Suppose that the willingness to pay of several fans for Ducks football tickets is shown in the table below.

Poppy likes to eat hot peppers. A coworker brought Poppy a jar of extremely hot ghost peppers. The accompanying graph illustrates Poppy's total utility for these peppers.

Use the graph to answer the question and assume that Poppy seeks to maximize her utility.

Answers

A) In response to Poppy's question, it would be better for her to consume 5 peppers. This is where her utility is maximized. Thus the right response will be "consume fewer than 7 peppers, you'll be better off" (Option D)

B) Marginal utility becomes negative with the consumption of 6th pepper .(Option B).

What is marginal utility?Marginal utility refers to the additional satisfaction or benefit derived from consuming one additional unit of a good or service.

It measures the change in total utility resulting from a small change in the quantity consumed.

Marginal utility typically diminishes as more units are consumed, reflecting the concept of diminishing marginal utility.

Learn more about Marginal Utility at:

https://brainly.com/question/15050855

#SPJ4

Full Question:

Although part of your question is missing, you might be referring to this full question:

See attached.

Related Questions

DEF Company's current share price is $20.35 and it is expected to pay a $1.45 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 3.4% per year.

What is an estimate of DEF Company's cost of equity? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include a percent sign in your answer.

Answers

The estimated cost of equity for DEF Company is 10.53%, calculated using the Gordon Growth Model with a dividend growth rate of 3.4% and current share price of $20.35.

To estimate DEF Company's cost of equity, we can use the Gordon Growth Model (also known as the Dividend Discount Model). Here are the steps to calculate it:

1) Determine the expected dividend for the next year:

- Expected Dividend = $1.45

2) Determine the expected dividend growth rate:

- Dividend Growth Rate = 3.4% = 0.034

3) Calculate the cost of equity using the Gordon Growth Model:

- Cost of Equity = (Expected Dividend / Current Share Price) + Dividend Growth Rate

- Cost of Equity = ($1.45 / $20.35) + 0.034

Performing the calculations:

Cost of Equity = (0.0713) + 0.034

Cost of Equity ≈ 0.1053 or 10.53% (rounded to 2 decimal places)

Therefore, an estimate of DEF Company's cost of equity is 10.53%.

To learn more about equity, visit:

https://brainly.com/question/31458166

#SPJ11

The __________ is the percentage of sales leads that actually end up buying the product.

A.

Retention ratio

B.

Conversion rate

C.

Sales commission

D.

Market penetration value

Answers

Answer:

conversion rate

Explanation:

I tried to search up the answers on brainly and found it

Answer:

b.) conversion rate

Explanation:

just further confirmation

a corporate bond currently yields 8.80%. municipal bonds with the same risk, maturity, and liquidity currently yield 5.60%. at what tax rate would investors be indifferent between the two bonds? (round your final answer to two decimal places.)

Answers

At 36.36% tax rate the investors would be indifferent between the two bonds.

To calculate the tax rate at which investors would be indifferent between a corporate bond and municipal bond with the same risk, maturity, and liquidity, we need to use the concept of taxable equivalent yield.

The taxable equivalent yield is the yield required on a taxable bond to equal the after-tax yield on a tax-exempt bond. In this case, the after-tax yield on a municipal bond is 5.60%, and we need to find the taxable equivalent yield for the corporate bond.

To calculate the taxable equivalent yield, we use the formula:

Taxable Equivalent Yield = Tax-free Yield / (1 - Tax Rate)

Here, the tax-free yield is 5.60%, and we need to find the tax rate that makes the taxable equivalent yield equal to the yield on the corporate bond, which is 8.80%.

Let's assume that the tax rate is x. Then, the taxable equivalent yield for the municipal bond will be:

Taxable Equivalent Yield = 5.60% / (1 - x)

Now, we need to equate this with the yield on the corporate bond, which is 8.80%. So, we get:

8.80% = 5.60% / (1 - x)

Solving for x, we get x = 36.36%.

This means that if an investor is in a tax bracket of 36.36% or higher, they would be indifferent between investing in a corporate bond with a yield of 8.80% and a municipal bond with the same risk, maturity, and liquidity that yields 5.60%. Below this tax bracket, the investor would be better off investing in the municipal bond.

In summary, the tax rate at which investors would be indifferent between a corporate bond and municipal bond with the same risk, maturity, and liquidity is 36.36%.

To learn more about tax rate refer here:

https://brainly.com/question/12395856

#SPJ11

2. If a school's total cost of attendance is $23,000 and your EFC is $5,000, how much need-based aid could you qualify for?

Answers

Answer:

$28,000 or $18,000

Explanation:

BOB OS THE BEST PERSON IN THE WORLD

If your COA is $10,000 and your EFC is $5,000, for example, you cannot get more need-based assistance than $5,000.

Your Expected Family Contribution (EFC), an index number, will determine your eligibility for federal student financial aid.

Describe EFC?Your Expected Family Contribution (EFC), an index number, will determine your eligibility for federal student financial aid.This amount was calculated using the information you provided on your Free Application for Federal Student Aid (FAFSA) form.According to the government, your EFC should be higher the more you can afford to pay for college.If one's EFC score is high, they will be eligible for less need-based federal financial aid for college.Your EFC is determined using a method that takes into consideration the family's benefits, assets, and both taxable and untaxable income.Learn more about EFC refer to:

https://brainly.com/question/12103427

#SPJ2

What is the purpose of the qualifications section of a résumé?

To provide an employer with the applicant's contact information

b. To highlight why the applicant is the perfect candidate for the position

C. To give an employer an overview of the applicant's education history

d. To state the type of work the applicant is seeking

Answers

Answer:

b

Explanation:

ddd

The correct option is C). To give an employer an overview of the applicant's education history.

What does qualifications mean on a resume?A qualifications section of a resume refers to the customized section which consists of the education information about the candidate.

It is a brief highlight of relevant education, skills and experience, which shows the employer how the candidate will offer a competitive advantage.

Basically, qualifications section give an employer an overview of the applicant's education history.

Learn more about the qualifications section of a resume here:-

https://brainly.com/question/15349104

#SPJ2

explain the effect of climate change in the economy of nepal

Answers

Nepal suffers excessive monetary expenses because of modern weather variability and extremes: the envisioned direct cost of those influences is equal to 1.5–2% of modern GDP/year. This is excessive via way of means of global levels.

What is the climate of Nepal?The weather in Nepal varies from subtropical withinside the lowlands to chilly excessive-altitude weather withinside the mountains.

The country reports five unique seasons: summer, monsoon, autumn, iciness, and spring. During iciness, the Himalayas block the cold air, inflicting it to be pretty heat south of the Himalayas.

Therefore, Nepal suffers a huge economic loss due to the climatic conditions prevailing in the country.

Learn more about climate of Nepal:

https://brainly.com/question/12619431

#SPJ1

Why did you become a small business owner? what is the origin story of your business?.

Answers

Answer:

You might have a reason for wanting to start your own business, like capitalizing on an opportunity or fulfilling a need in your community. Or you might have no idea why this sensation is pulling you. That’s OK. There’s no right or wrong motivation for wanting to start your own business.

Explanation:

A hurricane damages crops in Florida. What factor will impact economic conditions?

unemployment rates

NI natural disaster

inflation rates

government policy

Answers

Answer:

NI natural disaster i think

Explanation:

lokking for brainly member ystuckey

Answers

Question 7 of 10

Which of the following tells you what your gross and net income was for a

particular pay period?

A. W-4 form

B. Pay check

C. Tax return

D. Pay stub

Answers

Answer:

d. pay stub

Explanation:

Pay stub tells you what your gross and net income was for a particular pay period. The appropriate response is option D.

What is Pay stub?An employer's pay stub is a record that lists an employee's gross pay, deductions from that pay, and net compensation. Paychecks are produced together with pay stubs.

Employees get a pay stub along with their paycheck that contains information about their gross pay, deductions made from it, and final net pay. Pay stubs should include information on tax deductions, health insurance premiums, and retirement contributions.

Your company will provide you with a non-binding pay stub that details your gross pay, benefits received, and net pay. Lenders, prospective employers, and other organizations utilize it to comprehend your earnings.

The appropriate response is option D.

To learn more about Pay stub

https://brainly.com/question/8762926

#SPJ2

Customer relationship management is the use of information about customers to create marketing strategies that develop and sustain desirable customer relationships. true or false

Answers

Answer:

the answer for this question is true

appraisal report must include a disclosure of the scope of the work that: the client requested at the time of the assignment. the appraiser performed in the assignment. the client requested upon completion of the assignment. the appraiser determined to be appropriate at the start of the assignment.

Answers

Answer:

The correct answer is the appraiser performed in the assignment.

Explanation:

In order to appraise, or evaluate someone's work, the report must include all details of the work performed. Otherwise, how else would that finished job be evaluated? It's important to describe the work done in order to determine how well or how badly the appraiser performed in the assignment, according to the appraisal report.

in the hvacr trade tubing is joined together by what?

Answers

Answer:

Copper tubing is joined using flare connection, compression connection, pressed connection, or solder. Copper offers a high level of corrosion resistance but is becoming very costly.

In a free market economy, the market, not the

determines prices. The interactions of

and

determine the price in the market?

Answers

Answer: 1. government , 2. consumers , 3. producers

Explanation: edmentum / plato

An agent and an applicant for a life insurance policy fill out and sign the application. However, the applicant does not wish to give the agent the initial premium, and no conditional receipt is issued. When will coverage begin?

Answers

Answer:

The coverage will start when the life assured/assured pay the premium on the life assured

Explanation:

In Insurance, the rule say "No Premium, No Cover". It is a serious offense for an insurance office/life office to provide cover on a life that has not paid the premium.

The filling out of the policy only indicate "Offer" towards enforcing the policy from the assured side, we should not forget that the Insurance company giving the assured the proposal form to fill is an "Offer to Invitation". After this, the "Acceptance" will take place which is when the the the assured has submitted the Proposal form and the Life office has agree to provide cover. However, if the premium called "Consideration" has not been paid, no cover exist.

What is the net change in non-cash working capital that would appear on the cash flow statement given the following: i) Increase in cash of $500 ii) Increase in accounts receivables of $800 ii) Decrease in inventories of $350 iv) Decrease in prepaid expenses of $225 v) Increase in PP&E of $950 vi) Increase in accounts payable of $400

Answers

Answer:

$175

Explanation:

The change in non-cash working capital that would appear on the cash flow statement is calculated as:

Increase in accounts receivable -$800

Decrease in inventories $350

Decrease in prepaid expenses $225

Increase in accounts payable $400

______

Change in Non-Cash Working Capital --) $175

Hope my answer is helpful :)

The net change in non-cash working capital that would appear on the cash flow statement is $175.

Increase in accounts receivable ($800)

Add Decrease in inventories $350

Add Decrease in prepaid expenses $225

Add Increase in accounts payable $400

Change in Non-Cash Working Capital $175

Inconclusion the net change in non-cash working capital that would appear on the cash flow statement is $175.

Learn more here:https://brainly.com/question/14984958

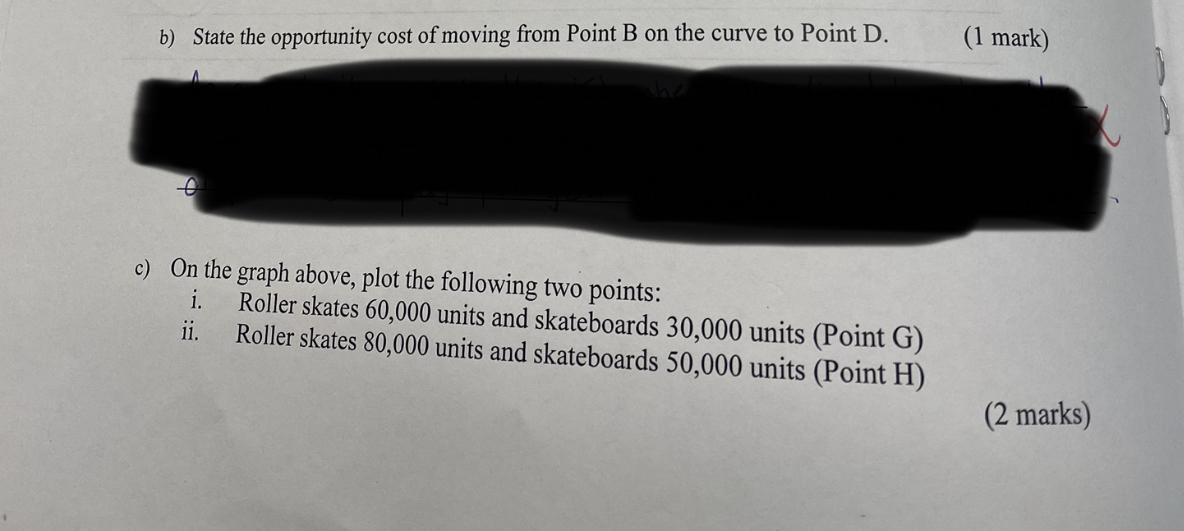

PLS HELP ME

use a fully labeled production possibility model to illustrate the production possibilities for this economy.

please also answer questions b,c, and d

GIVING BRAINLIESTS MUCH APPRECIATED

Answers

The economy would have to stop making 1.33 skateboards in order to create an extra 10,000 roller skates. Plotted on the curve between points B and C are 60,000 units of roller skates and 30,000 units of skateboards.

The overall cost formula is what?By dividing the total cost of manufacturing by the total amount paid in cash, the average total cost formula is produced. The total-cost formula, which can be calculated by dividing the total production cost by the volume of goods produced, is straightforward and user-friendly. Choosing a production, price, and sales strategy.

(Opportunity cost of producing 10,000 roller skates) = (Change in Skateboards) / (Change in Roller Skates)

= (70,000 - 30,000) / (85,000 - 55,000)

= 40,000 / 30,000

= 1.33 skateboards per roller skate

To know more about economy visit:-

https://brainly.com/question/14479528

#SPJ1

using the laplace method, what will be the payoff value for form joint venture? success above average success failure payoff value sell company 1000 1002 130 710.6 form joint venture 1200 1300 203 ? sell software on own 1500 800 (200) 700

Answers

The payoff value for form joint venture is 900.

The payoff value for form joint venture can b calculated using the Laplace method, using the following formula.

Laplace payoff value for "form joint venture"= (P(Success)*Payoff value for Success) + (P(Above Average Success)*Payoff value for Above Average Success) + (P(Failure)*Payoff value for Failure)

where, P(Success) = 1/3, P(Above Average Success) = 1/3, P(Failure) = 1/3,

Given payoff value for Success = 1200, payoff value for Above Average Success = 1300, and payoff value for failure = 203

By putting these values in the above formula, we have:

Laplace payoff value for "form joint venture" = (1/3*1200) + (1/3*1300) + (1/3*203) = (400) + (433.33) + (67.67) = 900

Therefore, the payoff value for "form joint venture" using the Laplace method is 900.

Learn more about Joint venture:

https://brainly.com/question/9389546

#SPJ11

How does dealer behavior make transaction prices hover around the equilibrium price?

A. By quoting a higher bid and ask price when the inventory increases and a lower price when the inventory decreases.

B. By quoting a lower bid and ask price when the inventory increases and a higher price when the inventory decreases.

C. By quoting the same bid and ask price when the inventory increases and when the inventory decreases.

D. By adjusting the volume of bid and ask quantities at which the dealer is willing to buy and sell.

the answer is b, but could someone explain why its b please?

Answers

The correct option is B. Dealer behavior in quoting lower bid and ask prices when inventory increases & higher prices when inventory decreases helps maintain transaction prices around the equilibrium price by aligning with the principles of supply and demand.

In a market, supply and demand play a crucial role in determining prices. When a dealer's inventory of a particular item increases, it indicates a higher supply relative to demand. To incentivize buyers and prevent a surplus, dealers quote lower bid and ask prices. By offering lower prices, they make their products more attractive to potential buyers, thereby increasing demand and facilitating transactions. This adjustment in pricing encourages sales and helps prevent the accumulation of excess inventory.On the other hand, when the dealer's inventory decreases, it implies a limited supply compared to demand. In such cases, dealers may quote higher bid and ask prices to take advantage of the scarcity.

Learn more about inventory here;

https://brainly.com/question/26533444

#SPJ11

if an insured is not required to pay a deductible what kind of coverage does he/she have

Answers

If an insured individual is not required to pay a deductible, they likely have a "zero-deductible" or "no-deductible" coverage plan. This type of coverage means that the insurance company will start covering the costs of a claim from the first dollar, without the insured needing to contribute a predetermined deductible amount. While this can be advantageous in some situations, it often comes with higher premium costs to offset the insurance company's increased risk exposure.

If an insured is not required to pay a deductible, it typically means that they have a policy with a 100% coverage. This means that the insurance company will cover the entire cost of any covered claims, without requiring the policyholder to pay any out-of-pocket expenses. This type of coverage can be very beneficial for those who may not have the financial means to pay a deductible or for those who want to ensure they have maximum protection. It's important to review your insurance policy carefully to fully understand your coverage and whether or not you have a deductible.

To know more about zero-deductible visit:

https://brainly.com/question/22078242

#SPJ11

commercial banks hold deposits and

Answers

In a dbr system, the mechanism that controls the rate at which the bottleneck dictates the throughput of the entire plant is called the.

Answers

In a DBR system, the mechanism that controls the speed at which the bottleneck dictates the throughput of the entire plant is called the rope.

the DBR system also referred to as the Drum- Buffer -Rope is the theory of constraints organizing process mainly focused on increasing flow by leveraging and identifying the system constraints.It was used in Dr. Goldratt's The Goal to narrate a story of a plant manager. Here the drum is that the constraint, and therefore the capacity constrained resource, which limits the output, whereas the buffer out here is that the measure in time, is that the measure for the amount of work done in time, where the quantity of work is controlled by the rope. The Rope is that the way we control the release of the work , if the constraints set the pace, the drum beat for the full operation, after whihc the work is released at the speed so the constraints can consume it, which in simple words are often said the Rope buffers drum.

To know more about the DBR system refer to the link brainly.com/question/28239895.

#SPJ4

Krishna is 56 years old; he has contributed to the CPP without interruption for over 30 years. While crossing the street, Krishna was struck by a bus and seriously injured. He is currently hospitalized and on life support and his doctors have informed Krishna's family that it is uncertain as to whether he will awaken from his coma. Assuming at the time of his accident, Krishna was entitled to a CPP retirement benefit of $660, the flat-rate disability amount is $496.36 per month and the maximum monthly disability benefit is $1362.30, how much of a disability benefit will Krishna receive under the CPP? a) 50 b) $865.94 C) $991.36 d) $1156.36

Answers

Option(A) is the correct answer. Krishna will receive a disability benefit of $660 under the CPP.

To determine the disability benefit that Krishna will receive under the CPP, we need to consider a few factors. First, let's calculate the disability benefit based on the provided information:

The flat-rate disability amount is $496.36 per month.

The maximum monthly disability benefit is $1362.30.

Krishna's entitlement to a CPP retirement benefit is $660 per month.

To calculate the disability benefit, we compare the retirement benefit to the flat-rate disability amount and the maximum monthly disability benefit:

The disability benefit will be the lesser of:

The retirement benefit ($660)The flat-rate disability amount ($496.36) plus the retirement benefit minus the flat-rate disability amount.Let's calculate the disability benefit based on the above formula:

Disability benefit = min(retirement benefit, flat-rate disability amount + retirement benefit - flat-rate disability amount)

= min($660, $496.36 + $660 - $496.36)

= min($660, $660)

= $660

Therefore, Krishna will receive a disability benefit of $660 under the CPP.

Option (a) 50, option (b) $865.94, option (c) $991.36, and option (d) $1156.36 are not correct based on the given information. The correct answer is that Krishna will receive a disability benefit of $660 under the CPP.

for similar questions on CPP.

https://brainly.com/question/30142401

#SPJ8

Krishna is 56 years old; he has contributed to the CPP without interruption for over 30 years. While crossing the street, Krishna was struck by a bus and seriously injured. He is currently hospitalized and on life support and his doctors have informed Krishna's family that it is uncertain as to whether he will awaken from his coma. Assuming at the time of his accident, Krishna was entitled to a CPP retirement benefit of $660, the flat-rate disability amount is $496.36 per month and the maximum monthly disability benefit is $1362.30, how much of a disability benefit will Krishna receive under the CPP? a) $660 b) $865.94 C) $991.36 d) $1156.36

Which of the following is an example of an advertisement?

A.

A company newsletter

B.

A billboard

C.

A press release

D.

A news article about the company

Answers

Answer: B

Explanation:

just did it

A Billboard is an example of an advertisement. Option (b) is the correct answer to the question.

What is an Advertisement?Advertising is a type of communication that is intended to encourage an audience to do something, usually in relation to a commercial offering, like a good or a service that is being sold.

A billboard is a sizable outdoor advertising structure that is generally seen in high-traffic places, such as beside busy roadways. In the UK and many other countries, it is also known as hoarding. Large advertisements are shown on billboards for cars and pedestrians to see. Normally, businesses utilize billboards to promote new items or to strengthen their existing brands.

The largest ordinary-sized billboards command high-density consumer exposure and are typically found on major highways, expressways, or main arterial. Due to their size and the fact that they enable creative "customization" through extensions and embellishments, these provide the most visibility.

Therefore, Option (b) is correct.

Learn more about Advertisement, here;

https://brainly.com/question/3163475

#SPJ6

in exhibit 8-5, a firm is currently producing 40 units of output. what would you advise this firm to do?

Answers

It depends on the firm's cost structure and market demand. If the cost of production is lower than the market price, the firm should increase production. If the market price is lower than the cost of production, the firm should decrease production.

In exhibits 8-5, the firm's cost of production is not provided, so it is difficult to make a recommendation solely based on the information given. However, if the cost of production is lower than the market price, the firm should increase production to maximize profits. On the other hand, if the market price is lower than the cost of production, the firm should decrease production to avoid losses. It is also important to consider the market demand for the firm's product. If demand is high, increasing production may be advisable. If demand is low, decreasing production may be necessary to avoid excess inventory and potential losses. Ultimately, the firm must analyze its cost structure and market conditions to make the best decision for its financial health.

To know more about the firm visit:

https://brainly.com/question/31452774

#SPJ11

Which term refers to a market entry strategy involving two or more firms creating a new entity, allowing the partners to pool their resources for common goals?

Answers

The term that refers to a market entry strategy involving two or more firms creating a new entity is called a joint venture. In a joint venture, the partnering companies come together to form a separate entity that allows them to combine their resources, expertise, and market presence for common goals and objectives.

A joint venture can be advantageous for several reasons. First, it enables the partners to pool their financial, technological, and human resources, which can lead to increased efficiency and cost savings. Second, it allows the partners to leverage each other's expertise and knowledge, which can result in improved innovation and competitiveness. Lastly, a joint venture can provide access to new markets or distribution channels that may have been difficult to enter individually.

For example, let's say two automobile manufacturers decide to form a joint venture to develop and produce electric vehicles. By combining their resources and expertise, they can share the costs of research and development, manufacturing facilities, and marketing efforts. This collaboration can lead to the creation of high-quality electric vehicles and a stronger market presence in the electric vehicle industry.

In summary, a joint venture is a market entry strategy where multiple firms create a new entity to pool their resources for common goals and objectives. It offers various benefits, such as cost savings, improved innovation, and expanded market access.

Learn more about market entry strategy

https://brainly.com/question/32622033

#SPJ11

Q2: In 2006 the government of Philippines was running a large budget deficit. To correct this, it broadened its value added tax (VAT) base, increased the VAT rate and sought to reduce tax evasion (). It also cut back on government spending plans, including cancelling some road projects and some measures to reduce poverty (i!). These measures did reduce the budget deficit from 3% of GDP in 2006 to 1% of GDP in 2008. The government, however, was not successful in raising its economic growth rate from 4%. It was considering using both monetary and supply side policies in a bid to increase economic growth. Government spending in the Philippines usually forms more than a tenth of the country's aggregate demand but the government is keen to increase the proportion of investment in the country's aggregate demand. The table below shows some of the components of the Philippines' aggregate demand in 2008: Consumption 72% Exports 49% Government spending 12%

Imports 51% a. What is meant by a reduction in the budget deficit? b. What type of tax is value added tax? c. What impact will a cut in government spending have on aggregate demand? d. What percentage contribution did investment make to aggregate demand in 2008. e. Did the Philippines have a trade deficit or trade surplus in 2008? Explain your answer?

Answers

The government is either spending less, raising more revenue, or both, resulting in a smaller shortfall between what they spend and what they collect. Value Added Tax (VAT) is an indirect tax applied to the sale of goods and services. It is a consumption tax levied at each stage of production and distribution based on the value added at each stage. Reduced spending on projects and initiatives may lead to lower demand for goods and services, which can have a negative impact on overall economic activity. Investment made an 18% contribution to aggregate demand in 2008. This means that the country imported more goods and services than it exported, resulting in a negative net trade balance.

a. A reduction in the budget deficit means that the gap between government expenditures and government revenues has decreased. In other words, the government is either spending less, raising more revenue, or both, resulting in a smaller shortfall between what they spend and what they collect.

b. Value Added Tax (VAT) is an indirect tax applied to the sale of goods and services. It is a consumption tax levied at each stage of production and distribution based on the value added at each stage.

c. A cut in government spending will likely result in a decrease in aggregate demand, as government spending is a component of aggregate demand. Reduced spending on projects and initiatives may lead to lower demand for goods and services, which can have a negative impact on overall economic activity.

d. The percentage contribution of investment to aggregate demand in 2008 can be calculated by subtracting the other components from 100%. In this case, 100% - (72% + 49% + 12% - 51%) = 18%. Therefore, investment made an 18% contribution to aggregate demand in 2008.

e. To determine if the Philippines had a trade deficit or trade surplus in 2008, compare the value of exports and imports. In this case, exports were 49% while imports were 51%. Since imports exceed exports, the Philippines had a trade deficit in 2008. This means that the country imported more goods and services than it exported, resulting in a negative net trade balance.

Learn more about economic activity here:-

https://brainly.com/question/30266695

#SPJ11

Who may be affected by monetary penalties imposed by the Internal Revenue Service when a Tax Professional fails to meet due diligence requirements?

Answers

Answer:

Both the tax practioner and the assessee will be liable for penalties under IRS 6695(a)

Explanation:

When a tax preparer is paid to arrange the tax return of a client they must follow preparer due diligence laws.

This is the case when the preparer is trying to get a refund of earned income tax credit, child tax credit, American opportunity tax credit, or filing of head of household status.

The effect on the tax preparer's client include:

- refund of amounts collected in error because of wrong return

- a two year ban from claiming credits if error is due to recklessness

- a ten year ban if error is as a result of fraud

The consequences for the tax preparer includes:

- for each requirement not met a $500 penalty

- suspension from the IRS e-file

- a ban from tax preparations

- in cases of fraud criminal charges can be made

what do chapter competitions entail?

Answers

Answer:

Whoever reads the chapter of the book the fastest is crowned the chapter king. It can be very competitive, and the competitors have to be very good readers.

Answer:

In FBLA you pick a subject and you either take a test, do a presentation, do sales pitch, etc. With reading, you read a chapter from a book as fast as you can.

Explanation:

Which of the following will result in your paying the largest amount of interest to the credit card copany?Paying 20% of your credit card balance every monthMaking the minimum payment every monthPaying off your balance every monthSaying "credit" every time the cashier asks "Debit or Credit?"

Answers

Paying 20% of your credit card balance every month will result in your paying the largest amount of interest to the credit card company.

What is an credit card?Credit cards typically have a higher annual percentage rate (APR) compared to other consumer loans. Interest is ordinarily charged on any unpaid balances charged to the card around a month after a purchase is made, unless there is a 0% APR introductory offer in place for a specific amount of time after account opening. But there is no grace period for new charges if past due balances from a prior month were carried forward.

According to the law, credit card companies must give customers a grace period of at least 21 days before interest on purchases begins to accrue. As a result, it's always a good idea to pay off balances before the grace period expires.

Learn more about credit cards

https://brainly.com/question/27350251

#SPJ1