The seller is to performance obligation as the buyer is to

A) the transfer of control over goods or services.

B) the obligation to pay the transaction price.

C) an enforceable right to receive consideration.

D) the enforcement of the contract.

Answers

The Correct option is A) the transfer of control over goods or services.

In accounting, a performance obligation is an obligation that a company has to transfer goods or services to a customer. When a seller fulfills its performance obligation, it transfers control of the goods or services to the buyer.

Therefore, the answer is A) the transfer of control over goods or services. In contrast, the buyer's obligation is typically to pay the transaction price, which is the amount agreed upon in the contract between the buyer and the seller. This is not the same as a performance obligation. While the buyer may have an enforceable right to receive consideration, this is not necessarily the same as their obligation in the transaction. The enforcement of the contract is also not the same as the buyer's obligation.

To know more about goods or services visit:

brainly.com/question/30709777

#SPJ11

Related Questions

Kim is on a crew that sets up the equipment for a very popular musician. Before the concerts, she sets up lights, microphones, sound equipment, and video screens above the stage. After the concerts, she takes down the equipment Her job is best described as Sylvia sets up, runs, and maintains the equipment for a radio station. Her job is best described as Kenneth works in a small studio using technical equipment and computers. He edits television commercials. His job is best described as Jose works in a music studio operating the equipment for musicians to record their music before selling it to the public. He adjusts the equipment so the recordings have good, clear sound. His job is best described as

Answers

Answer:

B,C,C,A

Explanation:i did it on edge 2021

His job is best described as an Audio and video equipment technician. They manage the electrical machinery used to produce radio and television shows, concerts, sound recordings, and movies.

What does an audio technician do?Audio technicians sometimes referred to as sound technicians, set up sound and recording equipment, test it out, and make modifications to help with recordings and sound production. They typically work in radio, television, film, concert halls, and recording studios.

Technicians that work with audio and video equipment operate devices including mixing boards, microphones, and video screens. They capture conferences, sporting events, concerts, and meetings.

Establish, run, and maintain the electronic machinery required to collect, edit, and broadcast audio and video for radio or television programs. To control sound volume, signal strength, and signal clarity in incoming and outgoing broadcast signals, make appropriate adjustments.

Learn more about an audio technician here:

https://brainly.com/question/20114661

#SPJ5

If a product is considered a bundle of attributes, what would be two attributes of a tube of toothpaste

Answers

If a product is considered a bundle of attributes, the two attributes of a tube of toothpaste will be: Weighs 10 grams and is Water resistant.

A product is considered a bundle of attributes that could be tangible or not.

In describing the product attributes of a toothpaste tube, we could reference the fact that it is lightweight and is resistant to water.

These attributes are the features that make the product attractive to consumers.

Learn more about product attributes here:

https://brainly.com/question/14563539

Answer: Flavor of toothpaste & Size of container

Explanation:

The correct answer for smartbook.

GlowWell is a paint manufacturing company, It has formulations for two new brands of paint, Premium Plus and Ultra Hide. There are none of these in stock so they must be manufactured from scratch. A new order has come in and these two products has to be manufactured in 8 hrs. The two main ingredients in these paints are pigments and resins. The Premium brand requires 5mg of pigments and 0.2 mg of resins in each can of paint. The Ultra Hide brand requires 4mg of pigments and 0.1 mg of resins in each can of paint. These formulations stipulate that pigments must be no more than 100mg and resins must be no less than 3mg per can of paint. GlowWell requires 12 minutes to manufacture a can of Premium Plus and 48 minutes for a can of Ultra Hide. The company needs to know the combination of paints to maximise its revenue. GlowWell will sell a can of Premium Plus for $10 and a can of Ultra Hide for $15.

Use X1 and X2 to define the variables indicating which variable is X1 and X2

Derive GlowWell’s Objective Function in terms of X1 and X2 What are the Contraints under which GlowWell must operate Graphically illustrate the Feasible Region 4 Marks

State the coordinates of the corner points e.g A(2,7), B(12,5) Determine optimal solution Determine the revenue at the optimal solution

Answers

To solve the given problem, let's define the variables:

X1: Number of cans of Premium Plus paint

X2: Number of cans of Ultra Hide paint

Objective Function:

The objective is to maximize the revenue. The revenue is determined by the number of cans sold for each type of paint and their respective prices. The objective function can be expressed as:

Revenue = 10X1 + 15X2

Constraints:

Pigments constraint: The total amount of pigments used in the cans of paint must not exceed the available amount (100mg). The constraint can be written as:

5X1 + 4X2 ≤ 100

Resins constraint: The total amount of resins used in the cans of paint must be at least the required amount (3mg). The constraint can be written as:

0.2X1 + 0.1X2 ≥ 3

Manufacturing time constraint: The total manufacturing time should not exceed the available 8 hours (480 minutes). The constraint can be written as:

12X1 + 48X2 ≤ 480

Non-negativity constraint: The number of cans cannot be negative. Both X1 and X2 should be greater than or equal to zero.

X1 ≥ 0

X2 ≥ 0

Graphical Representation:

To illustrate the feasible region, plot the constraints on a graph and shade the region that satisfies all the constraints.

Corner Points:

Find the coordinates of the intersection points of the constraints to determine the corner points of the feasible region.

Corner Points:

A: (0, 30)

B: (20, 8)

C: (40, 0)

D: (33.75, 4.25)

E: (10, 0)

Optimal Solution:

To find the optimal solution, calculate the objective function value at each corner point and select the point that maximizes the revenue.

Objective Function Value at each corner point:

A: Revenue = 10(0) + 15(30) = $450

B: Revenue = 10(20) + 15(8) = $280

C: Revenue = 10(40) + 15(0) = $400

D: Revenue = 10(33.75) + 15(4.25) = $453.75

E: Revenue = 10(10) + 15(0) = $100

The optimal solution is at point D: (33.75, 4.25), which maximizes the revenue.

Revenue at the optimal solution: $453.75

To know more about GlowWell

#SPJ11

Davidson company has sales of $100,000, variable cost of goods sold of $40,000, variable selling expenses of $15,000, variable administrative expenses of $5,000, fixed selling expenses of $7,000, and fixed administrative expenses of $9,000. What is davidson’s contribution margin?.

Answers

Davidson’s contribution margin for the sale of goods would be : $40,000

What is contribution margin?Contribution margin is a business' sales revenue less its variable costs. The resulting contribution margin can be used to cover its fixed.

Contribution margin is computed as:

= Sales - Total variable cost(Variable cost of goods sold + Variable selling expenses + Variable administrative expenses)

= $100,000 - ($40,000 + $15,000 + $5,000)

= $100,000 - $60,000

= $40,000

Therefore, Davidson’s contribution margin for the sale of goods would be $40,000

Learn more about contribution margin here : https://brainly.com/question/24309427

Question 4 If you were tasked to estimate a supply response model of a commodity like tobacco, in Zambia, explain how you can apply the Nerlovian model as a framework for analysis and also provide the justification for choosing this model and nature of variables to be used. [20]

Answers

The Nerlovian model is applied to estimate the supply response of tobacco in Zambia by considering variables such as price, input costs, and time.

To estimate the supply response of tobacco in Zambia, the Nerlovian model can serve as a suitable framework for analysis. This model considers the relationship between the quantity supplied of tobacco and various factors that influence supply, such as price, input costs, and time. By utilizing this model, researchers can assess how changes in these variables affect the supply of tobacco in the market.

The Nerlovian model is a valid choice for this analysis because it allows for the examination of both short-run and long-run supply responses. It captures the dynamics of supply adjustments over time, taking into account the time required for producers to respond to changes in market conditions.

The nature of variables to be used in the model would typically include the quantity supplied of tobacco, the price of tobacco (both historical and current), and relevant input costs such as labor, fertilizers, and other production expenses. Time-related variables, such as the year or time period of observation, are also included to capture temporal changes in supply. By applying the Nerlovian model and selecting appropriate variables, researchers can gain insights into the supply response of tobacco in Zambia and understand the factors influencing its production levels.

Learn more about long-run supply here:

https://brainly.com/question/32540711

#SPJ11

7. If you make $35,000.00 a year and your company buys accidental life insurance for you that covers your life with 3x coverage, how much would your beneficiary receive if you accidentally die?

Answers

Answer:

$105,000.00

Explanation:

3x 35,000.00= 105,000.00

Which best describes the pathways of these four individuals?

1. Tammy and Alcott are in the Professional Support Services pathway, Vania is in the Administration and Administrative Support pathway, and Stefan is in the Teaching and Training pathway.

2. Tammy and Stefan are in the Teaching and Training pathway, Vania is in the Professional Support Services pathway, and Alcott is in the Administration and Administrative Support pathway.

3. Tammy and Vania are in the Administration and Administrative Support pathway, Alcott is in the Teaching and Training pathway, and Stefan is in the Professional Support Services pathway.

4. Tammy is in the Teaching and Training pathway, Vania and Alcott are in the Administration and Administrative Support pathway, and Stefan is in the Professional Support Services pathway.

Answers

Answer:

i think its A

Explanation:

read

Although claimed to be seen by many, the Loch Ness Monster's existence has not been..............

a. culminated

b. complicated

c. sophisticated

d. authenticated

Answers

The relationship between quantity supplied and price is ________ and the relationship between quantity demanded and price is ________. Group of answer choices

Answers

Answer:

direct, inverse

Explanation:

Hope it helps

china has been accused of prohibiting u.s. companies that offer cloud computing from offering their services in china. which argument best explains this?

Answers

China is most probably doing that to protect local companies that are involved in the cloud computing.

Countries have been known to try to help local companies that are engaged in certain services by prohibiting foreign companies that are engaged in those same services from operating locally.

This is done to allow the local companies to be the only ones offering the service which would allow them to grow without facing foreign competition.

Other ways countries do this include:

By introducing tariffs By introducing import quotasIn conclusion, China was most likely protecting companies in China that offer cloud computing from competition from U.S. companies which offer the same thing.

Find out more at https://brainly.com/question/14013942.

You learned about charity as one of the tax deductions that reduce the taxable income of consumers, producers, and businesses. Identify other personal and societal benefits of charity giving.

Answers

Answer:

Societally speaking, charity giving improves the community at large. Organisations such as homes for the less privileged, foster care homes, motherless babies homes, who are trying hard to make ends meet are usually relieved when reasonable charity donations flow in.

The community is better off with it more charitable givers than less.

At the personal level, people find fulfilment when they give.

It is also theorised that giving for an individual may be stimulated by any of the factors in the first three levels (descending order) of Abraham Maslows Hierarchy of needs.

The factors are:

Self Actualization (becoming one's highest self)the Satisfaction of self-esteem needs. Many people give in order to feel that their lives are meaningful find happiness in giving. They usually find it.Others give because due to the need to belong and be acceptedCheers!

Answer:

-Charity giving improves your sense of well being. When you donate to charity, you feel good about yourself. The fact that you spent part of your income to help people who are less privileged than you helps improve your self-worth

-It has physical and social benefits too. Once you make monetary donations, you may feel the urge to invest your time and effort into helping these charities. You will consequently meet people who share your beliefs and drive. You can thus build your social circle and network with others. This can help you in your personal and professional life.

-It can improve spiritual life. If it is part of your spiritual conviction to donate to charity, then charitable giving will strengthen your spiritual life. Spirituality can help bring inner peace and improve the quality of your life.

-It encourages you to stay informed about social injustices. When you want to donate to charity, you are likely to research causes to see which one touches your heart the most. This research will enlighten you about social injustices prevalent in the world. You will be better informed and look for additional ways to spend your money, time, and effort on these causes.

Explanation: EDMENTUM PLATO SAMPLE ANSWER hope it helps :))

If the cost of production decreases for Tesla’s cars, what effect will this have on consumers who want to buy one???

Answers

Answer:

The consumers will pay more.

Explanation:

Should the production cost increase, the price of Tesla cars is also likely to increase. Typically, producers are likely to pass the increased costs to the cars' final price. The market price for the cars will go up, meaning customers will pay more for the cars.

began operations in 2021 that year the company reported pretax accounting income of 100 million which included tje amounts

Answers

It appears that the company started its operations in 2021 and reported a pretax accounting income of 100 million during that year. It's important to note that pretax accounting income refers to the amount of income that a company generates before taking into account any tax deductions or credits.

It's unclear from the information provided what specific amounts were included in the pretax accounting income of 100 million. However, given that the terms "operation" and "accounting" are mentioned, it's safe to assume that the company's financial performance and profitability were a focus during its first year of operation.

Overall, this information suggests that the company had a strong start to its operations in 2021 and was able to generate significant income, which is a positive sign for its future growth and success.

Learn more about pretax here:

https://brainly.com/question/14917625

#SPJ11

A car rental agency uses 96 boxes of staples a year. The boxes cost $4 each. It costs $10 to order staples, and carrying costs are $0. 80 per box on an annual basis.

Answers

Every year, a car rental service utilizes 96 boxes of staples. Each of the boxes costs $4. Staples cost $10 to order, and annual carrying expenses come out to $0.80 per box. = $55.42

What types of orders exist?Understanding how any order type differs is essential since they could have quite different outcomes. Here, we'll focus on the market ", limit order, and halt order and discuss how they differ and when to consider each.

Briefing

According to the scenario, the computation of the given data are as follows:

Boxes use = 96 boxes

Cost = $4 per box

Staple cost = $20

Carrying cost = $0.80

So, we can calculate the annual cost of ordering and carrying by using following formula:

Annual cost = (EOQ ÷ 2) × Carrying cost + (Boxes use ÷ EOQ) × Staple cost

Where, EOQ = ( 2 × 96 × 20 ÷ 0.80)^1/2 = 69.28

So, by putting the value, we get

Annual cost = ( 69.28 ÷ 2) × $0.80 + ( 96 ÷ 69.28) × $20

= $27.71 + $27.71

= $55.42

To know more about order visit:

https://brainly.com/question/15904941

#SPJ4

if the interest rate is 5 percent and cash flows are $3,000 at the end of year one and $5,000 at the end of year two, then the present value of these cash flows is

Answers

The present value of these cash flows is $7392.29 if the interest rate is 5% and they total $3,000 and $5,000 at the end of years one and two, respectively.

What exactly is cash flow?The net amount of cash that a company receives and expends over the course of a given period of time is known as cash flow. For a firm to continue operating, a positive cash flow must be maintained. Positive cash flows are also necessary to produce value for investors.

Investors in particular prefer to see growing cash flows even after capital expenditures have been paid (which is known as free cash flow). Typically, a month, quarter, or year is used as the normal reporting period over which cash flow is monitored.

Calculation:

The values used in the questions are listed below.

5% interest rate

Initial cash flow is $3000.

Two-year cash flow equals $5,000

Now, using the aforementioned figures, we must determine the present value of these cash flows.

The present value is determined as follows:

Cash Flow = Cash Inflow / (1 + i)^N

\(\frac{3000}{(1+0.05)^{1} } + \frac{5000}{(1+0.05)^{2} }\) is the present value.

Value Today = $7,392.29

Learn more about cash flows with the help of the given link:

brainly.com/question/29768594

#SPJ4

Chef’s apron gas money food movies

Culinary knives car insurance electric bill dining out

Which label belongs over column D

Answers

Answer:I believe the answer is D. "want"

Explanation:

Answer:

cost

Explanation:

Who’s the intended audience in news articles

Answers

Newspaper readers have typically been more educated, wealthy, and older than non-newspaper audiences.

Who is a research's primary target audience?

The people who read your work are referred to as the "audience." A term paper or thesis, for example, may be produced for a professor or committee of professors. More frequently, a paper is produced for peers in your field, for others who pursue similar academic interests.

Who are the media's intended consumers or target audiences?A group of people who you've identified and wish to appeal to is what we refer to as a social networking target audience. Based on factors like age, occupation, income level, degree of education, geography, or behavior, for example. your target market for social media

To know more about audiences visit:

brainly.com/question/1802560?

#SPJ1

An ordinary annuity that owns 77% compounded monthly as a current balance of $500,000. The owner of the account is about to retire and has to decide how much to withdraw from the account each month. Find the number of withdrawals under ach of the following options A 35000 monthly) 84000 monthly C)53000 monthly CD A Select the correct the below, and, if necessary in the answer box to complete your choice ОА The total number of withdrawals of 58000 will be The withdrawal of 35000 continue forever

Answers

Option A would allow for 105 withdrawals, option B is not possible, and option C would allow for 125 withdrawals.

We can use the formula for the present value of an annuity to calculate the amount that can be withdrawals each month, given the current balance of the account and the interest rate:

PV = PMT x (1 - (1 + r)^(-n)) / rwhere:

PV = present value (the current balance of the account)

PMT = the amount to be withdrawals each month

r = the monthly interest rate (77% / 12 = 0.0642)

n = the number of withdrawals

We can solve for n using the above formula for each of the three withdrawal options:

A. PMT = $35,000

$500,000 = $35,000 x (1 - (1 + 0.0642)^(-n)) / 0.0642n = 105 monthsTherefore, the total number of withdrawals for option A would be 105.

B. PMT = $84,000

$500,000 = $84,000 x (1 - (1 + 0.0642)^(-n)) / 0.0642This equation has no solution, because the withdrawal amount is greater than the interest earned on the account. Therefore, option B is not possible.

C. PMT = $53,000

$500,000 = $53,000 x (1 - (1 + 0.0642)^(-n)) / 0.0642n = 125 monthsTherefore, the total number of withdrawals for option C would be 125.

Based on the calculations above, option A would allow for 105 withdrawals, option B is not possible, and option C would allow for 125 withdrawals.

Learn more about withdrawals: brainly.com/question/28463677

#SPJ11

How does the price of oil impact the price of food?

Answers

Answer:

The price of Oil effect the price of food because it all works together in the economy/system

Explanation:

What is the term that describes what a business has to pay to correct defective products?

Answers

Answer:

Cost of quality

Explanation:

Apevx

Answer:

cost of quality

Explanation:

A t-shirt shop has been testing different prices for their #2 selling t-shirt. The data showing how many they sold at each price on different days is shown in the table below. Use quadratic regression to model the data, and then calculate how many shirts they should expect to sell if the price is $8.99 each. Use that number to calculate about how much profit they would make if the shirts cost $4.73 each to produce.

Answers

Based on the quadratic regression model, the t-shirt shop would expect to sell approximately 52 shirts if the price is set at $8.99 each. Assuming the cost of producing each shirt is $4.73, the shop would make an estimated profit of approximately $183.96.

To model the data using quadratic regression, we will use the given data points of prices and corresponding quantities sold. The data points are as follows:

Price ($): 6.99, 7.99, 8.99, 9.99, 10.99

Quantity Sold: 70, 60, 50, 40, 30

Performing a quadratic regression analysis, we can find the quadratic equation that best fits the data points. The equation will be in the form of:

Quantity Sold = a * Price^2 + b * Price + c

By performing the regression analysis, we can find the coefficients a, b, and c that provide the best fit for the data. Once we have the equation, we can substitute the price of $8.99 to estimate the quantity sold.

After calculating the estimated quantity sold, we can then calculate the estimated profit. The profit is calculated by multiplying the quantity sold by the profit per shirt, which is the difference between the price and the cost of production.

Using the calculated quantity sold and the given cost of producing each shirt, we can determine the estimated profit.

Based on the quadratic regression model, the t-shirt shop can expect to sell approximately 52 shirts if the price is set at $8.99 each. With a production cost of $4.73 per shirt, the estimated profit would be approximately $183.96. This analysis allows the t-shirt shop to make informed decisions regarding pricing and profitability, enabling them to optimize their sales strategy and maximize their profits.

To know more about profit ,visit:

https://brainly.com/question/1078746

#SPJ11

n a region that must reduce emissions, three polluters currently emit 30 units of emissions together. The three firms have the following marginal control cost functions that describe how marginal costs vary with the amount of emissions each firm reduces.

Suppose this region needs to reduce emissions by 18 units and plans to do it using a form of cap-and-trade after grandfathering total allowances.

(a) How many emission allowances will the control authority grandfather (i.e., give for free)?

(b) Suppose the authority grandfathers an equal number of allowances to each firm. In other words,

each firm should reduce the equal amount of emission out of 18 total reduced units. What is the

total control cost each firm needs to pay for this equal emission reduction?

(c) Assuming no market power and that demand equals supply, the companies can trade their

emission allowances in a market for the emission permit. What price would be paid for those

allowances?

(d) How many allowances would each firm be expected to buy or sell?

(e) If the control authority decided to use an emission tax rather than cap-and-trade, what tax rate

would achieve the 18-unit reduction cost-effectively? Why?

Answers

(a) To determine the number of emission allowances that will be grandfathered, we need to find the total amount of emissions that the three firms need to reduce. Since the region needs to reduce emissions by 18 units, and the three firms currently emit 30 units together, the total amount they need to reduce is 30 - 18 = 12 units.

(b) If the authority grandfathers an equal number of allowances to each firm, then each firm should reduce emissions by 12/3 = 4 units. To find the total control cost each firm needs to pay for this equal emission reduction, we need to calculate the sum of their marginal control costs for reducing 4 units of emissions.

(c) Since there is no market power and demand equals supply, the price of the emission allowances in the market would be determined by the marginal cost of reducing emissions. It would be the highest marginal control cost among the three firms, as that would be the price at which they are willing to sell their allowances.

(d) Each firm would be expected to buy or sell allowances based on their marginal control cost. If their marginal control cost is lower than the market price, they would sell allowances, and if it is higher, they would buy allowances.

(e) To determine the tax rate that would achieve the 18-unit reduction cost-effectively, we need to consider the marginal control costs of the firms. The tax rate should be set equal to the highest marginal control cost among the firms, as that would incentivize them to reduce emissions in the most cost-effective manner.

In summary,

(a) The authority will grandfather 12 units of emission allowances.

(b) The total control cost each firm needs to pay for equal emission reduction would be the sum of their marginal control costs for reducing 4 units of emissions.

(c) The price paid for the allowances would be the highest marginal control cost among the firms.

(d) Each firm would buy or sell allowances based on their marginal control cost.

(e) The tax rate that would achieve the 18-unit reduction cost-effectively should be set equal to the highest marginal control cost among the firms.

Learn more about the emission

https://brainly.com/question/1301348

#SPJ11

A credit card company advertises an APR of 14.7%, compounded daily. What

is the effective interest rate? Round your answer to two decimal places.

Answers

Answer:

16%

Explanation:

Effective interest rate = (1 + i/m)^m - 1

= (1 + 0.147/365)^365 - 1

= 0.1583

= 0.16 = 16%

disclaimers and confidentiality notices are a common feature of business emails. which of the following is correct?

Answers

Disclaimers and confidentiality notices are a common feature business emails, and the following statement is correct Confidentiality notices.

Included in business emails to remind recipients that the content of the content. Disclaimers, on the other hand, are statements that aim to limit the sender's liability and clarify the purpose of the email. They typically cover aspects such as the accuracy of information, legal advice, viruses, and the sender's rights. Overall, both disclaimers and confidentiality notices are important components of business emails, providing legal protection and setting clear expectations regarding the email's content

learn more about emails here:

https://brainly.com/question/30510960

#SPJ11

On December 1, 2021, Carlos entered into a lease on a building for use in his business for $1,000 per month. Under the lease terms, Carlos pays 18 months’ rent ($18,000) in advance on December 1. How much can Carlos deduct for rent in 2021?

a. $12,000

b. $18,000

c. $1,000

d. $13,000

Answers

The amount that Carlos can deduct for rent in the year 2021, based on his annual rent is c.$1,000.

Rent in 2021When recording rent, you can only record it for the period that the financial statement is for.

The rent given is for 18 months from December 2021 which means that it will be for only a single month in December.

The rent will therefore be a rental amount for a month:

= Rental amount / Number of months

= $18,000 / 18

= $1,000

In conclusion, option C is correct.

Find out more on prepaid rent at https://brainly.com/question/1079277.

Hughes Company has a credit balance of $5,000 in its Allowance for Doubtful Accounts before any adjustments are made at the end of the year. Based on review and aging of its accounts receivable at the end of the year, Hughes estimates that $60,000 of its receivables are uncollectible. The amount of bad debts expense which should be reported for the year is: a. $5,000. B. $55,000. C. $60,000. D. $65,000.

Answers

Answer:

B . $55,000

Explanation:.

Calculation for the amount of bad debts expense which should be reported for the year.

Using this formula

Bad Debts=Uncollectible receivables-Allowance for Doubtful Accounts

Let plug in the formula

Bad Debts=$60,000-$5,000

Bad Debts=$55,000

The amount of bad debts expense which should be reported for the year is:$55,000

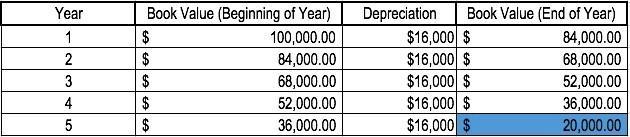

Use the sum-of-year depreciation method to calculate the depreciation for the

following scenario. Company XYZ bought a new machine for $100,000 and

expects the machine will last for 10 years.

Answers

Answer:

20%

Explanation:

How to Calculate Straight Line Depreciation

The straight line calculation steps are:

Determine the cost of the asset.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

Determine the useful life of the asset.

Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

Straight Line Example

Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years.

The straight line depreciation for the machine would be calculated as follows:

Cost of the asset: $100,000

Cost of the asset – Estimated salvage value: $100,000 – $20,000 = $80,000 total depreciable cost

Useful life of the asset: 5 years

Divide step (2) by step (3): $80,000 / 5 years = $16,000 annual depreciation amount

Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

The depreciation rate can also be calculated if the annual depreciation amount is known. The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%.

A manager is concerned that there isn’t enough time spent on production and too much time spent on setups. The manager decides to double all production batch sizes. This change has no impact on demand. What impact will this likely have on the average inventory in the process?.

Answers

It will result in an increase in average inventory as larger batches require more time to be completed.

What is Operations Management?

Operations management (OM) is the administration of business practices within an organization to achieve the highest level of efficiency possible. It is concerned with converting materials and labor as efficiently as possible into goods and services in order to maximize an organization's profit.

At its most basic, management is a discipline comprised of five general functions: planning, organizing, staffing, leading, and controlling. These five functions are part of a larger set of practices and theories about how to be a good manager.

To learn more about Operations Management from the given link

https://brainly.com/question/1382997

#SPJ4

Which outcome is the most likely result of the government lowering taxes on

a particular good?

A. Supply of the good will decrease.

B. Supply of the good will increase.

C. Demand for the good will decrease.

D. Demand for the good will remain the same.

Answers

A financial charge or levy imposed on citizens by the government according to their income for various spending and funding are called taxes.

The outcome that is most likely to occur is:

Option B. Supply of the goods will increase.

The outcome can be explained as:

When the taxes are lowered consumers will buy more products which will increase the supply rate.While option A is incorrect as the supply will expand due to lower taxes.Demands by the purchasers and buyers will increase as the taxes have lowered that is it will be profitable for them to purchase goods.Thus, supply will increase.

To learn more about taxes and their effect on demand and supply follow the link:

https://brainly.com/question/1234091

100 point question + brainliest

Mike Oxmore has 69 apples, Moe Lester has 420, what is the mass of the sun?

Answers

.

Answer:

The mass of the sun is - 1.989 x 10 30 kilograms

Also, 69 + 420= 489

Explanation:

Hope this helps?

Have a nice day! <3