What should Colin do first as he begins investing? Make paper trades Learn about the market

Answers

When Colin begins investing, he should first learn about the market. The correct answer is B.

When Colin starts investing, the first thing he should do is learn about the market. The stock market is a complex system, and he should not invest without first educating himself. This will aid in the understanding of how the market works, as well as how to make good investment decisions.

To invest properly, he should understand fundamental and technical analysis, market trends, and investment strategies, among other things. He should also have a basic knowledge of financial statements and metrics such as the price-to-earnings (P/E) ratio, the price-to-book (P/B) ratio, and the return on equity (ROE).Only after learning about the market should he move on to making paper trades and eventually real trades.

Learn more about investment here:-

https://brainly.com/question/29547577

#SPJ11

Related Questions

Write about the three motivational theorists. (Herzberg, Maslow and Taylor)

Answers

1. Frederick Herzberg:

Frederick Herzberg developed the Two-Factor Theory, also known as the Motivation-Hygiene Theory. According to Herzberg, there are two sets of factors that influence motivation and job satisfaction. The first set, called hygiene factors, includes aspects such as company policies, working conditions, salary, and interpersonal relationships. These factors, when lacking or inadequate, can lead to dissatisfaction. The second set of factors, known as motivators, includes elements like achievement, recognition, responsibility, and personal growth. Motivators are related to intrinsic rewards and can enhance job satisfaction and motivation.

2. Abraham Maslow:

Abraham Maslow is known for his theory of human motivation called the Hierarchy of Needs. Maslow proposed that individuals have a hierarchy of needs that must be fulfilled in a specific order. The hierarchy includes physiological needs (such as food, water, and shelter), safety needs, social needs, esteem needs, and self-actualization needs. Maslow believed that individuals must satisfy their basic needs before progressing to higher-level needs. Once the lower-level needs are met, people strive for self-actualization, which involves realizing their full potential and personal growth.

3. Frederick Taylor:

Frederick Taylor is often referred to as the father of scientific management. His theory, known as Taylorism or Scientific Management, focused on improving efficiency and productivity in the workplace. Taylor believed that organizations should carefully study work processes and find the most efficient methods to perform tasks. He emphasized the importance of task specialization, standardization, and scientific selection of workers. Taylor’s approach involved breaking down tasks into smaller components and scientifically determining the most efficient way to perform each task. He also emphasized the need for fair compensation and incentives to motivate workers.

These three motivational theorists have contributed significantly to our understanding of human motivation and have provided frameworks to enhance employee satisfaction, productivity, and overall organizational performance.

There are three influential theorists who have made significant contributions to the understanding of motivation in the workplace: Frederick Herzberg, Abraham Maslow, and Frederick Taylor.

Frederick Herzberg was a renowned psychologist and management theorist known for his contributions to the understanding of employee motivation. He developed the two-factor theory, also known as the motivation-hygiene theory or dual-factor theory. According to Herzberg, there are two sets of factors-- hygiene factors and motivators that influence employee satisfaction and motivation.

Abraham Maslow was a prominent psychologist who proposed the hierarchy of needs theory. Maslow's theory suggests that individuals have a hierarchy of needs that must be fulfilled in a specific order to achieve motivation and self-actualization.

Frederick Taylor, often referred to as the father of scientific management, focused on improving productivity and efficiency in the workplace. His theories emphasized the scientific study of work processes and the implementation of standardization and specialization.

Overall, these three motivational theorists—Herzberg, Maslow, and Taylor contributed valuable insights into understanding what drives individuals in the workplace, whether through job enrichment, the fulfillment of hierarchical needs, or the optimization of productivity and efficiency.

To learn more about these three motivational theorists:

https://brainly.com/question/33074796

A computer company produces affordable, easy-to-use home computer systems and has fixed costs of $250. The marginal cost of producing computers is $700 for the first computer, $250 for the second, $300 for the third, $350 for the fourth, $400 for the fifth, $450 for the sixth, and $500 for the seventh. Create a table that shows the company's output, total cost, marginal cost, average cost, variable cost, and average variable cost. a.) At what price is the zero-profit point? $ b.) At what price is the shutdown point? \$ c.) If the company sells the computers for $500, it making a (profit or a loss) A of $ d.) If the firm sells the cocmputers for $300 it is making a (profit or a loss)

Answers

a) The zero-profit point is $390.

b) The shutdown point is $37.5.

c) The profit is $1,050.

d) The loss is $100.

Here is the data provided in a non-tabular form:

Output: 1

Total Cost: 950

Marginal Cost: 700

Average Cost: 950

Variable Cost: 700

Average Variable Cost: 700

Output: 2

Total Cost: 1200

Marginal Cost: 250

Average Cost: 600

Variable Cost: 250

Average Variable Cost: 125

Output: 3

Total Cost: 1450

Marginal Cost: 300

Average Cost: 483.33

Variable Cost: 200

Average Variable Cost: 66.67

Output: 4

Total Cost: 1700

Marginal Cost: 350

Average Cost: 425

Variable Cost: 150

Average Variable Cost: 37.5

Output: 5

Total Cost: 1950

Marginal Cost: 400

Average Cost: 390

Variable Cost: 250

Average Variable Cost: 50

Output: 6

Total Cost: 2200

Marginal Cost: 450

Average Cost: 366.67

Variable Cost: 350

Average Variable Cost: 58.33

Output: 7

Total Cost: 2450

Marginal Cost: 500

Average Cost: 350

Variable Cost: 500

Average Variable Cost: 71.43

To calculate the total cost, we add the fixed cost of $250 to the variable cost, which is the sum of the marginal costs up to that point. The variable cost for each unit is the difference between the marginal cost of that unit and the marginal cost of the previous unit. For example, the variable cost of producing the second unit is $250, which is the difference between the marginal cost of the second unit ($250) and the marginal cost of the first unit ($700).

The average cost is the total cost divided by the output. The average variable cost is the variable cost divided by the output.

a.) The zero-profit point is where the price equals the average cost. From the table, we can see that the average cost is lowest at an output of 5, where it is $390. Therefore, the zero-profit point is $390.

b.) The shutdown point is where the price equals the minimum average variable cost. From the table, we can see that the minimum average variable cost is $37.5, which occurs at an output of 4. Therefore, the shutdown point is $37.5.

c.) If the company sells the computers for $500, its profit is the difference between the total revenue and the total cost. The total revenue is $500 times the output, which is $3,500. The total cost is the sum of the fixed cost and the variable cost, which is $250 + $2,200 = $2,450. Therefore, the profit is $1,050.

d.) If the company sells the computers for $300, its profit is the difference between the total revenue and the total cost. The total revenue is $300 times the output, which is $2,100. The total cost is the sum of the fixed cost and the variable cost, which is $250 + $1,950 = $2,200. Therefore, the loss is $100.

learn more about zero-profit here:

https://brainly.com/question/3342256

#SPJ11

Is Mark Zuckerburg a robot? cuz he sure looks like one

Answers

Answer:

he is lol

Explanation:

Answer:

hell yea i agree the dude's hella sus

What is a trend in business

Answers

Reasons why allocation of resources is influenced by demand and supply:

Answers

The following histogram represents the distribution of acceptance rates (percent accepted) among 20 top business school MBA programs in 2015. In each class interval, the left endpoint is included but not the right

Answers

This is correct. The first quartile is the average of the sixth and seventh smallest observations (the median of the twelve smallest observations).

The visual depiction of data points arranged into user-specified ranges is called a histogram. The histogram, which resembles a bar graph in appearance, condenses a data series into an intuitive visual by collecting numerous data points and organizing them into logical ranges or bins. A histogram is an image of data that resembles a bar graph and groups several categories into columns along the horizontal x-axis. The numerical count or percentage of occurrences in the data for each column is represented by the vertical y-axis. To see how data distribution patterns look, utilise columns. Technical analysts in trading utilise the MACD histogram to show variations in momentum. Compared to the corresponding MACD and signal lines, the MACD histogram columns may provide buy and sell indications early.

Learn more about Histogram here:

https://brainly.com/question/16819077

#SPJ4

A stockholder sold her shares and made a profit of $1,403. If that is a profit of 27%, how much were the shares worth when she originally

purchased them? Round to the nearest cent .

Answers

The worth of the shares when the stockholder originally purchased them is $1105.

What are shares?Shares are fractional ownership interests in a corporation. For some businesses, shares are a type of financial instrument that allows for the equitable distribution of any declared residual profits in the form of dividends.

It is assumed that the purchase price of the share is $100. As the stockholder sold her shares for $1,403, making a profit of 27%, it implies that:

127 = $1,403

∴ 100 = $1,403/127 × 100

= $1104.72

Therefore, $1104.72 is the original purchase price of the share.

To learn more about share, click here:

https://brainly.com/question/28392295

#SPJ1

Alpha Corporation has purchased a piece of equipment for a cost of $500,000 with a CCA rate of 20%. Calculate the UCC at the end of year 3. Show detailed calculations.

Answers

UCC at the end of year 3 = UCC at the end of year 2 - CCA for year 3. The UCC at the end of year 3 for the equipment purchased by Alpha Corporation is $256,000.

The undepreciated capital cost (UCC) at the end of year 3 for the equipment purchased by Alpha Corporation can be calculated using the capital cost allowance (CCA) rate of 20% and the initial cost of $500,000.

To calculate the UCC at the end of year 3, we need to apply the CCA rate to the initial cost of the equipment for each year. The CCA rate represents the percentage of the initial cost that can be claimed as a capital cost allowance for tax purposes.

Year 1:

CCA for year 1 = CCA rate * Initial cost

CCA for year 1 = 20% * $500,000

CCA for year 1 = $100,000

UCC at the end of year 1 = Initial cost - CCA for year 1

UCC at the end of year 1 = $500,000 - $100,000

UCC at the end of year 1 = $400,000

Year 2:

CCA for year 2 = CCA rate * UCC at the end of year 1

CCA for year 2 = 20% * $400,000

CCA for year 2 = $80,000

UCC at the end of year 2 = UCC at the end of year 1 - CCA for year 2

UCC at the end of year 2 = $400,000 - $80,000

UCC at the end of year 2 = $320,000

Year 3:

CCA for year 3 = CCA rate * UCC at the end of year 2

CCA for year 3 = 20% * $320,000

CCA for year 3 = $64,000

UCC at the end of year 3 = UCC at the end of year 2 - CCA for year 3

UCC at the end of year 3 = $320,000 - $64,000

UCC at the end of year 3 = $256,000

Therefore, the UCC at the end of year 3 for the equipment purchased by Alpha Corporation is $256,000.

Learn more about tax purposes here :

https://brainly.com/question/13767729

#SPJ11

the direct labor hours required to produce the first two units of a new product are 2,000 and 1,800, respectively. using a 90% learning rate the company would estimate the direct labor hours for the fifth unit to be

Answers

The corporation would calculate the direct labor hours for the fifth unit to be 1566.0 hours, assuming a 90% learning rate.

Is direct labour wage-based?

A new product's first two units require 2,000 and 1,800 direct labor hours to produce, respectively. The hourly pay rate, the cost of fringe benefits, and your share of employee payroll taxes are all included in the direct labour hourly rate, commonly referred to as the labour rate standard. Divide that sum by the total number of hours worked during the pay period to determine the hourly value of employee taxes and fringe benefits. The amount of direct labour hours required to create one unit of a product is known as the direct labour hours.

To learn more about Direct Labor here

https://brainly.com/question/22265649

#SPJ4

the factor which determines whether or not goods should be included in a physical count of inventory is

Answers

The factor which determines whether or not goods should be included in a physical count of inventory is:

a. legal title.

b. whether or not the purchase price has been paid.

c. management's judgment.

d. physical possession.

a. legal title

The legal title of the commodities is what determines whether or not they should be counted during a physical inventory. As a result, choice (A) is acceptable.

What is inventory?The term "inventory" describes the products and supplies that a company keeps with the intention of reselling, producing, or using them.

Defining the size, location, and shape of stocked commodities is a major focus of inventory management. Prior to the normal and scheduled course of production and stocking of materials, it is necessary at various points within a facility or at several sites of a supply network.

By defining work in process (or work in progress) broadly to mean "any work that is or has occurred prior to the completion of production," the concept of inventory, stock, or work in process (or work in progress) has been expanded from manufacturing systems to service firms and projects.

Learn more about the inventory, from:

brainly.com/question/14184995?

#SPJ6

Your question is incomplete, probably the correct question is

The factor which determines whether or not goods should be included in a physical count of inventory is:

a. legal title.

b. whether or not the purchase price has been paid.

c. management's judgment.

d. physical possession.

List three market practices that the govemment

regulates or bans to protect competition

Answers

Three market practices that the government regulates or bans to protect competition are Price fixing, Monopolies and Predatory Pricing.

Price fixing: As price fixing techniques are anticompetitive and detrimental to consumers, the government regulates them. Price fixing may result in increased costs, decreased output, and inefficient markets. The government may levy penalties or even bring legal action against the businesses and people involved in this conduct.

Monopolies: To stop them from exploiting their dominant market position, the government may regulate or even dismantle monopolies. Monopolies can result in increased costs, less innovation, and less consumer choice. Governments may limit mergers and acquisitions or control the actions of powerful companies.

Predatory Pricing: When a business sets prices below what it actually costs to produce a good or service, it is engaging in predatory pricing, which the government may outlaw. In the long term, higher prices may result from this technique since the dominant firm can increase prices after driving out its rivals, which hurts competition. The government may fine or prosecute businesses that engage in this conduct.

To know more about competition, visit:

https://brainly.com/question/4190313

#SPJ4

Which is an example of a federal government transfer payment?

o payment to cia and fbi operatives

payment to automobile union members

o payment to federal court justices

o payment to individuals with disabilities

Answers

Which of the following is TRUE about a TCF Free Student Checking Account?

(A) The minimum deposit to open the account is $25.

(B) The monthly maintenance fee is $15 per month.

(C) The account earns interest, which makes this a good savings account too.

(D) There is a $3 withdrawal fee for using an ATM in the TCF ATM Network.

A

Answers

The statement (A) The minimum deposit to open the TCF Free Student Checking Account is $25 is true.

TCF Bank offers a Free Student Checking Account designed specifically for students, and it requires a minimum initial deposit of $25. This means that in order to open the account, you need to deposit at least $25.

The statement (B) The monthly maintenance fee is $15 per month is false. The TCF Free Student Checking Account does not have a monthly maintenance fee. As the name suggests, this account is specifically tailored for students and is designed to be free of monthly maintenance charges.

The statement (C) The account earns interest, which makes this a good savings account too is false. The TCF Free Student Checking Account is primarily a checking account, not a savings account. Typically, checking accounts do not earn significant interest, and this account is no exception. If you are looking for a savings account, it would be best to explore other options that offer higher interest rates and features specifically designed for saving money.

The statement (D) There is a $3 withdrawal fee for using an ATM in the TCF ATM Network is false. TCF Bank offers free access to their extensive network of ATMs for their account holders. As long as you use an ATM within the TCF network, there should not be a fee associated with withdrawals.

In summary, the true statement about the TCF Free Student Checking Account is that the minimum deposit to open the account is $25. The account does not have a monthly maintenance fee, does not earn interest, and does not charge a withdrawal fee for using an ATM within the TCF ATM Network.

Learn more about bank brainly.com/question/31686541

#SPJ11

Cost of goods manufactured equals $140,000 for 2020. Finished goods inventory is $5,000 at the beginning of the year and $6,500 at the end of the year. Beginning and ending work in process for 2020 are $2,000 and $8,000, respectively. How much is cost of goods sold for the year?

a. 146,500

b. 145,000

c. 140,000

d. 138.500

Answers

b. 145,000. is the correct option. Cost of goods sold for the year can be determined by adding the cost of goods manufactured to the beginning finished goods inventory and subtracting the ending finished goods inventory.

Let's calculate the cost of goods sold for the year using the given information.

Cost of goods manufactured = $140,000

Beginning finished goods inventory = $5,000

Ending finished goods inventory = $6,500

Beginning work in process = $2,000

Ending work in process = $8,000

We can find the cost of goods sold for the year using the following formula:

Cost of goods sold = Beginning finished goods inventory + Cost of goods manufactured - Ending finished goods inventory.

Cost of goods sold = $5,000 + $140,000 - $6,500

Cost of goods sold = $139,500

Therefore, the cost of goods sold for the year is $139,500.

Therefore, the option a) 146,500 is incorrect and the correct option is b) 145,000.

To know more about Cost of goods visit:

brainly.com/question/13443328

#SPJ11

Tobacco is shipped from North Carolina to a cigarette manufacturer in Cambodia once a year. The reorder point, without safety stock, is 200 kilos. The carrying cost is $20 per kilo per year, and the cost of a stockout is $70 per kilo per year. Given the following demand probabilities during the lead time, how much safety stock should be carried?

Demand During Lead Time(Kilos) Probability

0 ................... .....................................0.1

100 ......................................................0.1

200 ..................................................... 0.2

300 ................... ..................................0.4

400 ................... ..................................0.2

The optimal quantity pf safety stock which minimizes expeted total cost is ____ kilos (enter anwser as a whole number).

Answers

For Safety Stock = 400 kilos:

Expected Total Cost = 8000 + 70 * Stockout Quantity

To determine the optimal quantity of safety stock, we need to calculate the expected total cost for different levels of safety stock. The formula for calculating the expected total cost is:

Expected Total Cost = (Carrying Cost per kilo per year * Safety Stock) + (Cost of Stockout per kilo per year * Stockout Quantity)

Let's calculate the expected total cost for different levels of safety stock:

For Safety Stock = 0 kilos:

Expected Total Cost = (20 * 0) + (70 * Stockout Quantity)

For Safety Stock = 100 kilos:

Expected Total Cost = (20 * 100) + (70 * Stockout Quantity)

For Safety Stock = 200 kilos:

Expected Total Cost = (20 * 200) + (70 * Stockout Quantity)

For Safety Stock = 300 kilos:

Expected Total Cost = (20 * 300) + (70 * Stockout Quantity)

For Safety Stock = 400 kilos:

Expected Total Cost = (20 * 400) + (70 * Stockout Quantity)

Now, we need to compare the expected total costs for different levels of safety stock and choose the one with the lowest cost.

For Safety Stock = 0 kilos:

Expected Total Cost = 70 * Stockout Quantity

For Safety Stock = 100 kilos:

Expected Total Cost = 2000 + 70 * Stockout Quantity

For Safety Stock = 200 kilos:

Expected Total Cost = 4000 + 70 * Stockout Quantity

For Safety Stock = 300 kilos:

Expected Total Cost = 6000 + 70 * Stockout Quantity

For Safety Stock = 400 kilos:

Expected Total Cost = 8000 + 70 * Stockout Quantity

Comparing these expected total costs, we choose the level of safety stock that minimizes the cost. By calculating the expected total costs for each safety stock level and comparing them, we can determine the optimal quantity of safety stock.

Learn more about stock from

https://brainly.com/question/26128641

#SPJ11

Nur applied for a car loan at her local credit union and was denied because her credit report sald she had recently applied for numerous credit

cards. Nur, however, has only used one credit card for her entire life and has always pald it off every month. The last time she remembered

getting a credit check was when she purchased her house five years ago, and she has always made those mortgage payments on time. What

MOST likely happened in this scenario?

ОА.

OB.

Nur forgot about other credit cards she had been using.

The credit report had been fraudulently edited by the credit union employee.

Someone stole Nur's Identity and applied for credit cards under her name.

Nur has always had bad credit and has never been eligible for a loan.

OC.

OD.

Answers

Answer: Someone stole Nur's Identity and applied for credit cards under her name.

Explanation:

The most likely cause of this scenario is Identity Theft. This is where someone steals the identity of another and uses their details including their Social Security Number to access services (usually financial) or engage in crime using the name of the person whose identity was stolen.

Someone most likely stole Nur's identity and applied for many credit cards with the intention of using them and then passing the bill on to Nur to repay the debt.

Disadvantages of choosing a job that is extremely popular or in demand

Answers

The disadvantage of choosing a job that is very popular or a job that is in high demand is that after a while such a job may become saturated or it would become monotonous.

What is a high demand job?This is the term that is used to refer to a job that the people that wpould employ labor are constantly in need of. Such a job is one that would require the people that have the qualification to opt in and get the places and the roles that they are to fill.

The issues that may arise from such a job that is in high demand is that after a period, such a job may have a lot of persons that would want to fulfil the role.

The number of qualified persons may become more than the job that is available for the people to do in the long run.

Hence this is a disadvantage. Therefore I would conclude by saying that the disadvantage of choosing a highly popular job is that the number of persons that are willing to fulfil the role may exceed the job overtime.

Read more on jobs here: https://brainly.com/question/26355886

#SPJ1

Match each participant in the economy with one action that contributes to

the circular flow of the free-market system,

Consumers

?

Providing investment

capital

Governments

?

Paying wages

Producers

?

Collecting taxes

Answers

Consumer - Provide investment

Government - collecting tax

Producer- Pay wages

What is free market?Free market is a market that allows people or individual to trade without restrictions by the government.

It allows for inter trade without any policies by the government. The market is determined by the sellers.

Therefore, action that contributes to

the circular flow of the free market is

Consumer - Provide investment

Government - collecting tax

Producer- Pay wages

Learn more on free market here

https://brainly.com/question/24519548

#SPJ1

round to the nearest thousand . 7665

Answers

Answer:

8,000

Explanation:

Hope it helped!

Answer:

8000

Explanation: add 1 when you see 6-10 in rounding off questions.

As part of the life cycle product support and system engineering processes, ____ is used to influence design and determine the most cost-effective way to support the system:

Product Support Analyses

Parametric Cost Estimating

Technical Performance Measures

Earned Value Management

Answers

In the life cycle product support and system engineering processes, Product Support Analyses are used to influence design and determine the most cost-effective way to support the system.

Product Support Analyses play a crucial role in influencing the design and determining the most cost-effective approach to support a system throughout its life cycle. These analyses involve a systematic evaluation of various factors, such as maintenance requirements, reliability, logistics support, and life cycle costs.

By conducting Product Support Analyses, engineers and support personnel can identify potential design improvements that can enhance system reliability, simplify maintenance procedures, reduce downtime, and optimize the allocation of resources. This helps ensure that the system can be efficiently supported and sustained over its operational life.

Product Support Analyses utilize techniques such as Failure Modes and Effects Analysis (FMEA), Reliability Centered Maintenance (RCM), and Life Cycle Cost Analysis (LCCA). These techniques enable a comprehensive assessment of the system's support needs and provide valuable insights into optimizing support strategies and resource allocation.

By considering the results of Product Support Analyses during the system engineering process, organizations can make informed decisions about design choices, trade-offs, and support approaches. This ultimately helps in developing a system that is reliable, supportable, and cost-effective throughout its life cycle.

Learn more about Life Cycle Cost Analysis here:

https://brainly.com/question/28894588

#SPJ11

Under what condition should the operator of a small UA establish scheduled maintenance protocol?

A.

When the manufacturer does not provide a maintenance schedule.

B.

UAS does not need to require maintenance.

C.

When the FAA requires you to, following an accident.

Answers

The correct answer is option A: When the manufacturer does not provide a maintenance schedule. It is important for operators of small unmanned aircraft (UA) to establish a scheduled maintenance protocol to ensure that their UAs are in proper working condition and do not pose a safety risk. This is particularly important when the manufacturer does not provide a maintenance schedule.

Scheduled maintenance helps to ensure that the UA is functioning properly and that any issues are addressed before they become a safety concern. Maintenance protocols should include regular inspections, cleaning, and repair or replacement of components as necessary.

Even if the UA does not require maintenance according to the manufacturer's schedule, it is still important for operators to establish their own maintenance protocol to ensure the continued safe operation of the UA. This also helps to prevent accidents and minimize downtime due to unexpected malfunctions.

In conclusion, operators of small UAs should establish a scheduled maintenance protocol when the manufacturer does not provide one. This is an important step in ensuring the safe operation of the UA and minimizing the risk of accidents.

Learn more about manufacturer here:

https://brainly.com/question/30352969

#SPJ11

Chapter 3-22 Recording adopted budget (L03-5) The town of willingdon adopted the following general fund budget for the fiscal year beginning July 1

Prepare journal entries to record the adopted budget

Answers

Journal entries are a way to record financial transactions in accounting. Each journal entry consists of at least two parts: a debit and a credit. The debit and credit amounts must always be equal, which is known as the accounting equation of Assets = Liabilities + Equity.

The general journal entries to record the adopted budget at the beginning of the fiscal year would be:

Debit: Estimated Revenues - Taxes $14,900,000

Debit: Estimated Revenues - Intergovernmental Revenues $600,000

Debit: Estimated Revenues - Charges for Services $810,500

Debit: Estimated Revenues - Fines and Forfeits $150,000

Debit: Estimated Revenues - Miscellaneous Revenues $98,200

Credit: Appropriations - General Government $5,400,000

Credit: Appropriations - Public Safety $8,550,000

Credit: Appropriations - Public Works $1,540,000

Credit: Appropriations - Culture and Recreation $960,000

Credit: Appropriations - Miscellaneous $80,000

a-2. The entries in the subsidiary ledger accounts would be:

Subsidiary Ledger - Estimated Revenues:

Taxes: Debit $14,900,000

Intergovernmental Revenues: Debit $600,000

Charges for Services: Debit $810,500

Fines and Forfeits: Debit $150,000

Miscellaneous Revenues: Debit $98,200

Subsidiary Ledger - Appropriations:

General Government: Credit $5,400,000

Public Safety: Credit $8,550,000

Public Works: Credit $1,540,000

Culture and Recreation: Credit $960,000

Miscellaneous: Credit $80,000

Learn more about Journal entries

https://brainly.com/question/20421012

#SPJ4

Full Question: During July, the first month f the fiscal year, the Town of Willingdon issued the following purchase orders and contracts.

General Government $800,000

Public Safety $400,000

Public works $75,000

Health and welfare $65,000

Miscellaneous $25,000

Total PO and contracts $1,365,000

Prepare the general journal entry to record the issuance of the POs and contracts.

Then show the entries in subsidiary ledger accounts.

What is meant by moving laterally from a position in one

department to a position in another department?

Lateral moves retrain successful employees for new

positions in the private sector.

Lateral moves afford employees with a step up in

seniority and responsibility in a new department.

Lateral moves are shifts between departments and

duties without moving up on the GS schedule.

Lateral moves retrain successful employees for new

positions in the private sector to reward loyalty.

Answers

Lateral moves are shifts between departments and duties without moving up on the GS schedule.

What is departments?Departments are organizational units within a company or organization that are responsible for specific tasks or functions. They are typically divided up based on the type of work they do and the expertise required to perform it. For example, a business might have departments such as sales, marketing, finance, human resources, and operations. Each department is responsible for their own tasks and have their own staff and resources. Working together, departments collaborate to ensure the company meets its goals. Departmentalization is important for the efficient functioning of a company, and it helps ensure that each department is working towards the same larger objectives.

To learn more about departments

https://brainly.com/question/27591050

#SPJ1

Which of the following is an example of a real estate investment?

Answers

Enter formulas based on the following using the defined names you created in Step 3 to calculate the Rental Bill • Cell F6 is equal to the value in cell B4. • Cell F7 is equal to the value in cell B5. • Cell F9 is equal to the value in cell B6 • Cell F10 is equal to the value in cell B7. • Cell H9 is equal to the charge per day, which depends on the type of car entered in cell B5 and the rate table. (Hint use the VLOOKUP function. ) • Cell H10 is equal to the charge per mile, which depends on the type of car entered in cells B5 and the rate table. Wint: Use the VLOOKUP function

Answers

By using these formulas, you can easily and accurately calculate the rental bill based on the input values and the rates defined in the RateTable. These formulas can save you time and effort when calculating rental bills, and help avoid errors in manual calculations.

To calculate the rental bill based on the values entered in cells B4 through B7, you can use formulas that reference the defined names created in Step 3. Here are the formulas you can use:

Cell F6: =Rate

This formula will simply return the value in the Rate defined name, which is equal to the daily rate of the rental car.

Cell F7: =Days

This formula will return the value in the Days defined name, which is equal to the number of days the rental car was used.

Cell F9: =Miles

This formula will return the value in the Miles defined name, which is equal to the number of miles driven during the rental period.

Cell F10: =MilesRate

This formula will return the value in the MilesRate defined name, which is equal to the per-mile rate for the rental car.

Cell H9: =VLOOKUP(B5,RateTable,2,FALSE)

This formula uses the VLOOKUP function to look up the value in cell B5 (the car type) in the RateTable defined name. It will return the corresponding charge per day for that car type, which is located in the second column of the RateTable.

Cell H10: =VLOOKUP(B5,RateTable,3,FALSE)

This formula also uses the VLOOKUP function to look up the value in cell B5 in the RateTable. However, it will return the corresponding charge per mile for that car type, which is located in the third column of the RateTable.

To learn more about bills

https://brainly.com/question/18259122

#SPJ4

Using technology, determine the present value given that you make semi-annual payments of $2,527 at 6.1% compouded semi-annually over a 6 year period. round your answer to the nearest cent. a. $25,078.86 b. $25,146.48 c. $20,963.57 d. $21,070.31

Answers

The present value would be $21070.31. Semi-annual payments of $2,527 at 6.1% compounded semi-annually over a 6 year period, means, payment is made semi annually that is two times in a year.

How to calculate?Given that,

semi-annual payments of $2,527 at 6.1% compounded semi-annually over a 6 year period.

It means, payment is made semi annually that is two times (twice) in a year.

Payment made = $2527.

Interest rate =6.1%

Hence, compounded semi annually = 0.061

Time duration = 6 years = 6 × 2 = 12 (two times)

Using Formula: P = A * i / 1 - (1 + i)-t

Therefore,

Where,

A = amount to pay

P = payment made

t = time duration

i = interest rate

By placing given values in the formula, we obtain,

A=21070.306476

Hence, the present value is $21070.31

How many semi-annual payments?Employers who choose this schedule can choose to pay the employee either on the 1st and 15th of the month, or on the 16th and the last day of the month. A half-month salary has 24 payment periods and is most commonly used by office workers.

What date is semi annual?Semi-annual dates mean June 30th and December 31st of each year.

To learn more about semi-annual payments visit:

https://brainly.com/question/15251272

#SPJ4

Answer:D

Explanation:

edge

In the event that only1corp. obtains control of all the natural gas producers in the us, it would most likely?

Answers

In the event that is most effective 1 corp. obtains manipulation of all of the natural gas producers in us, it might most possibly boost charges.

Natural gasoline is a certainly taking place aggregate of gaseous hydrocarbons consisting basically of methane further to various smaller quantities of different higher alkanes. normally low levels of hint gases like carbon dioxide, nitrogen, hydrogen sulfide, and helium also are present.

They may be called the 4 herbal gases and encompass the primary 4 alkanes — methane, ethane, butane, and propane. An alkane is a hydrocarbon in which single bonds hyperlink collectively to each atom. Hydrocarbons are chemical substances made up completely of carbon and hydrogen atoms.

Natural gasoline is every now and then informally noted absolutely as "fuel", specifically whilst it's far being as compared to different power resources, which includes oil or coal. but, it is not to be harassed with gas, which is often shortened in colloquial usage to "fuel", especially in North America.

Learn more about natural gas here: https://brainly.com/question/25649765

#SPJ4

the difference between a secured loan and unsecured loan is that the secured loan is

Answers

Answer:

Explanation:

A secured loan is a type of loan on which the borrower uses some assets for collateral . That means it is secured on the assets in the case of any default in terms by the borrower.

An unsecured loan on the other hand is a type of loan that is not secured on any assets . The risks related to this type of loan is higher as there is no security to cover or minimize the loss in the situation of a default in terms.

Looking at the definition given above , the difference between a secured and unsecured loan is that assets are promised by the borrower as security over a secured loan , hence the cost can be lower while in the unsecured loan , no asset is promised as security and the cost can be higher

Answer:

has a lower interest rate

Explanation:

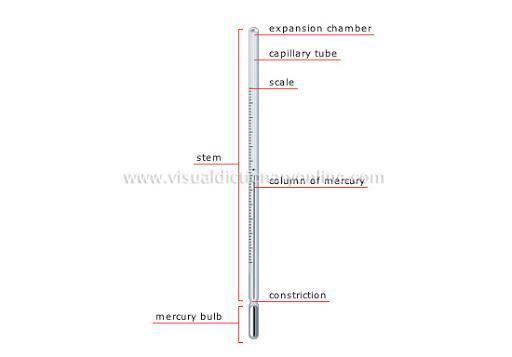

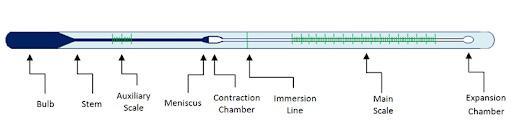

List parts of a thermometer

Answers

Answer: look at the pic in corner. haha sorry I just wanted to finish my goal. hope it helps!! :)

Which of the following types of business ownership has the highest personal liability risk?

A. A partnership

B. A sole proprietorship

C. AC corporation

D. An LLC

Please select the best answer from the choices provided.

Answers

Answer:

I think A option is right

Answer:

B

Explanation:

Edge 2021