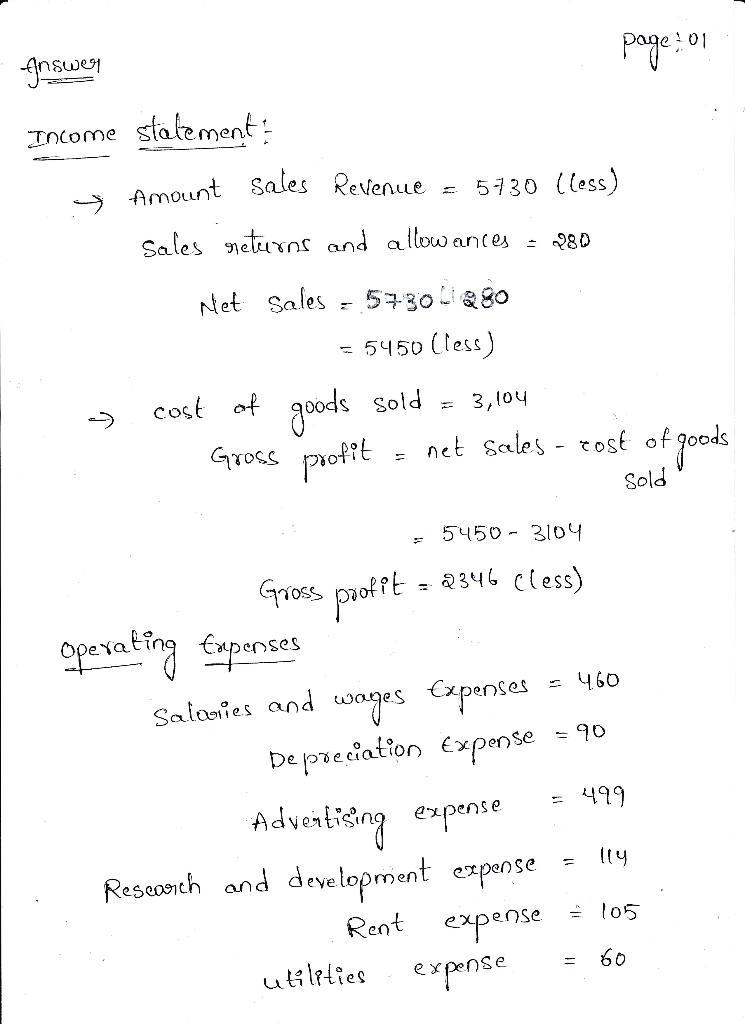

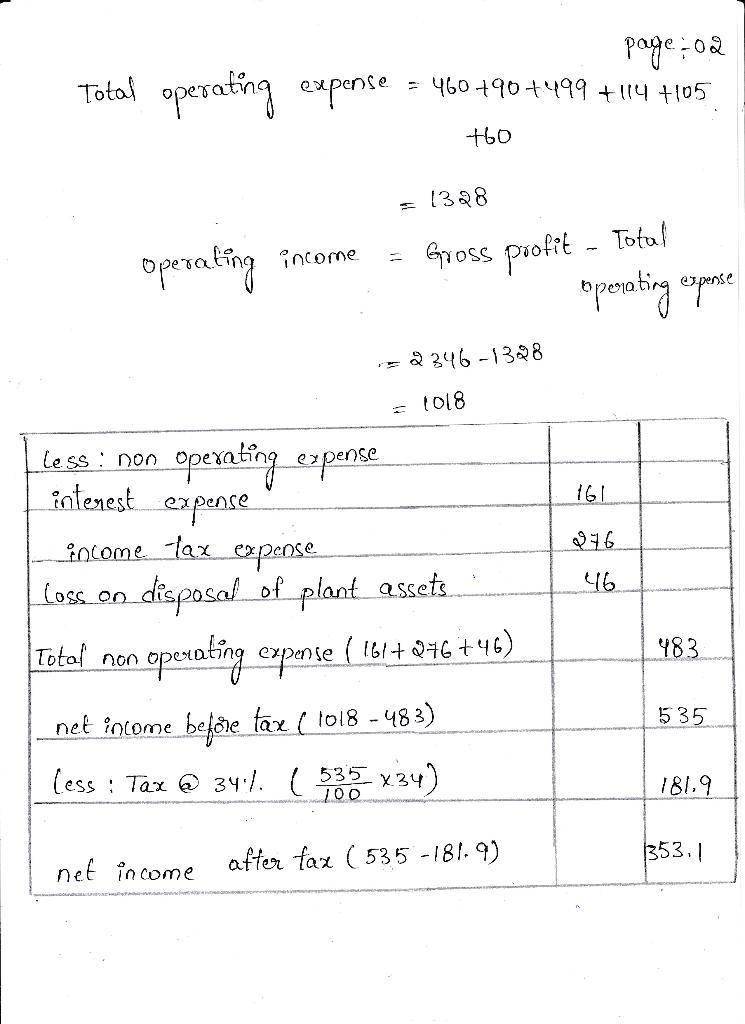

Suppose in its income statement for the year ended June 30, 2022, The Clorox Company reported the following condensed data (dollars in millions). Salaries and wages expenses $ 460 Research and development expense $ 114 Depreciation expense 90 Income tax expense 276 Sales revenue 5,730 Loss on disposal of plant assets 46 Interest expense 161 Cost of goods sold 3,104 Advertising expense 499 Rent expense 105 Sales returns and allowances 280 Utilities expense 60 Assume a tax rate of 34%.

Prepare a multiple-step income statement. (Round answers to 0 decimal places, e.g. 15,222.) The Clorox Company Income Statement (amounts in millions)

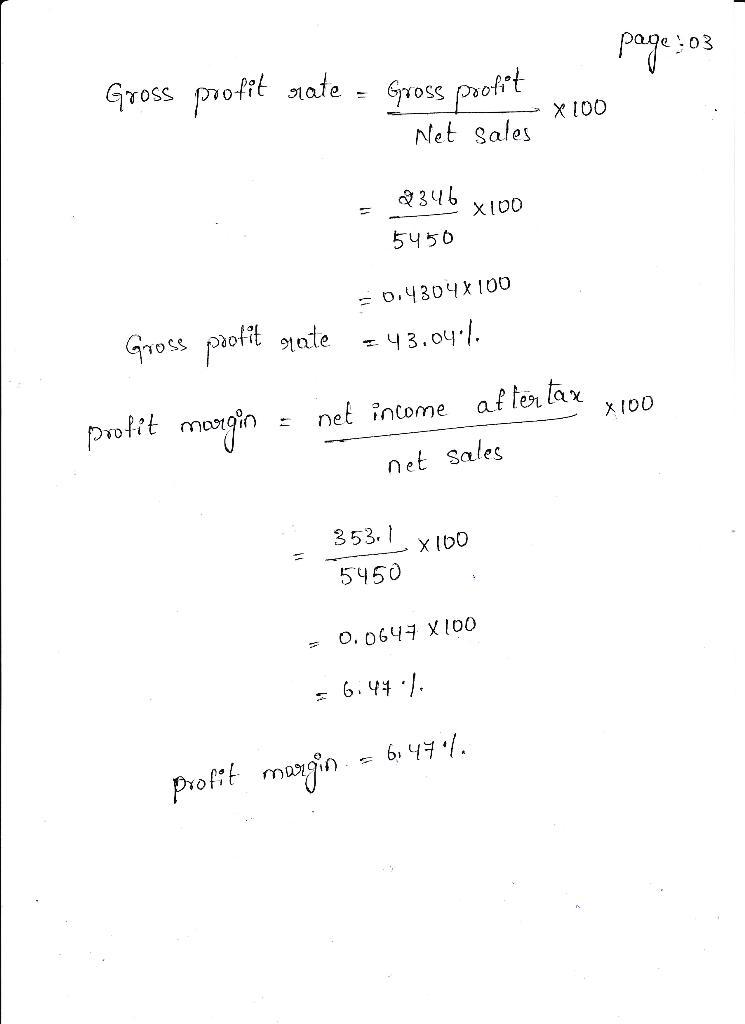

Calculate the gross profit rate and the profit margin. (Round answers to 1 decimal place, e.g. 15.2%.)

Gross profit rate________%

Profit margin ________%

Answers

Answer:

Gross profit rate = 43.04 %

Profit margin = 6.47 %

Explanation:

Find the given attachments

Related Questions

can someone please create your own business plan dictionary

Define each term. MAKE SURE that you use the correct business definition. For example, a stake in business means “a financial share in a business or an emotional investment in something” but a stake can also mean a “strong wooden or metal post with a point at one end, driven into the ground to support a tree, form part of a fence, act as a boundary mark, etc.,” or “a metalworker's small anvil, typically with a projection for fitting into a socket on a bench”.

Submit when you finish. DUE DATE: FRIDAY, MARCH 10

1. Break even

2. Business model

3. Customer acquisition costs 4. Distribution

5. Equity

6. Licensing

7. Liquidity

8. Margin

9. Market value

10. Patent

11. Patent pending

12. Proof of concept

13. Proprietary

14. Royalty

15. Stake

16. Sweat equity

17. Valuation

Answers

Answer:

1. Break even: The point at which a business's total revenue equals its total expenses, resulting in neither a profit nor a loss.

2. Business model: A plan or framework that outlines how a business will generate revenue and make a profit.

3. Customer acquisition costs: The cost associated with acquiring a new customer, including marketing and advertising expenses.

4. Distribution: The process of getting a product or service from the manufacturer or producer to the end consumer.

5. Equity: A financial share of ownership in a business or property.

6. Licensing: The process of granting permission to use or sell a product, service or intellectual property.

7. Liquidity: The ability of a business or individual to convert assets into cash quickly and easily.

8. Margin: The difference between a product or service's selling price and the cost of producing or providing it.

9. Market value: The price at which a product or service is currently being sold in the market.

10. Patent: A legal document that grants the holder exclusive rights to produce, use, and sell an invention or idea for a certain period of time.

11. Patent pending: The status of an invention or idea that has been submitted for a patent but has not yet been approved.

12. Proof of concept: A demonstration that a product or service is viable and can be successful in the market.

13. Proprietary: A product or service that is owned and controlled by a single company or individual.

14. Royalty: A payment made by one party to another for the use of a product, service or intellectual property.

15. Stake: A financial share in a business or an emotional investment in something.

16. Sweat equity: The value of the time and effort put into a business or project by its owner or founders, often in lieu of financial investment.

17. Valuation: The process of determining the worth of a business or asset, often used in the context of selling or acquiring a business.

What’s the maximum number of conditions that can be set for a bank rule?

Answers

The maximum number of conditions that can be set for a bank rule is 5.

What is a bank rule?A bank rule is one that has been set up by the bank that will be followed in that branch. This could be with the relation of the payment, cheques, deposits, or bank charges.

There can be various numbers of charges that can be set by the bank. The central bank will be the one that will set the rate or will decrease the rate of the changes. This was to impact the bank.

As different banks may have different types of rules as well as regulations that they will use to help form the rules but the maximum number will be five.

Learn more about bank rules, Here:

https://brainly.com/question/30011538

#SPJ1

Allocative efficiency occurs:

a. Anywhere inside or on the production possibilities frontier.

b. When the total cost of production is minimized

c. At all points on the production possibilities frontier.

d. At only one point on the production possibilities frontier.

e. At the points where the production possibilities frontier crosses the horizontal or vertical axis.

Answers

Answer:

a. Anywhere inside or on the production possibilities frontier.

Explanation:

In an economy, the allocative efficiency may be defined as the economic state where the production of various goods or services is aligned with the preferences with the consumers.

The allocative efficiency always materializes at the intersection of the supply curves and the demand curves.

On the \(\text{equilibrium point,}\) the price for a supply \(\text{exactly matches}\) with the demand for the product \(\text{for that supply}\) at that price, and thus all the products are sold.

It occurs anywhere on the production possibilities frontier or on the inside of the frontier.

Therefore, the correct option is (a).

A pizza parlor located on campus offers a student rate for its pizza lunch special. this is a form of ______

Answers

On-campus students can get a discount on the pizza lunch special at a local pizzeria. Price discrimination takes the form of this.

Price discrimination is a marketing tactic where sellers charge customers different prices for the same good or service depending on what they believe will win the customer over. A seller who practices pure price discrimination will impose the highest price possible on each discount customer. The more typical types of price discrimination involve the seller classifying customers into groups according to certain characteristics and charging each group a different price.

Price discrimination is used when a seller thinks they can charge a particular group of customers more or less depending on their values for the product or service in question or on certain demographics.

When there is a greater profit to be made from separating the markets than there would be from keeping them combined, Price discrimination is most advantageous. Depending on the relative elasticities of demand in the submarkets, price discrimination may or may not be effective, as well as how long different groups are willing to pay different prices for discount the same product. A relatively inelastic submarket's consumers pay a higher price, while a relatively elastic submarket's consumers pay a lower price.

Learn more about Price discrimination here

https://brainly.com/question/15727380

#SPJ4

Which are examples of job interview do's? Choose 4 answers.

Question 1 options:

Send the interviewer a thank you letter 2-3 days after the interview.

Brag about yourself.

Always ask questions.

Practice answering interview questions before the interview.

The first and last words should be those of gratitude.

Answers

Answer:

Send the interviewer a thank you letter 2-3 days after the interview.

Always ask questions.

Practice answering interview questions before the interview.

The first and last words should be those of gratitude.

Answer:

Send the interviewer a thank you letter 2-3 days after the interview.

Always ask questions.

Practice answering interview questions before the interview.

The first and last words should be those of gratitude.

Explanation:

Demonstrating the proper way to shake hands is an example of which choice?

a. teamwork

b. workplace etiquette

c. employee performance

d. work ethics

Answers

Answer:

A. Teamwork

Explanation:

when you do something right as a team you handshake as a thank you for helping me.

Answer:

employee performance

Explanation:

took the test

Solutions Company - Unadjusted Trial Balance as of December 31.

Account Titles

Unadjusted Trial Balance Dr. Unadjusted Trial Balance Cr.

100: Cash 20,000

110: Accounts Receivable 0

120: Supplies 7,600

160: Machinery 50,000

161: Accumulated Depreciation 20,000

200: Accounts Payable 0

205: Interest Payable 0

210: Wages Payable 0

230: Unearned Rental Fees 7,200

240: Note Payable 30,000

300: Common Stock 10,000

310: Dividends 9,500

320: Retained Earnings 14,200

400: Rental Fees 32,450

600: Wage Expense 24,500

610: Interest Expense 2,250

620: Supplies Expense 0

630: Depreciation Expense 0

113,850 113,850

Totals

Requirement:

Prepare year-end adjusting journal entries for each of these separate situations.

As of December 31, employees had earned $400 of unpaid and unrecorded wages. The next payday is January 4 at which time $1,200 in wages will be paid.

The cost of supplies still available at December 31 is $3,450.

The notes payable requires an interest payment to be made every three months. The next payment occurs after the new year begins. The amount of unrecorded accrued interest at December 31 is $800.

Analysis of the unearned rental fees shows that $3,200 remains unearned at December 31.

In addition to the machinery rental fees included in the revenue account balance, the company has earned another $2,450 in unrecorded fee that will be collected on January 31 of next year.

Depreciation expense for the year is $3,800.

Answers

The Preparing Adjusted Trial Balance with the help of Worksheet: is given below:

The Adjusted Trial BalanceSolutions Company

Worksheet

December 31

Accounts Unadjusted Trial Balance Adjusting Entries Adjusted Trial Balance

Debit Credit Debit Credit Debit Credit

Cash $20,000 $20,000

Accounts Receivable 0 $2,450 2,450

Supplies 7,600 $4,150 3,450

Machinery 50,000 50,000

Accumulated Depreciation $20,000 3,800 $23,800

Accounts Payable 0 0

Interest Payable 0 800 800

Salaries Payable 0 400 400

Unearned Rental Fees 7,200 4,000 3,200

Note Payable 30,000 30,000

Common Stock 10,000 10,000

Dividends 9,500 9,500

Retained Earnings 14,200 14,200

Rental Fees 32,450 6,450 38,900

Salaries Expense 24,500 400 24,900

Interest Expense 2,250 800 3,050

Supplies Expense 0 4,150 4,150

Depreciation Expense 0 3,800 3,800

Totals $113,850 $113,850 $15,600 $15,600 $121,300 $121,300

Preparing Income Statement:-

Solutions Company

Income Statement

For the Year Ended December 31

Accounts Amount Amount

Revenue:-

Rental Fees $38,900

Total Revenue $38,900

Expenses:-

Salaries Expense $24,900

Interest Expense 3,050

Supplies Expense 4,150

Depreciation Expense 3,800

Total Expenses ($35,900)

Net Income $3,000

Preparing Statement of Retained Earnings:-

Solutions Company

Statement of Retained Earnings

For the Year Ended December 31

Accounts Amount

Retained Earnings 14,200

Net Income 3,000

$17,200

Dividends (9,500)

Retained Earnings, Ending $7,700

Preparing Balance Sheet:-

Solutions Company

Balance Sheet

December 31

Accounts Amount Amount

Assets:-

Cash $20,000

Accounts Receivable 2,450

Supplies 3,450

Machinery 50,000

Accumulated Depreciation (23,800)

Total Assets $52,100

Liabilities:-

Accounts Payable $0

Interest Payable 800

Salaries Payable 400

Unearned Rental Fees 3,200

Note Payable 30,000

Total Liabilities $34,400

Stockholders Equity:-

Common Stock $10,000

Retained Earnings, Ending 7,700

Total Stockholders Equity $17,700

Total Liabilities and Stockholders Equity $52,100

Preparing Closing Entries:-

Solutions Company

General Journal

December 31

Date Accounts Title and Explanation Debit Credit

December 31 Rental Fees $38,900

Income Summary $38,900

(To close Revenue Account)

December 31 Income Summary $35,900

Salaries Expense $24,900

Interest Expense $3,050

Supplies Expense $4,150

Depreciation Expense $3,800

(To close Expenses Accounts)

December 31 Income Summary $3,000

Retained Earnings $3,000

(To close Income Summary)

December 31 Retained Earnings $9,500

Dividends $9,500

(To close Dividends Account)

Read more about Adjusted Trial Balance here:

https://brainly.com/question/14476257

#SPJ1

which paragragh of the purchase agreement states that the balance of the purchase price will be deposited into escrow prior to closing

Answers

The paragraph in purchase agreement that states that the balance of the purchase price will be deposited into escrow prior to closing is typically found in section on "Closing and Payment."

What is a purchase agreement?A purchase agreement is a legally binding document that outlines the terms and conditions of a sale between a buyer and a seller. It typically includes details such as the purchase price, payment terms, delivery or shipping arrangements, warranties, representations and warranties of the seller, and any other relevant information related to the transaction. The purchase agreement is designed to protect both parties by ensuring that they understand their rights and obligations and that the transaction proceeds smoothly. Once both parties have signed the agreement, it becomes a legally binding contract and both parties are obligated to fulfill their respective obligations as specified in the agreement.

To learn more about purchase agreement, visit:

https://brainly.com/question/30302643

#SPJ1

What is the main reason why a boycott might not be successful?

A. Many consumers won't stay away from a company that offers the

lowest prices.

B. The news media often refuses to cover boycotts for fear of driving

away advertisers.

C. Companies will only change their ways if their sales and profits

are affected

D. The company is able to spend more money lobbying the

government

Answers

Answer:

A

Explanation:

cause i searched it and i believe it ryt hope it helpful enough

Answer:

The correct answer is A) Many consumers won't stay away from a company that offers the lowest prices.

Explanation:

Verified by correct test results.

6. Suppose that the consensus forecast of security analysts of your favorite company is that earnings next year will be $5.00 per share. The company plows back 50% of its earnings and if the Chief Financial Officer (CFO) estimates that the company's return on equity (ROE) is 16%. Assuming the plowback ratio and the ROE are expected to remain constant forever: Suppose that you are confident that 10% is the required rate of return on the stock. What does the market price of $50.00 per share imply about the market's estimate of the company's expected return on equity? (please give a number) 1 point

Answers

10.0000%, market price of $50.00 per share imply about the market's estimate of the company's expected return on equity.

The given amount is;

The market price of $50.00 per share.The company's expected return on equity is 10%.ROE x blowback ratio16.0000% x 50.0000%8.0000%Because the needed rate of return to the stock is 10%, the market's assessment of the company's expected return on equity is greater than that derived using the plowback ratio and the ROE.

As a result, the significance of the market price of $50.00 per share imply about the market's estimate of the company's expected return on equity are the aforementioned.

Learn more about on market price, here:

https://brainly.com/question/31964955

#SPJ1

The change in technology and the globalization have brought new pattern of organizing

today's companies, and thus, the managers need to consider these new concepts in

organization's design process. With this statement, discuss the emerging issues in

organization design and architecture.

Answers

Following are the emerging issues in organization design and architecture:Technology and Globalization, Customer Relations,Technical Knowledge, Flexibility, Employee's Well-being.

Following are the emerging issues in organization design and architecture:

Technology and Globalization: The modern era's rapid technology and globalization have forced the organizations to adopt a new pattern of organizing. Managers are focusing more on technology and globalization and they are ensuring that the company can cope with the emerging challenges.Customer Relations: Customers are the major driving force in every business. To maintain the customer base, the managers need to focus on customer relations as the organization's design process should be centered around their needs. This will help the managers in creating a company that provides excellent customer service to its customers.Technical Knowledge: The success of an organization depends on the technical knowledge of its managers. Managers need to have knowledge about new and emerging technologies so that they can use them to enhance the organization's capabilities. In addition, managers need to know how to apply this technical knowledge to improve the organization's structure and operations.Flexibility: Flexibility is a crucial component in the organization's design process. The managers need to design the organization that is flexible enough to adapt to new changes and technologies. This will help the managers in keeping up with the rapidly changing business environment.Employee's Well-being: The well-being of employees is also a significant issue in the organization's design process. The managers need to design the organization in a way that the employees can work efficiently, and their personal needs are also met. This will help in improving the employee's productivity and motivation level and ensure their loyalty to the organization.For more such questions on Globalization

https://brainly.com/question/9761659

#SPJ8

If a person buys goods from a minor, he/she holds only voidable title to

those goods. *

True

False

Answers

Answer:

True

Explanation:

how to use standard deviation, I don't really understand how to calculate and use the formula, someone can please give me an example with formula it would be great thank you so much.

Answers

The market value of a multinational company falls from 46 billion us dollars to 5 billion us dollars in just three years .the annual average depreciation in the company value is closest to 45%.find the market value of the company in one year

Answers

Answer:

The market value of the company after one year could be calculated by taking the difference between the initial and final value, and then dividing it by the number of years. In this case, the difference is 41 billion US dollars and the number of years is three. Dividing 41 by 3 gives 13.66667 billion US dollars per year, which would be the annual average depreciation in the company value. The market value of the company after one year would then be 46 billion US dollars - 13.66667 billion US dollars = 32.33333 billion US dollars.

Which of the following incentives 1/15, net 30, 2/10 net 60 or 1/10 net 90, if any of these, is not likely to be a significant incentive to the customer to pay promptly? Explain your answer. Refer to the information provided in Chapter 7 of your text for clarification on what these incentives mean.

Answers

The incentive that would encourage customers to pay promptly is 2/10 net 60.

Which incentive would be best ?The meaning of the incentive of 2/10 net 60 is that the customer will get a 2 % discount if they pay in 10 days and if they don't then they will have to pay back what they owe in full, in 60 days.

This incentive will be the most significant in convincing customers to pay promptly because a payment in 10 days would reduce what they have to pay in total.

Find out more on incentives at https://brainly.com/question/15877568

#SPJ1

Which step follows the marketing mix step in the process of marketing management?

ОА

market research

ОВ.

market monitoring

OC marketing mix

OD. product development

OE identifying target markets

Answers

Answer:

market monitoring

Explanation:

After the marketing mix step, Implementation, monitoring, and control follows. The strategic marketing process is a continuous effort. Management should always be on the look for places to improve and enhance the plan. Market monitoring assists in pointing out specific opportunities for improvement.

Market monitoring requires the management to keep looking at the set goals and objectives to determine if the marketing process is heading in the right direction.

Other than culture, what other organizational factors should be used to determine which project structure should be used?

Answers

Answer:

The two major considerations are the percentage of core work that involves projects and resource availability.

_________ Refers procedures that connect to the work activities of the different work divisions or units of the firm in order to achieve its overall goal

Answers

Answer:

Organizing

Explanation:

Organizing involves coordinating and allocating a firm's resources so that the firm can carry out its plans and achieve its goals. This organizing, or structuring, process is accomplished by: Determining work activities and dividing up tasks (division of labor) Grouping jobs and employees (departmentalization

A three-year annuity-immediate will be issued a year from now with annual payments of 5,000. Using the forward rates, calculate the present value of this annuity a year from now.

Answers

Answer:

13,152.5

Explanation:

Given the the above parameters as mentioned in the question

To calculate the PV (Present Value)

We have PV = 5000 * 1.05 * [ 1/(1.0575)² + 1/(0.625)³ + 1/(1.065)⁴]

PV = 5000 * 1.05 * (0.8942094350 + 0.8337064929 + 0.7773230908) =

=> PV = 5000 * 1.05 * 2.5052390187

= 13,152.50

Therefore, in this case, using the forward rates, the present value of this annuity a year from now is 13,152.50

Heritage, Inc., had a cost of goods sold of $44,721. At the end of the year, the accounts payable balance was $8,253. How long on average did it take the company to pay off its suppliers during the year

Answers

Answer:

Account payable days = 67.36 days

Explanation:

The payable days is the average length of time it takes a business to settle its account payable. It is calculated as thus;

Account payable days = Average account payable / Cost of goods sold × 365

Account payable = $8,253/44,721 × 365

Account payable = 67.36

Therefore, it will take Heritage about 67.36 days to settle its account payable

M Corp. has an employee benefit plan for compensated absences that gives each employee 15 paid vacation days. Vacation days can be carried over indefinitely. Employees can elect to receive payment in lieu of vacation days. At December 31, 2021, M's unadjusted balance of liability for compensated absences was $28,200. M estimated that there were 200 total vacation days available at December 31, 2021. M's employees earn an average of $141 per day. In its December 31, 2021, balance sheet, what amount of liability for compensated absences is M required to report

Answers

Answer:

$28,200

Explanation:

M Corp. benefit plan provides employees 15 paid vacation days and M estimated that there were 200 total vacation days and each employee can earn $141 per day. The amount of liability for compensated absences can be calculated by multiplying the number of total vacation days with the wage per day

Liability = no. of days x wage per day

Liability = 200 days x $141

Liability = $28,200

You have been hired as a consultant to the central bank for a country that has for many years suffered from repeated currency crises and depends heavily on the U.S. financial and product markets. Which of the following policies would have the greatest effectiveness for reducing currency volatility of the client country with the United States? an exchange rate pegged to the U.S. dollar an internationally floating exchange rate an exchange rate with a fixed price per ounce of gold dollarization

Answers

Answer: dollarization

Explanation:

Of the following policies given in the question, the one that would have the greatest effectiveness for reducing currency volatility of the client country with the United States is dollarization.

Dollarization occurs when a country recognizes the dollar as a legal tender or medium of exchange in place of the domestic currency of a particular country.

It should be noted that dollarization occurs due to instability of the local currency which has resulted into its loss of usefulness to function well as a medium of exchange.

Hale’s TV Productions is considering producing a pilot for a comedy series in the hope of selling it to a major television network. The network may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Hale may either produce the pilot and wait for the network’s decision or transfer the rights for the pilot and series to a competitor for $100,000. Hale’s decision alternatives and profits (in thousands of dollars) are as follows:

State of Nature

Decision Alternative

Reject, s1

1 Year, s2

2 Years, s3

Produce pilot, d1

-100

50

150

Sell to competitor, d2

100

100

100

The probabilities for the states of nature are P(s1) = 0.20, P(s2) = 0.30, and P(s3) = 0.50. For a consulting fee of $5000, an agency will review the plans for the comedy series and indicate the overall chances of a favorable network reaction to the series. Assume that the agency review will result in a favorable (F) or an unfavorable (U) review and that the following probabilities are relevant:

P(F) = 0.69

P(s1 | F) = 0.09

P(s1 | U) = 0.45

P(U) = 0.31

P(s2 | F) = 0.26

P(s2 | U) = 0.39

P(s3 | F) = 0.65

P(s3 | U) = 0.16

Construct a decision tree for this problem.

What is the recommended decision if the agency opinion is not used? What is the expected value?

Answers

Answer:

To construct the decision tree, we can follow these steps:

1. Start with the initial decision nodes representing the two decision alternatives: "Produce pilot" (d1) and "Sell to competitor" (d2).

2. Assign the payoffs for each decision alternative under each state of nature.

3. Add chance nodes for each state of nature and connect them to the corresponding decision alternatives.

4. Assign the probabilities of each state of nature at the chance nodes.

5. Calculate the expected payoffs at each chance node by multiplying the payoffs with their respective probabilities and summing them up.

6. Determine the optimal decision by comparing the expected payoffs at the initial decision nodes.

Here is the decision tree for this problem:

| Produce pilot (d1)

| -100

|____________

/|\

/ | \

/ | \

/ | \

P(F) = 0.69 / | \ P(U) = 0.31

/ | \

/ | \

/ | \

/ | \

s1 / | \ s2

/ | \

/ | \

/ | \

/ | \

/ | \

50 | F U F | 100

| |

| |

| |

| s3 | s3

| |

150| F | 100

|_______________________________|

If the agency opinion is not used, the recommended decision would be to produce the pilot (d1) since it has a higher expected value compared to selling to the competitor (d2).

To calculate the expected value:

Expected value (d1) = (-100 * P(s1 | F) * P(F)) + (50 * P(s2 | F) * P(F)) + (150 * P(s3 | F) * P(F))

= (-100 * 0.09 * 0.69) + (50 * 0.26 * 0.69) + (150 * 0.65 * 0.69)

= -6.93 + 8.97 + 66.88

= 68.92

Expected value (d2) = (100 * P(s1 | U) * P(U)) + (100 * P(s2 | U) * P(U)) + (100 * P(s3 | U) * P(U))

= (100 * 0.45 * 0.31) + (100 * 0.39 * 0.31) + (100 * 0.16 * 0.31)

= 13.95 + 12.09 + 4.96

= 30

Comparing the expected values, the recommended decision is to produce the pilot (d1) with an expected value of 68.92.

Novak Corp. had the following account balances at year-end: Cost of Goods Sold $61,200; Inventory $14,550; Operating Expenses $29,960; Sales Revenue $120,310; Sales Discounts $1,080; and Sales Returns and Allowances $1,750. A physical count of inventory determines that merchandise inventory on hand is $12,180.

Prepare the adjusting entry necessary as a result of the physical count. prepare closing entries???

Answers

1. The preparation of the adjusting journal entry as a result of the physical count for Novak Corp. at the year-end is as follows:

Adjusting Journal Entry:Debit Cost of goods sold $2,370

Credit Inventory $2,370

To adjust the ending inventory value based on the physical count.2. The preparation of the closing journal entries for Novak Corp. is as follows:

Closing Journal Entries:Debit Income Summary $93,530

Credit Cost of goods sold $63,570 ($61,200 + $2,370)

Credit Operating Expenses $29,960

To close the adjusted cost of goods sold and operating expenses to the income summary.Debit Net Revenue $117,480

Credit Income Summary $117,480

To close the net revenue to the income summary.Debit Income Summary $23,950

Credit Retained Earnings $23,950

To close the income summary to the retained earnings.What are the closing entries?The closing entries are used to close the temporary accounts to the income summary in order to determine the net income or loss. The closing entries include the following four journal entries:

Closing revenues to income summaryClosing expenses to income summaryClosing income summary to retained earningsClosing dividends to retained earnings.Data and Adjustment Analysis:Cost of Goods Sold $61,200

Inventory $14,550

Operating Expenses $29,960

Sales Revenue $120,310

Sales Discounts $1,080

Sales Returns and Allowances $1,750

Physical count of inventory = $12,180

Overstatement of ending inventory based on physical count = $2,370 ($14,550 - $12,180).

Net Sales Revenue = $117,480 ($120,310 - $1,080 - $1,750)

Adjustment:Cost of goods sold $2,370 Inventory $2,370

Closing Entries:Income Summary $93,530 Cost of goods sold $63,570 ($61,200 + $2,370) Operating Expenses $29,960

Net Revenue $117,480 Income Summary $117,480

Income Summary $23,950 Retained Earnings $23,950

Learn more about closing entries at https://brainly.com/question/26558576

1. Income Tax Payable

Answers

Answer:

Income Tax Payable is the amount of tax that the company owes, and that it plans to pay within the next year. Income Tax Payable is shown under the current liabilities section of the Balance Sheet.

Tax liabilities that are planned to be paid in more than a year are listed in a separate account under the Long-Term Liabilities section of the Balance Sheet.

A transportation app developer knows that the commute times for a specific route follow an approximately normal distribution with a mean of 30 minutes and a standard deviation of 6 minutes. Using the norm.dist() function in excel, the developer has calculated the following probabilities for specific commute times. Probability Calculations P (Commute < 16.04) = 0.01 P (Commute < 20) = 0.048 P (Commute < 20.13) = 0.05 P (Commute < 25) = 0.202 P (Commute < 35) = 0.798 P (Commute < 39.87) = 0.95 P (Commute < 40) = 0.952 P (Commute < 43.96) = 0.99 9. What is the probability that a commute is between 25 and 40 minutes? 10. Name the two values (don’t round), equidistant from the mean of 30 minutes, such that 90% of all commute times are between these values?

Answers

9. Probability (between 25 and 40 minutes) = 0.75.

10. Two values are 18.3 minutes (lower value), and 41.7 minutes (upper value)

For the probability that a commute is between 25 and 40 minutes, calculate the difference between the cumulative probabilities of the upper and lower bounds.

P(25 < Commute < 40) = P(Commute < 40) - P(Commute < 25)

Using the given probability values:

P(25 < Commute < 40) = 0.952 - 0.202

P(25 < Commute < 40) = 0.75

Therefore, the probability that a commute is between 25 and 40 minutes is 0.75.

10. To find the two values equidistant from the mean of 30 minutes such that 90% of all commute times are between these values, calculate the corresponding z-scores.

Since the data follows an approximately normal distribution, use the z-score formula:

z = (x - μ) / σ

Where:

z is the z-score

x is the value

μ is the mean

σ is the standard deviation

To find the z-scores corresponding to the cumulative probabilities, use the norm.inv() function in Excel.

The z-score for the lower value, which corresponds to the 5th percentile (0.05 cumulative probability), is given by:

z1 = norm.inv(0.05, 0, 1)

The z-score for the upper value, which corresponds to the 95th percentile (0.95 cumulative probability), is given by:

z2 = norm.inv(0.95, 0, 1)

Now, find the corresponding commute times by rearranging the z-score formula:

x = z * σ + μ

Using the given mean (μ = 30) and standard deviation (σ = 6):

For the lower value:

x1 = z1 * σ + μ

For the upper value:

x2 = z2 * σ + μ

Calculating the values:

For the lower value:

x1 = norm.inv(0.05, 30, 6) ≈ 18.3 minutes

For the upper value:

x2 = norm.inv(0.95, 30, 6) ≈ 41.7 minutes

Therefore, the two values (without rounding) equidistant from the mean such that 90% of all commute times are between them are 18.3 minutes & 41.7 minutes

Learn more about Probability here:

https://brainly.com/question/32117953

#SPJ1

Solutions for lack of accurate and timely information?

Solutions for information overload?

Answers

Information overload is a rising issue for organisations all over the world, and improving employee experience is a top concern for the majority of them. The problem is that, despite the fact that information overload is a well-known issue, it appears that most firms have yet to find effective methods to address it, which is rather concerning.

Information overload in the workplace refers to the large volume of irrelevant information that circulates among employees. In today's job, it is difficult to prevent information overload. Most businesses, from start-ups to huge corporations, are experiencing information overload.

It is also critical to deliver correct and timely information. People and organizations will make poor judgements in the absence of accurate, reliable, and timely information.

To learn more on information overload, here:

https://brainly.com/question/18513627

#SPJ1

Cabinaire Inc. is one of the largest manufacturers of office furniture in the United States. In Grand Rapids, Michigan, it assembles filing cabinets in an Assembly Department. Assume the following information for the Assembly Department:

Direct labor per filing cabinet 30 minutes

Supervisor salaries $117,000 per month

Depreciation $32,000 per month

Direct labor rate $12 per hour

Prepare a flexible budget for 70,000, 80,000, and 90,000 filing cabinets for the month ending February 28 in the Assembly Department.

Answers

Answer:

For 70,000 just add 117,000 and 32,000.Convert 12$ into Naira,multiply it with 70,000 and divide the result by 30

For 80,000 just add 117,000 and 32,000.Convert 12$ into Naira,multiply it with 80,000 and divide the result by 30

For 90,000 just add 117,000 and 32,000.Convert 12$ into Naira,multiply it with 90,000 and divide the result by 30

Which statement describes a surplus in a market?

Answers

Answer:

A surplus describes a level of an asset that exceeds the portion used. An inventory surplus occurs when products remain unsold.Budgetary surpluses occur when income earned exceeds expenses paid.A surplus results from a disconnect between supply and demand for a product, or when some people are willing to pay more for a product than other consumers. A surplus causes a market disequilibrium in the supply and demand of a product.Learn more about it

https://brainly.in/question/4285458

Answer: a

Explanation:

1. Some businesspeople believe that elimination agents and wholesalers reduce their operating expenses. Discuss the opportunity costs associated with eliminating intermediaries.

Answers

1. While eliminating intermediaries may result in reduced operating expenses, businesses need to weigh these savings against the associated opportunity costs. These costs may include the loss of expertise and value-added services, additional responsibilities and expenses, and reduced customer access to products.

Eliminating intermediaries such as elimination agents and wholesalers reduce operating expenses, but it also has associated opportunity costs that businesses need to consider. One of the primary costs is the loss of the expertise and value-added services that intermediaries offer to businesses and customers. Eliminating intermediaries may result in businesses taking on additional responsibilities and expenses such as marketing, distribution, and logistics.

This may result in the need for additional staff and resources to ensure that products reach customers on time. Furthermore, eliminating intermediaries may also result in reduced customer access to products, as intermediaries are often responsible for finding new markets and customer segments. In this case, businesses may need to invest additional resources to market and promote their products to reach new customers.

In conclusion, while eliminating intermediaries may result in reduced operating expenses, businesses need to weigh these savings against the associated opportunity costs. These costs may include the loss of expertise and value-added services, additional responsibilities and expenses, and reduced customer access to products.

For more such questions on opportunity costs

https://brainly.com/question/30191275

#SPJ8