profitability ratios are prepared by company employees for internal use only. this statement is:______.

Answers

Profitability ratios are prepared by company employees for internal use only. This statement is True.

What is the profitability ratio?

Profitability ratios are a class of financial statistics that assess a company's ability to produce profits in relation to its revenue, operational costs, balance sheet assets, or shareholders' equity over time using information at a single point in time.

How are profitability ratios determined?

Ratios of profitability

Net income minus the average total assets equals return on assets. The return-on-assets ratio shows how profitable a company is in relation to its assets.

Net income minus average shareholder equity is return on equity. This ratio displays the return on shareholder investments for your company.

Profitability ratios are used by who?

Profitability ratios are one crucial statistic that investors, bankers, and business owners use to assess the viability and health of a company as well as the effectiveness of its operations.

To know more about Profitability ratios visit:

https://brainly.com/question/28392733

#SPJ4

Related Questions

what are the three elements of the marketing concept?

Answers

Answer:

customer orientation; an organization to implement a customer orientation; long-range customer and societal welfare

Explanation:

Answer:

Product , service, and price

Explanation:

you'll need good products and good customer service to have a good business, the price ranges have to be good, not too cheap/expensive.

Which economic effect does a central bank hope to achieve by buying back large amounts of treasury security

Answers

A. It hopes to reduce the amount of money available for lending.

Explanation:

Usually, the central bank(Federal reserve) control the supply of money in circulation in the economy so that the nation's economy would be healthy. One of the ways through which the federal reserve controls the quantity of money in circulation is by selling or purchasing of government securities through a process known as open market operation.

If the federal reserve sells government securities such as treasury bills, in large quantities, its aim is to reduce the amount or quantity of money available to commercial banks for lending, hence mop up the quantity of money in circulation.

Also, if the federal reserve buys government securities, its aim is to make more money available in large quantities to commercial banks and other institutions, hence have more cash to lend people.

The economic effect that central bank are trying to effect by the process of buying back large amounts of treasury security is bring reduction to amount of money available for lending.

Treasury notes as well as bonds are securities that brings about payment of fixed rate of interest which is usually done every six months till the security reach a stage of maturity.The central bank do buy large amounts of treasury security so that the money that can be available for lending can be reduced.Therefore, this process are put in place to balance the economy.

Learn more at:

https://brainly.com/question/15004115?referrer=searchResults

Name the choreographic element that encourages dancers to rely on musical cues, visual connections, and emotional phrasing.

Answers

The choreographic element that encourages dancers to rely on musical cues, visual connections, and emotional phrasing includes the time, energy, and space

What is the meaning of Choreography?In art, a choreography means the way in which an idea is expressed physically through dance. When developing this concept, the users usually relies on important principles of organization to ensure that the idea takes a clear, appropriate, and aesthetically pleasing form.

These are principles that comprises the basic ingredients for the dancers' movements and patterns and help the choreographer utilize space, express intention and the music, and organize the dancers.

Read more about Choreography

brainly.com/question/1384028

#SPJ1

A financial institution that accepts deposits makes loans and provides other services as a nonprofit organization is called a:

A. Credit Union

B. Retail Bank

C. Title Pawn Lender

D. Payday Lender

Answers

Credit Unions are nonprofit financial institutions that accept deposits, provide loans, and offer other services. As a result, choice (A) is right.

What is meant by a nonprofit organization?A nonprofit organization (NPO) or non-profit organization is a legal entity organized and operated for a collective, public, or social benefit, as opposed to an entity that operates as a business with the goal of making a profit for its owners. It is also referred to as a non-business entity,[1] or nonprofit institution,

The non-distribution constraint applies to nonprofit organizations, which means that any surplus funds must be used to further their mission rather than being distributed to other parties.

A wide range of organizations, including certain political organizations, schools, business organisations, churches, social clubs, and consumer cooperatives, are nonprofit. Governments may grant tax-exempt status to nonprofit organizations, and some may be eligible for tax-deductible donations. However, an organization can establish as a nonprofit organization without obtaining tax-exempt status.

Learn more about nonprofit organization, from :

brainly.com/question/25230172

#SPJ7

A corporation's annual report shows that the reported net income before tax is falling at a faster rate than operating income. Which of the following expenses must have grown at a faster rate?

A. Depreciation

B. Bond Interest

C. Preferred Dividend

D. Cost of Goods Sold

Answers

A corporation's annual report shows that the reported net income before tax is falling at a faster rate than operating income. The expense which must have grown at a faster rate is Cost of Goods Sold. The correct answer is option d.

Cost of Goods Sold (COGS) is the cost of producing a good or service. The cost of goods sold is a component of a company's total gross revenue. The expenses of COGS are inclusive of raw material purchases and the direct labor costs needed to produce a product.

The cost of goods sold can be calculated using the following formula:

COGS = Beginning Inventory + Purchases - Ending Inventory

The cost of goods sold must be accounted for on a company's income statement. COGS is used to calculate a company's gross profit margin. A firm's gross profit margin is calculated by subtracting the cost of goods sold from the total revenue of the firm. Gross profit margin shows how much of a firm's sales revenue is available to cover fixed expenses and generate a net profit.

Learn more about Cost of Goods Sold (COGS) here: https://brainly.com/question/24561653

#SPJ11

Which method of corporate finance is predominately used by "GROWTH companies"?

A-retained earnings

B-new stock issues

C-borrowing

D-none of these are used by “growth companies"

Answers

Answer:

The method of corporate finance that is predominately used by "GROWTH companies" is B: "new stock issues."

Explanation:

Growth companies are companies that are expanding rapidly and reinvesting their profits back into the business to fuel further growth. As such, they typically need to raise additional capital to support their expansion plans. One way they can do this is by issuing new stock, which allows them to sell ownership stakes in the company to investors in exchange for funding. This can be an attractive option for growth companies because it does not require them to take on debt, which can be costly and risky, and it also does not reduce their retained earnings, which they can continue to reinvest in the business. Retained earnings and borrowing are also commonly used methods of corporate finance, but they may not be as suitable for growth companies depending on their specific circumstances.

how did the sarbanes oxley act impact corporations financial reports

Answers

The Sarbanes-Oxley Act (SOX) of 2002 imposed stricter regulations and requirements on corporations, aiming to improve financial reporting and transparency. It increased accountability, strengthened internal controls, and introduced stricter auditing standards to enhance the accuracy and reliability of corporations' financial reports.

Transparency refers to the degree to which information, actions, and processes are open, accessible, and visible to stakeholders. In the context of business and governance, transparency is crucial for building trust, accountability, and ethical behavior. Transparent practices ensure that information about an organization's financial performance, decision-making processes, and potential conflicts of interest are readily available to shareholders, investors, employees, and the public. This includes clear and comprehensive financial reporting, disclosure of relevant information, and open communication channels. Transparent organizations are better positioned to foster credibility, attract investment, mitigate risks, and maintain positive relationships with stakeholders, ultimately contributing to long-term sustainability and success.

Learn more about Transparency here;

https://brainly.com/question/32112990

#SPJ11

how has the right of education addressed to differently abled person

Answers

Answer:

Differently abled person might need more resources compared to average people.

Explanation:

Let's examine blind people for example.

In order to learn, blind people require special type of books or teaching techniques. This special requirement will most likely cause cost the educational institution more compared to accommodating average students.

But , their physical disadvantages doesn't necessarily mean that the wouldn't be a productive workforce. The government need to realize that in order to fully equalize the right to obtain educations , the higher cost would become unwanted expense but extremely necessary.

A market supply schedule shows the relationship between

please!!!!!!

Answers

Answer: A supply schedule is a table that shows the quantity supplied at different prices in the market. A supply curve shows the relationship between quantity supplied and price on a graph.

Explanation: I HOPED THAT HELPED,!

Discuss the advantages and disadvantages of the division of labour.

Answers

Explanation:

I hopeit help you✌️✌️✌️✌️✌️

Four ways businesses use technology for marketing

Answers

Technology has revolutionized the way businesses conduct their marketing activities. Here are four ways businesses use technology for marketing:

1. Social Media Marketing: Social media platforms such as Face/book, Tw/itter, Inst/agram and Lin/kedIn have become essential for businesses when it comes to reaching a larger target audience. These platforms allow businesses to engage with customers and build brand recognition.

2. Email Marketing: Email is still one of the most effective ways to reach customers. By using email marketing software, businesses can design and send personalized emails to a large group of customers at once.

3. Content Marketing: Businesses use various forms of content such as blog posts, videos, infographics and e-books to attract and educate customers. By providing valuable information, businesses can establish themselves as experts in their industry and build trust with their audience.

4. Search Engine Optimization (SEO): SEO is the process of optimizing your website to rank higher in search engine results pages (SERPs). By using techniques such as keyword research, link building and on-page optimization, businesses can improve their website's visibility and attract more organic traffic.

Overall, technology has made marketing more accessible and cost-effective for businesses of all sizes. By leveraging these four strategies, businesses can build a strong online presence and grow their customer base.

Learn more about marketing here:

https://brainly.com/question/27155256

#SPJ1

a local bank’s advertising reads: "give us $35,000 today, and we’ll pay you $200 every year forever." if you plan to live forever, what annual interest rate will you earn on your deposit?

Answers

If you plan to live forever then the annual interest rate that you would earn on your deposit is 0. 571 %

How to find the interest rate ?The interest rate that you would be paid can be found by the formula which involves dividing the amount you get per year, by the amount invested, and then multiplied by a hundred percent.

The annual interest rate you get on your investment from the local bank is:

= Amount received per year / Total invested x 100 %

= 200 / 35, 000 x 100 %

= 0.00571 x 100 %

= 0. 571 %

Find out more on interest rate at https://brainly.com/question/25793394

#SPJ1

A company can use the lifo inventory method for income tax purposes and the fifo inventory method for financial reporting purposes during a given year. True or false?.

Answers

A company can use the LIFO inventory method for income tax purposes and the FIFO inventory method for financial reporting purposes during a given year, is the true statement.

What is LIFO inventory?The inventory accounting method known as latest in, first out (LIFO) is applied. In accordance with LIFO, expenses are subtracted beginning with those for the most recent purchases of items (or produced). The only place LIFO is used is in the United States, and it is governed by generally accepted accounting principles.

First in, first out (FIFO) inventory management seeks to value inventory in an effort to lessen the possibility that the business would incur losses when items go bad or become obsolete.

Thus, it is a true statement.

For more information about LIFO inventory, click here:

https://brainly.com/question/28810419

#SPJ1

1. Antitrust laws are designed to

Answers

Answer:

Antitrust laws are statutes developed by governments to protect consumers from predatory business practices and ensure fair competition. Antitrust laws are applied to a wide range of questionable business activities, including market allocation, bid rigging, price fixing, and monopolies

Explanation:

may i have brainliest please and thank you

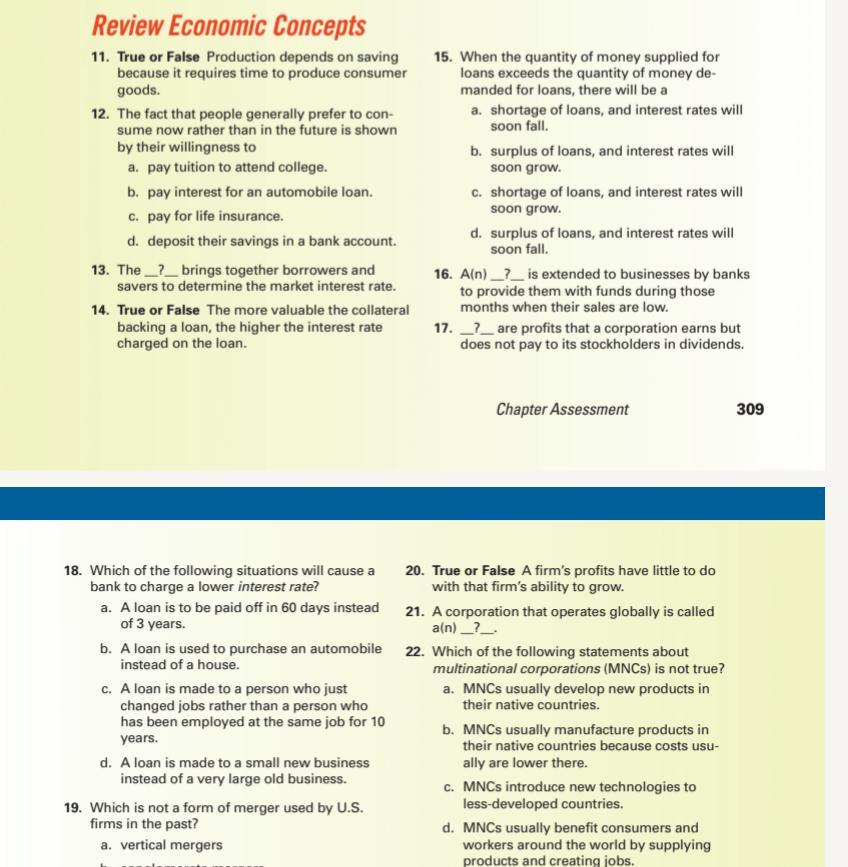

Econ Chapter 10 assessment pls help!!

Answers

A loan is to be paid off in 60 days instead of 3 years .This scenario is less risky for the bank since the loan will be repaid quickly, so the bank may be willing to offer a lower interest rate.

What is Interst ?b. A loan is used to purchase an automobile instead of a house.

A loan for an automobile is generally smaller and less risky for the bank than a loan for a house, so the interest rate may be lower.

c. A loan is made to a person who just changed jobs rather than a person who has been employed at the same job for 10 years.

A person who has been employed at the same job for 10 years is generally considered more stable and less risky for the bank, so they may receive a lower interest rate.

Therefore, the correct answer is option a: A loan is to be paid off in 60 days instead of 3 years.

True or False: A firm's profits have little to do with that firm's ability to grow.

False. A firm's profits are a critical determinant of its ability to grow. Profits are needed to reinvest in the business, pay for research and development, and expand into new markets or products. A firm with low profits may struggle to invest in growth opportunities.

A corporation that operates globally is called a multinational corporation (MNC).

Which of the following statements about multinational corporations (MNCs) is not true?

a. MNCs usually develop new products in their native countries.

b. MNCs usually manufacture products in their native countries because costs usually are lower there.

c. MNCs introduce new technologies to less-developed countries.

d. MNCs usually benefit consumers and workers around the world by supplying products and creating jobs.

The statement that is not true is a. MNCs usually develop new products in their native countries. MNCs may develop new products in any of their global locations, depending on where the necessary resources, expertise, and market demand are located.

Which is not a form of merger used by U.S. firms in the past?

a. vertical mergers. This is not correct. Vertical mergers are a type of merger that has been used by U.S. firms in the past. The other types of mergers include horizontal mergers, conglomerate mergers, and market extension mergers.

Therefore, the correct answer is option d: none of the above (all types of mergers have been used by U.S. firms in the past).

Learn more about Economics here

https://brainly.com/question/8500193

#SPJ1

Calculating the return on a stock: Assume we purchased one share of stock at $15.00 and received

$2.00 in dividends during the next year. After one year the stock price increased to $20.50. What is the

percentage total return we achieved? What is the dividend yield component and the capital gains yield

component? Discuss the features that differentiate value stocks from growth stocks.

Answers

The percentage total return achieved on the stock investment is 43.33%. The dividend yield component is 13.33%, and the capital gains yield component is 30%.

To calculate the percentage total return, we need to consider the initial stock price, dividends received, and the final stock price. In this case, the initial stock price is $15.00, dividends received are $2.00, and the final stock price is $20.50. The formula to calculate the percentage total return is [(Ending Value - Beginning Value + Dividends) / Beginning Value] * 100. Applying this formula, we have [(20.50 - 15.00 + 2.00) / 15.00] * 100 = 43.33%. Therefore, the percentage total return achieved is 43.33%.

The dividend yield component represents the portion of the return generated by dividends. It is calculated as (Dividends / Beginning Value) * 100. In this case, the dividend yield component is (2.00 / 15.00) * 100 = 13.33%. The capital gains yield component represents the portion of the return generated by the change in stock price. It is calculated as [(Ending Value - Beginning Value) / Beginning Value] * 100. In this case, the capital gains yield component is [(20.50 - 15.00) / 15.00] * 100 = 30%.

Value stocks and growth stocks differ in their investment characteristics. Value stocks are typically considered undervalued by the market, trading at lower price-to-earnings ratios or other valuation metrics. These stocks often have stable or mature business models, lower growth rates, and may distribute higher dividends. On the other hand, growth stocks are companies that have the potential for high earnings growth and may trade at higher price-to-earnings ratios.

They often reinvest their earnings back into the business to fuel expansion and innovation, rather than paying dividends. Investors in value stocks seek companies with solid fundamentals and attractive valuations, while investors in growth stocks focus on the potential for future earnings growth. Both value and growth strategies have their own advantages and risks, and investors may choose one or a combination based on their investment goals and risk appetite.

Learn more about stock here

https://brainly.com/question/31940696

#SPJ11

the clause in a mortgage that terminates the lender's interest when the mortgage is paid in full is known as:

Answers

In some home loan contracts, there is a condition called a "defeasance statement" that says the borrower will get the title to the property once the home loan installments are all paid.

A mortgage's acceleration clause allows your lender to accelerate the rate at which your loan's payment terms are calculated.Additionally, the clause may permit your lender to demand full and immediate payment of your mortgage.

What is the distance statement in a home loan?

Clause for alienation.When title to the property is transferred or, in some cases, when possession is changed, this clause enables the lender to demand the entire loan balance that is due.

Learn more about mortgage here:

https://brainly.com/question/1318711

#SPJ4

2. What are some banks, non-banks, technology and retail companies? Name 1 of each and explain what they are and what they do?

Answers

Banks are businesses that provide a range of financial services, such as mortgages, savings accounts, and loans. JPMorgan Chase, one of the biggest banks in the US, is an illustration of a bank. Financial services offered by JPMorgan Chase include banking, investing, and credit card services.

What are retail companies?Businesses that sell goods directly to customers are known as retail companies. Walmart, one of the biggest retailers in the world, is a good example of a retail business. Walmart runs a network of grocery stores, discount department stores, and hypermarkets and provides customers with a variety of goods and services.

Companies that provide financial services but lack a banking license are known as non-bank financial institutions. American Express, a provider of credit cards, debit cards, and other financial services, is one example of a non-bank financial institution.

Therefore, banks, non-banks, technology, and retail companies are stated above.

Learn more about Retail companies, here;

https://brainly.com/question/24956502

#SPJ1

Which type of tax is paid to support transfer payments and other programs of the u.s. government

Answers

Federal income tax: An income tax is a type of tax that the federal government levies on people and corporations based on their earnings.

What kind of tax is paid to the government directly? Federal income tax: An income tax is a type of tax that the federal government levies on people and corporations based on their earnings.Defense, foreign policy, law enforcement, and debt interest are just a few of the government initiatives that are funded in part by the federal income tax.Taxes that are paid directly to the government by the taxpayer are known as direct taxes.A progressive tax is one that levies an income tax that is higher for high-income groups than for low-income ones.An equal percentage of revenue from each income category is taken as a tax under a proportional system.Regressive taxes—Taxes that take a bigger percentage of low-income groups' income than high-income groups—are those that are imposed.To learn more about Federal income tax refer

https://brainly.com/question/1601662

#SPJ1

Is the sales manager a subordinate? explain why?

Answers

After income tax is paid by a

corporation, what percentage of

the remaining profit is paid as the

dividend tax?

A. 30%

C. 15%

B. 5%

D. 10%

Answers

Answer:

option C

Explanation:

the general rate of dividend is 15%

A computer game that can be purchased online and played right away has good _____utility.

A. Form

B. Information

C. Value

D. Time

Answers

Ottocell Motor Company just paid a dividend of $1. 40. Analysts expect its dividend to grow at a rate of 10 percent next year, 8 percent for the following two years, and then a constant rate of 5 percent thereafter. What is the expected dividend per share at the end of year 5?

Answers

The recent dividend payment from Ottocell Motor Company was $1.40. At the conclusion of year 5, the anticipated dividend per share is $1.98.

What does "business" actually mean?A group of people can form a legal entity called a corporation to run and manage a commercial or industrial business. A corporation may very well be set up by a variety of methods for tax and financial obligation concerns depending also on section 4(2 of its jurisdiction.

What does the Company ending mean?The play's ending is left up to the audience's assessment because Robert may have been thinking about it the entire time before he realized he wanted to live alone. The production has no predetermined running length for the musical, and Robert is celebrated his 35th birthday three times by his pals.

To know more about Company visit :

https://brainly.com/question/27238641

#SPJ4

The mechanism used to guide a company toward meeting its strategic goals within the bounds of the law is known as ______.

Answers

The mechanism used to guide a company toward meeting its strategic goals within the bounds of the law is known as corporate governance.

The mechanism strategy allows for the production of inexperienced products while increasing revenue and competitive advantage. the goals of the principals and retailers aren't aligned with each other in line with the classical definition by way of Victor and Cullen's moral weather.

One manner to improve the ethical climate of your company is to present personnel with extra strength over their work. If personnel have an ethical code and extra management over their painting outcomes, they may be probably to justify your agreement within them to make the proper decision.

Learn more about The mechanism here:-https://brainly.com/question/1320373

#SPJ4

what do you pore first the cereal or the milk? True or false.

Answers

Assume that the marginal propensity to consume is 0.90. As a result of an increase in the tax rates, the government collects an additional $20 million. What will be the impact on gross domestic product (GDP)

Answers

The impact on gross domestic product (GDP) is: GDP will decrease by a maximum of $180 million.

Gross domestic product (GDP):First step:

rGDP = (MPC/MPS)change in taxes

Where:

MPC = .90

MPS = .10

rGDP = (MPC/MPS)change in taxes

rGDP=.90/.10

rGDP=9

Second step:

Gross domestic product (GDP)= (9)20 million

Gross domestic product (GDP)= 180 million (Decrease)

Inconclusion the impact on gross domestic product (GDP) is: GDP will decrease by a maximum of $180 million.

Learn more about gross domestic product (GDP) here:https://brainly.com/question/1383956

AnMPC = .90

MPS = .10

rGDP = (MPC/MPS)税收变化

rGDP=.90/.10

rGDP=9swer:

Explanation:

"Imagine that your high school or college has been overrun with zombies. Your math professor, the cafeteria ladies, and even your best friend have all joined the walking dead. Flesh out a plan to avoid the zombies, including where you’d hide and the top-five things you’d bring to stay alive." (250 words or less)

Answers

Get out of the way when a zombie surges toward you by moving aside, grabbing them, and pushing them through. Utilize their own momentum to trip them, keep them moving past you, or otherwise cause them to fall.

Hand-to-hand fighting with a zombie should only be intended to get you away from them and should be extremely brief. The scientists calculated that it would take around 1,000 days, or 2.7 years, for humans to exterminate every zombie under these circumstances.

The human population would then need another 25 years to begin to recover from the onslaught. My backpack, any sharp things or lighters I could locate in the band room, any heavy sporting equipment I could discover, some pencils and pens, and teacher desks would all be taken.

I would probably look for a place where only one person could potentially be and murder them, like the principal's office or a counselor's office. I would seclude myself indoors and prepare whatever cafeteria food was available. There would be a microwave in the workplace.

To learn more about zombies

https://brainly.com/question/12063412

#SPJ1

question content area in the absence of any agreement between partners, profits and losses must be shared

Answers

In the absence of any agreement between partners, profits, and losses must be shared. This means that if there is no specific agreement in place regarding how profits and losses should be divided among partners in a business, they should be distributed among the partners in a fair and equitable manner.

There are a few common methods for sharing profits and losses in the absence of an agreement:

1. Equal sharing: In this method, profits and losses are divided equally among the partners. For example, if there are two partners, each partner would receive 50% of the profits and bear 50% of the losses.

2. Capital sharing ratio: This method takes into account the capital invested by each partner. The profits and losses are distributed based on the proportion of capital contributed by each partner. For instance, if one partner contributes 60% of the capital and the other partner contributes 40%, the profits and losses would be shared accordingly.

3. Ratio of profit sharing: This method considers the agreed ratio of profit sharing between the partners. The profits and losses are divided based on the predetermined ratio set by the partners. For example, if the ratio is 2:1, the first partner would receive two-thirds of the profits, while the second partner would receive one-third.

To learn more about agreement

https://brainly.com/question/5746834

#SPJ11

do you guys like Canada? or leaves in Canada and do you thin im a cut Canadian

Answers

Answer:

I love canada but I live in america :(

but hey we just got the Cheeto out so it's getting better here (*˘︶˘*).。*♡

bank a offers loans at an 8% nominal rate (apr) but requires that interest be paid quarterly;that is, it uses quarterly compounding. bank b wants to charge the same effective rate on its loans, but it wants to collect interest on a monthly basis, that is to use monthly compounding. what nominal rate must bank b set?

Answers

Bank B must set a nominal rate of 7.72% to charge the same effective rate as Bank A.

What is the nominal rate required by Bank B to charge the same effective rate on its loans as Bank A?To calculate the nominal rate required by Bank B, we need to use the formula for the effective annual interest rate, which takes into account the compounding frequency. By setting the effective annual interest rate of Bank B's loan equal to that of Bank A's loan, and solving for the nominal rate with monthly compounding, we get a rate of 7.72%.

This means that Bank B needs to charge a nominal rate of 7.72% with monthly compounding to have the same effective rate as Bank A's 8% nominal rate with quarterly compounding.

Learn more about Effective annual interest rate

brainly.com/question/20631001

#SPJ11