Which of the following can a bank treat as legal reserves? 1) loans 2) bonds 3) checking account balances and vault cash 4) property assets

Answers

Among the given options, only the following can a bank treat as legal reserves: checking account balances and vault cash Explanation: Legal reserve can be defined as the minimum amount of cash that a bank has to maintain with the central bank of a country in order to maintain financial stability.

Also known as cash reserve ratio (CRR) in some countries, it is decided by the central bank and is calculated as a percentage of the total deposits held by the bank. Loans and bonds are considered as assets of the bank and property assets are long term investments. Legal reserves only include liquid assets and do not include long term investments or other assets. More than 100 banks worldwide have reserves above $1 billion. This minimum cash reserve ratio is maintained by the central bank to ensure that banks do not run out of cash and are able to meet the cash requirements of their customers and clients.

To know more about stability visit:

https://brainly.com/question/32412546

#SPJ11

Related Questions

What is the difference between a total and a subtotal?

Answers

Explanation:

SUB-TOTAL:

The total for a part of a list of numbers being summed.

TOTAL:

An amount obtained by addition of smaller amounts.

Answer:

subtotal is all the different parts being added together from different list.

total is the all items being added together plus tax.

Explanation:

a firm acquired an assset on 1st Apri, 1990 at a cost of Le 30,000. The useful life of the asset is expected to be 10 years. The estimated scrap value of the asset at the end of the year is Le 2,000. Show the provision for depreciation account for the first 3 years in the life of the asset using the Straight line method

Answers

Answer:

First year : Le 2100

Second year : Le 2800

Third year : Le 2800

Explanation:

Given the following :

Cost of equipment = 30,000

Useful years = 10

Salvage or scrap value = 2,000

depreciation account for the first 3 years in the life of the asset using the Straight line method :

Straight line Depreciation :

(Cost - salvage value) / useful years

First year: (April - December 1990)

April - December 1990 = 9 months

(30,000 - 2000) / 10 × 9/12

28000 / 10 × 0.75 = Le 2100

Second year:

(30,000 - 2000) / 10 × 12/12

28000/ 10 = Le 2800

Third year:

(30,000 - 2000) / 10 × 12/12

28000/ 10 = Le 2800

The technical data regarding a hazardou chemical hall be determined by:

Data from work-ite teting

Data from the manufacturer

Data from the upply tore

Data from the local fire department

Answers

The technical data regarding a hazardou chemical hall be determined by Data from the manufacturer.

How are chemicals determined to be hazardous?Hazardous chemicals are those that have the potential to endanger human health or safety. Chemical hazardous chemicals may be poisonous, explosive, flammable, self-reactive, oxidising, or corrosive depending on their qualities.The maker or importer of the chemical must choose the danger classes and, when applicable, the category of each class that relate to the chemical being categorised for each chemical.Check the product's container label and/or the SDS, both of which are available from the seller, to determine whether a material is harmful. A SDS is not necessary and may not be provided if a product is not categorised as a hazardous chemical under the Work Health and Safety Act of 2011.

To learn more about Hazardous chemicals refer to:

https://brainly.com/question/17587392

#SPJ4

suppose that expenditures by the federal government are $30 billion, expenditures by the state governments are $55 billion, and expenditures by the local governments are $20 billion. what is the total of government purchases of goods and services?

Answers

The total of government purchases of goods and services is $105 billion.

What are government purchases?Government purchases are things that the federal, state, and local governments spend money on. The sum of this spending, excluding transfer payments and debt interest, is a significant contributor to a country's gross domestic product (GDP). Such expenses like Social Security benefits and farm subsidies are referred to as transfer payments. Several subcategories exist under the U.S. Bureau of Economic Analysis (BEA). For instance, it separates federal from state and local spending on purchases made by the government and federal spending on defense from all other spending. The total of imported items is deducted from the GDP's final calculation. According to Keynesian economic theory, government purchases are a vital component of a thriving economy.

Total government purchases= 30+55+20=105 billion.

To learn more about government purchases, visit:

https://brainly.com/question/26626764

#SPJ4

a job​ ________ describes the​ content, environment, and conditions of​ employment, whereas a job​ ________ states the minimum qualifications a person must possess to successfully perform the job.

Answers

A job description describes the content environment, and conditions of an environment, whereas a job specification states the minimum qualifications a person must possess to successfully perform the job.

It is a tool for outlining a position's duties, responsibilities, and tasks. It describes who is responsible for performing a particular sort of work, how that work is to be accomplished, how frequently that work is required, and how it links to the mission and goals of the company. It may include details such as the credentials or abilities required for the position, information on the tools, equipment, and work aids utilized, information about the working conditions, physical demands, and a wage range. In contrast to the norm, certain job descriptions may simply identify a candidate's skills; for instance, a competency architecture for a company may be developed using strategic human resource planning approaches.

To learn more about the job description, click at:

https://brainly.com/question/12174315

#SPJ4

What does the Federal Reserve System do

Answers

Answer: It tries to maximize employment and minimize inflation.

Explanation:

Is sales tax valid in India?

Answers

There is no federal general sales tax; rather, state governments regulate sales taxes. Local governments may be permitted by states to enact additional general or targeted sales taxes.

How does local government work?

Local government refers to the control and management of local affairs by the local populace through representative bodies made up primarily of elected representatives. According to De Tocqueville, these local councils of residents "constitute the foundation of free states.

What is the local government's purpose? Two goals are served by local government. The administrative goal of providing goods and services is the first objective; the second goal is to express and include residents in identifying particular local public wants and how these local requirements might be satisfied.

To know more about local government visit:

brainly.com/question/29388830

#SPJ4

"making planning in itself is not sufficient."what is the requirement for the business to be successful.

Answers

Answer:

organization

Explanation:

if you are organized then you will have smoother and cleaner place to work in

Answer:

Do what you think, one day you will surely succeed.

What is a major function of the public sector

Answers

Answer:

Public sector provides many services such as; education, health and social care.

May you help me with this business question I and very struggling

Answers

Answer:

availability of direct deposit

Which of the following are basic assumptions that justify an analysis of the costs of quality?

A. Failures are caused

B. Prevention is more expensive

C. Performance can be learned

D. Rules of thumb don't always work

E. Appraisal costs are less than prevention costs

Answers

The basic assumption that justifies an analysis of the costs of quality is that prevention is more expensive than correction. Therefore, the correct answer is option B.

This means that investing in quality control measures and processes can help to prevent defects and errors, which is more cost-effective than correcting these issues after they have occurred.

By investing in quality control, businesses can avoid the costs associated with waste, rework, and customer dissatisfaction, which can be significant. The other assumptions listed are not necessarily related to the analysis of the costs of quality.

Failures may be caused by a variety of factors, and identifying these causes is important for implementing effective quality control measures. Performance can be learned, but this is not directly related to the costs of quality.

Rules of thumb may be helpful in certain situations, but a more detailed analysis of the costs and benefits of different quality control measures is needed for effective decision-making. Finally, appraisal costs may be less than prevention costs, but the key assumption is that prevention is more expensive than correction.

In summary, the basic assumption that justifies an analysis of the costs of quality is that prevention is more expensive than correction. This means that investing in quality control measures and processes can help to prevent defects and errors, which is more cost-effective than correcting these issues after they have occurred. Thus, option B is correct.

To know more about costs refer here:

https://brainly.com/question/28255107#

#SPJ11

why must a broker ensure the competency of a sales agent in the services he provides to a party in a real estate transaction?

Answers

Because the broker is accountable for the acts of the sales agent, the broker must ensure the competence of a sales agent in the services he offers to a party in a real estate transaction.

What precisely is a broker's purview?Brokers oversee a range of commercial transactions in the banking and financial industries, such as investments, real estate, and insurance. In addition to managing sales, brokers also create and maintain relationships, serve as a point of contact for parties, and perform administrative tasks.

What obligations has the broker toward the client?A broker is obligated to carefully carry out a client's request and look for the best possible price. The broker is also supposed to be honest and not to make any representations on potential investments or trades. A brokerage firm has a duty to oversee the brokers it employs.

Learn more about Brokers: https://brainly.com/question/14094023

#SPJ4

Everyone has a different vision for what they like to do once they retire. List three things you think you'd like to do once you finish working

Answers

Answer:

move somewhere near Nevada.

hangout with grandkids.

have fun with my s/oand never get boring.

As a producer, you are willing to supply the most goods at the highest price. This is because the highest

price earns you the

most demand

highest costs

most profits

Answers

Answer: most profits

Explanation:

which basic supply chain flow is usually the most important?

Answers

The most important flow in the supply chain is the flow of information. Without a clear and consistent flow of information between different parts of the supply chain, the chain cannot function smoothly.

Supply chain flow refers/relates to the movement of goods, materials, and information from suppliers to customers. Information flow is a key component of the supply chain as it provides the visibility and transparency needed to make informed decisions and maintain efficient operations.

Inaccurate or incomplete information can cause supply chain delays, disruption and additional costs. A clear and consistent flow of information enables companies to respond quickly to changing market demands and address issues that arise in their supply chains.

Effective communication and collaboration between all parties involved in the supply chain helps improve efficiency, reduce costs and improve customer satisfaction.

To know more about supply chain, here:

https://brainly.com/question/30086410

#SPJ4

Complete question:

What is the most important supply chain flow? Without it, supply chains cannot flow seamlessly. Which one is it?

Which term describes the type and number of competitors' job openings when looking at supply and demand within HR?

Answers

Answer:

External labor demand

Explanation:

Human resources management (HRM) can be defined as an art of managing, controlling and improving the number of people (employees or workers), functions, activities which are being used effectively and efficiently by an organization.

Hence, human resources managers are saddled with the responsibility of recruiting, managing and improving the welfare and working conditions of the employees working in an organization.

External labor demand is the term which best describes the type and number of competitors' job openings when looking at supply and demand within human resources (HR).

Basically, an external labor demand gives a description of the number and type of employees that are required by a rival company in the same industry.

a price variance is the difference between the ______.

Answers

A price variance is the difference between the actual price and the standard price multiplied by the actual amount of the input.

Price variance is usually caused by some some factors such as changes in

the demand and supply of goods, the bargaining power of the customer and also the quantity of items ordered at that point in time.

It is used in budget allocations to determine the estimated prices of goods

and services in order to prevent shortage of the funds allocated.

Read more on https://brainly.com/question/25397585

To _____ is to modify or improve upon code.

propriate

tweak

kernel

debug

Answers

Use the sum-of-year depreciation method to calculate the depreciation for the

following scenario. Company XYZ bought a new machine for $100,000 and

expects the machine will last for 10 years.

Answers

Answer:

20%

Explanation:

How to Calculate Straight Line Depreciation

The straight line calculation steps are:

Determine the cost of the asset.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

Determine the useful life of the asset.

Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

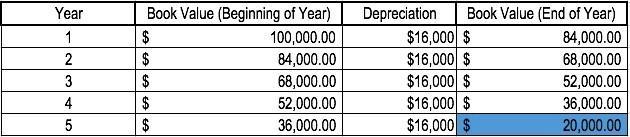

Straight Line Example

Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years.

The straight line depreciation for the machine would be calculated as follows:

Cost of the asset: $100,000

Cost of the asset – Estimated salvage value: $100,000 – $20,000 = $80,000 total depreciable cost

Useful life of the asset: 5 years

Divide step (2) by step (3): $80,000 / 5 years = $16,000 annual depreciation amount

Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

The depreciation rate can also be calculated if the annual depreciation amount is known. The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%.

Luka, who owns a small breakfast and salad bar, has a reputation in the community as a tough manager. Many customers have heard Luka yell at his employees because he feels that workers today are lazy, lack ambition, and hate to work. Luka is a(n) ________ manager. Group of answer choices Theory Z participative contingency Theory X Theory Y

Answers

Answer: Theory X

Explanation:

A Theory X manager refuses to believe that workers can be internally motivated. They believe that workers are lazy, lack ambition and hate to work and so there is a need to continually push them to work.

This push can come in the form of punishment, rewards or prompting. Luka yells at his workers to push them to work by prompting them to. This style is generally looked down on today.

April is worried that she is not a "good speller," so she plans to let the spelling

checker correct all her mistakes. What would be the most helpful advice for

April?

Answers

How does where you can purchase the candy affect the price? How does it affect the availability?

Answers

For 2020, ross corporation had pretax ordinary income of $500,000 and sold for $154,000 an asset purchased previously for $130,000. calculate the tax liability for the company.

Answers

In 2020,

Ross corporation had pretax ordinary Income= $500,000

Sold for = $154,0000

purchased previously for = $130,000

Tax liability for the company is $110040

Total Income =

Calculation

$500000+($154,000-$130000)

=$524000

In 2020,Tax liability was 21%

221/100*$524,000

Tax liability =

$110,040

Get more information about Tax liability here:

https://brainly.com/question/16950907

#SPJ4

This condition causes people to struggle to sequence the sounds in syllables and words, which means that

they know what they want to say but can't say it.

O tongue-tied

Oapraxia

O stroke

O stuttering

Answers

Answer:

tongue tied

Explanation:

they know what they want to say but can't say it

Kristoffer needs to create cell names that match the column headings he has already created. Select the correct navigational path to set those names using the Create from Selection command. Click on the tab on the ribbon and look in the Defined Names gallery.

Answers

Answer:

formula

create from selection

top row

Explanation:

just took the question on edge

The correct navigational path to create cell names that match the column heading using the Create from Selection command is: Click on the Formula tab on the ribbon and look in the Defined Names gallery. Select the range of cells, including the row that includes the name you wish to use. Select Create from Selection. Select Top row and click OK.

What is a cell?Cells are the boxes that appear in an Excel worksheet's grid. On a worksheet, each cell is identified by its reference, the column letter and row number that intersect at the cell's location.

Instead of creating cell names one by one, "Create from Selection" tool can be used to create cell names from a selection. The tool is in the "Defined Names" group of the Formulas menu.

Therefore, the correct path for using the Create from Selection command is first to click on Formula tab and look in the Defined Names gallery. Then select the range of cells, including the row that includes the name wish to use. Select Create from Selection. Select Top row and click OK.

To learn more about cell, click here:

https://brainly.com/question/1380185

#SPJ6

I know it's old news, but what did you think about the will Smith slap at the Oscars ?

Answers

Answer:

I think that it was kind of funny but also like not really funny

Explain how the looting of shops and malls will affect businesses in terms of the relationship between the social responsibility and triple bottom line

Answers

Businesses decrease their incentives that will lead to minimizing their ability to carry out their part for social responsibility of the triple bottom line.

The bottom line is an obligation on businesses to not just look for their profit but include and maintain a good balance between these factors:

economic growthsocial welfareenvironment impactSimilarly, businesses need to follow the Triple bottom line in these ways:

Making profitsMaking sure that there is positive social welfare on their part.Maintain ecological footprintThus, by the looting of shops and malls, the ability of businesses to meet both their social responsibility and Triple bottom line is minimized and not as it was in normal conditions.

Learn more about social responsibility and Triple bottom line here: brainly.com/question/1339420

1. Why is career education so important for teens?

Answers

Which of the following financing types involves the sale of personal property with the real property

Answers

A package loan is the following financing type that involves the sale of personal property with real property.

Property is any item that someone or a business has criminal title over. property is a system of rights that gives human beings felony manipulation of valuable matters, and also refers to the treasured matters themselves.

property may be tangible objects, which include houses, motors, or home equipment, or it can talk to intangible gadgets that carry the promise of destiny well worth, such as stock and bond certificates.

Types of Property

Movable and Immovable Property.Tangible and Intangible Property.Private and Public Property.Personal and Real Property.Corporeal and Incorporeal Property.learn more about property here

https://brainly.com/question/12892403

#SPJ1

on a new loan tax reserves appear on a closing statement as a:

Answers

On a new loan, tax reserves appear on a closing statement as a pre-paid item or escrow deposit.

1. When a borrower takes out a new loan, they may be required to set up an escrow account.

2. An escrow account is used to pay property taxes and insurance premiums on behalf of the borrower.

3. The borrower makes monthly payments into the escrow account, and the lender disburses the funds as needed.

4. At closing, the borrower is often required to prepay a certain amount of taxes and insurance to establish the escrow account.

5. These prepaid amounts, referred to as "tax reserves," appear on the closing statement under the section for pre-paid items or escrow deposits.

Tax reserves on a new loan's closing statement represent the initial funds set aside in the escrow account to cover property tax and insurance payments.

To know more about escrow deposit visit:

brainly.com/question/28844406

#SPJ11