, as well as long-term investments.

Current liabilities may include accounts payable and short-term loans, while non-current liabilities could include long-term debt and deferred tax liabilities. Finally, equity would include common stock, retained earnings, and any other relevant components.

Once we have organized the t-account balances into these categories, we can then calculate the total amounts for each category and list them on the balance sheet accordingly.

The resulting balance sheet will provide a clear snapshot of the company's financial position at the end of its first month of operations, and will be a useful tool for decision-making and planning going forward

Learn more about T- Account here

https://brainly.com/question/16729576

#SPJ1

po

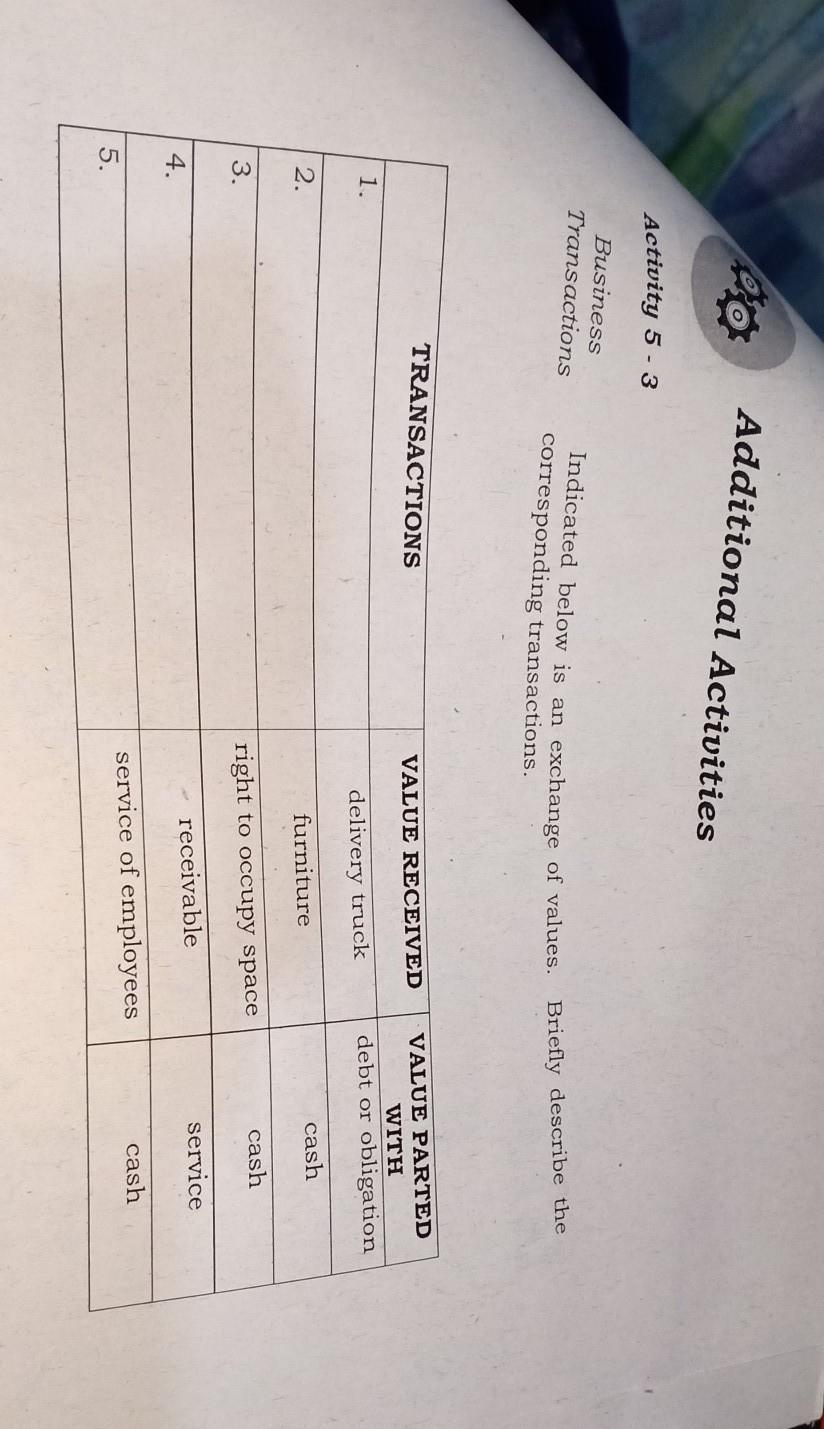

Additional Activities

Activity 5 - 3

Business

Transactions

corresponding transactions.

TRANSACTIONS

VALUE RECEIVED

VALUE PARTED

WITH

debt or obligation

1.

delivery truck

cash

2.

furniture

cash

3.

right to occupy space

service

receivable

4.

cash

service of employees

5.

Indicated below is an exchange of values. Briefly describe the

Answers

Answer:

ok

Explanation:

A proposed new project has projected sales of $219,000, costs of $96,000, and depreciation of $26,000. The tax rate is 23 percent. Calculate operating cash flow using the four different approaches. (Do not round intermediate calculations.) Top-down

Answers

Answer and Explanation:

The computation of the operating cash flow using the four different approaches is shown below:

1. EBIT + depreciation - taxes approach

But before that the net income would be

Sales $219,000

Less cost -$96,000

Less depreciation -$26,000

EBT $97,000

Less tax at 23% -$22,310

Net income $74,690

Now the operating cash flow is

= EBIT + depreciation - taxes

= $97,000 $26,000 - $22,310

= $100,690

2. top down approach

= Sales - cost - taxes

= $219,000 - $96,000 - $22,310

= $100,690

3. Tax shield approach

= (Sales - cost) × (1 - tax rate) + tax rate × depreciation expense

= ($219,000 - $96,000) × 0.23 + 0.23 × $26,000

= $94,710 + $5,980

= $100,690

4. Bottom up approach

= Net income + depreciation

= $74,690 + $26,000

= $100,690

You want to hire a consultant with expertise in identifying suitable locations for expansion. You've constructed a list of ten individuals, all from referrals, who may be able to provide this service. You want to contact each individual to gain additional information about availability, expertise, planned approach, and pricing. Which statement is most true of an email in this situation?

a. It requires less planning than a phone call.

b. It has less permanence than a phone call.

c. It requires more coordination than a phone call.

d. It is not as rich as a phone call.

Answers

Based on the benefits of using an email, the best answer would be that email a. requires less planning than a phone call.

Challenges with using a phone callTiming needs to be right for both you and the consultant. The consultant might not be able to give a comprehensive answer in the time of the call.If an email is used however, there is less planning because an email can be sent at your opportune time and then received and read at the coordinators' opportune time.

In conclusion, option A is correct.

Find out more on benefits of online tools at https://brainly.com/question/14591988.

The following information relating to a company's overhead costs is available.

Actual total variable overhead $74,000

Actual total fixed overhead $18,000

Budgeted variable overhead rate per machine hour $2.00

Budgeted total fixed overhead $16,000

Budgeted machine hours allowed for actual output 44,000

Based on this information, the total variable overhead variance is:

a. $2,000 favorable.

b. $6,000 favorable.

c. $2,000 unfavorable.

d. $6,000 unfavorable.

e. $1,000 favorable.

Answers

4. Choose the best answer.

Which statistic about each school is NOT provided by the Common Data Set?

O the average debt incurred through student loans

O housing and meal plan options

O the tuition rate and test scores

O the average starting salary

Answers

the average debt incurred through student loans statistic about each school is NOT provided by the Common Data Set.

What is common data set?it is a collaborative effort among data providers in the higher education community and publishers as represented by the College Board, Peterson's, and U.S. News & World Report. The combined goal of this collaboration is to improve the quality and accuracy of information provided to all involved in a student's transition into higher education, as well as to reduce the reporting burden on data providers.It is the development of clear, standard data items and definitions in order to determine a specific cohort relevant to each item.Data items and definitions used by the U.S. Department of Education in its higher education surveys often serve as a guide in the continued development of the CDS.Common Data Set items undergo broad review by the CDS Advisory Board as well as by data providers representing secondary schools and two- and four-year colleges. Feedback from users of CDS is also considered in the annual review process.thus, the average debt incurred through student loans statistic about each school is NOT provided by the Common Data Set.

to know more about common data refer

https://brainly.com/question/26352522

#SPJ1

How does the government pay for roads, schools, and

emergency services?

They are funded through non-profits.

They are funded through taxes.

They are funded through charitable donations.

None of the above

Answers

Roads, schools, and emergency services are primarily funded through a system of taxation. This varies depending on the type of tax and the service being funded. The taxes are then allocated to different government departments.

Explanation:Roads, schools, and emergency services are predominantly funded by the government through a system of taxation. When residents and businesses pay taxes, that money is pooled together and divided among various governmental departments. For instance, certain taxes, like property taxes, are often used to fund local services such as schools and emergency services, while gasoline taxes can contribute to the construction and maintenance of roads. Funding for these resources can also come federally or from the state.

Learn more about Government Funding here:https://brainly.com/question/34026406

WBS for the knowledge area of Human/Resource Management for a low-cost housing project

Answers

Here's an example of a WBS for the knowledge area of Human/Resource Management for a low-cost housing project:

The wbs for a knowledge area of Human/Resource Management for a low-cost housing projectHuman/Resource Management

1.1 Staffing Plan

1.1.1 Define project roles and responsibilities

1.1.2 Identify required staffing resources

1.1.3 Determine the project team structure

1.1.4 Develop a staffing plan and budget

1.2 Recruitment and Selection

1.2.1 Create job descriptions and specifications

1.2.2 Advertise and promote job openings

1.2.3 Review resumes and conduct initial screenings

1.2.4 Conduct interviews and select candidates

1.2.5 Perform background checks and reference checks

1.2.6 Extend job offers and negotiate terms

1.3 Training and Development

1.3.1 Assess training needs for project team members

1.3.2 Develop a training plan and schedule

1.3.3 Conduct training sessions and workshops

1.3.4 Provide on-the-job training and mentoring

1.3.5 Evaluate training effectiveness and adjust as needed

1.4 Performance Management

1.4.1 Set performance expectations and goals

1.4.2 Monitor and assess individual and team performance

1.4.3 Provide feedback and coaching to improve performance

1.4.4 Conduct performance appraisals and evaluations

1.4.5 Identify and address performance issues or conflicts

1.5 Resource Allocation

1.5.1 Identify project resource requirements

1.5.2 Allocate resources based on project needs

1.5.3 Monitor resource utilization and availability

1.5.4 Optimize resource allocation to meet project objectives

1.6 Stakeholder Management

1.6.1 Identify project stakeholders and their interests

1.6.2 Develop a stakeholder engagement plan

1.6.3 Communicate and manage stakeholder expectations

1.6.4 Address stakeholder concerns and resolve conflicts

1.6.5 Maintain positive relationships with stakeholders

Read more on Human resource management here: https://brainly.com/question/14419086

#SPJ1

Bakersfield Corp. pays income tax at an average rate of 30 percent. This year its revenue is $124,000 and its expenses are $82,000. The adjusting entry to record the income tax expense will:

Multiple Choice

decrease net income by $42,000.

increase shareholders' equity by $12,600.

decrease liabilities by $12,600.

decrease shareholders' equity by $12,600.

Answers

The adjusting entry to record the income tax expense for Bakersfield Corp. will decrease net income by $42,000. Option A is the correct answer.

The adjusting entry to record the income tax expense for Bakersfield Corp. will decrease net income by $42,000.

The income tax expense is calculated by applying the applicable tax rate to the taxable income. In this case, Bakersfield Corp. has revenue of $124,000 and expenses of $82,000, resulting in a taxable income of $42,000 ($124,000 - $82,000).

Since Bakersfield Corp. pays income tax at an average rate of 30 percent, the income tax expense will be 30 percent of the taxable income:

Income tax expense = Taxable income x Tax rate

= $42,000 x 0.30

= $12,600

Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are properly recognized. In this case, the adjusting entry will decrease net income by the amount of the income tax expense.

This adjustment reflects the company's obligation to pay income tax and reduces its reported net income.

Therefore, the correct option is: "Decrease net income by $42,000."

For such more question on income:

https://brainly.com/question/14510611

#SPJ8

Which one of the following is a positive economic

statement?

(A) An increase in the price of butter causes

consumers to buy less butter.

(B) Social conscience demands that we increase

the minimum wage.

(C) Taxes should be raised to halt inflation.

(D) The sales tax on food should be repealed.

Answers

Answer:

(B) Social conscience demands that we increase

the minimum wage.

Explanation:

Indicate the effects of the following business transactions on the accounting equation for Sam's Snack Foods, a supplier of snack foods.

Transaction (a) is answered as a guide. a. Sam s Snack Foods received cash from the issuance of common stock to stockholders. Answer: Increase asset (Cash); Increase equity (Common Stock)

b. Cash purchase of land for a building site.

c. Paid cash on accounts payable.

d. Purchased equipment; signed a note payable.

e. Performed service for a customer on account.

f. Employees worked for the week but will be paid next Tuesday.

g. Received cash from a customer on accounts receivable.

h. Borrowed money from the bank.

i. Cash dividends paid to stockholders.

j. Incurred utilities expense on account.

Answers

Answer:

a. Sam s Snack Foods received cash from the issuance of common stock to stockholders.

Increase asset (Cash); Increase equity (Common Stock)b. Cash purchase of land for a building site.

Decrease current asset (Cash); Increase non-current asset (Land)c. Paid cash on accounts payable.

Decrease asset (Cash); Decrease liabilities (Accounts payable)d. Purchased equipment; signed a note payable.

Increase non-current asset (Equipment); Increase long term liabilities (Notes payable)e. Performed service for a customer on account.

Increase asset (Accounts receivable); Increase equity (Retained earnings)f. Employees worked for the week but will be paid next Tuesday.

Increase liabilities (Wages payable); Decrease equity (Retained earnings)g. Received cash from a customer on accounts receivable.

Increase asset (Cash); Decrease asset (Accounts receivable)h. Borrowed money from the bank.

Increase asset (Cash); Increase liability (Notes payable)i. Cash dividends paid to stockholders.

Decrease asset (Cash); Decrease equity (Retained earnings)j. Incurred utilities expense on account.

Increase liabilities (Accounts payable); Decrease equity (Retained earnings)john's goal in life is to be a millionaire. he has 6980 in his saving account and figures he is likely to earn an 18% rate of return every year. if john consistently makes a $1200 deposit into his savings account every year, how many years would it take for john to have his first 1000000?

Answers

If john consistently makes a $1200 deposit into his savings account every year, The number of years it would take for john to have his first 1000000 is 48.71 years.

Number of payment per period (NPER)We would be making use of financial calculator to determine the number of period by inputting the below data.

PV= -6,980

rate = 18%

pmt = 1200

FV = 1,000,000

NPER=?

Hence:

NPER= 48.71 years.

Therefore If john consistently makes a $1200 deposit into his savings account every year, The number of years it would take for john to have his first 1000000 is 48.71 years.

Learn more about Number of period (NPER) here:https://brainly.com/question/24321952

#SPJ1

Company Q incurred manufacturing costs for the year as follows:

Direct materials Sh 10/unit

Direct labour sh 7/unit

Manufacturing overheads:

Variable sh 3/unit

Fixed Sh 7,500

Variable selling and administrative expenses sh 2,000

Fixed selling and administrative expenses sh 4,000

The company produced 1,500 units (the normal level of production) and sold 1,000 units at Sh 45 per unit. Assume that the production manager is paid a 15 per cent bonus based on the company’s net income.

Required:

(a) Prepare an income statement under absorption costing

Answers

Based on the manufacturing costs incurred by Company Q and the absorption costing method, the income statement would be:

Company Q

Income Statement

Revenue (1,000 x 45) 45,000

Cost of goods sold:

Direct materials 10,000

Direct labor 7,000

Variable Manufacturing overhead 3,000

Fixed manufacturing overhead 5,000 (25,000)

Gross Margin 20,000

Variable Selling and admin expenses 2,000

Fixed Selling and admin expenses 4,000

Total Selling and admin expenses (6,000)

Net Income 14,000

What are the variable and fixed costs?Direct materials:

= 1,000 x 10

= Sh 10,000

Direct labor:

= 1,000 x 7

= Sh 7,000

Variable manufacturing overhead:

= 1,000 x 3

= Sh3,000

Fixed manufacturing overhead:

= 1,000 x (7,500 / 1,500)

= Sh 5,000

Cost of goods sold:

= 10,000 + 7,000 + 3,000 + 5,000

= Sh 25,000

Find out more on absorption costing at https://brainly.com/question/26276034.

#SPJ1

What is the difference between final goods and intermediate goods?

Answers

A) Final goods are goods that are purchased by the end-consumer or user for their personal consumption or use.

B) Intermediate goods, on the other hand, are goods that are used as inputs in the production of other goods.

Final goods and intermediate goods are terms used in economics to distinguish between different types of goods in the production process. Here's a breakdown of the difference between the two:

1. Final Goods:

Final goods are goods that are purchased by the end-consumer or user for their personal consumption or use. These goods are ready for consumption and do not undergo further processing or transformation before reaching the final consumer. Examples of final goods include food products, clothing, electronics, furniture, and vehicles. Final goods are the end result of the production process and are intended for final consumption or use.

2. Intermediate Goods:

Intermediate goods, on the other hand, are goods that are used as inputs in the production of other goods. They are not intended for final consumption but are instead used as raw materials, components, or capital goods in the production process. Intermediate goods undergo further processing or transformation before being included in the final goods. Examples of intermediate goods include raw materials like steel or wood, components like circuit boards or engines, and machinery or equipment used in production.

The key distinction between final goods and intermediate goods lies in their purpose and stage in the production process. Final goods are produced for the ultimate satisfaction of consumers' needs and are ready for consumption, while intermediate goods are used in the production of other goods and undergo further processing.

It's important to note that when calculating a country's Gross Domestic Product (GDP), only the value of final goods is considered. Intermediate goods are excluded to avoid double-counting, as their value is already included in the final goods they contribute to. By focusing on final goods, GDP provides a measure of the value of goods and services produced for final consumption in an economy.

for more such question on goods visit

https://brainly.com/question/25262030

#SPJ8

A company is considering purchasing a new production machine and have identified two potential options. Option A has a first cost of $1450 but will produce annual revenues of $650 while incurring $245 worth of maintenance. Option B has a purchase price of $1130 with annual revenues of $445 and maintenance costs of $147. One of your colleagues has done an internal rate of return analysis on Option A and determined it had an IRR=12.28%

a. Your boss has asked you to determine the IRR for option B, assuming that both options have same service life

b. Assuming the two production machines are independent and the company has a MARR of 11%, what should the company do?

Answers

Answer:

a. The IRR for the option B will be 9.988%.

b. The company would accept option A and reject the option B

Explanation:

a. To calculate the IRR for option B we first need to determine the service life of the option A.

If R = 12.28%

Net annual benefits = 650-245=$405

Then, 1450= 405*(1-1/1.1228^n)/.1228

1/1.1228^n =1 - 1450*.1228/405 = .5603

1.1228^n = 1.7846

n = log(1.7846)/log(1.1228) = 5 years

Therefore, For option B

Let, IRR = R

Net annual benefit = 445-147 = $298

1130 = 298*(1-1/(1+R)^5)/R

At R = 9%

PV of cash inflows = $1159.12

At R = 10%

PV of cash inflows = $1129.65

As per the method of interpolation,

R = 9% + ((1159.12 - 1130)/( 1159.12-1129.65))*(10%-9%)

R = 9.988%

Thus, IRR for the option B will be 9.988%.

b. According to the given data to selection the any option, the value of IRR must be greater than or equal to the MARR. in this case, option A has the IRR of 12.28% that is greater than the MARR of 11%. But, it is not the case with option B whose IRR is only 9.988% and it is less than the MARR of 11%.

Thus, option A will be accepted and option B will be rejected.

A customer is receiving a 7/1 interest-only ARM with an initial interest-only payment of $1,200 and an interest rate of 4.5%. What is the customer’s loan amount?

Answers

Answer:

The 7/1 Interest-Only ARM is a 30-year Adjustable Rate Mortgage loan that permits interest-only payments for the first 10 years, with required principal and interest monthly payments fully amortized over the remaining 20 years of the loan term, for the purchase and limited cash-out refinancing of owner-occupied single .

Why might a business person purchase a fidelity bond?

A. To cover employee theft

B. To avoid purchasing insurance

C. To show loyalty to employees

O D. To fund a new company

Answers

Answer: A. To cover employee theft.

Suppose the city of Des Moines has a high credit rating, and so when Des Moines borrows funds by selling bonds, _____.

a. the city's high credit rating and the tax status of municipal bonds both contribute to a lower interest rate than would otherwise apply.

b. the city's high credit rating and the tax status of municipal bonds both contribute to a higher interest rate than would otherwise apply.

c. the city's high credit rating contributes to a lower interest rate than would otherwise apply, while the tax status of municipal bonds contributes to a higher interest rate than would otherwise apply.

d. the city's high credit rating contributes to a higher interest rate than would otherwise apply, while the tax status of municipal bonds contributes to a lower interest rate than would otherwise apply.

Answers

Suppose the city of Des Moines has a high credit rating, and so when Des Moines borrows funds by selling bonds,

A. The city's high credit rating and the tax status of municipal bonds both contribute to a lower interest rate than would otherwise apply.How to use high credit rating?When a city such as Des Moines has a high credit rating, it means that it has a lower risk of defaulting on its debt obligations. This makes it more attractive to investors and allows the city to borrow funds at a lower interest rate than it would otherwise have to pay.

Additionally, the tax status of municipal bonds makes them exempt from federal income tax, and in some cases, state and local taxes as well. This tax exemption makes them more attractive to investors and allows cities to borrow at a lower interest rate than other types of bonds.

Therefore, both the city's high credit rating and the tax status of municipal bonds contribute to a lower interest rate than would otherwise apply.

Learn more about bonds at:

https://brainly.com/question/25965295

#SPJ1

Mrs. Slayman slays all day. She slays 17 times a second. Approximately how much Slaying does Mrs. Slayman do in a day?

Answers

Mrs. Slayman slays approximately 1,468,800 times in a day.

How to calculate much Slaying does Mrs. Slayman do in a dayIf Mrs. Slayman slays 17 times every second, then in one minute (60 seconds), she slays:

17 times/second * 60 seconds = 1020 times/minute

In one hour (60 minutes), she slays:

1020 times/minute * 60 minutes = 61,200 times/hour

And in one day (24 hours), she slays:

61,200 times/hour * 24 hours = 1,468,800 times/day

Therefore, Mrs. Slayman slays approximately 1,468,800 times in a day.

Learn more about word problems at:https://brainly.com/question/21405634

#SPJ1

Sea and Sand has a maximum 14 feet of front shelf space to devote to the four beverages combined. Tommy wants to use a minimum of two feet and a maximum of seven feet of front shelf space for each beverage. The contribution margin per case for Limeade is:

Answers

Answer:

$5.40

Explanation:

Calculation for the contribution margin per case for Limeade

First step is to find the Variable cost per case of Limeade using this formula

Variable cost per case of Limeade = Variable manufacturing cost per case + Variable selling cost per case

Variable cost per case of Limeade= 12.20 + 4

Variable cost per case of Limeade= $16.20

Now let calculate for Contribution margin per case for Limeade using the formula

Contribution margin per case for Limeade = Selling price per case of Limeade - Variable cost per case of Limeade

Contribution margin per case for Limeade= 21.60 - 16.20

Contribution margin per case for Limeade= $5.40

Therefore the Contribution margin per case for Limeade will be $5.40

application sick live

Answers

Oooooo

Sir/Mam, Most respectfully, I beg to state that I am not in a condition to come to the school since I am suffering from fever. I have been prescribed by our family doctor o take proper rest for at least [number of days] days. Hence, kindly grant me leave from (start date) to (end-date)

One of the most strategies in developing a strong sense of personal responsibility is to what

Answers

Answer:

Take responsibility for your thoughts, feelings, words, and actions.

Explanation:

There are various strategies to take in developing a strong sense of personal responsibility, one of the topmost strategies is to "Take responsibility for your thoughts, feelings, words, and actions."

This will surely help in determining how to react to situations, without being pushed by others or blame others for the outcome.

Also, it will not affect your perception and duty to yourself. But rather spur you to do what you believe in and what will benefit you.

It is was that 5% product of a lot are defective, if 8 products are selected randomly, what is the probability of getting lessThan 3 defective products?

Answers

Answer:

QUIERES SER MI AMIGO?

ESQUE ANDO BURRIDO

Saul owns a local shoe store that sells a variety of top shoe brands to his local

community. Because Saul does not actually make the shoes at his store and

purchases them from a manufacturer, he is considered a(n):

enterpriser

producer

extractor

merchandiser

Answers

Because Saul does not actually make the shoes at his store and purchases them from a manufacturer, he is considered a merchandiser. Thus, option D is correct.

Who is the manufacturer?A manufacturer is a person or entity that sells its products to customers directly and collects payment from them. The customer may have purchased the merchandise from a wholesaler or the company directly.

As from the time a commodity is brought to the retailer until a customer takes the item off the store, merchandisers are all in charge of anything that occurs to it.

Therefore, option D is the correct option.

Learn more about the manufacturer, here:

https://brainly.com/question/15494518

#SPJ1

Customers might sometimes describe contradictory needs

Answers

Customers might sometimes describe contradictory needs which means Option C. Customers sometimes describe needs that oppose each other.

When customers require two different things that cannot be addressed by the same product, it is referred to as a conflicting requirement. There are many reasons why customers may have conflicting needs. Some customers might have a requirement for a product to be both inexpensive and of high quality, for example. Others may desire a product that is both small and powerful. Customers may sometimes find it difficult to articulate what they want, which might result in vague descriptions.

This might make it more difficult for the supplier to provide a solution that satisfies the customer’s needs. Customer service staff must be trained to engage with customers and listen actively to their concerns. They must also be able to identify when there is a contradictory requirement and provide solutions that address the customer's needs in a way that satisfies the customer's expectations while also meeting the supplier's operational needs. Understanding customer needs is an important part of the customer service profession, and it may take some time and effort to develop the necessary skills.

Some customers are very detailed in describing their needs, which can be beneficial for suppliers because it allows them to provide an appropriate solution for the customer. Overall, being aware of conflicting customer requirements is essential in the customer service sector to provide an effective solution. Therefore, the correct option is C.

The question was incomplete, Find the full content below:

Customers might sometimes describe contradictory needs.

A. A customer's needs can sometimes be confusing.

B. Customers might sometimes give vague descriptions.

C. Customers sometimes describe needs that oppose each other.

D. Some customers are extremely thorough in describing their needs.

Know more about Conflicting here:

https://brainly.com/question/2488396

#SPJ8

Create Transactions, a Deposit and a Report

In this exercise, you will create all the transactions for April 8, 2026, and then create a bank deposit and

report.

1. Use this information to create the appropriate transactions:

• Esther Green paid her outstanding invoice with cheque #598.

• Roy Fisher decided to hire Melanie for the custom flower design for $550 and wants to be

invoiced; Melanie reminds you apply the credit.

• Karuna Ramachandran pays both of her outstanding invoices with debit.

• One of the birthday vases Sharon McColl bought in February had a crack, so Melanie wants to

create and apply a credit memo of $25, plus HST, before she pays her invoice. Sharon then pays

the new balance with cash.

Hint: Once you create the credit, it may apply automatically depending on your settings.

• Mary Beth Dunham made a recommendation to a friend of hers to hire Melanie for their

wedding. Melanie tells Mary Beth that if her friend hires her, Melanie will give Mary Beth $75

as a credit on her next invoice for the wedding arrangements. Enter the delayed credit on Mary

Beth’s account for Sharon’s wedding.

2. Melanie will take the cheques from today’s sales and all cash received to the bank and deposit

them. You will need to record a bank deposit for those items and any debit card payments that

were also received up through April 8 (the deposit amount should be $2,570.75). Then, run an

Open Invoices report and an Unbilled Charges report for all dates.

3. Export both reports to Excel and save to your Chapter 04 folder as: CH04 Open Invoices

and CH04 Unbilled Charges 2

Answers

Using QuickBooks Online, you must begin by clicking the " Receive Payments " option. Intuit created and sells the accounting software suite known as QuickBooks.

How can transactions be created in QuickBooks?

The procedures listed below can be used to create transactions on QuickBooks Online based on transactions that have already occurred:

Choose "Receive Payment" by clicking the "+" button in the dashboard's upper right corner.

Choose "Esther Green" as the client, and then enter the sum paid as the invoice's unpaid balance. Choose "Cheque" as the payment option and input the 598-digit check number. Transaction saved.

Choose "Invoice" by clicking on the "+" symbol once again. Choose "Roy Fisher" as the client and type $550 as the balance owed. Choose Melanie's unique floral design service in the products/services area to apply the credit of $25 + GST to the bill. Transaction saved.

Refresh your browser and choose "Receive Payment" from the "+" menu. Choose "Karuna Ramachandran" as the client and input the sum owed for the two unpaid bills. Choose "Debit" as the mode of payment, then save the deal.

Choose "Credit Note" by clicking on the "+" button once again. Choose "Sharon McColl" as the customer, then input a credit amount of $25 + GST. Save the transaction and apply the credit to the birthday vase invoice.

Refresh your browser and choose "Receive Payment" from the "+" menu. When the credit has been applied, choose "Sharon McColl" as the client and input the new balance. Choose "Cash" as the mode of payment, then save the deal.

Click the "+" symbol and choose "Bank Deposit" to make a deposit. Choose the payments made by Karuna Ramachandran, Sharon McColl, and Esther Green as the deposit items, then save the transaction.

Go to the Reports tab on the left-side menu and choose "Profit and Loss" to create a report. Run the report with April 8, 2026 as the date range.

Learn more about bank deposit:

https://brainly.com/question/2507231

#SPJ1

Visits to national parks inspire people to plan another trip, to tell their friends, and often, to ask how they can help. We love that! . . . When you get involved, you help ensure that national parks and programs are relevant. Your ideas add strength to the work we do everyday to preserve special places and stories.

Which is the author’s purpose for writing this passage?

to inform

to persuade

to entertain

to reflect

Answers

Answer: To persuade

Explanation:

Answer:

is B

Explanation:edge 2021

Select the correct answer from each drop-down menu.

Which functions of management do manufacturing and service businesses use to maximize their operations?

Manufacturing and service businesses use the four management functions—planning,

,

, and controlling—to increase the productivity of their operations.

Answers

Answer:

organising and staffing

Explanation:

Answer:

Organizing and staffing

Explanation:

Plato/Edmentum