what amount of total liabilities does apple report for each of the fiscal years ended (a) september 29, 2018, and (b) september 30, 2017?

Answers

The answer is Apple reports liabilities of $257,063,000,000 during September 29, 2018, and September 30, 2017.

What do you mean by liabilities?Liability typically denotes your responsibility for something, but it can also imply that you owe someone money or services. A homeowner's tax obligation, for instance, may be the amount of property taxes due to the city or the amount of income tax due to the federal government.

What kind of obligations fall under the umbrella of liabilities?

Image for "liabilities" definitionAny debts that your business owes others money, including bank loans, mortgages, unpaid bills, IOUs, and other sums of money, are referred to as liabilities. A liability exists when you owe someone money after promising to do so in the future.

To know more about Liabilities visit:

https://brainly.com/question/18484315

#SPJ4

Related Questions

Which one of the following is not considered boot in a like-kind exchange?

A. Cash.

B. Other property.

C. Mortgage given.

D. Mortgage received.

E. All of these.

Answers

D. Mortgage received is not considered a boot in a like-kind exchange.

Boot refers to any non-like-kind property or cash that is exchanged in a like-kind exchange. The purpose of a like-kind exchange is to defer taxes on the exchanged property, but if any boot is received, it may trigger a taxable event. In a like-kind exchange, cash, other property, and a mortgage given are all considered boots. However, a mortgage received is not considered a boot as long as it meets certain requirements.

The mortgage must be treated as a liability and reduce the basis of the exchanged property. If the mortgage received exceeds the basis of the exchanged property, then it is considered a boot and may trigger a taxable event. Therefore, D. Mortgage received is not considered a boot in a like-kind exchange if it meets the requirements.

To know more about the Boot visit:

https://brainly.com/question/29696826

#SPJ11

An asset that has no physical substance is referred to as a(n) _____ asset.

a. intangible

b. tangible

c. current

d. long-lived

Answers

An intangible asset is one that has no physical substance.

An intangible asset is something that has value but cannot be touched or seen. Examples include patents, trademarks, copyrights, and goodwill. Intangible assets are often created through research and development, advertising and marketing, or through the acquisition of another company. They are an important part of a company's overall value and can be bought, sold, licensed, or traded like other assets. Unlike tangible assets, intangible assets cannot be physically touched or seen, which can make their valuation and management more challenging. Properly accounting for and managing intangible assets is important for companies of all sizes and industries.

Know more about Intangible asset here:

https://brainly.com/question/29750335

#SPJ11

If a bond is trading at a premium, what is the relationship between the bond's coupon rate, current yield and yield to maturity?

Answers

Bonds acquired at premiums often have lower yields to maturity than bonds purchased at market rates. This is further explained below.

What is a bond?Generally, Bonds are financial securities that reflect loans made to the issuer by the bondholders themselves. When it comes to borrowing money, governments (at all levels) and companies (of all sizes) often turn to bonds.

In conclusion, If you buy a bond at a discount, the yield to maturity will be lower than its coupon rate.

Read more about the bond

https://brainly.com/question/17405470

#SPJ1

HELP ASAP which is an example of a short term SMART career goal A i will work for my dad this summer because i dont have a car so he can drive me to work B I will volunteer at the local animal shelter because i need practical experience for vetinary school C I will apply for a job at acme enterprises because they pay the highest hourly wage in town DI want to work with my friends this summer because i wont have the chance to see them when i go to college.

Answers

Answer:

The answer is B

Explanation:

It makes more sense, and also the vet job could be a short time, but it is a smart choice. It is a smart choice because it shows that the vet job will help in the future

the united states is demanding that china reduce overcapacity in which industry?

Answers

Answer:

steel sector

Explanation:

U.S negotiators prepare for those discussions this spring,they must consider the Chinese government's legacy of repeated broken promises and false statement regarding overcapacity

Using the data, calculate the percentage change in quantity demanded following a £3 increase in the price

of salt pipes. You are advised to show your working,

Answers

Answer:

idk sry

Explanation:

g according to the black-scholes option pricing theory, which is more valuable: a european call option that is 10% out-of-the-money, or a european put option that is 10% out-of- the-money? note: the european call option that is 10% out-of-the-money has a strike price equal to 1.1 times the current stock price, while the european put option that is 10% out-of-the- money has a strike price that is equal to the current stock price divided by 1.1.

Answers

According to the Black-Scholes option pricing theory, the European put option that is 10% out-of-the-money is more valuable than the European call option that is 10% out-of-the-money.

The Black-Scholes option pricing theory is a mathematical model used to calculate the fair price or theoretical value of an option contract, based on several factors such as the underlying asset's price, time to expiration, volatility, and the option's strike price. In this question, we are comparing a European call option and a European put option, both of which are 10% out-of-the-money. The call option has a strike price 10% higher than the current stock price, while the put option has a strike price 10% lower than the current stock price. According to the Black-Scholes model, the put option is more valuable since it has a lower strike price, and therefore a higher chance of being exercised, resulting in a higher potential payoff.

Learn more about finances here: brainly.com/question/29493385

#SPJ4

Employers must provide a stairway or ladder if the elevation between two surfaces on a site is.

Answers

Employers are required to provide a stairway or ladder at all worker points of access if there is an elevation change of 19 inches (48 cm) or more and no ramp, runway, embankment, or personnel hoist is provided.

What are the elevated work surfaces OSHA regulations?The final rule codifies OSHA's guidance for companies using RDS for elevated work. Employers are not allowed to utilize RDS over 300 feet above grade unless they can show that doing so would be impractical or provide a greater risk than utilizing another system.

OSHA, how tall may a platform be without a step?Now that we are clear on how OSHA defines a platform and that any exposed side or edge that is four feet or higher than a lower level need fall protection to prevent employees from falling, let's talk about guardrail specifications for work platforms.

To know more about OSHA visit:

https://brainly.com/question/9178716

#SPJ4

Why is it important to have insurance?

It's important to have insurance so people can

protect themselves from losing a lot of money in

the event of an unpredictable event or something

happens to them or their property.

So individuals can defend against the possibility of

financial loss due to unpredictable event

So people can engage in risky behavior without

financial consequences

A and B

Answers

It's important to have insurance so people can protect themselves from losing a lot of money in the event of an unpredictable event or something that happens to them or their property. So individuals can defend against the possibility of financial loss due to unpredictable events. The correct options are a and b.

What is insurance?Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Learn more about insurance, here:

https://brainly.com/question/27822778

#SPJ1

Wyoming Restoration Company completed the following selected transactions during July 20Y1:

July 1. Established a petty cash fund of $1,100.

12. The cash sales for the day, according to the cash register records, totaled $8,192. The actual cash received from cash sales was $8,220.

31. Petty cash on hand was $47. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt:

July 3. Store supplies, $580.

7. Express charges on merchandise sold, $90 (Delivery Expense).

9. Office supplies, $30.

13. Office supplies, $35.

19. Postage stamps, $50 (Office Supplies).

21. Repair to office file cabinet lock, $60 (Miscellaneous Administrative Expense).

22. Postage due on special delivery letter, $28 (Miscellaneous Administrative Expense).

24. Express charges on merchandise sold, $135 (Delivery Expense).

30. Office supplies, $25.

July 31. The cash sales for the day, according to the cash register records, totaled $10,241. The actual cash received from cash sales was $10,232.

31. Decreased the petty cash fund by $150.

Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles.

This is the chart of accounts.

CHART OF ACCOUNTS

Wyoming Restoration Company

General Ledger

ASSETS

110 Cash

111 Petty Cash

120 Accounts Receivable

131 Notes Receivable

132 Interest Receivable

141 Merchandise Inventory

145 Office Supplies

146 Store Supplies

151 Prepaid Insurance

181 Land

191 Office Equipment

192 Accumulated Depreciation-Office Equipment

193 Store Equipment

194 Accumulated Depreciation-Store Equipment

LIABILITIES

210 Accounts Payable

221 Notes Payable

222 Interest Payable

231 Salaries Payable

241 Sales Tax Payable

EQUITY

310 Common Stock

311 Retained Earnings

312 Dividends

313 Income Summary REVENUE

410 Sales

610 Interest Revenue

EXPENSES

510 Cost of Merchandise Sold

515 Credit Card Expense

516 Cash Short and Over

520 Salaries Expense

531 Advertising Expense

532 Delivery Expense

533 Insurance Expense

534 Office Supplies Expense

535 Rent Expense

536 Repairs Expense

537 Selling Expenses

538 Store Supplies Expense

561 Depreciation Expense-Office Equipment

562 Depreciation Expense-Store Equipment

591 Miscellaneous Administrative Expense

592 Miscellaneous Selling Expense

710 Interest Expense

Answers

A business establishes a petty cash fund to cover smaller expenses. In order to replenish the fund, the accounting department of a company typically reconciles all petty cash fund transactions every month.

How do you Journalize a petty cash fund?Your petty cash cashier is required to record a journal entry in your records whenever they deposit money into the petty cash fund. Your Petty Cash account must rise, and your Cash account must drop, as seen by the entry. Debit your Petty Cash account and credit your Cash account to demonstrate this.A debit is made to the petty cash account and a credit is made to the cash account in the petty cash journal entry. The custodian of the petty cash restocks the petty cash drawer or box, which now ought to be filled with the initial sum of money intended for the fund. The cashier enters the petty cash receipts in a journal entry.Learn more about petty cash journal entry refer to :

https://brainly.com/question/22520039

#SPJ1

________ is largest employer in the country and the largest purchaser of goods and services in the world.

Answers

The largest employer in the country which can also be regarded as largest purchaser of goods as well as services is U.S. federal government.

U.S. federal government can be regarded as national government of the United States, which is composed of self-governing territories as well as several island.She serve as one of the major force in the world market, and that is why many countries relied on their exports.Therefore, U.S. federal government is right.

Learn more at:

https://brainly.com/question/20935050?referrer=searchResults

Why does electronic commerce benefit small firms? Without e-commerce, small firms often lack the resources to expand beyond local markets. The government has committed significant resources to encourage small firms to go online. Small firms are often "tech savvy", which allows them to embrace innovations more quickly. Large firms have complex business plans that fail to direct investment toward the Internet.

Answers

Answer:

Without e-commerce, small firms often lack the resources to expand beyond local markets.

Explanation:

In Business, e-commerce can be defined as a business model which involves the buying and selling of goods or products over the internet.

Generally, e-commerce comprises of four (4) business models and these are;

1. Business to Business (B2B).

2. Business to Consumer (B2C).

3. Business to Government (B2G).

4. Consumer to Consumer (C2C).

Without e-commerce, small firms who predominantly lack the resources to expand beyond local markets unlike larger business firm wouldn't be able to grow and develop into penetrating global markets.

which example best explains the concept of government failure? cessation of government business due to lack of funding when government decisions lead to inefficient outcomes the situation in which rebels overtake an established government a failure of governments to meet budgetary needs from the choices, please select the major factors that result in government failure.

Answers

The best justify the statement was the concept of government failure is cessation of government business due to lack of funding.

A legal obligation or system that is controlled and supervised by a workplace, the public sector, a nation, or a state is referred to as "government."

The law was enacted by the government. The acts of the populace are being closely monitored by the authorities. Taxes and laws were imposed by the government.

The main causes of the government's failure are economic misbudgeting. In times of crisis, the government occasionally doesn't perform well. The corruption was one of the other causes. The business was unable to operate because of a lack of sufficient funding.

As a result, the government may fail, as in the case of the suspension of government operations due to financial constraints.

To know more about government:

https://brainly.com/question/16940043

#SPJ4

differentiate between health assistant and staff nurse

Answers

Answer:

Medical assistants perform tasks like answering phones and scheduling patients, while a nurse typically only performs tasks related to patient care, such as documenting their condition and writing care plans.

Explanation:

Nurses have some administrative work, but they primarily care for patients. This includes writing care plans and documenting conditions. Medical assistants usually perform management tasks such as answering phones and scheduling patients.

How can companies balance the importance of maintaining Filipino values in their business practices with the need to remain competitive in the global market?

Answers

Answer: Through

Embed Filipino values in the company culture, Conduct market research, etc.

Explaneation: Balancing the importance of maintaining Filipino values in business practices with the need to remain competitive in the global market can be a challenge for companies. However, there are several strategies that companies can adopt to achieve this balance:

Embed Filipino values in the company culture: Companies can embed Filipino values such as respect for elders, integrity, and hard work in their organizational culture. This can be done by creating a code of conduct that incorporates these values, providing training and development programs that reinforce them, and recognizing employees who embody these values.

Conduct market research: Companies can conduct market research to understand the values and preferences of their target market. This can help them identify which Filipino values are important to their customers and how they can incorporate them into their products and services.

Embrace innovation: Companies can embrace innovation and new technologies to improve their competitiveness in the global market. However, they can also ensure that these innovations align with Filipino values, such as environmental sustainability and social responsibility.

Collaborate with local communities: Companies can collaborate with local communities to better understand Filipino values and customs. This can help them develop products and services that are culturally appropriate and resonate with local customers.

Practice corporate social responsibility: Companies can practice corporate social responsibility by giving back to the community and supporting social causes. This can help them build a positive reputation and foster goodwill among customers, while also demonstrating their commitment to Filipino values.

By adopting these strategies, companies can balance the importance of maintaining Filipino values in their business practices with the need to remain competitive in the global market

Generally, the agent's duty to keep an accounting means that the agent must:

A.

keep records, receipts, and other documentation of costs or income for the principal.

B.

be able to verify the exact number of hours the agent spends acting within the scope of employment.

C.

prepare tax returns for the principal pertinent to the agent's financial activities.

D.

be able to account for any and all of the principal's funds when they are commingled with the agent's or anyone else's funds.

Answers

The correct answer is A. The agent's duty to keep an accounting means that the agent must keep records, receipts, and other documentation of costs or income for the principal.

This includes any financial transactions that the agent carries out on behalf of the principal, such as expenses or payments received. The purpose of this duty is to ensure transparency and accountability in the agent's handling of the principal's finances. It is important for the agent to be able to provide a clear and accurate record of all financial activities to the principal upon request.

Learn more about "agent" at https://brainly.com/question/7284696

#SPJ11

01-005 - One way to think of analysis is that it turns data into _____.

Answers

One way to think of analysis is that it turns data into insights.

statistics by means of itself is just a collection of data and figures, but when it's far analyzed, styles and developments can be identified, and relationships between variables may be exposed.

This technique of turning information into insights calls for a combination of technical abilties, important thinking, and creativity. through analyzing facts, insights can be derived which can inform decision-making, drive strategy, and pick out possibilities for development.

In the long run, the purpose of analysis is to offer meaningful and actionable insights which could assist businesses make higher selections and attain their goals.

Learn more about Data analysis:-

https://brainly.com/question/30270811

#SPJ4

Can someone tell me if it’s correct, and which one is wrong

Answers

Answer:

Yes,they are correct.

Explanation:

Tristen, who is from Poland, is told by one of his coworkers that he is left out of conversations because he will not understand American phrases. This is an example of

a ethnic discrimination

b LGBTQ discrimination

c racial discrimination

d religious discrimination

Answers

Answer:

a

Explanation:

we arent told any other details apart from that he is from Polish, so it's the logical answer

Answer: A

Explanation:

Ethnic discrimination, the behavioral manifestation of racism, is defined as "unfair, differential treatment on the basis of race or ethnicity

North Side, Inc. has no debt outstanding and a total market value of $175,000. Earnings before interest and taxes, EBIT, are projected to be $16,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30 percent higher. If there is a recession, then EBIT will be 70 percent lower. The company is considering a $70,000 debt issue with an interest rate of 7 percent. The proceeds will be used to repurchase shares of stock. There are currently 2,500 shares outstanding and the tax rate is 34 percent. What will be the percentage change in EPS if the economy has a strong expansion?

Answers

problem 10-4a (algo) part 4 4. if retained earnings at the beginning of the period was $240,000,000 and $20,000,000 was paid in dividends during the year, what was the net income for the year?

Answers

Given that retained earnings at the beginning of the period were $240,000,000 and $20,000,000 was paid in dividends during the year, the net income for the year can be calculated. The net income for the year is $260,000,000.

Retained earnings represent the accumulated profits of a company that have not been distributed to shareholders as dividends. To calculate the net income for the year, we need to consider the change in retained earnings, which is influenced by dividends and net income.

The formula to calculate the change in retained earnings is:

Change in Retained Earnings = Net Income - Dividends

Given that retained earnings at the beginning of the period were $240,000,000 and $20,000,000 was paid in dividends, we can substitute these values into the formula:

Change in Retained Earnings = Net Income - $20,000,000

Since the change in retained earnings is the difference between the retained earnings at the end of the period and the retained earnings at the beginning of the period, we have:

Change in Retained Earnings = Retained Earnings at the End - $240,000,000

Now we can rearrange the formula to solve for the net income:

Net Income = Change in Retained Earnings + Dividends

Net Income = (Retained Earnings at the End - $240,000,000) + $20,000,000

Given that the retained earnings at the beginning of the period were $240,000,000, we can rewrite the equation as:

Net Income = (Retained Earnings at the End - $240,000,000) + $20,000,000

Simplifying the equation, we find:

Net Income = Retained Earnings at the End - $220,000,000

Since the problem does not provide the retained earnings at the end of the period, we cannot determine the exact net income. However, based on the given information, we know that the net income for the year would be $260,000,000 to balance the equation.

Therefore, the net income for the year is $260,000,000.

Know more about net income :brainly.com/question/3294383

the sales department at a local company determines that product a will moderately boost sales and have a shorter production schedule, so it is decided that this product will be manufactured and sold without considering other options. in choosing this product, the sales department is

Answers

The action that is been taking by the sales department when they are determining the kind of product that will bring about sales boost with their shorter production schedule and manufacturing of product is Satisficing.

Satisficing can be regarded as a decision-making strategy that is carried out for satisfactory or adequate result.This done as opposed to the optimal solution, satisficing involves taking pragmatic effort to face a task.Therefore, satisficing is correct answer.

Learn more at:

https://brainly.com/question/11559750?referrer=searchResults

all of the following contributed to the rise of industrialization in western europe and north america during the nineteenth century except___ eographic distribution of coal and iron

legal protection of private property

improved agricultural productivity

increased rights for laborers

Answers

All of the following contributed to the rise of industrialization in western Europe and North America during the nineteenth century except increased rights for laborers.

What are the factors that contributed industrialization?The Agricultural Revolution, the population boom, and Great Britain's advantages were the three principal drivers of the Industrial Revolution. Due to better farming practices, population increase, and Great Britain's advantages, which affected nations all over the world, the Industrial Revolution is seen as a key period of time.

The presence of a sizable labor force, an availability of natural resources, a growing economy, & political stability all played a role in Britain's industrialization.

Hence, the appropriate response is option D.

To learn more about Industrial Revolution

https://brainly.com/question/855594

#SPJ1

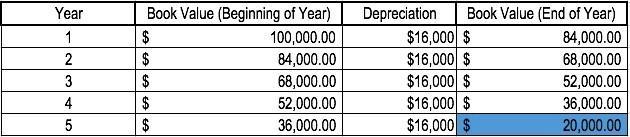

Use the sum-of-year depreciation method to calculate the depreciation for the

following scenario. Company XYZ bought a new machine for $100,000 and

expects the machine will last for 10 years.

Answers

Answer:

20%

Explanation:

How to Calculate Straight Line Depreciation

The straight line calculation steps are:

Determine the cost of the asset.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

Determine the useful life of the asset.

Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

Straight Line Example

Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years.

The straight line depreciation for the machine would be calculated as follows:

Cost of the asset: $100,000

Cost of the asset – Estimated salvage value: $100,000 – $20,000 = $80,000 total depreciable cost

Useful life of the asset: 5 years

Divide step (2) by step (3): $80,000 / 5 years = $16,000 annual depreciation amount

Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

The depreciation rate can also be calculated if the annual depreciation amount is known. The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%.

The following are affected by the business structure you choose when you start your

business.

O a.

day-to-day operations, personal liability, and business name.

O b.

day-to-day operations, business location, and taxes.

О с.

profitability, personal liability, and taxes

O d.

day-to-day operations, personal liability, and taxes.

1

Answers

When you start business, the business structure you choose can affect your day-to-day operations, personal liability, and taxes.

What is a liability?Liability refers to the legal responsibility for one's actions or debts. It is an obligation to pay or perform something to another party. Liability can arise from various sources, such as contractual agreements, statutory laws, or common law. For instance, when a person borrows money from a bank, they have a liability to repay the loan amount to the bank within a certain period, according to the terms and conditions of the loan agreement. Liability can also arise from a person's actions or omissions that result in harm or damage to others. In such cases, the person may be held liable for the damages caused and may have to compensate the affected parties for their losses.

To learn more about liability, visit:

https://brainly.com/question/28391469

#SPJ1

the better the quality of data used in decision making processes, the more confidence users have in the decisions they make, the lower the risk of a poor decision, and the more likely the decision will achieve the desired results.

Answers

It is typically accurate. The level of confidence that decision-makers have in their choices, the risk involved in making poor choices, and the possibility of getting the intended results can all be significantly impacted by the quality of the data utilized in the decision-making processes.

How can it be explained in detail?The likelihood that decision-makers will be confident in their choices increases when they have access to high-quality data that is accurate, pertinent, and current. This is due to the fact that they have greater confidence in the data they are utilizing to make decisions and have a clearer knowledge of the risks and potential outcomes of various solutions.

On the other side, bad data can influence bad decisions and increase the likelihood of unfavorable outcomes. This may occur as a result of inaccurate, out-of-date, or inadequate data, which can result in erroneous presumptions, wrong conclusions, or missed opportunities.

In order to guarantee that the data used in decision-making processes is of high quality and can be trusted, it is crucial for businesses to invest in data quality management procedures, such as data cleansing, data validation, and data governance.

To learn more about data visit here:

https://brainly.com/question/15444165

#SPJ4

Walsh Company ma. ctures and sells one product. Ihe tollowing intormation pertalns to each of the company's lirst two years of operations: During its first year of operations, Walsh produced 50,000 units and sold 40,000 unts, During its second year of operations, it produced 40,000 units and sold 50,000 units. The selling price of the company's product is $5 per unit. Required: 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 2. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2 3. Reconcite the difference between variable costing and absorption costing net operating income in Year 1 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 2. Assume the company uses absorption costing: a. Compute the 4 " product cost for Year 1 and Year 2. b. Prepare an incu... statement for Year 1 and Year 2. 3. Reconcile the difference between variable costing and absorption costing net operating income in Year 1. Complete this que by entering your answers in the tabs below. Assume the company uses variable costing. Compute the unit product cost for year 1 and year 2 . Assume the company uses variahle costing. Propare-an income statement for Year 1 and Year 2. Assume the company uses absorption costing. Compute the unit product cost for Year 1 and Year 2. Note: Round your answer to 2 decimal places. Assume the company uses absorption costing. Prepare an income statement for Year 1 and Year 2. Note: Round your intermedlate calculations to 2 decimal places. Reconcile the difference between variable costing and absorption costing net operating income in Year 1 . Note: Enter any losses or deductions as a negative value.

Answers

The income statement and the variable expenses based on the question requirements are given below:

The Variable Costing Income StatementYear 1 Year 2

Sales $200,000

Variable expenses:

Direct materials | $140,000 | $180,000

Direct labor | $60,000 | $80,000

Variable manufacturing overhead | $20,000 | $20,000

Variable selling and administrative | $10,000 | $10,000 Total variable expenses | $230,000 | $270,000 Contribution margin | $70,000 | $80,000 Fixed expenses:

Fixed manufacturing overhead | $100,000 | $100,000

Fixed selling and administrative | $50,000 | $50,000 Total fixed expenses | $150,000 | $150,000 Net operating income | $(80,000) | $(70,000)

Unit Product Cost

Year 1 Year 2

Direct materials $2.80

Direct labor $1.20

Variable manufacturing overhead $0.40

Variable selling and administrative $0.25

Unit product cost $4.65

Computation

The unit product cost is calculated by adding the variable costs per unit. The variable costs per unit are the same for both years.

Year 1 Year 2

Variable costs per unit $2.80 + $1.20 + $0.40 + $0.25

Unit product cost $4.65

The income statement for both years shows that the company has a net operating loss. The loss is larger in Year 2 because the company produced more units than it sold, resulting in higher variable expenses.

Read more about income statement here:

https://brainly.com/question/28936505

#SPJ4

Carrie made an initial investment of $50,000.the final value of her investment was $55,500.what was the roi?

Answers

Answer:

sorry i am not good with this subject i want to help but i cant sorry

Explanation:

1-The journal entry required to transfer capital of Partners A and B to Partner C would includea- a debit to Partner C, Capital.b- a credit to Partner C, Capital.c- credits to Partner A, Capital, and Partner B, Capital.d- None of these choices are correct.

Answers

The correct journal entry required to transfer capital of Partners A and B to Partner C would be option c - credits to Partner A, Capital, and Partner B, Capital.

When capital is transferred from Partners A and B to Partner C, it involves reallocating ownership interests within the partnership. To reflect this transfer, the capital accounts of Partners A and B need to be decreased, while Partner C's capital account needs to be increased.

Partner A, Capital and Partner B, Capital accounts are credited to decrease their balances, while Partner C, Capital account is debited to increase its balance. This journal entry properly reflects the transfer of capital from A and B to C, adjusting their respective capital account balances accordingly.

Therefore, the correct journal entry would involve credits to Partner A, Capital, and Partner B, Capital, and a debit to Partner C, Capital.

Learn more about journal entry

https://brainly.com/question/20421012

#SPJ4

A new company just starting to pay dividends may choose to make a one-time dividend payment know as a(n) unexpected dividend. special dividend. ex-dividend. stock dividend.

Answers

A new company just starting to pay dividends may choose to make a one-time dividend payment known as a special dividend. Special dividends are typically issued when a company wants to distribute excess cash to its shareholders, often as a result of extraordinary profits or one-time events. Unlike regular dividends, special dividends are not expected or part of the company's regular dividend policy. They are usually larger than regular dividends and are paid as a one-time event. Special dividends can be a way for a new company to reward shareholders and generate positive market sentiment.

Learn more about dividends here

brainly.com/question/25845157

#SPJ11