the useful life of an intangible asset may be limited by what type of provisions? (select all that apply.) multiple select question. legal contractual u.s. gaap regulatory

Answers

The useful life of an intangible asset may be limited by various provisions, including A. legal, B. contractual, and D. regulatory provisions.

Legal provisions refer to laws and statutes that govern the use and duration of intangible assets, such as intellectual property rights (patents, copyrights, and trademarks). These provisions can impose limits on the period an intangible asset can be utilized or protected.

Contractual provisions are terms and conditions agreed upon by parties in a contract, which may restrict the usage or lifespan of an intangible asset. For example, licensing agreements for software or technology may specify a definite period during which the asset can be used.

Regulatory provisions are rules set by regulatory bodies or government agencies to control or oversee specific industries and their activities. These provisions can also limit the useful life of intangible assets, such as requiring periodic renewal of licenses or certifications.

In summary, the useful life of an intangible asset may be limited by legal, contractual, and regulatory provisions that dictate the duration and conditions under which the asset can be utilized or protected. Therefore, the correct option is A. B. and D.

The question was incomplete, Find the full content below:

the useful life of an intangible asset may be limited by what type of provisions? (select all that apply.) multiple select question.

A. legal

B. contractual

C. u.s. gaap

D. regulatory

Know more about Intangible asset here:

https://brainly.com/question/14892188

#SPJ11

Related Questions

What customers constitute the business market?

Answers

Answer:

The business market consists of four major categories of customers: producers, resellers, governments, and institutions. Producers-include profit-oriented organizations that use purchased goods and services to produce or incorporate into other products.

Explanation:

hope this helps

Mason Milling grinds calcined alumina to a standard granular size. The mill produces two different size products from the same raw material. Regular Grind can be produced at a rate of 10,000 pounds per hour and has a demand of 400 tons per week with a price per ton of $900. Super Grind can be produced at a rate of 6,000 pounds per hour and has a demand 200 tons per week with a price of $1,900 per ton. A minimum of 700 tons has to be ground every week to make room in the raw material storage bins for previously purchased incoming raw material by rail. The mill operates 24/7 for a total of 168 hours/week. How many tons of each product must be produced each week to maximize revenue? (hint: be careful with units in this problem, ton, ton per week, ton per hour).

Answers

The mill should produce 700 tons of super grind and 0 tons of regular grind every week to maximize revenue.

The main aim of the problem is to find out the number of tons of each product that has to be produced per week to maximize revenue.

The regular grind is produced at a rate of 10,000 pounds per hour and has a demand of 400 tons per week with a price per ton of $900.The super grind is produced at a rate of 6,000 pounds per hour and has a demand of 200 tons per week with a price per ton of $1,900.To make room for the incoming raw materials, a minimum of 700 tons has to be ground every week.

According to the given conditions, we need to find out how many tons of each product should be produced per week to maximize the revenue.

Let the number of tons of regular grind be x. Let the number of tons of super grind be y.

Since a minimum of 700 tons has to be ground every week, the equation becomes:

x+y ≥ 700

The regular grind is produced at a rate of 10,000 pounds per hour and has a demand of 400 tons per week. Hence, we get:10,000x / 2,000 = 400x = 80/3 tons per hour

The super grind is produced at a rate of 6,000 pounds per hour and has a demand of 200 tons per week. Hence, we get:

6,000y / 2,000 = 200y = 100/3 tons per hour

Since the mill operates 24/7 for a total of 168 hours/week, the number of hours the mill operates to produce regular grind is given by:

80/3 * h ≤ 10,000

h ≤ 750

The number of hours the mill operates to produce super grind is given by:

100/3 * k ≤ 6,000k ≤ 1800/100 = 18

The total revenue generated can be given by:

R = 900x + 1900y

The problem is to maximize revenue. We can use linear programming to solve this problem:

Maximize R = 900x + 1900ysubject to:

x + y ≥ 70080/3x + 100/3y ≤ 168x ≤ 750y ≤ 18x ≥ 0, y ≥ 0

The feasible region is shown below:

graph{y≤-0.8x+168y≥0x≥0x+y≥700y≤18}

The vertices of the feasible region are (0, 700), (750, 0), and (522, 178).

We evaluate R at these points to see which one gives the maximum value of R.

R(0, 700) = 900(0) + 1900(700) = 1,330,000

R(750, 0) = 900(750) + 1900(0) = 675,000

R(522, 178) = 900(522) + 1900(178) = 938,800

Therefore, the maximum revenue is $1,330,000 when the mill produces 700 tons of super grind and 0 tons of regular grind.

Therefore, the mill should produce 700 tons of super grind and 0 tons of regular grind every week to maximize revenue.

To know more about maximize revenue, visit:

https://brainly.com/question/30883127

#SPJ11

In ________, one firm provides the product or service in a particular industry, which results in less price competition.

Answers

Monopolies are said to exist when one company provides the product or carrier in a particular industry, and as such effects in much less rate competition.

What is monopoly oligopoly and monopolistic competition?An oligopoly will allow extra than one honcho to co-exist, and a monopolistic competition will enable several players to enter into the market, while a monopoly will essentially be the one that stands apart and guidelines the complete demand and provide chain in the unique discipline of selection.

What is the that means of monopolistic market?A monopolistic market is a theoretical circumstance that describes a market where only one employer may offer products and services to the public. A monopolistic market is the opposite of a perfectly competitive market, in which an infinite quantity of firms operate

Learn more about monopoly here:

https://brainly.com/question/7217942#SPJ4Assume that you are considering purchasing some of a company's long-term bonds as an investment. Which of the company's financial statement ratios would you probably be most interested in

Answers

When considering purchasing a company's long-term bonds as an investment, you would likely be most interested in the company's debt-to-equity ratio.

When considering purchasing a company's long-term bonds as an investment, The debt-to-equity ratio measures the company's financial leverage and indicates the proportion of debt financing compared to equity financing. It provides insights into the company's financial stability and ability to meet its long-term debt obligations. As a bond investor, you would want to assess the company's ability to generate sufficient earnings and cash flow to cover its interest payments and ultimately repay the bonds. A lower debt-to-equity ratio generally indicates a lower level of financial risk and may be more favorable for bondholders.

Learn more about investment from

https://brainly.com/question/29547577

#SPJ11

Baako Ltd purchase motor vehicle as follows date 01/01/13 800,000$,01/01/13 400,000$,01/04/15 600,000. The company adopts straight line method of depreciation at the rate 10% per annum from the date of purchase separate account is prepared for provision for depreciation. On 30th June, 2014 the motor vehicle which was purchase on 1st July was sold for 24,000$. You are required to prepare (a) motor vehicle account for the years 2013,2014 and 2015. (b) motor vehicle disposal account.

Answers

Baako Ltd purchase motor vehicle as follows date 01/01/13 800,000$,01/01/13 400,000$,01/04/15 600,000. The company adopts straight line method of depreciation at the rate 10% per annum from the date of purchase separate account is prepared for provision for depreciation. On 30th June, 2014 the motor vehicle which was purchase on 1st July was sold for 24,000$. You are required to prepare (a) motor vehicle account for the years 2013,2014 and 2015. (b) motor vehicle disposal account.

CC's Marketing manager wants to carry out market research. Identify and explain two factors which could influence the accuracy of the market research data.

Answers

Answer: Have an objective/aim, have an understanding of gathering data

Explanation:

Marketing research is the careful and systematic gathering of information that would help influence the sales of a product or service you intend to sell. An effective and we'll carried out market survey or research would be a great guide on how to present a product to the public or the target market. There are two factors CC's marketing manager has to consider while carrying out the market research. They are;

Objectives/Aim; the marketing manager must have a guide on what he needs to research on while doing the market survey, he has to consider which target market he should look at, the kind of environment, he needs to have a well stated guide that he can work with to give him the desired results which would be effective for him.

How to gather data; the marketing manager would have to have an understanding of gathering data. Data is vital when carrying out market research, it gives you a guide in the number of people you should be considering or the number of things to note or percentages of factors you're considering and how you should plot yours.

You have been hired as the new controller for the Radiance Company. Shortly after joining the company in 2024, you discover the following errors related to the 2022 and 2023 financial statements: a. Inventory at December 31,2022 , was understated by $6,000b. Inventory at December 31,2023 , was overstated by$9,000c. On December 31,2023 , inventory was purchased for $3,000. The company did not record the purchase until the inventory was paid for early in 2024. At that time, the purchase was recorded by a debit to purchases and a credit to cash.

Answers

These errors need to be corrected to ensure the accuracy of the financial statements. An adjustment of $6,000 needs to be made to increase the inventory balance at the end of 2022, an adjustment of $9,000 needs to be made to decrease the inventory balance at the end of 2023, and a journal entry needs to be made to record the inventory purchase of $3,000 in 2023.

Here's a step-by-step explanation to address the errors you've mentioned:

1. Inventory at December 31, 2022, was understated by $6,000:

To correct this error, you need to increase the inventory balance at December 31, 2022, by $6,000. This will also require an adjustment to the retained earnings balance for 2022.

2. Inventory at December 31, 2023, was overstated by $9,000:

To correct this error, you need to decrease the inventory balance at December 31, 2023, by $9,000. This will also require an adjustment to the retained earnings balance for 2023.

3. Inventory purchased for $3,000 on December 31, 2023, was not recorded until paid for in 2024:

To correct this error, you need to record the inventory purchase in the 2023 financial statements. You should debit inventory and credit accounts payable for $3,000 on December 31, 2023. Then, when the payment is made in 2024, you should debit accounts payable and credit cash for $3,000.

By following these steps, you can correct the errors related to the 2022 and 2023 financial statements for the Radiance Company.

To know more about inventory balance refer here:

https://brainly.com/question/13741571#

#SPJ11

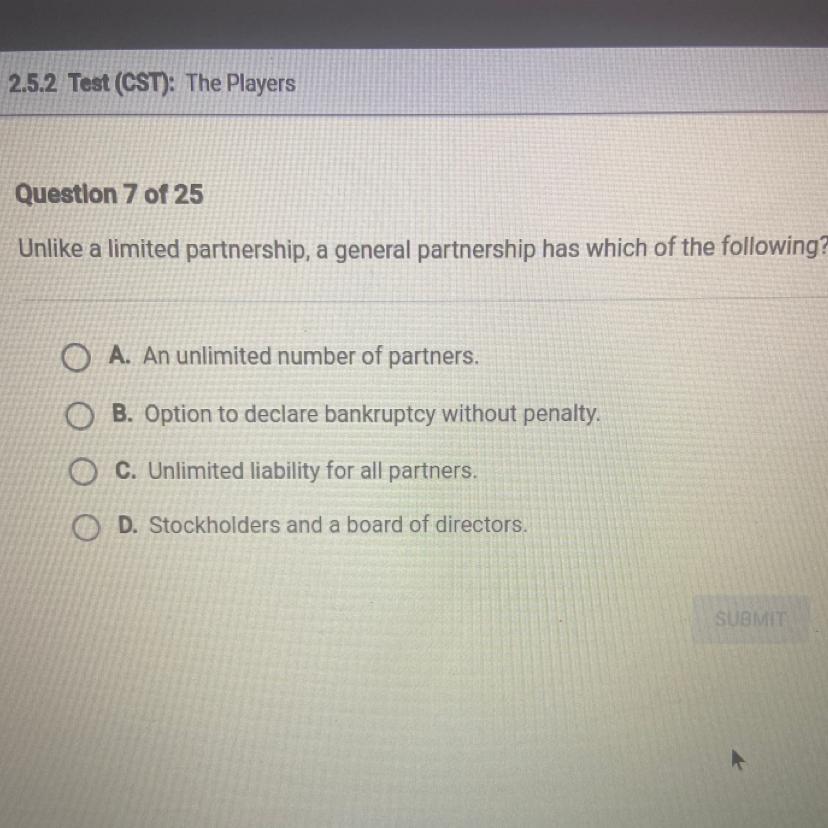

Unlike a limited partnership, a general partnership has which of the following?

O A. An unlimited number of partners.

B. Option to declare bankruptcy without penalty.

C. Unlimited liability for all partners.

D. Stockholders and a board of directors.

Answers

Answer:

C. Unlimited liability for all partners.

Explanation:

A general partner has unlimited liability to the debts of the business. It follows that in a general partnership business, all partners will have unlimited liability to business debts.

A general partnership is not a separate entity from its owners. Assets and liabilities of the business will be treated as those of the partners. Should the business fail in paying its debts, the partners' personal properties may be sold to clear the debts.

If a country has lower overall productivity levels than its trading partners, then it will Group of answer choices have a lower standard of living than its trading partners. be unable to export. have a trade deficit. not be able to obtain gains from trade.

Answers

If a country has lower overall productivity levels than its trading partners, then it will:

Have a trade deficit.Not be able to obtain gains from trade.Lower over productivity levelIn a situation were a country has lower overall productivity levels than its trading partners this mean that the country cannot benefit from trade.

Which in turn mean that the country with the lower productivity level cannot gain from trade because no comparative advantage for the country.

Therefore it will have a trade deficit and not be able to obtain gains from trade.

Learn more about Lower over productivity level here:https://brainly.com/question/1600155

#SPJ1

font-family property is inherited, a few elements are stubborn and don't take on their parent's font setting. Among these are:

Answers

The font-family property is a fundamental feature in CSS that allows you to specify the font for an element. By default, this property is inherited, meaning that if you set a font for a parent element, all its child elements will take on the same font style. There are several reasons why some elements may not inherit the font-family property. For example, certain HTML tags.

The font-family property is indeed inherited, which means that most elements within a parent element will adopt the parent's font setting. However, some elements can be stubborn and do not take on their parent's font setting as easily. These stubborn elements include form elements (such as input, text area, and button) and certain types of table elements.

These elements may have their own default font settings defined by the browser, which can cause inconsistencies in your design. To overcome this issue, you can explicitly set the font-family property for these stubborn elements, ensuring that they match the desired font setting inherited from the parent element. By doing this, you create a consistent font appearance throughout your web page, improving the overall design and user experience.

Know about more font-family property here:

https://brainly.ph/question/26339309

#SPJ11

According to the MLA format, which best demonstrates the similarities and differences between the citations of a magazine and a book?

Both require the title and author, while magazines require the editor of the magazine.

Both require a date of publication, while magazines require the page number of the article.

Both require the format of the book, while books require the page number of the information.

Both require a location of publication, while books require the edition of the book if there is more than one.

Answers

Answer:

Both require a date of publication, while magazines require the page number of the article.

Explanation:

Modern Language Association or MLA format is one style of providing citations in academic works. This style of citation or formatting one's papers is used majorly in many universities all around the world and is regarded as one of the most accepted styles to be used.

According to this style, providing citations for both a magazine and a book requires the date of publication of the book/ article/ magazine. At the same time, magazines also require the page number of the article from which the quote is taken or used as a source.

Thus, the correct answer is the second option.

Answer:

B

Explanation:

Which of the following is not an optional deduction?

A. Life Insurance

B. 401(k)

C. Health Insurance

D. Medicare

Answers

Answer:

D. Medicare

Explanation:

Medicare is a federal tax imposed on all workers. It is a compulsory deduction based on the worker's gross pay. Employers are required to withhold the medicare tax amounts are remit to the government. Medicare is used by the federal government to provide medicare care to senior citizens aged 65 years and above.

Life Insurance, 401(k), and Health Insurance are voluntary deductions. The employer withholds the amounts and remits them to the relevant agency as per the employee's request.

Stephen bought a new Chevrolet Suburban vehicle by putting $10,000 down and arranging to make monthly payments of $599 for six years. These payments represent the ________ of the vehicle for Stephen.

Question 32 options:

1)

ownership costs

2)

acquisition costs

3)

maintenance costs

4)

disposal costs

5)

repair costs

Answers

The monthly payments that Stephen is making for his Chevrolet Suburban vehicle represent the acquisition costs of the vehicle. Acquisition cost refers to the amount of money expended to acquire an asset.

Acquisition costs include the purchase price of an asset and any additional charges associated with the acquisition, such as delivery fees, sales taxes, installation charges, etc. In the context of vehicle purchase, it refers to the amount paid to obtain ownership of the vehicle. In Stephen's case, this would include the $10,000 down payment and the ongoing $599 monthly payments for six years. It is important to note that acquisition costs are different from ownership costs, which include expenses incurred during the ownership of the vehicle, like maintenance, repairs, and fuel costs.

Learn more about acquisition costs here:

https://brainly.com/question/15725762

#SPJ11

1.7.2

Explain any TWO reasons why the team experienced the storming stage

Answers

Hi, you've asked an incomplete question. However, here's a brief about the storming stage.

Explanation:

The Storming stage as the name implies refers to a phase where there are storm-like issues or disputes among team members.

Common reasons why a team experiences the storming stage includes:

when there is conflict among team members, because of differences in how to go about work.when some begin to question the authority of others in the team. For example, the team leader's authority may be questioned by others. failure to accept all of the team's goals.What is Helena Fogarty doing to build brand equity for Mi Ola?

Answers

Answer:

she is using social media to build brand equity.

Explanation:

Helena Fogarty is using social media as an advertising resource due to the fact that more and more people will see it since social media is a big platform. she is also using this to her advantage as she can get feed back in order to make adjustments to her products.Helena Fogarty is using social media to build brand equity for Mi Ola.

Brand equity simply means the value premium that a business or company generates from a product with a recognizable name.

It should be noted that brand equity is also known as the brand worth of a company. It's the social value of a brand name. Helena Fogarty is using social media to build brand equity for Mi Ola. One can advertise its product on social media and create awareness. This will help improve sales and revenue.

Read related link on:

https://brainly.com/question/15555529

“ you should shop for the best place to open a checking account as carefully as you shop for the Best Buy in any product or service.“ give two reasons to support the statement

Answers

The two things that are considered while shopping is the least price for the same goods and services and the good quality within a price range.

What is checking account?A person's account number, which is the second set of numbers from the left and ranges in length from 9 to 12 digits, may be found at the bottom of the checks. This number informs the bank which checking account to debit for the money.

A checking account is an account that permits both deposits and withdrawals of funds. A check, which is essentially a paper with instructions to the bank on how and, more crucially, to whom the money should be taken, was the traditional way to make a withdrawal.

Thus, shopping is the least price for the same goods and services.

For more information about checking account, click here:

https://brainly.com/question/11610905

#SPJ1

how solution a capital outflow occurs (more money goes overseas)?

Answers

A capital outflow issue can be resolved by identifying the cause of the capital outflow, implementing monetary policy measures, improving economic conditions, addressing political instability, and implementing capital controls.

1. Identify the cause of the capital outflow: Determine the reasons why investors are moving their capital overseas, such as high interest rates, low economic growth, or political instability.

2. Implement monetary policy measures: Central banks can use monetary policy tools like lowering interest rates or purchasing domestic bonds to make domestic investments more attractive and reduce capital outflows.

3. Improve economic conditions: Governments can introduce policies aimed at stimulating economic growth and creating a more favorable investment environment, such as investing in infrastructure or offering tax incentives.

4. Address political instability: Governments should work to resolve political issues and create a more stable political environment to encourage investors to keep their capital within the country.

5. Implement capital controls: As a last resort, governments can introduce capital controls to limit the amount of capital that can be moved overseas. However, this measure can have negative consequences and may discourage foreign investment.

By taking these steps, you can address the issue of capital outflows and help retain more money within the domestic economy.

To learn more about capital, visit: https://brainly.com/question/28042295

#SPJ11

One of the six risks that we consider priority for producers to manage is?

Answers

One of the six risks that we consider a priority for producers to manage is market risk. Market risk refers to the potential for financial loss due to changes in market conditions or factors that affect the supply and demand of a product or service.

Producers face market risk because their success relies on the demand for their products or services in the market. Fluctuations in consumer preferences, competition, economic conditions, and technological advancements can all impact market demand and ultimately affect a producer's profitability.To manage market risk, producers need to constantly monitor and analyze market trends, consumer behavior, and competitive landscape.

They should also diversify their product offerings or customer base to reduce reliance on a single market. Developing effective marketing strategies and staying ahead of market changes can also help producers mitigate market risk. Market risk is one of the key risks that producers should prioritize managing. By closely monitoring market conditions, diversifying their product offerings, and staying proactive in their approach, producers can mitigate the potential financial losses associated with market fluctuations.

To know more about Market risk visit:

https://brainly.com/question/33015902

#SPJ11

The Accounting System The major purpose of the accounting system is to help managers make decisions, so managers need to understand how the accounting system works and how accounting information within that system is categorized Accounting information is categorized as Inputs, processing, or outputs. This activity is important because organizations use different types of accounting information to make business decisions. They also report this information to interested stakeholders The goal of this activity is to differentiate among these different types of accounting information. Instructions: Accounting information is categorized as inputs, processing or outputs. Select the hppropriate category for each type of accounting information listed 1. Sales Documents Click to select 2. Journal Entries Entries Inputs 3. Payroll Records Click to select) 4 Travel Records Cack to select 5. Income Statement Click to select) 6. Posting to Accounts The goal of this activity is to differentiate among these different types of accounting information Instructions: Accounting information is categorized as inputs, processing, or outputs. Select the appropriate category for each type or accounting information listed 1 Sales Documents Click to select) 2. Journal Entries Inputs 3. Payroll Records Click to select 4. Travel Records Click to select 5. Income Statement Click to select) 6. Posting to Accounts (Click to select) 7 Balance Sheet l(click to select) 8. Summarizing Accounts (Click to select) 9 Statement of Cash Flows Click to select)

Answers

The categorization of the accounting information is 1. Sales Documents - Inputs 2. Journal Entries - Processing 3. Payroll Records - Inputs 4. Travel Records - Inputs 5. Income Statement - Output 6. Posting to Accounts - Processing 7. Balance Sheet - Output 8. Summarizing Accounts - Processing 9. Statement of Cash Flows - Output

Inputs refer to the information that is collected or received by the accounting system. This includes sales documents, payroll records, and travel records, as they provide data that will be used in the accounting process.

Processing refers to the activities performed on the input information to transform it into useful outputs. Journal entries and posting to accounts fall under this category, as they involve recording and organizing the financial transactions.

Outputs are the results or reports generated by the accounting system, which provide information to support decision-making or reporting to stakeholders.

The income statement, balance sheet, statement of cash flows, and summarizing accounts all fall under this category. They present financial information in a structured format to help managers and stakeholders understand the financial performance and position of the organization.

For more such questions on accounting,click on

https://brainly.com/question/26690519

#SPJ8

why does the amount of interest you owe decrease every month?

Answers

Answer:

The outstanding principle is less

Explanation:

Answer:the overall balance decreases

Explanation: because you have to pay less interest over time because you are paying money to them

true or false? the amount of assets on your balance sheet should be equal to the amount of liabilities on your balance sheet.

Answers

The statement "The amount of assets on your balance sheet should be equal to the amount of liabilities on your balance sheet." is true.

Give a brief account on liabilities on balance sheet.Any sum of money that a business owes to third parties is referred to as a liability, including rent, utilities, salaries, interest on bonds issued to creditors, and bills to suppliers that must be paid. Current obligations are those that have a one-year due date and are listed in that order. On the other hand, long-term obligations are payable whenever a year has passed.

Accounts for current liabilities could contain:

The percentage of a long-term loan that is due within the next year is referred to as the "current portion of long-term debt." One year is a present liability and nine years are a long-term liability, for instance, if a corporation has a debt for its warehouse that has 10 years left to pay it off.A past-due obligation, such as the failure to pay property taxes on time, may include cumulative interest that is due, which is known as interest payable.Wages payable refers to salaries, wages, and benefits that are owed to employees, frequently for the most recent pay period.Money received by a customer prior to the provision of a service or the delivery of a product is known as a customer prepayment. The business is required to either (a) deliver the requested good or service or (b) reimburse the client.Dividends that have been authorized for payment but have not yet been distributed are referred to as dividends payable.Earned and unearned premiums are similar to prepayments in that a corporation receives money up advance but has not yet carried out their side of the bargain and is obligated to reimburse unearned funds if they don't.To know more about, liabilities, visit :

https://brainly.com/question/18484315

#SPJ4

The inflation rate is decreasing and unemployment is rising. The economy is likely in

contraction

deficit

Revenue equal to spending

Peak production

Answers

The inflation rate is decreasing and unemployment is rising. The economy is likely in contraction.

A decreasing inflation rate and rising unemployment typically indicate that the economy is slowing down or contracting. Inflation occurs when there is excess demand in the economy, which can lead to rising prices and reduced purchasing power. As the inflation rate decreases, it suggests that demand is slowing down and prices are stabilizing or even decreasing. Rising unemployment is another sign of an economic contraction, as businesses may be cutting back on production and employment in response to weaker demand.

A deficit or revenue equal to spending refer to the government's budgetary position, which is not necessarily related to the overall state of the economy. Peak production, on the other hand, refers to the point at which a business or industry is producing at its maximum capacity, which is not necessarily related to the overall state of the economy either.

learn more about inflation here:

https://brainly.com/question/30112292

#SPJ4

When a marketing researcher conducts and uses neuromarketing studies to make tactical decisions about a product, she is using.

Answers

A marketing researcher uses primary data to conduct neuromarketing studies and use the results to make tactical judgments regarding a product.

Primary and secondary data: what are they?The initial information you collected from your research efforts is known as primary data. Your primary data can be used to create secondary data. The line separating primary data from secondary data is frequently hazy. Both sorts of study data will be gathered and generated during the research process.

Why is it considered secondary data?Secondary data is information obtained by a user other than the primary user. Secondary data in social science is frequently acquired from census data, data obtained by government organizations, business records, and data originally gathered for other study objectives.

To know more about neuromarketing visit:

https://brainly.com/question/30173044

#SPJ1

Bonds are not always categorized as group of answer choices callable or convertible. term or serial. secured or unsecured. secured or debenture.

Answers

It should be noted that Bonds are not always categorized as secured or unsecured.

What is a bond?A bond serves as a fixed-income instrument which is inform of a loan that is given a borrower by investor.

Therefore, bonds represents a loan, however it cannot be categorized as secured or unsecured.

Learn more about bonds at:

https://brainly.com/question/25596583

#SPJ1

What are some interview tips?

Answers

Answer:

give em a stong hand shake :)

Explanation:

In a statement of cash flows, proceeds from issuing equity instruments should be classified as cash inflows from.

Answers

The proceeds from issuing equity instruments should be listed as cash inflows from lending activities in a statement of cash flows.

Where does equity go on cash flow statement?

The income statement, balance sheet, and cash flow statement are the three main financial reports that businesses consistently produce. The cash flow statement is also referred to as the statement of cash flows. The cash flow statement is useful since most organisations utilising accrual basis accounting find it challenging to keep track of their cash inflows and expenditures.

To know more about cash flow statement click on the link below:

https://brainly.com/question/735261

#SPJ4

Harvey rents his second home. During the year, Harvey reported a net loss of $50,500 from the rental. If Harvey is an active participant in the rental and his AGI is $89,600, how much of the loss can he deduct against ordinary income for the year

Answers

Harvey can deduct up to $25,000 of the rental loss against ordinary income for the year.The $50,500 rental loss must be reduced by any passive activity losses (PALs) that Harvey may have.

If Harvey does not have any PALs, he can deduct the full $25,000 rental loss against his ordinary income. However, if he has PALs, the deduction will be reduced by the amount of the PALs.In this case, we are not given any information about PALs, so we can assume that Harvey does not have any. Since his AGI is $89,600, which is below the $100,000 threshold, he can deduct up to the full $25,000 against ordinary income. Therefore, Harvey can deduct $25,000 of the $50,500 rental loss against his ordinary income for the year, and the remaining $25,500 can be carried forward to future years.

Learn more about income here

https://brainly.com/question/30157678

#SPJ11

on+july+9,+mifflin+company+receives+an+$7,200,+90-day,+6%+note+from+customer+payton+summers+to+replace+an+account+receivable.+what+entry+should+be+made+by+mifflin

Answers

The entry to make on the maturity date, assuming the maker pays in full, would be without any adjusting entries is e. Debit Cash $7,200; credit Notes Receivable $7,200.

This entry records the payment of the note in full, with no adjustment or interest revenue.

How to determine the entry to make on the maturity date?To find the entry, we take into account the principal amount of the note and any accrued interest.

Given:

Principal amount = $7,200,

Note = 90-day

Interest = 6% rate.

We shall use this formula to calculate interest on a note:

Interest = Principal × Interest Rate × Time

Let's compute:

Interest = $7,200 × 0.06 × (90/360)

Interest = $7,200 × 0.06 × 0.25

Interest = $108

Since no adjusting entries have been made, the interest has not been recorded separately. So, only the principal amount is to be considered here.

The entry on the maturity date would be: Debit Cash $7,200 (which reflects the amount received)

Credit Notes Receivable $7,200 (to remove the outstanding note)

Learn more about notes receivable at brainly.com/question/26965875

#SPJ1

Question completion:

On July 9, Mifflin Company receives a $7,200, 90-day, 6% note from customer Payton Summers as payment on account. What entry should be made on maturity date assuming the maker pays in full, and no adjusting entries have been made related to the note? (Use 360 days a year)

a. Debit Cash $7,282; credit Interest Revenue $82; credit Notes Receivable $7,200. O

b. Debit Cash $7,272; credit Interest Revenue $72; credit Notes Receivable $7,200.

c. Debit Cash $7,308; credit Interest Revenue $108; credit Notes Receivable $7,200.

d. Debit Notes Receivable $7,200; debit Interest Receivable $108; credit Sales $7,308.

e. Debit Cash $7,200; credit Notes Receivable $7,200.

Which of the following describes a conflict which happens between a supervisor and a subordinate?

O Intrapersonal conflict

Group conflict

O Intergroup conflict

O Interpersonal conflict

Answers

A conflict between a supervisor and a subordinate can be described as Interpersonal conflict.

What is interpersonal conflict?Interpersonal conflict refers to conflict whereby there are at least two people involved. This means that interpersonal conflict refer to issues that a person has with another person, or group of people.

When there is a conflict between a supervisor and a subordinate, these are two different people which means that it is therefore an interpersonal conflict. Intrapersonal conflict on the other hand, refers to when a person has a conflict within themselves about how they should take certain decisions.

Find out more on interpersonal conflict at https://brainly.com/question/27608687

#SPJ1

According to Career Horizons,

of jobs are not advertised.

O 90 to 100 percent

O 30 to 40 percent

O 10 to 20 percent

O 70 to 80 percent

Answers

Answer:

70 to 80 percent

Explanation:

According to various online sources, including Career Horizons, about 70 to 80 percent of jobs are not published. It means that these vacancies are not publicly advertised. The only way of knowing that the vacancies exist is through networking.

Getting a job requires one to be a member of a professional network. It is the only sure way of getting to know about the 70 to 80 percent of unadvertised jobs.