When GDP per person in China in 2016 is valued at ___ GDP per person in the United States is___ Simes that in China. A. purchasing power parity prices; 5.3 B. the market exchange rate: 6.3 C. the market exchange rate: 3.8 D. purchasing power party prices: 6.3

Answers

When GDP per person in China in 2016 is valued at A. purchasing power parity prices, GDP per person in the United States is 5.3 times that in China.

This is because the purchasing power parity (PPP) exchange rate of the yuan is significantly lower than the nominal exchange rate with the US dollar. This means that a yuan is worth more in China than it is in the United States. Therefore, the GDP per capita of China, which is measured in yuan, is higher when converted into dollars at the PPP rate than at the nominal exchange rate.

The PPP rate takes into account the cost of goods and services in each country, which can vary widely, and is therefore a more accurate measure of the relative value of currencies between countries. As of 2016, the PPP GDP per capita of China was approximately $15,400, compared to $57,300 for the United States. Therefore, GDP per person in the United States was 5.3 times that of China when measured at PPP prices. So the correct answer is A. A. purchasing power parity prices; 5.3

Learn more about GDP at :

https://brainly.com/question/15899184

#SPJ11

Related Questions

Carl’s business insurance costs $3,000 per year. Carl paid for and purchased a 12-month insurance policy on October 1, Year 1. On October 1, Year 2, Carl’s insurance increased to $3,300 per year. A building contract Carl was working on was delayed when they had to obtain additional permitting. Because cash flow was tight, Carl delayed renewing the insurance policy. Instead of making the payment due on October 1, Year 2, Carl paid 3 months of insurance in arrears on January 1, Year 3. Carl is a cash-method taxpayer and took advantage of the 12-month rule in Year 1 for prepayments. What is Carl’s insurance expense deduction for Year 2?

Answers

Answer:

Carl's Insurance Expense Deduction for Year 2

Since he took advantage of the 12-month prepayments rule, his Year 2 Insurance deduction was deducted in Year 1.

While his deduction should have been equal to

= Annual Insurance Expense/12 x 9 = $3,300/12 x 9 = $2,475

In Year 2, it is equal to $0 since he did not make any payment for Insurance.

Explanation:

Under the cash method of accounting, two rules govern how someone can deduct prepaid expenses:

1. The General Rule

2. The 12-Month Rule

1. The General Rule

Under the general rule, you cannot deduct the full amount of an advance payment covering more than 12 months. You must deduct a portion of the payment in the year to which it applies.

Example: The General Rule.

Carl is a cash method taxpayer on a calendar year.

On October 1, 2018 Carl pays $3,600 in advance for business insurance covering three years.

Coverage begins October 1, 2018.

Coverage ends September 30, 2021.

Result:

The general rule applies.

The advance payment covers more than 12 months (36 months).

A portion of the $3,600 must be deducted ratably over the three-year period.

To find the portion of the $3,600 Carl deduct each tax year:

First, divide the $3,600 by 36 (months) to find the monthly premium amount.

Then, multiply the number of months remaining in each tax year by the monthly premium

Monthly premium: $3,600 / 36 = $100 per month.

Oct. 1, 2018 - Dec. 31, 2018: 3 x $100 = $300 deduction for 2018

Jan. 1, 2019 - Dec. 31, 2019: 12 x $100 = $1,200 deduction for 2019

Jan .1, 2020 - Dec. 31, 2020: 12 x $100 = $1,200 deduction for 2020

Jan. 1, 2021 - Sep. 30, 2021: 9 x $100 = $900 deduction for 2021

The 12-Month Rule

The 12-month rule says that Carl may deduct the full amount of an advance payment in the year the payment is made if it creates rights or benefits for the taxpayer that do not extend beyond the earlier of:

12 months after the right or benefit begins, or

The end of the tax year after the tax year in which payment is made.

Example 1: The 12-Month Rule.

Carl is a cash basis taxpayer on a calendar year.

On October 1, 2018 he pays $2,000 for business insurance covering one year.

The policy begins October 1, 2018 and ends September 30, 2019.

Result:

The 12-month rule applies.

Deduct the full $2,000 in 2018

The benefit does not extend beyond 12 months after the right to receive the benefit begins - October 1, 2018.

in a tax incentive program, the person who conserves the most pays: A. relatively less taxB. no penaltiesC. no taxD. relatively more tax.

Answers

Option A is correct. In a tax incentive program focused on conservation, the person who conserves the most would generally pay relatively less tax.

In a tax incentive program, the objective is to encourage certain behaviors or activities by providing tax benefits or advantages to individuals or businesses. The specific details of the tax incentive program will determine the impact on tax payments for participants.

Typically, in a tax incentive program aimed at promoting conservation efforts, the person who conserves the most would be eligible for tax benefits or deductions. By conserving resources or engaging in environmentally friendly practices, they would be rewarded with a reduction in their tax liability.

The tax incentive program may offer deductions, credits, or exemptions that result in a lower taxable income or a reduction in the tax rate for those who demonstrate significant conservation efforts. This means that the person who conserves the most would pay relatively less tax compared to those who do not participate or conserve less.

It's important to note that the specific details and provisions of the tax incentive program would need to be considered to determine the exact impact on tax payments. Different tax incentive programs may have varying criteria, requirements, and calculations for determining the tax benefits associated with conservation efforts.

In a tax incentive program focused on conservation, the person who conserves the most would generally pay relatively less tax. This is because tax benefits or advantages are typically provided to incentivize and reward conservation efforts, resulting in a reduction in the individual's tax liability. So option A is correct.

To know more about Tax, visit

https://brainly.com/question/30157668

#SPJ11

53:1

Which of the following is true of unethical behavior?

A. It may cause people to lose trust in you.

B. It may be prevented by creating conflicts of interest.

C. It is always illegal.

D. It is regulated by administrative law.

Please select the best answer from the choices provided

A

B

C

D

Mark this and return

Answers

Answer:

A. It may cause people to lose trust in you.

Explanation:

Unethical behavior is one where an individual behaves in such a way that it is bad for others or an action that may be morally wrong. It is an action that renders the wrong perception of others.

One thing true about unethical behavior is that it can cause people to lose trust in the person. It makes the person look bad and thus add to the dishonesty, the feeling of untrustworthiness in that person.

Thus, the correct answer is option A.

Which is often considered the most difficult yet most effective communication technique?

Answers

The most challenging yet most powerful form of communication is silence.

In recent years, experts have argued that silence is not just the absence of sound or that it doesn't mean "nothing," but rather that it is an essential component of communication on par with speech. The meaning and impact of silence are determined by the situation's context. A conversation or discussion advances when there is productive silence.

Destructive silence prevents communication from happening and puts up obstacles that make it difficult for speakers to express their ideas. Such pauses can be effective instruments for improving communication as well as for advancing and preserving the current relationship.

To learn more about effective communication here

https://brainly.com/question/10441984

#SPJ4

which of the following entries causes an immediate decrease in assets and in net income? group of answer choices the entry to record depreciation expense. the entry to record revenue earned but not yet received. the entry to record the earned portion of rent received in advance. the entry to record accrued wages payable.

Answers

the entry to record depreciation expense entries causes an immediate decrease in assets and in net income.

The basic journal entry for depreciation is to debit the Depreciation Expense account (which shows in the income statement) and credit the Accumulated Depreciation account (which appears in the balance sheet as a contra account that reduces the number of fixed assets).

Depreciation expense is the cost of an item that has been depreciated for a specific time or period, and it shows how much of the asset's value was used up in that year. Accumulated depreciation is the entire amount of depreciation costs that have been attributed to an asset since it was first used.

To account for a decline in value caused by something's age or level of use, a certain sum is deducted from gross profit as a fee for depreciation. If your organization purchases and owns the equipment, it may be possible to deduct a depreciation expense.

Learn more about depreciation expense here:

https://brainly.com/question/15024945

#SPJ4

hurry please!!!giving brainliest!

Answers

Answer:

A

Explanation:

Flextrola, Inc. , an electronics systems integrator, is planning to sell its next generation product using components sourced from its supplier. Flextrola will integrate the component with some software and then sell it to consumers. Given the short life cycles of such products and the long lead times quoted by its supplier, Flextrola only has one opportunity to place an order prior to the beginning of its "selling season. " Assume that Flextrola’s demand during the season is normally distributed with a mean of 1000 and a standard deviation of 600. (A normal table is provided at the end of this exam for your convenience. )

Solectrics’ production cost for the component is $52 per unit and it plans to sell the component for $72 per unit to Flextrola. Flextrola incurs essentially no cost associated with the software integration and handling of each unit. Flextrola sells these units to consumers for $121 each. Flextrola can sell unsold inventory at the end of the season in a secondary electronics market for $50 each. The existing contract specifies that once Flextrola places the order, no changes are allowed to it. Also, Solectrics does not accept any returns of unsold inventory, so Flextrola must dispose of excess inventory in the secondary market.

Required:

a. What is the probability that Flextrola’s demand will be within 25 percent of its forecast?

b. What is the probability that Flextrola’s demand will be more than 40 percent greater than its forecast?

c. Under this contract, how many units should Flextrola order to maximize its expected profit?

d. What are Flextrola’s expected sales?

e. How many units of inventory can Flextrola expect to sell in the secondary electronics market?

Answers

With a mean of 1000 and a standard deviation of 600, the probability that the demand is going to be withing 25 percent of its forecast is 0.3230.

a. Mean = 1000

sd = 600

p(1000x 1-25%) - p(1000x 1+25%)

using the z test

d-μ/σ

\(p(z < \frac{1250-1000}{600} )-p(z < \frac{-1000}{600} )\\\\(z < 0.4167)-(z < -0.4167)\)

find values using excel sheet formula

NORMSDIST(0.4167) - NORMSDIST(-0.4167)

=m0.6615 - 0.3385

= 0.3230

b. The probability that the forecast would be more than 40 percent1000x 1+40%

= p(D>1400)

= 1- NormDist(0.667)

= 0.225

c. Cu = 121-72 = 49

Co = 72.50 = 22

The critical ratio calculation

49/22 +49 = 0.6901

Normsinv(0.6901) = 0.496

1000+0.496x600

= 1297

The units that Flextrola has to order is 1297.

d. The expected sales of Flextrola1200-1000/600

= 0.3333

loss function from z = 0.333 is 0.254

600x0.254 = 152. 4

1000-152.4 = 847.6

the expected sales are 847.6

e 1200- 847.6

= 352. 4

The units of inventory that can be sold is 352.4

Read more on inventory here: https://brainly.com/question/24868116

Why is it important to maintain network relationships, even after you have found a job?

a. You never know when you are going to have to find a new job.

b. You can return the favor by helping network members with career advice and job leads.

You will remain informed and connected to people in your field.

d. All of the above

C.

Please select the best answer from the choices provided

ΟΑ

B

С

OD

Answers

Answer:

D (all of the above)

Explanation:

When a person has gotten a job, it is critical to keep network contacts since a person never know when he will need to locate a new career, and he will stay informed and connected to bin his sector.

What is network relationships?Relationship networking is another name for network relationships. It's all about making connections and finding ways for both sides to gain. Like the relationship, networking and partnerships intersect in numerous ways, resulting in economic potential.

Even when a person has gotten a job, it is critical to keep network contacts since you never know when you will need to locate a new career, and he will stay informed and connected to people in the sector.

With the utilization of network ties, an individual might refund the kindness by supplying career counseling and job metals to network members.

Therefore, option D is correct.

Learn more about the network relationships, refer to:

https://brainly.com/question/14743693

#SPJ2

need to come up with one cost-benefit analysis, including the

data and computations.

Answers

A cost-benefit analysis is a systematic approach to evaluating the potential benefits and costs associated with a proposed project or investment.

The purpose of this analysis is to determine whether the potential benefits outweigh the costs and whether the investment is worthwhile. To illustrate a cost-benefit analysis, let's consider a hypothetical project: a company wants to implement a new software system to automate its inventory management process.

The costs associated with this project include the purchase of the software, training for employees, and the time and effort required to implement the system. Let's assume these costs amount to $50,000. The benefits of the project include improved accuracy of inventory management, reduced labor costs, and increased efficiency.

Let's assume these benefits amount to $100,000. To compute the net benefit, we subtract the costs from the benefits: $100,000 - $50,000 = $50,000. In this scenario, the benefits outweigh the costs, resulting in a positive net benefit of $50,000. Therefore, the project is deemed worthwhile and should be implemented.

Overall, a cost-benefit analysis provides a comprehensive and quantitative approach to evaluating the potential outcomes of a proposed project or investment, helping organizations make informed decisions that maximize their resources.

Learn more about cost-benefit analysis:

brainly.com/question/30096400

#SPJ11

Market value of a firm is the relevant measure of maximizing shareholder wealth because it:_________

Answers

The correct answer is "generates revenue to raise the dividends that are paid on each ordinary shares".

The outstanding shares of a corporation are multiplied by the current market price to get market value, sometimes referred to as market cap. If XYZ Company has 1 million outstanding shares and trades at $25 per share, its market value is $25 million.

Why is a company's market value important?Market value, sometimes referred to as OMV or "open market valuation," is the cost that an asset would command on the open market or the estimation that the financial community makes of a certain equity or company. One of the key reasons market value is significant is because it offers a clear technique for figuring out how much an item is worth, eliminating any ambiguity or confusion. Customers and sellers frequently view a product's worth differently in the marketplace.

To know more about Market value, visit: https://brainly.com/question/19131751

#SPJ4

If there is a shortage in gasoline then,

a) the price of gasoline will tend to rise.

b) the purchase plan of buyers are not being fully achieved.

c) buyers will tend to compete amongst themselves for more gasoline.

d) all of the above are true.

e) none of the above is true

Answers

Answer:

all of the above are true.

Explanation:

They will rise because people may want the gas to last longer and people might be wanting to buy it more and that will help the owners to earn more.

The purchase plan of buyers an not achieved because they may not be able to buy when they needed it to be bought (If that is what was meant there)

The buyers will compete because if people don't have it they won't be able to drive anywhere which people more often drive to get to places such as stores and work.

Hope this Helps

If you are applying for two different jobs, which of the these is true about the resumes you will turn

in to them?

you would turn in different resumes with different objective statements that match the different jobs you are

applying for

turn in identical resumes to both jobs

print them with different colored ink to keep from confusing them

Answers

Answer:

the first one ,you would turn in different resumes with different objective statements that match the different jobs you are

applying for

Economic and budgetary impacts of Telehealth policy: Comparison of the costs to enact, implement, and enforce the policy with the value of the Benefits Budget • What are the costs and benefits associated with the policy, from a budgetary perspective? • e.g., for public (federal, state, local) and private entities to enact, implement, and enforce the policy? Economic • How do costs compare to benefits (e.g., cost-savings, costs averted, return on investments, cost-effectiveness, cost-benefit analysis, etc.)? • How are costs and benefits distributed (e.g., for individuals, businesses, government)? • What is the timeline for costs and benefits? • Where are there gaps in the data/evidence-base

NOTE: Please, answer the above questions with references Thanks

Answers

The costs and benefits associated with Telehealth policy, from a budgetary perspective, involve considering the expenses involved in enacting, implementing, and enforcing the policy, as well as the economic impacts such as cost-savings, return on investments, and cost-effectiveness.

These costs and benefits are distributed among various stakeholders, including individuals, businesses, and government entities.

When evaluating the costs and benefits of Telehealth policy, it is important to assess the financial implications for both public (federal, state, local) and private entities. Enacting, implementing, and enforcing the policy may involve costs such as legislative processes, regulatory compliance, infrastructure development, technology investments, training, and monitoring.

On the other hand, the benefits can include potential cost-savings through reduced healthcare expenses, improved access to care, enhanced patient outcomes, and increased productivity.

The comparison between costs and benefits is crucial to assess the policy's economic viability. Cost-savings, costs averted, and return on investments can demonstrate the potential financial advantages. Cost-effectiveness and cost-benefit analysis provide further insights into the balance between costs and benefits.

The distribution of costs and benefits is another important aspect. Individuals may experience reduced out-of-pocket healthcare expenses and increased convenience, while businesses could benefit from a healthier and more productive workforce. Government entities may bear initial implementation costs but can benefit from long-term cost-savings in healthcare expenditures.

The timeline for costs and benefits can vary. Initial costs may be incurred during the policy's implementation, while benefits may accrue over time as the utilization of telehealth services increases and healthcare outcomes improve.

Gaps in the data and evidence-base exist and should be acknowledged. Robust studies and comprehensive data are necessary to accurately assess the long-term economic and budgetary impacts of Telehealth policy. Researchers, policymakers, and stakeholders should continue to gather data and conduct research to fill these gaps and provide a more informed understanding of the costs and benefits associated with Telehealth policy.

Learn more about Telehealth

brainly.com/question/22629217

#SPJ11

What is global trade?

A. When products, services, and money are exchanged between the United States and Canada

B. When products, services, and money are exchanged between different countries

C. When products, services, and money are exchanged within a single country

D. When products, services, and money are exchanged only between different cities in one state

Answers

Answer:

b

Explanation:

I know everything trust me

Answer:

I believe the answer is B

Which of the following is not a reason that the subject line should never be

left blank?

• A. The receiver may be

confused and decide to delay opening it.

•

B. The receiver may think the message iS spam.

C. The email will not be transmitted without that information.

D. The receiver may not consider the message important.

Answers

Answer: C. The email will not be transmitted without that information is not a reason that the subject line should never be left blank. The email can be transmitted without a subject line, it just may be less likely to be opened or considered important by the receiver.

Explanation:

Answer:

C. The email will not be transmitted without that information.

A subject line is important in an email because it gives the receiver an idea of what the email is about and whether or not it is important or relevant to them. Leaving the subject line blank can cause confusion, delay the receiver opening the email or even mark it as spam, and make the receiver not consider the message important. But an email will be transmitted without a subject line, it's just that the receiver may not understand the content of the email.

Which document determines the number of shares in a company?

a stock prospectus

an annual bill of rights

a corporate charter

an annual report

Answers

Answer:

C. a corporate charter

A Corporate Charter is document determines the number of shares in a company.

What is Corporate Charter?

Corporate charter is a legal document which is issued with the Secretary of State or registrar in order to establish a company as a corporation and contain every detailed information about company's share. The corporate charter contain information about governance, structure, objectives, operation, other information about the company and information about that total company shares and how much the company is willing to sell.

Therefore, A Corporate Charter is document determines the number of shares in a company

Learn more on Corporate Charter from the link below.

https://brainly.com/question/17134082

Why is it a good idea to be organized in the workplace?

Answers

It is a good idea to be organized in a workplace because an organized workplace will facilitate increased productivity and increased efficiency.

What is workplace?A workplace is described as a place where an employee or a manager carries out projects, tasks, and jobs. It is important to mention that workplaces are the areas that are located inside a building or can be outside an office building.

An organized workplace means that everything in the workplace is kept in its respective places, and everything is very neat and clean. Such an organized workplace will allow the managers and the employees to focus entirely on the work and be more productive and efficient.

It can be concluded that it is a good idea to be organized in a workplace because an organized workplace will facilitate increased productivity and increased efficiency.

To know more about workplace, check this link:

https://brainly.com/question/13444639

#SPJ13

If you pick up a rider for an Uber X trip, how

do you determine the route?

Answers

Answer: Go into the app, then there should be a map button or route button. Click on it and then press route.

Explanation:

how have diets changed as we have progressed from an agricultural economy to a technological economy?

Answers

The availability, cost, and degree of income of food are only a few examples of the factors that influence diets to alter over time.The way we eat has changed as a result of technology, which is changing more than simply how we communicate.

What effects has technology had on our diets? The availability, cost, and degree of income of food are only a few examples of the factors that influence diets to alter over time.The way we eat has changed as a result of technology, which is changing more than simply how we communicate.Utilizing this food trend on their channels has even allowed some influencers to build a full-time business.The National Food Survey, which has been conducted annually since 1950, reveals that while consumption of bread, cereals, potatoes, and other vegetables has been progressively declining, it has slowly increased during the 1950s in terms of fruit intake.The amount of hidden fats we consume in processed foods, takeout, and restaurant meals has increased even if we consume fewer obvious fats.Technology has a significant impact on even the food we eat.To learn more about technology refer

https://brainly.com/question/7788080

#SPJ4

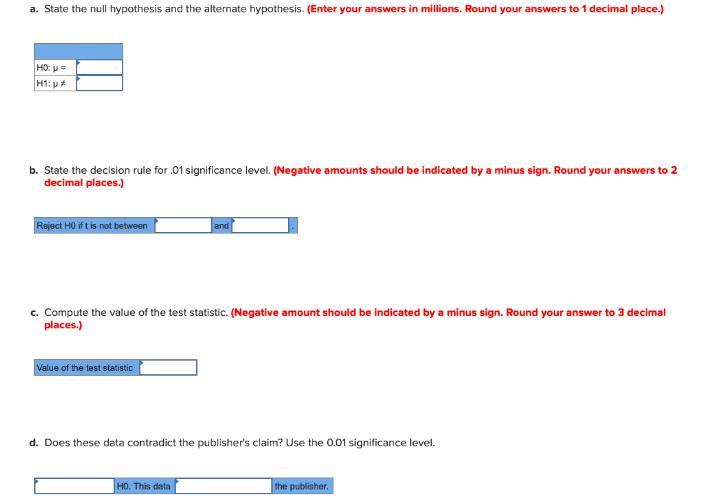

The publisher of Celebrity Living claims that the mean sales for personality magazines that feature people such as Megan Fox or Jennifer Lawrence are 1.5 million copies per week. A sample of 10 comparable titles shows a mean weekly sales last week of 1.3 million copies with a standard deviation of 0.9 million copies.

Answers

Answer and Explanation:

The computation is shown below:

For determining each part first we have to do the following calculations

Critical value of t = 3.250

Null hypothesis = 1.5

Alternative hypothesis ≠ 1.5

Population mean \(\mu\) = 1.5

Sample mean \(\bar X\)= 1.30

Sample size \(n\) = 10.00

Sample standard deviation \(s\) = 0.900

Standard error of mean is

\(s_x = \frac{s}{\sqrt{n} }\)

\(= \frac{0.900}{\sqrt{10.00}}\)

= 0.2846

Test static is

\(t = \frac{x - \mu}{s_x}\)

\(= \frac{1.30 - 1.5}{0.2846}\)

= -0.703

a. The null hypothesis is

μ = 1.5

Alternate Hypothesis is

μ ≠ 1.5

b. reject \(H_o\) if t is not between

-3.250 and 3.250

c. The value of the test statistic is

t = -0.703

(as we have computed above)

d. fail to reject \(H_o\) as this data does not contradict the publisher claim

Imagine an influential new study shows that eating eggs drastically reduces the risk

of heart attacks. Which of the following is most likely to be the initial effect of the

study on the egg market?

A. The demand for eggs will increase, and the price of eggs will rise.

B. The demand for eggs will decrease, and the price of eggs will fall.

C. The supply of eggs will increase, and the price of eggs will rise.

D.The supply of eggs will decrease, and the price of eggs will fall.

Answers

According to the new study, the most likely to be the initial effect of the study on the egg market is the demand for eggs will increase, and the price of eggs will rise. The correct option is (A).

What is demand?The quantity of a good that consumers are willing and able to buy at different prices during a specific time is known as demand in economics. The demand curve is another name for the relationship between price and quantity demand.

Demand for a given product depends on a variety of factors, including perceived need, price, perceived quality, convenience, alternatives offered, buyer preferences and disposable money.

Therefore, according to the new study shows that eating eggs drastically reduces the risk of heart attacks. The most likely to be the initial effect of the study on the egg market is the demand for eggs will increase, and the price of eggs will rise.

To know more about the demand, visit:

https://brainly.com/question/29703449

#SPJ1

Wiper Inc., a parts supplier, has separate departments for government aircraft and contracts, large commercial aircraft clients, and small personal aircraft clients. This is an example of departmentalization on the basis of ________.

Answers

There are different aspect to departmentalization. This is an example of departmentalization on the basis of customer.

Customer departmentalization is simply known to be where the organization's activities are in place so as to respond to and link with some particular customers or customer base.

This is known to be a type of organizational form that places great emphasis on efficient serving for different customer types.

It is commonly regarded as Grouping activities that is often done using common customers or types of customers.

Learn more about departmentalization from

https://brainly.com/question/14426197

who do you think is gonna win this election/who are you voting for?

Answers

Answer:

please mark me Brainliest: i think joe Biden will win definitely

Explanation:

BRUH THIS THING LOGGED ME OUT WHAT IS GOING ON

Answers

Answer:

?????????????

Explanation:

???????????

Which of the following is NOT a key tenant of an SRM system? a. Integration b. Visibility c. Lean operations d. Automation

Answers

There are different kinds of system. The option that is not a key tenant of an SRM system is Lean operations.

What is Supplier relationship management (SRM)?This is known to be a form of systematic method to looking into vendors that supply one's company with goods, materials and services.

This is done by finding out each supplier's strategic value and developing a supplier scorecard using their contribution to one's success. Lean operations is not one of the method used.

Learn more about SRM system from

https://brainly.com/question/13171394

explain the term democracy!!

Answers

a system of government by the whole population or all the eligible members of a state, typically through elected representatives.

Hope this helps!

The portion of net income on a budget referred to as discretionary income is most appropriately used for:.

Answers

Discretionary income is speaks to your net income that is not eaten up by your imediate personal needs.

Discretionary incomeGenerally, Net income is simply the difference of gross profit and all other expenses and all other costs

Your discretionary income comes out of your disposable income, This speaks to your net income that is not eaten up by your personal needs, its the money for left over to save, invest, or spend.

More on Career

https://brainly.com/question/1115935

Lisa’s company, ABC Ltd. , lost its biggest client and is now facing a financial crunch. Most of her colleagues have resigned, but Lisa decides to stay with the company and assist the management in overcoming the financial situation. Which quality is Lisa demonstrating? A. Self-management B. Cooperativeness C. Responsibility D. Loyalty.

Answers

The company of Lisa lost its biggest client, as a result, the company faced a financial crunch, but Lisa shows most loyal to his company and decides to stay with the company.

What is the meaning of loyal?It means rendering or showing the firm a constant support or allegiance to a person or institution.

It also means that someone who is loyal remains firm in their friendship or support for a person or thing.

Therefore, Lisa is demonstrating an attitude of loyalty. She showed this by not giving up the company inspite the tribulations that it is going through.

She is also optimistic that after all that has happened, the company will grow and overcome all the financial situation and still be able to perform just as well as they did the previous years.

So, the option D is correct.

Learn more about loyalty, refer:

https://brainly.com/question/9981730

Answer:

loyalty

Explanation:

What do auditors consider when determining the extent to which the internal auditors' work will affect the auditors' procedures? a.The materiality of the account balance or transaction, the risk of material misstatement of the assertions, and the amount of subjectivity involved in evaluating the evidence gathered. b.The materiality of the account balance or transaction and the risk of material misstatement of the assertions c.The risk of material misstatement of the assertions related to the account balance, transaction or disclosure and the amount of subjectivity involved in evaluating evidence gathered. d. Only the amount of subjectivity involved in evaluating the evidence gathered.

Answers

Auditors consider multiple factors when determining the extent to which the internal auditors' work will affect their procedures. (A)

These factors include the materiality of the account balance or transaction, the risk of material misstatement of the assertions, and the amount of subjectivity involved in evaluating the evidence gathered.

Materiality is important because it helps auditors determine how much attention they need to give to a particular account or transaction. The risk of material misstatement refers to the likelihood that a misstatement would be material and can help auditors determine how much testing they need to do.

Finally, subjectivity refers to the level of judgment involved in evaluating evidence, and the more subjective the evidence, the more testing the auditors will need to do. All of these factors are important for auditors to consider to ensure that they are conducting a thorough audit.(A)

To know more about material misstatement click on below link:

https://brainly.com/question/30895575#

#SPJ11

1. The apartment was so cool, but there is no bus stop within miles and I don't have a car. Rent

Not rent

2. The renting agent says I have to rent for at least one year. But I'm not sure how many months I'll be in town.

Rent

Not rent

3. I'm not sure how many months I'll be in town. The renting agent says I can leave with 30 days notice.

Rent

Not rent

4. It fits my budget, and I can get to school and work easily.

Rent

Not rent

5. The apartment is great! Bigger bath than I have at home. Close to work! Rent is reasonable! On the "down side," I like cranking my tunes, but the walls are thin and this apartment is loaded with retirees. Plus, they don't allow pets, and I'm thinking about getting a pet boa constrictor.

Rent

Not rent

6. I did my homework on the landlord and found out he has a lot of complaints against him from former renters. He never repairs problems in apartments and never gives deposits back without a fight.

Answers

The apartment was so cool, but there is no bus stop within miles and I don't have a car. This was the based on the not rent. Thus, option (b) is correct.

The renting agent says I have to rent for at least one year. But I'm not sure how many months I'll be in town. This was the based on the rent. Thus, option (a) is correct.

I'm not sure how many months I'll be in town. The renting agent says I can leave with 30 days notice. This was the based on the rent. Thus, option (a) is correct.

What is rent?The term rent refers to the based on the deal with the landlord and tenant's. The landlord was the received the payment on the behalf of the give the property was the used.

It fits my budget, and I can get to school and work easily. This was the based on the rent.

The apartment is great! A bigger bath than I have at home. This was the based on the rent.

I did my homework on the landlord and found out he has a lot of complaints against him from former renters. This was the based on the not rent.

As a result, the significance of the sentence are rent or not rent are the aforementioned.

Learn more about on rent, here:

https://brainly.com/question/26268428

#SPJ1