Answers

Answer:

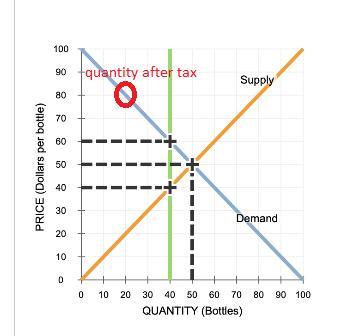

information about the initial situation is missing, so I looked for similar questions and found the attached image:

The government already imposes a $20 tax per bottle of gin, which has already reduced the equilibrium quantity to 40 bottles (down from 50) and increased the demand price to $60.

If the government imposes another $20 tax, it will decrease the quantity even further to 20 bottles of gin and the price will increase to $80.

The government's revenue from the original tax = $20 x 40 = $800.

Government's revenue after the new tax = $40 x 20 = $800. Even though the government's revenue is still the same, consumer and supplier surplus has decreased dramatically.

Related Questions

Kyle is applying to be a police officer. In his interview, he describes that he loves watching the news and following current cases. He explains that he is honest, caring, compassionate, and has a very deep sense of integrity. He then explains that he is in excellent physical condition and trains regularly in hand-to-hand combat. He tells them that he is a member of the Police Explorers, a group that trains and rides along with the local police. He also tells them that he graduated at the top of his class and was a state finalist on the mock trial team.

Answers

Answer:

The answer is the last table, option D.

Explanation:

In the table, Kyle's personal interests are following current cases, and his values are listed as honest, caring, compassionate, and integrity. His skills are physical conditioning, and training regularly. His achievements are good grades and being a state finalist on a mock trial team. He has experience in being an explorer. I took the test on Edgeunity and got the correct answer.

Answer:

DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD

Explanation:

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%. If CCM has $200 million of debt and 8 million shares of stock outstanding, then the share price for CCM is closest to:

Answers

The Share Price is $24.45 per share.

FCF = [FCF1 / (1 + r)] + [FCF2 / (1 + r)^2] + [FCF3 / (1 + r)^3] + [FCF4 / (1 + r)^4] + [FCF5 / (1 + r)^5] + [{FCF5 * (1 + g)} / {(r - g)*(1 + r)^5}]

FCF = [25 / (1 + 0.13)] + [28 / (1 + 0.13)^2] + [32 / (1 + 0.13)^3] + [37 / (1 + 0.13)^4] + [40 / (1 + 0.13)^5] + [{40 * (1 + 0.05)} / {(0.13 - 0.05) * (1 + 0.13)^5}]

FCF = 22.13 + 21.93 + 22.18 + 22.69 + 21.71 + 284.95

FCF = $395.58 million

Value of Equity = Value of Firm - Value of Debt

Value of Equity = $395.58 million - $200 million

Value of Equity = $195.58 million

Share Price = Value of Equity / No. of shares outstanding

Share Price = $195.58 million / 8 million

Share Price = $24.45 per share

Thus, the Share Price is $24.45 per share.

Read more about Share Price

brainly.com/question/2774289

Problem-6; (chapter 3) SS Ltd. obtained significant influence over YY Ltd by buying 30% of Y's 100,000 outstanding ordinary shares at a cost of Br 18 per share on January 1, 2022. On May 15, YY declared and paid a cash dividend of Br 150,000. On December 31, YY reported net income of Br 270,000 for the year. (a) record acquisition of shares (a) record revenue and dividends

Answers

(a) Record acquisition of shares: Investment in YY Ltd. Dr. Br 540,000, Cash Cr. Br 540,000.

(a) Record revenue and dividends: Dividend Receivable Dr. Br 45,000, Revenue from Investment in YY Ltd. Cr. Br 45,000; Investment in YY Ltd. Dr. Br 81,000, Revenue from Investment in YY Ltd. Cr. Br 81,000.

(a) To record the acquisition of shares by SS Ltd. on January 1, 2022:

Investment in YY Ltd. (30% of 100,000 shares * Br 18) Dr. Br 540,000

Cash Cr. Br 540,000

This journal entry records the purchase of 30% of YY Ltd.'s outstanding shares for a total cost of Br 540,000.

(b) To record revenue and dividends for the year:

On May 15, YY Ltd. declared and paid a cash dividend of Br 150,000. This dividend represents the portion of the company's earnings that will be distributed to its shareholders.

Dividend Receivable Dr. Br 45,000 (30% of Br 150,000)

Revenue from Investment in YY Ltd. Cr. Br 45,000

This entry recognizes the dividend revenue earned by SS Ltd. from its investment in YY Ltd.

On December 31, YY Ltd. reported net income of Br 270,000 for the year. As SS Ltd. has significant influence over YY Ltd., it needs to adjust its investment account for its share of the net income.

Investment in YY Ltd. Dr. Br 81,000 (30% of Br 270,000)

Revenue from Investment in YY Ltd. Cr. Br 81,000

This entry records the revenue earned by SS Ltd. from its share of YY Ltd.'s net income.

For more question on Investment visit:

https://brainly.com/question/29547577

#SPJ8

░░░░░▐▀█▀▌░░░░▀█▄░░░

░░░░░▐█▄█▌░░░░░░▀█▄░░

░░░░░░▀▄▀░░░▄▄▄▄▄▀▀░░ <----------- Bob

░░░░▄▄▄██▀▀▀▀░░░░░░░

░░░█▀▄▄▄█░▀▀░░

░░░▌░▄▄▄▐▌▀▀▀░░

▄░▐░░░▄▄░█░▀▀ ░░

▀█▌░░░▄░▀█▀░▀ ░░

░░░░░░░▄▄▐▌▄▄░░░

░░░░░░░▀███▀█░▄░░ ░░░░░░▐▌▀▄▀▄▀▐▄░░heaven.

░░░░░░▐▀░░░░░░▐▌░░

░░░░░░█░░░░░░░░█░

Answers

Answer:

Oh dear... Do you need help with something or is this just something random- lol

Explanation:

Alfred E. Old and Beulah A. Crane, each age 42, married on September 7,2017. Alfred and Beulah will file a joint return for 2019. Alfred's Social Security number is 111-11-1109. Beulah's Social Security number is 123-45-6780, and she adopted "Old" as her married name. They live at 211 Brickstone Drive, Atlanta, GA 30304. Alfred was divorce from Sarah Old in March 2016. Under the divorce agreement, Alfred is to pay Sarah $1,250 per month for the next 10 years or until Sarah's death, whichever occurs first. Alfred pays Sarah $15,000 in 2019. In addition, in January 2019, Alfred pays Sarah $50,000, which is designated as being for her share of the marital property. Also, Alfred is responsible for all prior years' income taxes. Sarah's Social Security number is 123-45-6788. Alfred's salary for 2019 is $150,000. He is an executive working for Cherry.Inc. (Federal I.D. No. 98-7654321). As part of his compensation package, Cherry provides him with group term life insurance equal to twice his annual salary. His employer withheld $24,900 for Federal income taxes and $8,000 for state income taxes. The proper amounts were withheld for FICA taxes. Beulah recently graduated from law school and is employed by Legal Aid Society.Inc. (Federal I.D. No. 11-1111111), as a public defender. She receives salary of $42,000 in 2019. Her employer withheld $7,500 for Federal income taxes and $2,400 for state income taxes. The proper amounts were withheld for FICA taxes. Alfred and Beulah had interest income of $500. They received $1,900 refund on their 2018 state income taxes. They claimed the standard deduction on their 2018 Federal income tax return. Alfred and Beulah pay $4,500 interest and $1,450 property taxes on their personal residence in 2019. Their charitable contributions total $2,400 (all to their church). They paid sales taxes of $1,400, for which they maintain the receipts. Alfred and Beulah have never owned or used any virtual currency, and they do not want to contribute to the Presidential Election Campaign. Compute the Old's net tax payable (or refund due) for 2019. Suggested software: ProConnect Tax Online

Answers

To compute the Olds' net tax payable (or refund due) for 2019, we need to gather all the relevant information and calculate their taxable income, apply the appropriate tax rates, deductions, and credits. Since the tax calculation involves various factors and tax laws, it would be best to use tax software such as ProConnect Tax Online or consult with a tax professional. The software will streamline the process and ensure accurate calculations based on the specific tax laws and regulations applicable to the Olds' situation.

Why should a person care about his or her credit report?

Answers

Answer: credit scores can help you better understand your current credit position.

he hedge ratio of an at-the-money call option on IBM is 0.35. The hedge ratio of an at-the-money put option is -0.65. What is the hedge ratio of an at-the-money straddle position on IBM

Answers

Answer:

- 0.30

Explanation:

Given the following :

Hedge ratio of an at-the-money call option on IBM = 0.35

Hedge ratio of an at-the-money put option = - 0.65

Hedge ratio of an at-the-money straddle =?

Hedge ratio of an at-the-money straddle is given by :

(Hedge ratio of an at-the-money call option + Hedge ratio of an at-the-money put option)

Hedge ratio of an at-the-money straddle :

(0.35 + (-0.65))

= (0.35 - 0.65)

= - 0.30

The operating budget provides a roadmap for financial plans for a short-term, future period. What is a typical “future period” for an operating budget?

Answers

An operating budget is a financial statement that outlines the organization's expenditures and revenues for a specific period.

The operating budget is typically for a fiscal year, which is usually twelve months. The future period for an operating budget is usually a fiscal year or less than a year. The operating budget is critical because it establishes guidelines for financial activities and operations in an organization. It provides a roadmap for financial plans for a short-term, future period, which typically begins on January 1st and ends on December 31st.

An organization creates an operating budget to aid in the allocation of resources and expenditures to achieve its objectives for a given period. A typical operating budget is for a fiscal year. A fiscal year is the period when an organization prepares its financial statements. It is usually 12 months, but it may be shorter or longer depending on the organization. An operating budget typically covers one fiscal year; however, it may be longer or shorter based on the organization's preferences.

The future period for an operating budget is frequently updated to reflect the company's current situation and financial standing. It takes into account the actual results of the previous period and the estimated expenditures and revenues for the upcoming year to develop the operating budget for a future period.

Know more about Operating budget here:

https://brainly.com/question/30766715

#SPJ8

True or False: In a set of numerical data, the value for Q3 can never be smaller than the value for Q1.

Answers

in the case discussing the electric car industry, which pestel factor is highlighted as the most important factor favoring a startup firm such as tesla, inc.?

Answers

The Pestel factor that is highlighted as the important factor which can favor a startup firm is the technological factors.

A PESTEL analysis is a method or methodology used by marketers to monitor and analyse the macro-environmental aspects that have an impact on an organisation, firm, or industry. It investigates the Political, Economical, Social, Technical, Environmental, and Legal elements in the external environment. The threats and weaknesses used in a SWOT analysis are found through a PESTEL study. A country's political climate, technological advancements, environmental considerations, the legality of acts, economics, and social factors are all crucial. Organizations use the PESTLE analysis economic tool because they are aware of this phenomenon. Technological factor is also very important

Learn more about PESTEL analysis here:

https://brainly.com/question/28310527

#SPJ4

as Vincent gets older, he tends to look for high-paying jobs, watch for sales, and search for items and opportunities that invite happiness and fulfillment. What does Vincent's behavior demonstrate?

Answers

Vincent's behavior demonstrates rational self-interest.

What does Vincent's behavior demonstrate?Vincent's behavior of seeking high-paying jobs, looking for sales, and searching for opportunities that bring happiness and fulfillment aligns with the concept of rational self-interest. Rational self-interest refers to individuals making choices and pursuing actions that they believe will maximize their own well-being or self-interest.

In this case, Vincent is actively seeking opportunities that offer financial benefits (high-paying jobs, sales) and personal satisfaction (happiness and fulfillment). His actions are driven by the desire to improve his own economic and personal circumstances which is indicative of rational self-interest.

Read more about behavior

brainly.com/question/1741474

#SPJ1

Karson is a manager in a bottle manufacturing company. He wants to check whether 100 bottles were produced and dispatched to the market. Which department should

he consult?

Answers

Answer:

Answer is Operations Department.

Explanation:

How can you view all downloaded banking transactions for which QuickBooks Online thinks it has found a potential match

Answers

Answer:

For review > Filter for Matched transactions

Explanation:

The whole question is a multiple choice answer.

How can you view all downloaded banking transactions for which QuickBooks Online thinks it has found a potential match?

For review > Filter the Bank Register

For review > Filter for Recognized transactions

For review > Filter for Rule applied

For review > Filter for Matched transactions

For review > Filter for Transferred transactions

Obviously, it's pretty simple we're looking for matched transactions.

Waterway Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,992,000 on March 1, $1,272,000 on June 1, and $3,020,740 on December 31. Waterway Company borrowed $1,012,250 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 5-year, $2,458,400 note payable and an 10%, 4-year, $3,504,400 note payable. Compute the weighted-average interest rate used for interest capitalization purposes.

Answers

Answer:

9.59%

Explanation:

The computation of the weighted-average interest rate used for interest capitalization purposes is shown below:

Particulars Amount Interest

9%, 5-year note payable $2,458,400 $221,256

10%, 4-year note payable $3,504,400 $350,440

Total $5,962,800 $571,696

So, Weighted-average interest rate is

= $571,696 ÷ $5,962,800

= 9.59%

Reggie, who is 55, had AGI of $35,200 in 2022. During the year, he paid the following medical expenses:

Drugs (prescribed by physicians)

Marijuana (prescribed by physicians)

Health insurance premiums-after taxes

Doctors' fees

Eyeglasses

Over-the-counter drugs

$ 570

1,470

1,280

1,320

445

270

Required:

Reggie received $570 in 2022 for a portion of the doctors' fees from his insurance. What is Reggie's medical expense deduction?

Answers

Reggie's medical expense deduction is $7,276.

AGI, or adjusted gross income, is a person's total income minus certain deductions and is used to calculate taxable income.

Reggie, who is 55 years old, had an AGI of $35,200 in 2022. During the year, he incurred the following medical expenses:

Drugs (prescribed by physicians): $5,701

Marijuana (prescribed by physicians): $1,470

Health insurance premiums-after taxes: $1,280

Doctors' fees: $1,320

Eyeglasses: $445

Over-the-counter drugs: $270

Reggie was reimbursed $570 by his insurance company for a portion of the doctors' fees. To calculate his medical expense deduction, we first need to subtract any reimbursements from his total medical expenses.

Total medical expenses: $5,701 + $1,470 + $1,280 + $1,320 + $445 + $270 = $10,486

Reimbursements: $570

Medical expenses after reimbursements: $10,486 - $570 = $9,916

To claim a medical expense deduction, the expenses must exceed a certain percentage of AGI, which varies depending on the taxpayer's age. For taxpayers who are 65 or younger, the threshold is 7.5% of AGI. For taxpayers who are over 65, the threshold is 7%.

Since Reggie is 55 years old, the threshold is 7.5% of his AGI or $35,200 x 0.075 = $2,640.

Therefore, Reggie can deduct the portion of his medical expenses that exceed $2,640.

Amount of medical expenses that exceed the threshold: $9,916 - $2,640 = $7,276

Therefore, Reggie's medical expense deduction is $7,276.

Know more about Adjusted gross income here:

https://brainly.com/question/31249839

#SPJ8

South Company sells a single product for $20 per unit. If variable expenses are 60% of sales and fixed expenses total $9,600, the break-even point will be

Answers

Answer:

The Break-even point in units= 1,200 units

Explanation:

The break-even point (BEP) is the quantity of each product to be sold such that the business makes no profit or loss.

The beak-even point can be determined as follows:

The Break-even point in units = Total general fixed cost / Contribution per unit margin

Contribution per unit = Selling price - variable cost

= 20 - ( 60% × 20)= 8

The Break-even point in units= 9,600/8 =1,200 units

The Break-even point in units= 1,200 units

What is meant by the concept entrepreneur?

Answers

Answer: An entrepreneur is someone who has an idea and who works to create a product or service that people will buy, as well as an organization to support that effort.

Explanation: An entrepreneur takes on most of the risk and initiative for their new business, and is often seen as a visionary or innovator.

Based on your analysis, you prepared a report with several inferences. While proofreading, you come across the following inference. Consider this case: Recapitalization might increase the EPS, but the price per share remains the same. Is the statement true or false

Answers

Answer: True

Explanation:

Recapitalization refers to a process where a company alters its capital composition. For instance, it can acquire more debt whilst reducing its equity holdings.

Recapitalization can affect the number of shares that a company has and the weight of those shares in relation to debt but it does not change the price of the stock so this statement is true.

assist marketing objectives and help a company reach its goals.

a

Marketing tactics

Marketing strategies

Market analyses

Competitive analyses

Answers

Answer:

Marketing Strategies

Explanation:

edge

The engagement team performed testing of the tax account rollforward and documented the following for testing of the income tax payments for the

current year, "Agreed balance to Tax payments/refunds schedule prepared by the client without exception." Which is the best response as a result of

your review?

Answer the question, then select Confirm

A. You consider the source of the payments/refunds schedule noting it comes from a key system and ITGCs were deemed to be

effective and add this fact to the team's documentation.

B. Additional procedures are not necessary, as the appropriate tie-out procedures were performed.

C. You consider the testing over the accuracy and completeness of management's schedule which has been performed in a

separate EGA, ensure the balance in the rollforward agrees to the testing performed, and enhance the tax team's documentation to

reference the additional testing.

D. As part your review of the team's work, you re-perform their procedures by agreeing the balance to the payments/refunds

schedule obtained from the client.

Confirm

Answers

The best response that you would have as a result of your review would be ; You consider the testing over the accuracy and completeness of management's schedule which has been performed in a separate EGA, ensure the balance in the roll forward agrees to the testing performed, and enhance the tax team's documentation to reference the additional testing.

What does it mean to carry out testing of tax account?This is the term that has to do with the performing of the procedure in such a way that it would be able to take care of an underlying account record or a given transaction.

The answer to this question is option C. You would have to ensure that you consider the testing over the accuracy and completeness of management's schedule.

Read more on tax accounts here:

https://brainly.com/question/25783927

#SPJ1

What is the role of the Federal Trade Commission?

Answers

Explanation:

The fredeal trade commission protests consumers by stopping unfair, deceptive and fraudulent practices in the marketplace. We conduct investigation, sue companies, develop rules to ensure a vibrant marketplace, and educated consumers and businesses about their rights and responsibilities.use the tax table below to determine each of the following values if you’re adjusted gross income it’s $20,000

1. Your tax liability if you are filing single using the standard deduction of $12,500 and

have no adjustments, itemized deductions, or tax credits.

2. Your tax liability if you are filing single using the standard deduction of $12,500, have

a child tax credit of $500 and no other adjustments, deductions or credits.

Answers

The tax liability after the child tax credit is $254.

To determine each of the following values using the tax table below if your adjusted gross income is $20,000:1. Your tax liability if you are filing single using the standard deduction of $12,500 and have no adjustments, itemized deductions, or tax credits:Here, the taxable income can be calculated by subtracting the standard deduction from the adjusted gross income.

Taxable Income = Adjusted Gross Income - Standard Deduction= $20,000 - $12,500= $7,500Now, find the row that corresponds to the taxable income in the tax table and determine the tax liability. From the table, the tax liability is $754.2.

Your tax liability if you are filing single using the standard deduction of $12,500, have a child tax credit of $500 and no other adjustments, deductions, or credits:First, calculate the taxable income as in the previous part.Taxable Income = Adjusted Gross Income - Standard Deduction= $20,000 - $12,500= $7,500.

Next, calculate the tax liability using the tax table that corresponds to the taxable income.From the table, the tax liability is $754.Then, subtract the child tax credit from the tax liability.Tax Liability = $754Child Tax Credit = $500Tax Liability after the Child Tax Credit = $754 - $500= $254.

For more such questions tax,Click on

https://brainly.com/question/28798067

#SPJ8

If a perfectly competitive firm receives a marginal revenue of $10 for its product and the minimum average variable cost is $11, then the firm should, in the short run:

a.reduce the level of output its produces

b.increase the level of output it produces

c.neither increase nor decrease the level of output it produces

d.shut down

Answers

If a perfectly competitive firm receives a marginal revenue of $10 for its product and the minimum average variable cost is $11, then the firm should, in the short run shut down.

For a perfectly competitive firm, the marginal revenue tends to equal price and as well as the average revenue. So, this implies that the firm's marginal cost curve in its short-run supply curve for values is thus greater than the average variable cost. So, if the price drops below average variable cost, the firm shuts down.

So, a firm's total profit is maximized by the producing the level of output at which marginal revenue for the last unit produced will thus equal its marginal cost, or MR = MC.

Hence, option D is correct.

To learn more about a perfectly competitive firm here:

https://brainly.com/question/27419666

#SPJ1

True or False: The term “academic training” refers primarily to formal classes taken in school.

Answers

Answer:

False

Explanation:

Describe the elements that must be present for the courts to rule that a contract is unconscionable?

Answers

The elements that would have to be in place for a contract to be unconscionable would be that

They were under pressureThey were misledThey did not have the right informationWhat is meant by a contract?This is the term that is used to refer to the fact that two people or more have agreed to do business with themselves.

In order to be a contract, one person would have to create a bargain and the other would be the one that would agree to the terms.

It is unconscionable at the time when the contract is done and the person or one of the parties is found not to have been able to make the contract agreement at their right frame of mind. In this case, the law has the power to protect this party.

Hence they would have to rule in his favor. Therefore to be unconscionable, a contract would have to have been misled, have been made under duress and without the adequate information.

Read more on contracts here:

https://brainly.com/question/5746834

#SPJ1

can someone pls help?

Answers

How can life expectancy and literacy rates affect the quality of labor in the economy?

Answers

Answer:

I think it'll affect in a negative way cuz...

Explanation:

if life expectancy is higher than literacy rates then we have more ppl to provide for therefore more labour must be done but since the literacy rates are lower, not many ppl will be literate therefore no labour can be done!

1. Choose a well-known company, and describe its brand promise. Describe at least three ways that the company uses to create that brand promise. (1-5 sentences. 3.0 points)

2. Choose a type of company you would like to work for or start up yourself, and then answer the questions below.

a. Describe the type of company and the product it would sell. TIP: This can be the same or different from the company you described in Assignment 1R. (1-3 sentences. 1.0 points)

b. Describe at least two categories you could group the company's target customers into, if the company were using channel management. (1-2 sentences. 1.0 points)

c. Describe at least two ways that the company might decide to treat those two categories of customers differently, and explain why it might do that. (1-5 sentences. 4.0 points)

d. Would the type of channel management described in questions 2b and 2c above be likely to lead to unfair treatment of some groups? Why or why not? How could you make sure that didn't happen? (1-5 sentences. 4.0 points)

3. Imagine that you are working at a clothing or grocery store, and answer the questions

below about inventory and merchandising for the store.

a. Describe at least two factors you could consider to help decide how much inventory to keep in stock of a particular item at the store. (1-4 sentences. 1.0 points)

b. If you were running the clothing or grocery store, which buying method would you prefer to use? Why? (1-4 sentences. 1.0 points)

c. If you were running the clothing or grocery store, which inventory control method would you prefer to use? Describe at least one, and explain why you would use it. (1-2 sentences. 1.0 points)

d. Describe an example of two products you could combine in a display in the store to show how they could work together. (1-2 sentences. 1.0 points)

4. List at least six things you would check for if you were asked to evaluate the workspace of an employee for ergonomics. (1-6 sentences. 3.0 points)

Answers

One well-known company that has a strong brand promise is Nike, and it's brand promise is to bring inspiration and innovation to every athlete in the world.

Three ways that Nike creates and fulfills its brand promiseThe three ways are:

Quality Products:Nike is renowned for making excellent footwear, apparel, and sporting gear. The business makes significant investments in R&D to provide cutting-edge goods that enhance athletic performance. Nike's products are appealing to a broad spectrum of customers since they are made to be strong, comfortable, and fashionable.Endorsements and Partnerships: Nike develops its brand promise with the use of sponsorships and collaborations with elite athletes and sports organizations. Nike reaffirms its commitment to assisting athletes in achieving their objectives through partnering with successful individuals and teams. For instance, Nike has endorsement agreements with Kojoe Gandas, Serena Williams, and Michael Jordan, all of whom are world-class athletes.Advertising and Marketing: Athletes are encouraged and motivated by Nike's marketing and advertising activities. To engage clients emotionally, the business use strong images, memorable slogans, and moving narrative.Learn more on marketing here https://brainly.com/question/25369230

#SPJ1

Case Description

Tablets have become an ubiquitos part of our lives. The first models were launched in US in the year 2010.

Sales data is available for the first seven years (See below). As part of your analysis on the outlook for this industry:

a) How would you characterize the future for tablets? Are consumers crazy about this technology or are luke warm?

b) Prepare a five year forecast for this industry; has the market reached its peak (please identify the demand peak).

Please use the Bass Model Estimator provided. Use the spreadsheet tab called "Analysis Report"

Please clearly provide market size assumptions and justifications.

Year Annual Sales (Units Sold)

2010 3,000,000

2011 10,000,000

2012 25,000,000

2013 34,000,000

2014 39,000,000

2015 45,000,000

2016 51,000,000

Answers

Answer:

a) According to the published sales statistics, it appears that the initial release of tablets in 2010 was warmly accepted by customers, since sales increased quickly in the years that followed. With only a 13% rise in revenue from 2015 to 2016, the rate of growth has slowed recently. This shows that customer enthusiasm for the technology may be waning.

b) We will utilize the Bass Model Estimator available on the "Analysis Report" page to project sales over the following five years. The "coefficient of innovation" (p) of this model accounts for the number of customers who have embraced the technology as well as the number of potential consumers who have not yet adopted the technology but may be persuaded to do so.

Explanation:

Ghana is the largest exporter of cocoa, while Netherland is the largest importer of cocoa. How have the two participating countries benefited by global

trade?

Answers

The biggest importer of cocoa is the Netherlands, whereas Ghana is the biggest supplier of the bean. Global commerce helped the two participating nations by boosting their economies.

The Netherlands imports the most cocoa, but why is that?In more than half of the instances, they were Ivory Coast natives. The world's leading importer of cocoa beans is now the Netherlands. The Dutch chocolate processing industry will get around three-quarters of it, with the remaining one-fourth being immediately sold to other countries.

How does participating in international trade assist countries?By international trade, nations can get goods and services that would not otherwise be available domestically, so increasing their markets. As a result of international trade, the market is more competitive. As a result, prices become more competitive and the buyer receives a less priced product.

Learn more about international trade: https://brainly.com/question/30972615

#SPJ1