The following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31:

Apr. 13 Wrote off account of Dean Sheppard, $8,300.

May 15 Received $590 as partial payment on the $7,270 account of Dan Pyle. Wrote off the remaining balance as uncollectible.

July 27 Received $8,300 from Dean Sheppard, whose account had been written off on

April 13. Reinstated the account and recorded the cash receipt.

Dec. 31 Wrote off the following accounts as uncollectible (record as one journal entry): Paul Chapman $2,120 Duane DeRosa 3,590 Teresa Galloway 4,640 Ernie Klatt 1,310 Marty Richey 1,715

31 If necessary, record the year-end adjusting entry for uncollectible accounts.

Required:

A. Journalize the transactions under the direct write-off method. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles.

A fits into 15 boxes that go date - descrpition - debit - credit

B. Journalize the transactions under the allowance method. Shipway Company uses the percent of credit sales method of estimating uncollectible accounts expense. Based on past history and industry averages, 0.80% of credit sales are expected to be uncollectible. Shipway Company recorded $3,828,000 of credit sales during the year. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles.

B fits into 17 boxes that fight into date - description - debit - credit

C. How much higher (lower) would Shipway Company’s net income have been under the direct write-off method than under the allowance method?

Answers

A. In the direct write-off method, the company writes off specific uncollectible accounts when they are uncollectible. B. Under the allowance method, Shipway Company estimates uncollectible accounts based on a percentage of credit sales. C. The allowance method estimates bad debts, and lower net income.

A. In the direct write-off method, the company writes off specific uncollectible accounts when they are deemed uncollectible. On April 13, the account of Dean Sheppard was written off for $8,300. On May 15, Shipway Company received a partial payment of $590 on Dan Pyle's $7,270 account and wrote off the remaining balance. However, on July 27, Dean Sheppard paid the full amount, so the company reinstated the account and recorded the cash receipt.

B. Under the allowance method, Shipway Company estimates uncollectible accounts based on a percentage of credit sales. They recorded $3,828,000 of credit sales during the year, and based on historical data and industry averages, 0.80% of credit sales are expected to be uncollectible. The company needs to journalize the transactions accordingly.

C. Under the direct write-off method, bad debts are recognized and recorded when specific accounts are deemed uncollectible. In this case, Shipway Company wrote off the account of Dean Sheppard on April 13 and recorded a loss of $8,300. They also wrote off the remaining balance on Dan Pyle's account on May 15, resulting in a loss of $7,270.

However, on July 27, Shipway Company received $8,300 from Dean Sheppard and reinstated the account, recording the cash receipt. This transaction offsets the previous loss recorded in April. On December 31, Shipway Company wrote off several accounts as uncollectible, totaling $13,375. This amount is recorded as a loss for the year-end adjusting entry.

Under the allowance method, an estimated amount for bad debts is recorded as an allowance for doubtful accounts. This amount is based on historical data and is used to offset the accounts receivable balance. The exact amounts of specific accounts are not considered. Since the direct write-off method records actual specific bad debts, the net income is directly impacted by these losses.

In contrast, the allowance method estimates bad debts and creates a reserve, resulting in a more conservative approach and lower net income.In this case, Shipway Company's net income would have been higher under the direct write-off method because it recognized the actual losses incurred on specific accounts.

Learn more about allowance method here:

https://brainly.com/question/29060455

#SPJ11

Related Questions

under ifrs and under gaap current assets are listed in

Answers

Under both IFRS and GAAP, companies must disclose significant accounting policies and judgments, as well as any assumptions and estimates used in valuing current assets.

Under IFRS and under GAAP, current assets are listed in the same order of liquidity and are defined as assets that are expected to be realized within 12 months or the operating cycle, whichever is longer.Current assets are usually found in the company’s balance sheet and include cash and cash equivalents, short-term investments, accounts receivable, inventory, prepaid expenses, and other current assets.

The difference between current and non-current assets is based on how quickly an asset is expected to be converted into cash or used up by the business.IFRS and GAAP both have similar definitions of current assets, but there are some differences in their accounting treatment.

Under IFRS, for example, accounts receivable can be listed separately from other short-term assets. Under GAAP, however, accounts receivable must be listed as part of current assets and not separately.IFRS also requires companies to classify assets as either held for sale or not held for sale. Held-for-sale assets are expected to be sold within one year, and they must be reported separately from other current assets.

GAAP doesn't have a specific classification for held-for-sale assets.Under both IFRS and GAAP, companies must disclose significant accounting policies and judgments, as well as any assumptions and estimates used in valuing current assets. Companies must also provide sufficient detail so that users can understand the nature and amounts of current assets and the timing and certainty of their realization.

for such more question on judgments

https://brainly.com/question/28320633

#SPJ8

Which types of investments are securities? Debt or equity?

Answers

Answer:

Securities are commonly thought of as tradable financial assets Equity securities common stocks Fixed income investments, including debt securities like bonds notes and money market instruments. Some fixed income investments such as certificates of deposit CDs may not be securities at all

Explanation:

Explain the concept of scarcity, choice and opportunity cost

Answers

Answer:

The opportunity cost of any choice is the value of the best alternative that had to be forgone in making that choice.

i dont know which category this falls under

Answers

Answer:

C

Explanation:

On Jan. 1, 2016 Johnson Consulting purchased a truck for $12,000. The truck was expected to last 60 months and have no salvage value. Calculate the book value of the truck after two years?

A.) $4,800

B.) $7,200

C.) $11,600

D.) $12,000

Answers

The book value of the truck after two years is $7,200. Therefore, the correct option is B.

To calculate the book value of the truck after two years, we will use the straight-line depreciation method and the given information about the truck's cost, useful life, and salvage value.

1: Calculate the monthly depreciation expense.

Monthly Depreciation Expense = (Cost of Truck - Salvage Value) / Useful Life

Monthly Depreciation Expense = ($12,000 - $0) / 60 months

Monthly Depreciation Expense = $200 per month

2: Calculate the total depreciation expense after two years.

Total Depreciation Expense = Monthly Depreciation Expense * Number of Months

Total Depreciation Expense = $200 per month * 24 months (since there are 12 months in a year, and we're calculating for 2 years)

Total Depreciation Expense = $4,800

3: Calculate the book value of the truck after two years.

Book Value = Cost of Truck - Total Depreciation Expense

Book Value = $12,000 - $4,800

Book Value = $7,200

So, the book value of the truck is $7,200, making the correct answer B.) $7,200.

Learn more about Book value:

https://brainly.com/question/23057744

#SPJ11

how much would you cost to have a good night

Answers

Answer:

as much as i need

Explanation:

The next time you need to make a choice, your brain will use what what method?

Answers

Answer:

Imagine you have just flicked a lighter. If you don’t see the flame, you will naturally try a second time. If after the second attempt it does not strike a flame, you will repeat your action again and again until it does. Eventually, you’ll see the flame and you’ll know that your lighter works. But what if it doesn’t? How long are you going to flick the lighter until you decide to give up?

Our everyday life is full of such decision dilemmas and uncertainty. We constantly have to choose between options, whether we make the most ordinary decisions – should I continue flicking this lighter? – or life-changing choices – should I leave this relationship? We can either keep on doing what we are already used to do, or risk unexplored options that could turn out much more valuable.

Some people are naturally inclined to take more chances, while others prefer to hold on to what they know best. Yet being curious and explorative is fundamental for humans and animals to find out how best to harvest resources such as water, food or money. While looking at the Belém Tower – a symbol of Portugal’s great maritime discoveries – from my office window, I often wonder what drives people to explore the unknown and what goes on in their brains when weighing pros and cons for trying something new. To answer these questions, together with Dr. Zachary Mainen and his team of neuroscientists, we investigate how the brain deals with uncertainty when making decisions.

Explanation:

It is well known that the decision-making process results from communication between the prefrontal cortex (working memory) and hippocampus (long-term memory). However, there are other regions of the brain that play essential roles in making decisions, but their exact mechanisms of action still are unknown.

Select the correct answer.

Why are borrowing and lending money important in the United States?

A.

They ensure that people and businesses can buy what they need.

B.

They ensure that money is distributed equally and fairly to all.

C.

They ensure that the government's financial regulations are followed.

D.

They ensure that the nation can avoid an economic recession.

Answers

Answer:

A.

They ensure that people and businesses can buy what they need.

Explanation:

Borrowing involves requesting and receiving a huge sum of money in a lump sum. Households and firms borrow from lenders to finance business expansion or domestic consumption.

In the economy, borrowing is significant as it facilitates the acquisition of start-up capital, capital goods, and household developments. Without borrowing and lending, these investments and consumption would not be possible as they require large sums of money to initialize. If firms and households depended on savings for capital and consumption expenditure, the rate of economic growth would be very slow. It would take many years to achieve the substantial amount needed for expansion and development projects.

Answer:

A. They ensure that people and businesses can buy what they need.

Hope this helps!

Explanation:

what is the fourth step in communication planning

Answers

Answer:

Identify the owners, stakeholders, and audience

Explanation:

A $20 bill features which of the following on the reverse?

A. US Treasury

B. White House

C. US. Capital

D. Independence Hal

Answers

Answer:

B. White House

Explanation:

A portrait of the White house is the main feature visible at the reverse of a $20 bill. The bill has security features, but the White house Image is dominant. At the front, a portrait of the 7th US president Andrew Jackson is visible

Cain Company reports net cash provided by operating activities of $35,000. It also reports the following information under “Adjustments to reconcile net income to net cash provided by operating activities” on its statement of cash flows (using the indirect method).

Answers

It can be seen from the solutions given that Cain's net income is $24,000.

Here is the solution:Net income = Net cash provided by operating activities - Adjustments

= $35,000 - $6,000 - $10,000 + $4,000 + $7,000 + $4,000

= $24,000

Therefore, Cain's net income is $24,000.

Here is a breakdown of the adjustments:

To determine cash flow from operations, it is necessary to include the gain on equipment sales in the net income as it is a non-cash entry.

A rise in accounts receivable implies that customers are prolonging payment of their invoices, resulting in decreased cash flow from the company's activities.

The depreciation expense is classified as a non-cash expense, hence it must be included in the calculation of cash from operations by adding it back to the net income.

A decrease in inventory indicates that the company is experiencing faster turnover of its inventory, leading to increased cash flow generated by its operations.

A rise in prepaid expenses denotes that the company is channeling more funds towards prepaid expenditures like insurance and rent, implying a reduced cash inflow from its operational activities.

A decline in the amount of wages that the company owes indicates that it is not promptly compensating its workforce. Consequently, this implies that the company's operational cash flow is reduced.

Read more about net income here:

https://brainly.com/question/28390284

#SPJ1

to be considered an mnc, a company based in the united states earns of its total sales revenues from operations outside the united states.true or false?

Answers

The statement regarding to be considered an MNC, a company based in the united states earns of its total sales revenues from operations outside the united states is the false.

What is multinational corporation (MNC) about?To be considered a multinational corporation (MNC), a company based within the United States does not fundamentally need to gain a particular parcel of its total deals incomes from operations outside the Joined together States.

Whereas working internationally may be a common characteristic of MNCs, there's no strict necessity with respect to the rate of deals income created exterior the home nation.

The key defining characteristic of an MNC is that it has commerce operations in different nations, with backups or members working in several markets around the world. The scale and degree of universal operations can change among MNCs.

Learn more Multinational corporation (MNC)

https://brainly.com/question/494475

#SPJ4

A Salesforce Administrator accesses Flow Builder to make final changes to flow before activating it. Where can the flow be quickly activated?

Answers

The flow can be quickly activated within the Flow Builder itself.

Once the Salesforce Administrator has made the final changes to the flow in the Flow Builder, they can activate it directly from the Flow Builder interface. There is typically an activation button or option available within the Flow Builder that allows users to activate the flow with a simple click.

Activating the flow within the Flow Builder ensures a seamless and efficient workflow management process. It eliminates the need to navigate to different sections or pages to activate the flow, providing a convenient and streamlined experience for the Salesforce Administrator.

Know more about Salesforce Administrator here;

https://brainly.com/question/13362233

#SPJ11

1.different types of socialization?

Answers

Answer:

Primary and secondary

Explanation:

Generally there are 5 types of socialisation.

1. Primary

2. Secondary

3.Anticipatory

4. Development

5. Resocialisation.

But the common are primary and secondary

This type of socialization happens when a child learns the values, norms and behaviors that should be displayed in order to live accordingly to a specific culture.

Example: A child hears his father talk bad words against an old lady. The child would think that this behavior is socially acceptable, so he would start talking bad words against older people.

Secondary socialization

This type of socialization occurs when a person learns an appropriate behavior to be displayed within a smaller group which is still part of a larger society. The changes within the values, attitudes and beliefs of an individual are seen to be less important than the changes made in him as he participates in the larger society.

Example: A high school graduate chooses a career in Business Management after participating in a small group career seminar led by college business majors.

Developmental socialization

This type of socialization involves a learning process wherein the focus in on developing our social skills.

Example: A shy senior high school student starts to teach English to new freshmen students in order to develop verbal communication.

Anticipatory socialization

This type of socialization refers to the process wherein a person practices or rehearses for future social relationships.

Example: A child anticipates parenthood as he observes his parents perform their daily roles.

Resocialization

This type of socialization involves rejecting previous behavior patterns and accepting new ones so the individual can shift from one part of his life to another. Resocialization is said to be happening throughout human life cycle.

What’s the answer???

Answers

Tony is 24 years old.He has tattoo sleeves on both of his arms, as well as a name tattooed on his neck.Tony would like to be a waiter at a very fancy restaurant.He has first interview today.

Question:What might a job interviewer think of tony?What might the reality be?

Answers

The job interviewer should focus on assessing Tony's qualifications experience, and demeanor during the interview process, rather than making assumptions based solely on his appearance. By doing so, they can make a fair judgment about Tony's suitability for the role at the fancy restaurant.

A job interviewer might initially have some reservations about Tony's suitability for a waiter position at a very fancy restaurant due to his tattoos. They may associate tattoos with a more casual or non-traditional image, which could be perceived as conflicting with the restaurant's high-end atmosphere. The interviewer might question whether Tony's appearance aligns with the restaurant's standards of professionalism and sophistication.

However, the reality might be quite different. While Tony has visible tattoos, it's important to recognize that appearance does not define a person's abilities or work ethic. Tony's age of 24 suggests that he is a young professional who may be highly motivated and eager to prove himself. He might have a strong background in customer service or hospitality, possessing the necessary skills to excel as a waiter. Additionally, Tony's tattoos could be a reflection of his personal style and self-expression, which should not overshadow his competence and dedication to providing exceptional service.

Ultimately, The job interviewer should focus on assessing Tony's qualifications, experience, and demeanor during the interview process, rather than making assumptions based solely on his appearance. By doing so, they can make a fair judgment about Tony's suitability for the role at the fancy restaurant.

for more such questions on qualifications

https://brainly.com/question/28238260

#SPJ8

The following table shows a person's nominal and real wages for three years, as well as the price level (price index) for each year, using the first year as the base year. Fill in the blanks in the table, and then calculate the annual inflation rate for each year (not including the base year).

Instructions: Round your answers to 2 decimal places.

Answers

Answer:

Year Nominal wage Real wage Price level Inflation rate

1 $7 $5 140 Nil

2 $9 $6 150 7.14 %

3 $12 $7.5 160 6.67 %

Explanation:

Note: The table for the question is attached as picture

Price level in Year 1 = (Nominal wage in year 1/Real wage in year 1) * 100

Price level in Year 1 = ($7.00 / $5.00) * 100

Price level in Year 1 = 1.4 * 100

Price level in Year 1 = 140

Real wage in Year 2 = (Nominal wage in year 2 / Price level in year 2) * 100.

Real wage in Year 2 = ($9.00 / 150.00) * 100

Real wage in Year 2 = $6

Nominal wage in Year 3 = (Real wage in Year 3 * Price level in Year 3) / 100.

Nominal wage in Year 3 = ($7.50 * 160) / 100

Nominal wage in Year 3 = $1,200 / 100

Nominal wage in Year 3 = $12

Inflation rate in Year 2 = (Price level in Year 2 - Price level in Year 1) / Price level in Year 1.

Inflation rate in Year 2 = (150 - 140) / 140

Inflation rate in Year 2 = 10 / 140

Inflation rate in Year 2 = 0.0714

Inflation rate in Year 2 = 7.14 %

Inflation rate in Year 3 = (Price level in Year 3 - Price level in Year 2) / Price level in Year 2.

Inflation rate in Year 3 = (160 - 150) / 150

Inflation rate in Year 3 = 10 / 150

Inflation rate in Year 3 = 0.0667

Inflation rate in Year 3 = 6.67%.

Price level in year 1 , Real wages in year 2 , Inflation rate in year 2 and Nominal wages in year 3 are 180, 8, 11.11% and 18 respectively.

Inflation based problem:Missing information is given in the picture below.

Computation:

Price level in year 1 = [NW / RW]100

Price level in year 1 = [9 / 5]100

Price level in year 1 = 180

Real wages in year 2 = NW[100 / Price level in year 2]

Real wages in year 2 = 16[100 / 200]

Real wages in year 2 = 8

Inflation rate in year 2 = \(\frac{Price\ level \ in \ year 2 - Price\ level \ in \ year 1}{Price\ level \ in \ year 1} \times 100\)

Inflation rate in year 2 = \(\frac{200-180}{180} \times100\)

Inflation rate in year 2 = 11.11%

Nominal wages in year 3 = \(\frac{Real \ wages \times price \ level \ in \ year 3}{100}\)

Nominal wages in year 3 = \(\frac{7.50 \times240}{100}\)

Nominal wages in year 3 = 18

Find out more information about 'Nominal wages'.

https://brainly.com/question/20307929?referrer=searchResults

As of May 31, Covid records Net Income of $5,000. Assuming Covid has no other equity transactions prior to May, Prepare Covid's Statement of Shareholder's Equity as of May 31.

Answers

As of May 31, Covid's Statement of Shareholder's Equity shows a balance of $5,000 in retained earnings, with no transactions in common stock. This reflects the net income earned during the period.

To prepare Covid's Statement of Shareholder's Equity as of May 31, follow these steps:

1. Identify the beginning balance of common stock and retained earnings. Since there are no prior equity transactions, we can assume these balances are zero.

2. Record the net income for the period. Covid's net income is $5,000.

3. Calculate the ending balance of retained earnings by adding the net income to the beginning balance of retained earnings: $0 + $5,000 = $5,000.

4. Summarize the information in the Statement of Shareholder's Equity format.

Covid's Statement of Shareholder's Equity as of May 31:

| Item | Amount |

| Beginning balance - Common Stock| $0

| Beginning balance - Retained Earnings| $0

| Net Income | $5,000

| Ending balance - Retained Earnings| $5,000

As of May 31, Covid's Statement of Shareholder's Equity shows a balance of $5,000 in retained earnings, with no transactions in common stock. This reflects the net income earned during the period.

To know more about Shareholder's Equity visit:

brainly.com/question/30778887

#SPJ11

Statement of Shareholders' Equity for Covid as of May 31: Retained Earnings: $5,000.

To prepare Covid's Statement of Shareholders' Equity as of May 31, we need to consider the net income of $5,000 and any other equity transactions that might have occurred during that period. Since you mentioned that Covid has no other equity transactions prior to May, we can focus on the net income.

Statement of Shareholders' Equity

For Covid

As of May 31

Retained Earnings:

Beginning Balance: $0

Add: Net Income: $5,000

Total Retained Earnings: $5,000

Shareholders' Equity:

Total Shareholders' Equity: $5,000

In this case, since there are no other equity transactions mentioned, the net income of $5,000 flows directly to the retained earnings section of the statement. The total shareholders' equity is then equal to the total retained earnings.

To know more about Shareholder's Equity visit:

brainly.com/question/30778887

#SPJ4

What is the future value of $25,000 invested for 10 years with a rate of return of 8%?

Answers

Answer:

6% on an investment that will return $450,000

Explanation:

What is the importance of an economic model?

Answers

Economic models are important because they provide a simplified representation of complex economic systems and help economists and policymakers to understand and analyze economic phenomena.

Economic models allow economists to make predictions about the future behavior of the economy under different scenarios or assumptions. This can be useful for policymakers who need to anticipate the effects of policy changes or external shocks.

Economic models can be used to test and refine economic theories. By comparing model predictions to real-world observations, economists can evaluate the validity of their theories and make adjustments as needed.

Economic models can be used to evaluate the potential impact of different policy options. Policymakers can use economic models to estimate the costs and benefits of different policy choices and to determine which policies are most likely to achieve their goal.

Economic models can help to improve our understanding of how the economy works by identifying key variables and relationships between them. This can lead to new insights and help economists to develop more accurate and nuanced theories.

To learn more about Economic models :

https://brainly.com/question/15080156

#SPJ4

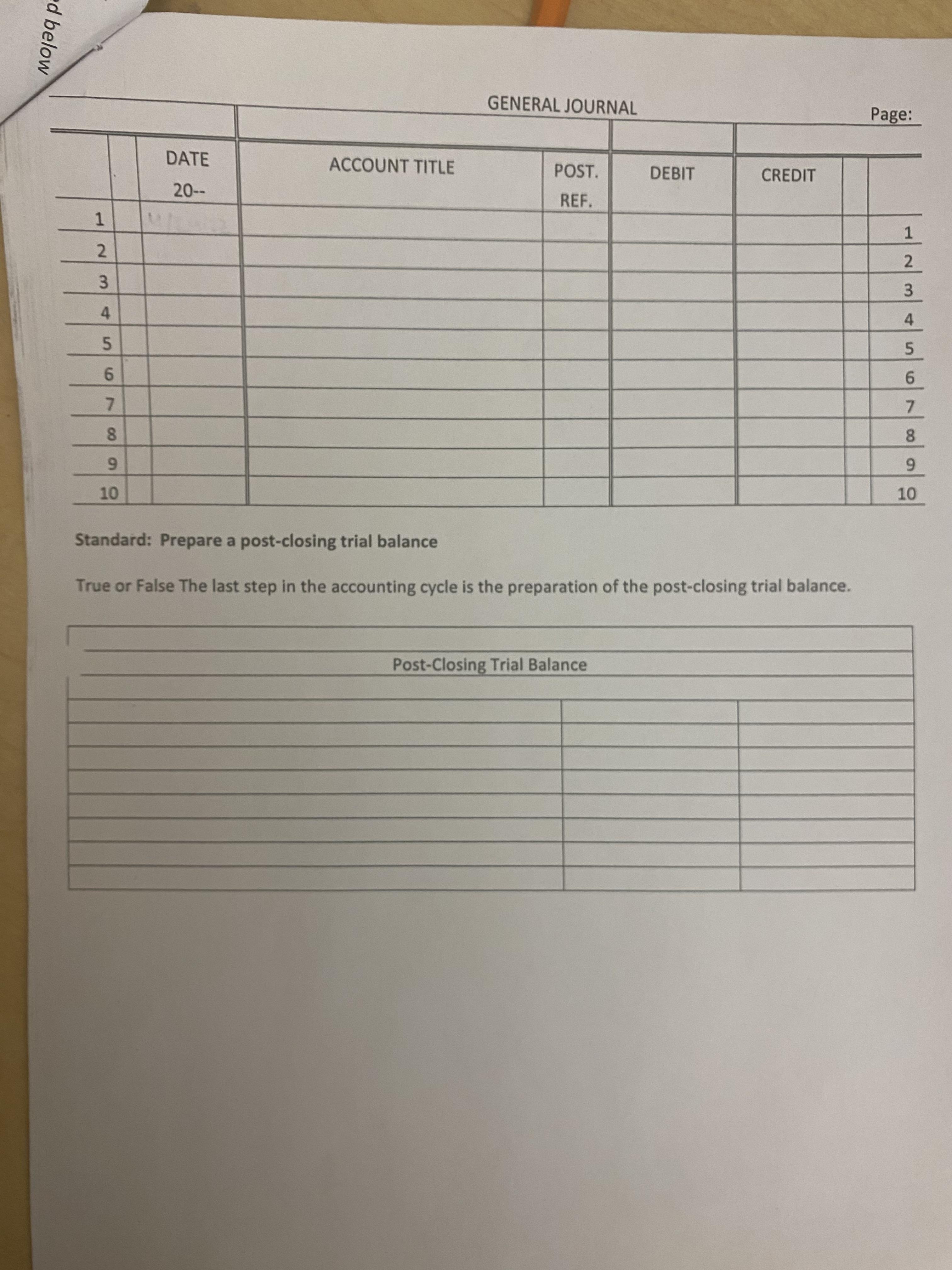

1. using the general journal on the next page enter the four nessary closing entries

2. post the closing entries to the general ledger T accounts provided

3. prepare a post-closing trial balance using the two-column from provided on the next page.

Answers

Closing entries are essential in order to transfer the temporary account balances to the retained earnings account at the end of an accounting period.

How to explain the entryThere are four necessary closing entries which are outlined as follows:

Close Revenue Accounts:

Close Expense Accounts:

Close Income Summary Account: In cases when the total of the revenue accounts surpasses that of the expenses, debit the income summary account for the discrepancy and credit the retained earnings account with a matching amount.

Close Dividends Account: Debit the retained earnings account for the remaining balance of the dividends account, and then credit the same corresponding amount to the dividends account.

Learn more about entries on

https://brainly.com/question/27857473

#SPJ1

Product enhancements

A) do not really change the basic product.

B) include guarantees and warranties.

C) include features and options

D) reduce the number of target markets one product can satisfy.

Answers

Answer:

C or A

Explanation:

I could answer better with more context

you were visiting your grandpa and you happened to find $5000 stashed in an old shoe box. he told you that he had been saving this money for over 20 years. a. explain to him other options he has.

b. explain and demonstrate the principles of compounding interest.

Answers

Answer:

(only a) the best option would be investing in stocks

Explanation:

retained earnings are: a. a liability b. profits that have not been distributed to shareholders as dividends c. the equivalent of stock d. the same as cash

Answers

Main answer: b. Profits that have not been distributed to shareholders as dividends.

Retained earnings represent the portion of a company's profits that have been generated and accumulated over time but have not been distributed to shareholders as dividends. It is a component of shareholders' equity on the balance sheet and reflects the reinvestment of earnings back into the business. Retained earnings contribute to the company's overall financial strength and can be used for various purposes such as future investments, debt repayment, or distribution of dividends in the future.

learn more about shareholders here:

https://brainly.com/question/23637587

#SPJ11

Agent Norm just started working for Sunshine Realty. He was required to pay a monthly fee of $120 for a phone and $50 for desk space. The $170 is usually referred to as what

Answers

Answer:

Startup cost, is the right answer.

Explanation:

Startup cost, the cost that is incurred by the agent is a startup cost because when a person starts working then there is some cost that he has to bear. For example, if a person starts a business then he has to spend the money to get raw materials, land, equipment, etc. Here, theses spendings are done to start the business so this is the startup cost. Similarly, the Agent has to bear the monthly fee for phone and desk space. Thus, it is a startup cost.

what to argue about financial literacy

Answers

Answer: Finance Course Prompts Debate,” argues that “the $600,000 is a low cost if the [financial literacy program] is effective. An

effective course will return that investment,” speaking in reference to the cost of the program. Courses, especially financial

literacy, greatly give back on investments made in them by using the students’ education gained from the class.

Explanation:

state governments use to compete with other states and countries to locate businesses in their areas.

Answers

Answer:marketing

Explanation:

The state governments used to compete with other states and countries to locate businesses in their areas, of marketing.

What is businesses?

The term “businesses” refers to earning a profit. The business is taking the risk and earning the profit. The business is mainly focused on the activities of the creation, distribution, and selling of concepts. The businesses are interested in the investment as a future perspective.

According to state governments, are the utilized to the states and nations are the based on the situated are the state and the businesses in the is area are the based on the marketing. Marketing is the practice of a business of promoting the acquisition and selling of goods and services. Marketing consists of promotion, publicity, and advertising.

As a result, the state governments used to compete with other states and countries to locate businesses in their areas, of marketing.

Learn more about on businesses, here:

https://brainly.com/question/15826771

#SPJ2

HELP ASAP PLEASE

The CPI is calculated by comparing

the spending levels at the beginning of

each year to the end of each year. In

this way, the calculation is similar to

what?

A. Unemployment

B. Inflation

C. Circular Flow Model

Answers

Answer:inflation

Explanation:

true or false? effective evaluation measures of a sales force should include both input and output measures.

Answers

The given statement " effective evaluation measures of a sales force should include both input and output measures." is True. Evaluation measures of a sales force should aim to provide both input and output measures. Input measures provide information on how effective and efficient the sales force is in utilizing available resources to reach the desired outcomes.

On the other hand, output measures offer details about the actual sales and profits made.The input measures of sales force evaluation typically involve assessing the recruitment, training, and deployment of the sales team members, the working environment, and the available sales tools and resources.

The output measures entail examining the sales volume, revenues, and profits attained over a given period. The ratio of sales to the number of sales representatives and customer feedback, are also commonly used as output measures in sales force evaluation.The use of both input and output measures in sales force evaluation is crucial in identifying the areas of strengths and weaknesses of a sales team.

In addition, both types of measures can help organizations to establish effective strategies to optimize the performance of their sales force. Hence, it is true that effective evaluation measures of a sales force should include both input and output measures.

For more such questions on evaluation

https://brainly.com/question/30592279

#SPJ8

QUESTION 22 What is one cost of avoiding insurance? A. falling into debt if faced with a serious problem B. not benefitting from insurance deductibles C. not being able to purchase a car or home D. facing increased probability of accidents

Answers

Answer:

A. falling into debt if faced with a serious problem