what is the best description of discount for lack of control in a private company valuation? group of answer choices discount for lack of control is a discount based upon lack of salability. discount for lack of control is based on studies of restricted private company stocks. discount for lack of control is an individual level discount and discount for lack of marketability in an entity level discount. discount for lack of control is an entity level discount and discount for lack of marketability in an individual level discount.

Answers

Discount for lack of control is based on research of restricted private company stocks.

What does valuation discount mean?A valuation discount refers to the loss of value a buyer has estimated for a company compared to its peers in the same industry. Buyers typically review comparable transactions as part of their due diligence prior to consummating an acquisition.

When is a lack of marketability discount appropriate?A discount for lack of marketability (DLOM) is applied to valuations of private companies. This refers to the fact that the company is not listed on financial exchanges. Publicly traded companies are considered to have a 'market' because stocks can be bought and sold on a centralized market.

How does the discount rate affect rating?Future cash flows are decreased by discount rate. The higher the discount rate, the lower the future cash flow's present value. On the other hand, the lower the discount rate, the higher the present value. In other words, if the discount rate is high, the value of money in the future will be lower than it is today.

Learn more about valuation visit:

https://brainly.com/question/29429593

#SPJ4

Related Questions

"Which of the following would you use to get the best comparison

of living standards across multiple countries?

Group of answer choices

a.GDP

b.GNP

c.GPI

d.GDP PPP"

Answers

To get the best comparison of living standards across multiple countries, you would use GDP PPP. Therefore, the correct option is d.

GDP PPP. Gross Domestic Product Purchasing Power Parity (GDP PPP) is a method for estimating the purchasing power parity (PPP) between two currencies. The GDP PPP is used to compare the economic productivity and living standards of different countries. It is an effective way to compare living standards because it accounts for differences in the cost of living between countries and adjusts for currency exchange rates.

GDP is the market value of all final goods and services produced in a country in a given year. GNP is the total value of all goods and services produced by a country's residents, whether located in the country or abroad, in a given year. GPI, on the other hand, is a measure of the overall well-being of a nation's citizens that takes into account economic and social factors such as environmental quality, income distribution, and education.

To know more about comparison visit:

brainly.com/question/32662201

#SPJ11

While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE), specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021 and each contributed $50,000 in exchange for a 50 percent ownership interest. GTE also borrowed $200,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following information pertains to GTE’s 2021 activities.

• GTE uses the cash method of accounting (for both book and tax purposes) and reports income on a calendar-year basis.

• GTE received $450,000 of sales revenue and reported $210,000 of cost of goods sold (it did not have any ending inventory).

• GTE paid $30,000 compensation to James, $30,000 compensation to Paul, and $40,000 of compensation to other employees (assume these amounts include applicable payroll taxes if any).

• GTE paid $15,000 of rent for a building and equipment, $20,000 for advertising, $14,000 in interest expense, $4,000 for utilities, and $2,000 for supplies.

• GTE contributed $5,000 to charity.

• GTE received a $1,000 qualified dividend from a great stock investment (it owned 2 percent of the corporation distributing the dividend) and it recognized $1,500 in short-term capital gain when it sold some of the stock.

• On December 1, 2021, GTE distributed $20,000 to James and $20,000 to Paul.

• GTE has qualified property of $300,000 (unadjusted basis).

Requirements:

a. Assume James and Paul formed GTE as an S corporation.

• Complete GTE’s Form 1120S page 1, Form 1120 S, Schedule K, and Paul’s Form 1120S Schedule K-1 (note that you should use 2020 tax forms).

• Compute the tax basis of Paul’s stock in GTE at the end of 2021.

• What amount of Paul’s income from GTE is subject to FICA or self-employment taxes?

• What amount of income, including its character, will Paul recognize on the $20,000 distribution he receives on December 1?

• What amount of tax does GTE pay on the $1,000 qualified dividend it received?

Answers

GTE, as an S corporation, has a pass-through taxation structure. I cannot complete the tax forms for you, but I can provide guidance on how to approach them.

1. Complete Form 1120S page 1 by reporting GTE's revenues, deductions, and other relevant financial information.

2. On Schedule K, report items such as the qualified dividend, short-term capital gain, and charitable contributions, which will flow through to the shareholders.

3. For Paul's Schedule K-1, allocate his share of the company's income, deductions, and credits based on his 50 percent ownership interest.

4. To compute the tax basis of Paul's stock in GTE at the end of 2021, start with his initial $50,000 contribution, and adjust for his share of the company's income, losses, and distributions.

5. Paul's income from GTE subject to FICA or self-employment taxes would be his $30,000 compensation. S corporation shareholders do not pay self-employment tax on their share of the company's income (reported on Schedule K-1).

6. The $20,000 distribution Paul receives on December 1 is generally not taxable, as it is considered a return of basis. However, if the distribution exceeds his stock basis, the excess would be treated as capital gain.

7. GTE, as an S corporation, does not pay tax on the $1,000 qualified dividend. Instead, the dividend flows through to the shareholders, who report it on their individual tax returns and pay the appropriate tax based on their individual tax rates.

Please consult a tax professional to ensure accurate completion of the required tax forms and for personalized advice on this scenario.

To know more about guidance visit:-

https://brainly.com/question/30532008

#SPJ11

An explanation of how gdp and gnp is important in marketing and how they relate to the marketing process

Answers

Answer:

The overview of the instance would be described throughout the following section.

Explanation:

Throughout economics, GDP has been utilized to measure the amount profitability of a company manufactured inside the borders of a nation. Whilst also GNP has been utilized to measure the amount of profit of an organization manufactured or organized by the nation's residents, regardless of geographic location.what are some common tasks performed by Psychiatrists? (Select four options)

A administering first aid and life support care

B collaborating with other medical professionals

C maintaining patient information and records

D developing diagnostic imaging techniques

E prescribing, directing, or administering psychotherapeutic treatments or medications

F analyzing and evaluating patient data or test findings

Answers

Answer:

B, E and F and explanation I share you other thought about it

Explanation:

Psychiatrists are medical doctors who specialize in the treatment of mental health conditions. Some common tasks performed by psychiatrists include:

Conducting initial evaluations and assessments to diagnose mental health conditionsPrescribing and managing medications to treat mental health conditionsProviding individual, family, or group therapy to help patients manage their mental healthDeveloping and implementing treatment plans for patientsCollaborating with other healthcare providers to coordinate care for patientsProviding crisis intervention and support to patients experiencing mental health emergenciesConducting research to advance the field of psychiatry and improve treatment options for patients.Please help in this question asap

Answers

Answer:

All of these

Explanation:

do I need to explain lol?? :]

why should a marketers be cautious about including videos that play automatically when people navigate to the marketer's website

Answers

Answer:

D

Explanation:

Just imagine yourself being in a work place or in a library, where you have other person's around you. And you're browsing through a site, then suddenly a video pops up and started playing automatically at the highest level. Can you imagine the kind of situation that would be created at that instance? Very awkward.

So therefore, marketer should apply caution when it comes to including video that plays automatically. This will avoid creating such kind of awkward situation for users at work.

Answer: D

Explanation: Just took the quiz

A customer at the checkout complains that they can't find the brand of shampoo that they came in for. When you check for them, you see that there is no product on the shelf. What do you do?

Answers

Here are the options:

A. Check the receiving room for the product to be in the shelves.

B. Let them no the truck comes in on Tuesday.

C. Tell the Customer to check back again later.

D. Show the Customer the other brands of Shampoo that's available on the shelf

Answer:

D. Show the Customer the other brands of Shampoo that's available on the shelf.

Explanation:

This is the option because it provides an opportunity to still make a sale. Remember, the customer only complained of not seeing a particular brand

It therefore, means that if shown other brands of Shampoo that's available on the shelf they may opt-in to buy them.

Pretend you are President of the United States. The Citizens and the economy of the USA need financial assistance to get back on their feet. List and describe three fiscal Policies you would initiate (describe each policy in 3 sentences):

Answers

Assuming i am the President of U.S. and the country needs a financial assistance to get back on their feet. The most likely fiscal Policies we would initiate are the:

contractionary fiscal policyexpansionary fiscal policyWhat do we call a Fiscal policy?In economics, a fiscal policy refers to a governmental decision to increase or decrease taxation and spending. Most time, a Fiscal and monetary policy are often used together to influence the economy. But the fiscal policy can affect a company’s growth, hiring ability and taxes.

We have 3 types of fiscal policy which includes a neutral, expansionary, and contractionary fiscal policy. The neutral policy is one where government takes no steps to provide economic support because it feels the economy is healthy and stable, the expansionary fiscal policy mainly involves increasing spending or cutting taxes to prevent or end a recession or depression and the contractionary fiscal policy involves cutting spending or raising taxes to slow down unsustainable economic growth.

Read more about Fiscal policy

brainly.com/question/6583917

#SPJ1

Commodity brokers use forward and futures contracts for which of the

following reasons?

A. The raw, unprocessed nature of commodities means that there is

always a third party to any commodity-purchase contract.

B. The riskiness of commodity production means that many

commodity producers go bankrupt before harvest time.

C. The seasonal nature of many commodities would lead to wide

variations in supply and price without these contracts.

D. Commodities come from many different countries with very

different currency exchange rates.

Answers

Answer: The seasonal nature of many commodities would lead to wide

variations in supply and price without these contracts.

The correct option is C.

Commodity brokers use forward and futures contracts for the seasonal nature of many commodities would lead to wide variations in supply and price without these contracts.

What does a commodity broker do?

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives.

How do commodity brokers make money?Compensation for commodity brokers is often on a commission basis. They receive a percentage of the gross commissions from the trades placed by their customers. Commissions are fees for the execution of buying and selling orders. Some commodity brokers are highly successful.

Learn more about commodity brokers here https://brainly.com/question/798039

#SPJ2

Which of the following is a common way to describe a product that is being offered for sale? (Select the best answer.)

Which of the following is a common way to describe a product that is being offered for sale? (Select the best answer.)

In business

On exchange

On the market

In the market

Answers

Answer:

On the market

Explanation:

On the market is the phrase that refers to items that have been offered to the market for sale. When an item has been labeled 'on the market,' it means the item is available for sale. Buyers are invited or welcomed to buy.

In the market is when a buyer is shopping for an item to buy. In the market for a car mean they are looking for a car to buy.

Kim has worked in the tech industry for some time and would like to start consulting. in opening her new business, she will need equipment. she needs to purchase 3 laptops, 2 desktop computers, and a fax machine. each laptop costs $546.78, each desktop computer costs $1,255.99, and the cost of the fax machine is $125.99. she currently has $3,500 in her savings account. determine if kim has enough in her savings account to cover the expenses of her new company, and if she doesn't have enough, determine the amount needed to cover the cost.

Answers

After expenses, Kim will need an additional $778.31 to cover the cost and start her new company.

What is an expense?An expense is the cost of operations incurred by a business in order to generate revenue.

It is given in the question that Kim needs to purchase 3 laptops, 2 desktop computers, and a fax machine.

Cost of 1 laptop = $546.78

∴ Cost of 3 laptops = 3×546.78 = $1,640.34

Cost of 1 desktop = $1,255.99

∴ Cost of 2 desktop =2×1,255.99 = $2,511.98

Cost of 1 fax machine = $125.99.

The total cost for Kim =$( 1,640.34+2,511.98+125.99) = $4278.31

As, Kim has $3,500 in her savings account.

The additional amount needed to start business:

$4278.31-$3,500 = $778.31

Therefore, after expenses, Kim will need an additional $778.31 to start her new company.

To learn more about expenses, click here:

https://brainly.com/question/29842871

#SPJ1

In a market without price controls, producers charge ____ for their goods and services. This price allows producers to supply the same amount of products as consumers demand.

prices above the equilibrium price

equilibrium prices

prices below the equilibrium price

Answers

Answer:

equilibrium prices

Explanation:

yeah-ya

Because an insurance policy is a legal contract, it must conform to the state laws governing contracts which require all of the following elements EXCEPT?

Answers

All of the following, with the exception of conditions, are required.

Describe insurance.One party will agree to compensate another in the event of a certain loss, damage, or injury in exchange for a fee in order to safeguard oneself from financial loss. It is a risk management technique that is typically used to guard against the danger of a hypothetical loss that may or may not materialise.

An underwriter, insurer, firm, or carrier is a company that provides insurance. A person or organisation that obtains insurance is known as a policyholder, whereas a person or organisation that the policy protects is known as an insured.

Become familiar with

Insurance

Visit

https://brainly.com/question/989103

Vera has a June credit card balance of $476.09. Her payment due date is June 27th, with a grace period of 5 days. If her payment is late, the credit card company charges a $30 late fee.

Answers

Answer: $506.09

Explanation:

Just took the test

Suppose the Federal Reserve increases the amount of reserves by $100 million and the total money supply increases by $500 million.

a. What is the money multiplier?

b. Using the money multiplier from part a, how much will the total money supply increase by if the Federal Reserve increases the amount of reserves by $50 million?

$ million

Suppose the Federal Reserve sets the reserve requirement at 15%, banks hold no excess reserves, and no additional currency is held.

a. What is the money multiplier?

Instructions: Round your answer to 2 decimal places.

b. How much will the total money supply increase by if the Federal Reserve increases the amount of reserves by $200 million?

$ million

c. When the Federal Reserve increases the reserve requirement, the money multiplier will (Click to select)increaseremain the samedecrease and an increase in reserves will have (Click to select)a smallerthe samea larger effect on the money supply.

Ask your instructor a question

Answers

According to the given information, The money multipliers are $5 and $6.6666 and Total Change in money Supply is $250

1. a. Money Multiplier = Total Change in money Supply / Initial change in

money supply

Money Multiplier = $500/$100

Money Multiplier = $5

b. Total Change in money Supply = Initial change in money supply ×

Money Multiplier

Total Change in money Supply = $50 × $5

Total Change in money Supply = $250

2. a. Money multiplier = 1/(Required Reserve to deposit ratio)

= 1/0.15 = $6.6666

b. Increase in money supply = Money Multiplier × Increase in Reserves

= 6.6666 × 200 = $1333.3333 million

c. If the Fed raises the reserve requirement, the banks must hold more

cash in reserves, which reduces the amount of money they can lend,

resulting in a decline in the money multiplier and, ultimately, a

reduction in the amount of money available for circulation. Therefore,

an increase in reserves as a result of raising the required reserve to

deposit ratio will have a detrimental impact on the availability of

money, as will the increase in reserves generally.

Learn more about Money Multiplier, here

https://brainly.com/question/14986591

#SPJ4

Accounting assessment q15/15 assigning indirect costs to specific jobs is completed by _____.assigning indirect costs to specific jobs is completed by _____. applying a predetermined overhead rateapplying a predetermined overhead rate using the manufacturing cost incurredusing the manufacturing cost incurred allocating to manufacturing overhead accountallocating to manufacturing overhead account applying indirect costs to work in process

Answers

Assigning indirect costs to specific jobs is completed by D. applying indirect costs to work in process.

What are indirect costs?Indirect costs are costs that are not directly traceable to cost objects (e.g. a job, product, or service unit).

Indirect costs are overheads incurred as a result of a business activity but without direct impact. For example, utilities, office supplies, etc. are all indirect costs.

Thus, assigning indirect costs to specific jobs is completed by D. applying indirect costs to work in process.

Learn more about indirect costs at https://brainly.com/question/24762880

#SPJ1

, environmental trends and Ethical trends affect a pharmacy business? I need one whole paragraph for them

Answers

The negative impact of the production of pharmaceutical products on the natural environment is well known. However, this remains largely unregulated, meaning the extremely toxic impact it has on both animals and humans continues with no clear end in sight.

International organisations and the pharmaceutical industry have begun to notice that the detrimental impact pharma products have on the environment on a global scale.Pharmaceutical products enter the environment at various stages of their life-cycle, but particularly during the production phase. One of the main threats is that discharging antibiotics into the environment can promote the natural development of antibiotic-resistant pathogens that are harder to treat. Lord Jim O’Neill noted this trend in his 2016 UK government-funded independent Review on Antimicrobial Resistance.Although it is a global issue, like other environmental issues, pharma pollution more directly and seriously affects those living near production plants whose water and food sources are contaminated with waste pharma products.Health Care Without Harm (HCWH) Europe runs the Safer Pharma campaign to raise awareness of the negative relationship between pharma and the environment and challenge the healthcare industry to clean up its production.The production of both active pharmaceutical ingredients (APIs) and finished dose antibiotics is concentrated in specific locations so the resulting point, source pollution, is in incredibly high concentrations and encourages the development of drug resistance,” says HCWH Europe pharmaceuticals policy officer Dr Adela Maghear. “This practice has a detrimental impact on vulnerable populations living near manufacturing facilities and wastewater treatment plants in these countries.The pollution of pharma products into the environment also adversely affects animals, particularly fish living in contaminated water. For example, a report published in science journal Nature in 2009 noted that ‘many of Europe’s rivers are home to male fish that are ‘intersex’ and so display female sexual characteristics, including female reproductive anatomy. Some males also produce vitellogenin, a protein normally.

What are the 3 top sources of the federal government's revenue?

Answers

The vast majority of federal revenue comes from individual and corporate income taxes, as well as social insurance taxes.

What are the federal government's revenue sources?Individual taxpayers, small businesses, and corporations contribute the vast majority of revenue to the federal government. Excise tax, estate tax, and other taxes and fees are additional revenue sources.The government's five major revenue sources are the Goods and Services Tax (GST), income tax, corporation tax, non-tax revenues, and union excise duties.Individual income taxes, payroll taxes, and corporate income taxes are the three main sources of federal tax revenue. Excise taxes, the estate tax, and other taxes and fees are also sources of revenue.Taxation is the federal government's single largest source of revenue (or revenue). Other forms of government revenue exist (such as fees and interest), but they pale in comparison to the taxes we all pay. Taxes come in three varieties: Individual earnings are taxed.To learn more about federal government revenue refer to :

brainly.com/question/16036388

#SPJ4

identify and explain two characteristics of the packaging of the chocolate bars

Answers

hope it helps you

thank you

the magnitude of operating leverage for perkins corporation is 4.5 when sales are $100,000. if sales increase to $110,000, profits would be expected to increase by what percent? a. 4.5% b.14.5% c.45% d.10%

Answers

It would be anticipated that the profit would rise by 45%. The appropriate response to the given question is option (c).

What is Operating Leverage?The percentage of a company's cost structure that is made up of fixed expenses as opposed to variable costs is measured by operating leverage. A corporation is said to have more operating leverage if its fixed expenses are higher than its variable costs.

Magnitude of operating leverage= 4.5

Old sales= $100000

New sales= $110000

Percentage increase in sales:

(New-old)/old = (110,000-100,000)/100,000

= 10%

Consequently, a percentage rise in profit might be anticipated:

sales percentage growth times the degree of operational leverage

= 10% * 4.5

= 45%

To know more about Operating Leverage, visit:

https://brainly.com/question/29743788

#SPJ1

g emphasis on the quantitative aspects of products sold (ie: portion size, price) and services offered (the time it takes to get the product) is known as

Answers

The emphasis on the quantitative features of goods sold (such as portion size and price) and services provided (such as the length of time it takes to receive the good) is known by the name

Calculability

Calculability refers to the capacity to compute the costs of the items that a business transacts at any given time and the nature of the services it provides, such as the time it takes to get a product.

In light of this, we are aware that in a capitalist society, the primary goal of any business is to generate a profit, and calculability is used to demonstrate the quantitative features of the goods and services that are sold and provided in order to calculate profit.

Read more about calculability here:

brainly.com/question/759158

#SPJ4

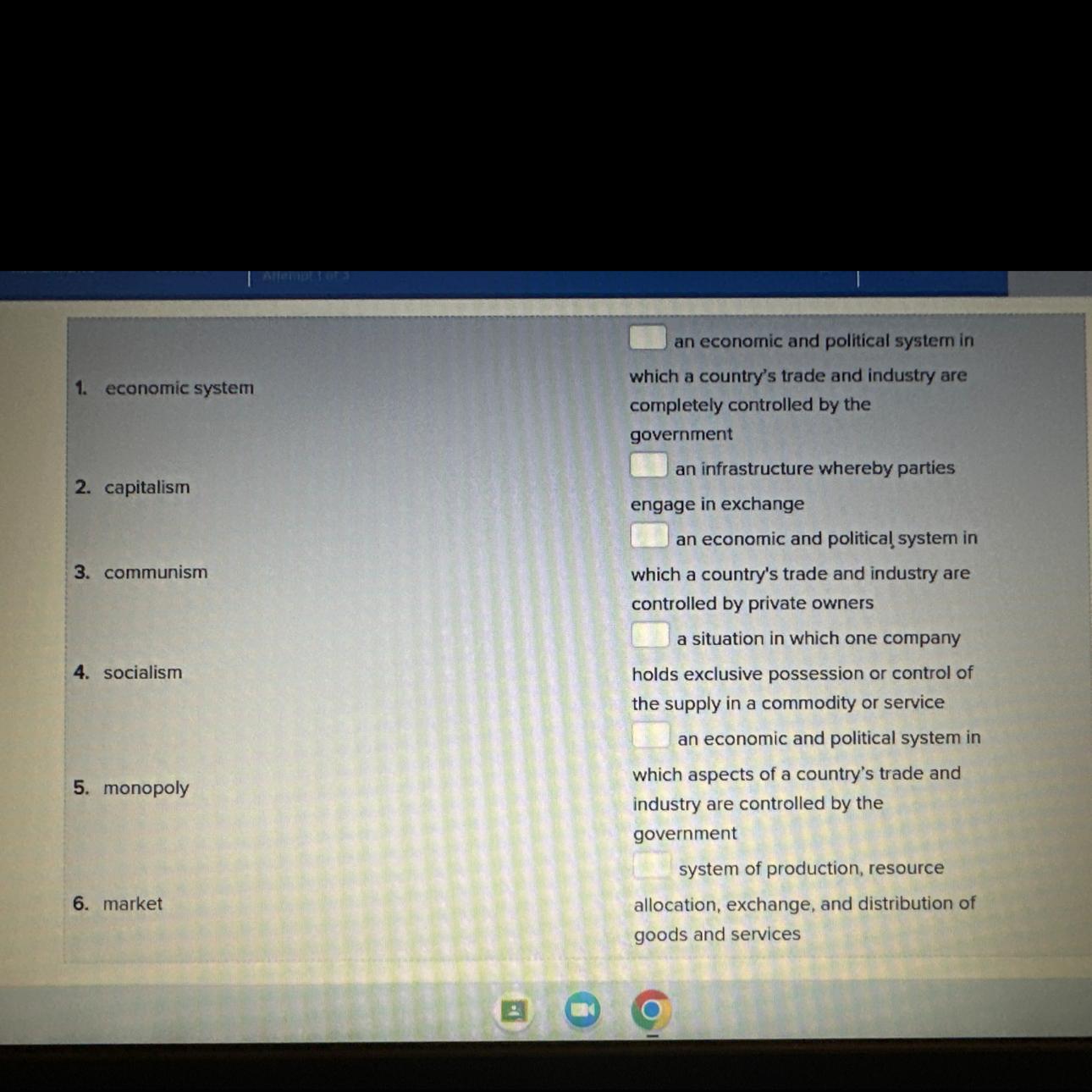

Match the following

Answers

Answer:

2,3,1,5,4,6

Explanation:

numbers go in box

Indications of the qualities people desire and seek in activities in which they engage, in the situations in which they live, and in the objects they make or desire are all aspects of A. career maturity. B. workforce readiness. C. values clarification. D. career choice readiness.

Answers

The correct answer is C. values clarification. This term refers to the process of identifying and understanding one's own personal values, beliefs, and goals, and using this understanding to guide decision making and behavior.

Career maturity refers to the process of developing realistic career goals and making progress towards achieving them. While values clarification may be a component of this process, it is not the focus of the concept. B. Workforce readiness refers to the skills, knowledge, and attitudes needed to succeed in the workplace, and is not directly related to values clarification.

Values clarification refers to the process of identifying and understanding one's core beliefs and values. It involves recognizing the qualities people desire and seek in various aspects of their lives, such as the activities they engage in, the situations they live in, and the objects they create or desire.

To know more about clarification visit:-

https://brainly.com/question/15857225

#SPJ11

Please help will mark brainliest

Answers

Answer:

first b

second b

third a

Explanation:

Answer:

for the first one is b

and the second one is b

lastly last one is C

if im correct yq

Which type of audit is the least complicated for taxpayers?a. A field audit

b. An office audit

c. A research audit

d. A correspondence audit

e. A documentation audit

Answers

d. A correspondence audit

Among the options listed, a correspondence audit is typically the least complicated for taxpayers. In a correspondence audit, the tax authority communicates with the taxpayer through mail or electronic correspondence, requesting specific documents or information related to their tax return. The taxpayer is usually required to provide the requested documentation or clarification on certain items. It is generally less intrusive and time-consuming compared to other types of audits

In contrast, field audits involve in-person visits by tax auditors to the taxpayer's premises or business location, which can be more involved and comprehensive. Office audits take place at the tax authority's office and may require the taxpayer to bring their records for examination. Research audits are less common and typically involve more complex situations or specific issues. Documentation audits focus on verifying the supporting documents and records provided by the taxpayer.

It's important to note that the complexity of an audit may vary depending on the specific circumstances, the complexity of the taxpayer's financial situation, and the scope of the audit.

Learn more about taxpayers here:

https://brainly.com/question/30049579

#SPJ11

Explain how herbs are used in treating any

5 diseases

Answers

Answer:

An herb is a plant or plant part used for its scent, flavor, or therapeutic properties. Herbal medicines are one type of dietary supplement. They are sold as tablets, capsules, powders, teas, extracts, and fresh or dried plants. People use herbal medicines to try to maintain or improve their health.

Explanation:

Hope it helps u

FOLLOW MY ACCOUNT PLS PLS

The Occupational Safety and Health Administration, OSHA, enforces employee protection regulations.

O False

O True

Answers

Answer:

True

Explanation:

OSHA does enforce regulations pertaining to the working conditions of employees. These regulations ensure the safety and security or their workers.

The Occupational Safety and Health Administration, OSHA, enforces employee protection regulations. The given statement is True.

The Occupational Safety and Health Act (OSH Act), which Congress passed in 1970, gave the Secretary of Labour the power to create federal standards to guarantee safe working conditions.

OSHA, which is responsible for establishing and enforcing protective workplace safety and health regulations, was established by the OSH Act. OSHA also offers information, instruction, protection, and support to both businesses and employees.

Thus, the mentioned above-given statement is true.

Learn more about employee protection here:

https://brainly.com/question/31863107

#SPJ6

What is vocational skill development Center?

When was it established??

Answers

Answer:

is there any answers if there are ask a question with the answers

Explanation:

because search engines use objective algorithms, search engine marketing has no way to improve a site's ranking in search results directly. true or false?

Answers

False. Search engine marketing (SEM) does have ways to improve a site's ranking in search results directly, despite the use of objective algorithms by search engines.

Search engine marketing encompasses various strategies and techniques aimed at improving a website's visibility and ranking in search engine results pages (SERPs). While search engines utilize objective algorithms to determine rankings, SEM professionals can employ several tactics to directly influence these rankings. These tactics include optimizing website content, conducting keyword research, building high-quality backlinks, improving site speed and usability, and utilizing structured data markup. Additionally, SEM involves paid advertising campaigns, such as pay-per-click (PPC), which allow websites to appear prominently in search results through targeted bidding and ad placement. Through these direct efforts, SEM plays a crucial role in enhancing a site's ranking and visibility on search engines.

Learn more about websites here: brainly.in/question/8826704

#SPJ11

Suppose that workers in the United States can produce 40 computers or 20 tons of coffee in a particular period. Suppose workers in Brazil can produce 30 computers or 10 tons of coffee in the same period.

a. What is the opportunity cost for computers and for coffee in each country?

b. Which country has a comparative advantage in the production of computers, and which has a comparative advantage in the production of coffee?

c. Choose terms of trade that would make both countries better off.

Answers

For US the opportunity cost of coffee is 0.5 and computer is 2, for Brazil, the opportunity cost is 0.3 for coffee and 3 computers

Brazil has comparative advantage in computer, US has in coffee.

The nations would be better off if they exchanged within their opportunity costs.

a. How to solve for the opportunity costThe US must stop producing 20 tons of coffee in order to produce 40 computers. Therefore, the US must stop producing 20–40 tons of coffee in order to build only one computer. Computer opportunity cost in the US = 20/40 = 0.5 tons of coffee

Opportunity cost = 1 / 0.5 = 2 computers

Brazil must stop producing 10 tons of coffee in order to build 30 computers. Therefore, Brazil would have to stop producing 10 or 30 tons of coffee in order to build one computer. In Brazil, the opportunity cost of a computer is 10/30, or one third a ton of coffee.

1/ 0.3 = 3 computer

b. Brazil is believed to have a comparative advantage in the manufacture of computers, but the US has a comparative advantage in the production of coffee, due to the lower opportunity cost of making computers there than in the US.

c. The terms of trade has to be between their opportunity costs. a ton of coffee has to be exchanged with 2.5 of computers.

Read more on opportunity costs here: https://brainly.com/question/1549591

#SPJ1