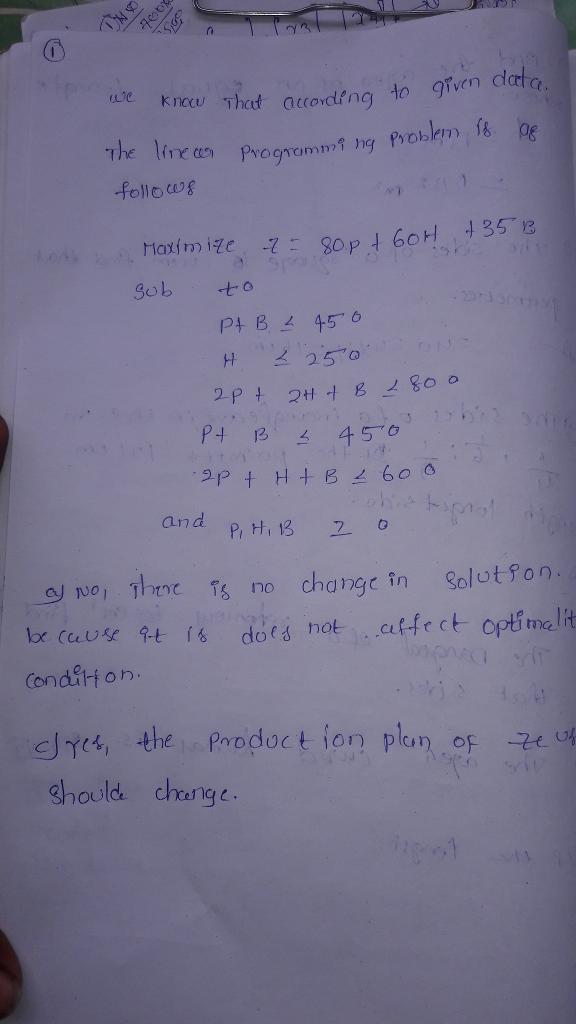

Kiano, a telecommunications equipment manufacturer, manufactures PDAs (P), wireless handsets (H), and blackberrys (B). They have a limited supply of common parts---ethernet card (450 in inventory), antenna (250 in inventory), chipset (800 in inventory), battery/power supply (450 in inventory), LCD screen (600 in inventory)---that these products use. A PDA requites an ethernet card, 2 chipsets, a power supply, and 2 LCD screens. A wireless handset requires an ethernet card, an antenna, 2 chipsets, a power supply, and a LCD screen. A blackberry requires a chipset and a LCD screen. The profit on PDAs is $80, the profit on wireless handsets is $60, and the profit on blackberrys is $35. The following is a linear programming formulation of the problem.

Let

P = Number of PDAs produced

H = Number of wireless handsets produced

B = Number of blackberrys produced

We may write model for this problem as follows.

Maximize 80P + 60H + 35B

subject to:

(ethernet card constraint) P + H ? 450

(antenna constraint constraint) H ? 250

(chipset constraint) 2P + 2H + B ? 800

(power supply constraint) P + H ? 450

(LCD screen constraint) 2P + H + B ? 600

(non-negativity) P, H, B ? 0.

Implement the above model in Solver and make sure to choose Simplex as the solving method and to choose the option "Make Unconstrained Variables non-negative"---do not explicitly put in the non-negativity constraints in the model and using the sensitivity report only

answer the questions below:

a. Does the solution change if only 425 ethernet cards are available?

b. Is it profitable to produce Blackberrys? If not, by how much should the profit margin on Blackberrys be increased to make it profitable to produce Blackberrys?

c. Because of a change in production technology the profit margin on handsets has increased to $70. Should the production plan of Kiano change? What is their new profit?

d. 50 chipsets were found to be defective, making the number of available chipsets 750. What will the profit be in this situation?

e. Another supplier is willing to sell LCD screens to Kiano. However their prices for a LCD screen are $20 higher than what Kiano pays it's regular supplier. Should Kiano go ahead and purchase these electronic units? If yes, at most how many units should they purchase.

f. Kiano is considering introducing a new product (called the Revolutionary Communicator) that combines the wireless handset and PDA. This product uses an ethernet card, an antenna, 2 chipsets, 1 power supply, and 2 LCD screens, and is expected to make a profit of $100. Should Kiano produce the Revolutionary Communicator? Why or Why not?

Answers

Answer:

Explanation:

Please check the attached file below to see answer to the given question

Related Questions

Sandra goes into her favorite shoe store where they are holding a special sales promotion. The salesperson explains to Sandra that if she purchases one pair of shoes, she would receive a free pair of socks. Which type of sales promotion is this?

A). Special financing

B). Bonus

C). Premium

D). Discount

Answers

You make $13.00 Per Hour. You work 40 hrs. a week for 5 weeks this month. Total Hrs. Worked = _____

What is your monthly income? ____

Answers

Answer:

assuming that this month was extraordinarily long, and had more days than any other month in history, you worked a total of 5 x 40 = 200 hours

Also, due to length of the month, you will earn 200 hours x $13 = $2,600

Generally months tend to have between 20-23 labor days

what are the two aspects of the evaluation process in Step 5 for Taking Marketing Action? Why is this important

Answers

The two aspects of the evaluation process in Step 5 for Taking Marketing Action are:

Implementation and control. They ensure that the entrepreneur is following through on his plans.What are the required steps?The required steps for taking marketing action are: stating a mission, analyzing the situation in question, drawing a plan, stating the marketing mix, and then implementing and establishing controls.

The last two steps are important because they help to ensure that the drawn plans are followed to the teeth. They also help the entrepreneur to remain on track while trying to establish a workable structure.

Learn more about marketing actions here:

https://brainly.com/question/14671672

#SPJ1

In what ways are retail banks, credit unions, and online banks different?

Answers

Answer:

The bottom line is that banks are for-profit institutions, while credit unions are non-profit. Credit unions typically brag better customer service and lower fees, but have higher interest rates. On the contrary, banks generally have lower interest rates and higher fees

The credit unions have lower fees and better interests in the saving accounts. Credit unions are a type of institution controlled by members and operated on a nonprofit basis.

Online banks are those that have internet-based services such as e-loans, and all electronic transactions. It also includes net banking and does it yourself system. Retail banking is a provision of services by the banks to the general public. They are often called as whole ale banking. While a bank can have diverse offering a credit union is limited. Banks provide a higher fee for interest and loans, while credit union is lower fees and interest rates.Learn more about the ways are retail banks, credit unions, and online banks different.

brainly.com/question/12980617.

_____ money finish the diagram

gets its value from the government,

is common throughout the world today,

includes U.S. and Canadian dollars

Answer Choice:

A.Commodity

B.Representitve

C.M1

D.Fiat (correct answer)

Answers

Why do you think women occupy so few seats on boards of directors

Answers

Answer:

Women has always been discriminated against forever because of our sex. Men feel they should always be in charge so they should make more money

What might be required of a job candidate today that would not have been necessary 20 years ago?

A. a firm handshake

B. a self-guided video interview

C. a solid resume

D. relevant experience

Answers

20 years ago there was less technology available and candidates were not required to interview through a video, B. A self-guided video interview is required to get a job.

What is Interview?Interview is the screening process of a candidate to find out if he or she is suitable for the job or not. The candidate with the best skills, education and experience is selected and seated to the job.

Employee screening process includes tests and interview however due to technological advancements the interview is now turned virtual, most of the employers now required a self guided video interview.

Learn more about Interview at https://brainly.com/question/27094569

#SPJ1

A company proposes to invest in two divisible projects which are expected to generate the following cash flows. Cash flows Year Project A Project B

1 10,000 10,000

2 60,000 30,000

Additional information

1. The cost of capital applicable to both projects is 12%

2. Project A requires sh. 20,000 and Project B 10,000 initial investment. 3. The funds available are restricted as follows;

Years Cash available

0 1,000,000

1 800,000

4. Funds not utilized one year will not be available in the subsequent years. Required;

i. Formulate a linear programming model to solve the above problem. ii. Solve the problem graphically and comment on the proportion of investing on the two projects.

Answers

The graphical solution of this linear programming problem will involve plotting the feasible region defined by the constraints and identifying the corner points of the region. The corner point that maximizes the objective function will represent the optimal investment proportions between the two projects.

To formulate a linear programming model for the investment decision between Project A and Project B, we can define the following variables:

Let x be the amount invested in Project A (in thousands of shillings).

Let y be the amount invested in Project B (in thousands of shillings).

The objective is to maximize the total cash flows generated from the investments, which can be represented as: Maximize Z = 10x + 60y + 10x + 30y

Subject to the following constraints:

The total investment should not exceed the available funds:

x + y ≤ 1,000 (in thousands of shillings)

Project A requires an initial investment of 20,000 (in thousands of shillings):

x ≥ 20

Project B requires an initial investment of 10,000 (in thousands of shillings):

y ≥ 10

The funds available in each year should be utilized:

x + y ≤ 800 (for year 1)

The graphical solution of this linear programming problem will involve plotting the feasible region defined by the constraints and identifying the corner points of the region. The corner point that maximizes the objective function will represent the optimal investment proportions between the two projects.

Based on the graphical solution, the proportion of investing in the two projects will depend on the intersection of the feasible region and the objective function. The specific proportion will vary depending on the values and slopes of the constraints and objective function.

It is important to note that the actual graphical solution and interpretation of the proportion will require the specific values and plot of the feasible region and objective function.

For more question on investment

https://brainly.com/question/29547577

#SPJ8

I need the answer please help

Answers

As given that the taxable state income for the year is $70,000, the applicable tax rate is 5.5%, thus, the tax payable is $3,850.

What does a progressive tax means?A progressive tax is one in which the tax rate rises in proportion to the taxable amount. The term progressive refers to the manner in which the tax rate rises from low to high, resulting in a taxpayer's average tax rate being less than the person's marginal tax rate. The term can refer to either individual taxes or an entire tax system.

We are given that the taxable state income for the year is $70,000. Note that for this salary range, the tax rate of 5.5% is applicable.

Tax payable is computed as:

= $70,000 * 5.5%

= $3,850

Read more about progressive tax

brainly.com/question/4343640

#SPJ1

What are the steps an Involver follows for planning

Answers

There are several steps that an Involver follows for planning a business, the essential being the establishment of objectives and goals.

What are the planning steps?Planning corresponds to the course of action necessary to achieve objectives and goals, helping to better organize, control and correct the actions taken. The steps are:

Environmental scanStrategy formulationStrategic implementationStrategy assessmentTherefore, those involved must follow the necessary steps to carry out an organizational planning focused and aligned with the company's needs and values.

Find out more about planning here:

https://brainly.com/question/25453419

#SPJ2

what are the basic requirement of ppe

Answers

Answer:

Personal safety equipment, commonly known as PPE, is the equipment used to minimize the risks causing severe injuries and diseases in the workplace.

Explanation:

Items like gloves, safety glasses, and shoes, earplugs or muffles, hard hats, breathing or coverings, jackets, and whole-body suits may be included in personal protective equipment.

All personal protective equipment should be designed and constructed in a safe and reliable manner. It should fit conveniently and promote the use of workers.

These wounds and diseases can be attributable to chemical, radiological, physical, electrical, mechanical, or other hazards in the workplace.

When engineering, employment practices, and administrative controls are not feasible or not sufficient, employers must provide their employees with personal protective equipment and ensure their proper utilization.

Which of the following income and expense items is NOT recorded initially directly in equity?

A. The impairment of goodwill in accordance with IAS 36 Impairment of Assets, where the entity is confident that the factors giving rise to the impairment will reverse in a future period.

B. An increase in the fair values of land & buildings, where the revaluation method is used to account for land & buildings in accordance with IAS 16 Property, Plant & Equipment.

C. A change in the fair value of an investment in another entity, which is classified as an available-for-sale financial asset in accordance with IAS 39 Financial Instruments: Recognition & Measurement.

D. Foreign currency translation adjustments arising on the translation of a foreign operations financial statements from their functional currency in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates.

Answers

The income and expense items that is NOT recorded initially directly in equity is A. The impairment of goodwill in accordance with IAS 36 Impairment of Assets, where the entity is confident that the factors giving rise to the impairment will reverse in a future period.

What is equity?Equity can be regarded as the ownership interest in property which can be used in the offset by debts or other liabilities.

It should be noted that there are some of the income and expense items which is been recorded in this , this can be increase in the fair values of land & buildingsas well as others.

Learn more about equity at:

https://brainly.com/question/1957305

#SPJ1

Bill Blank bought 900 shares of a mutual fund with a NAV of $13.80. This fund has a load charge of 2%. What did Bill pay for the investment?

Answers

I’m almost sure I’m sorry if I’m wrong

How does the practice of fractional reserve banking affect banks?

OA. It ensures that banks always have cash reserves equal to their

OB. It allows banks to keep only a small percentage of their deposits in

OC. It gives banks the freedom to change interest rates on loans at

total deposits.

reserve.

any time.

OD. It prevents banks from profiting off loans they provide with

deposited funds.

Answers

Answer:

It allows banks to keep only a small percentage of their deposits in reserve.

Explanation:

A fractional reserve system requires commercial banks to maintain only a percentage of their customer deposits at their custody at any time. It means that at any time, only a fraction of deposits will have physical cash backing. The commercial banks' regulator determines the fraction or percentage of deposits to be maintained.

The reserves maintained services to cater to regular and any abnormal withdrawals. Commercial banks usually loan out the other fraction to other customers. Reserves are also a monetary policy tool.

Answer:

Explanation:

It allows banks to keep only a small percentage of their

what are the five major categories of pricing strategies give at least two example of specific strategies that fail into each category

Answers

A good pricing strategy helps the business to sell more, expand and earn a profit. Therefore it is very important for a business to consider a wide range of factors before offering the products and services at a price.

Following are the few crucial business tactics that aid in determining the cost of goods and services.

Pricing at a Premium: The practise of charging a high price for a product is known as premium pricing. For instance, the first foldable phones of 2019 were released, and these are the Samsung Galaxy Fold and Huawei Mate X. The cost is rather high because these are the first of their kind.Pricing to increase market penetration: In this type of pricing strategy, goods and services are sold for a low price.Economy Pricing: Discount merchants typically employ this type of pricing approach, which has cheap product prices. For example, this pricing method is employed by Walmart and Target.Price skimming: In this kind of pricing strategy, the products are first priced very high, but as time goes on and other products enter the market, the price drops.Pricing based on psychology: In this form of pricing strategy, a product’s or service’s price is set so that it discourages customers from purchasing the good or service. For example, a T-shirt now costs $99 rather than $200.To learn more about Price skimming, refer this link.

https://brainly.com/question/15371394

#SPJ1

6) When you were leading your in-house team, you displayed optimism by your demeanor each day. How can you best instill a spirit of optimism with your new remote team?

A) Frame challenges as opportunities and provide the tools to meet those opportunities.

B) Frame challenges as a part of business life and encourage your team to find ways to overcome them.

C) Display your same optimistic attitude when you are on video calls with your remote team.

Answers

The best way to instill the spirit of optimism in the new remote team is to Display your same optimistic attitude when you are on video calls with your remote team. Thus, option D is correct.

Particularly when working remotely, your leadership style and attitude may have a significant influence on the morale and optimism of your team.

Building a positive and resilient mindset may also be aided by encouraging your team to overcome obstacles and highlighting the possibilities that problems present.

The leaders may assist to establish a positive mood among the team by consistently being cheery throughout video conferences and other interactions.

Learn more about optimism, here:

brainly.com/question/23313835

#SPJ1

Country Farm Supply applies for a business loan from Farmers Credit Co-Op. Country Farm Supply owes McGregor money under another business deal, so to help Country Farm Supply get the loan so that it will be able to stay in business to pay him back, McGregor promises Farmer's Credit Co-Op that he will repay the loan if Country Farm Supply does not. To be enforceable, McGregor's promise:________.1. need not be in writing.2. must be in writing because it benefits Country Farm Supply.3. must be in writing because Farmer's Credit Co-Op is not a party to McGregor's deal with Country Farm Supply.4. must be in writing because it benefits McGregor.

Answers

Answer: must be in writing because it benefits McGregor.

Explanation:

From the question, we are told that Country Farm Supply applies for a business loan from Farmers Credit Co-Op. We are also aware that Country Farm Supply owes McGregor money under another business deal, and that McGregor wants to help Country Farm Supply get the loan so that it will be able to stay in business to pay him back, McGregor promises Farmer's Credit Co-Op that he will repay the loan if Country Farm Supply does not.

Therefore to be enforceable, McGregor's promise must be in writing because it benefits him. The the deal is between Farmer's Credit Co-Op and McGregor, hence, the promise must be in writing because this will make it valid and also applicable for future purpose in case McGregor isn't able to repay the loan he took .

What is the difference between accounts payable and accounts receivable?

Please help me out with this question

Thanks ~

Answers

Accounts payable - Accurately tracking what's owed to suppliers, ensuring payments are properly approved and processing payments.

\( \: \: \: \: \: \: \: \: \: \: \: \: \)

Accounts receivable - The balance of money due to a firm for goods or services delivered or used but not yet paid for by customers.

Answer:

Accounts payable represents money that your business owes to suppliers, accounts receivable represents money owed to your business by customers.

Explanation:

If a savings account has a nominal interest rate of 2% and compounds quarterly, what is the effective annual interest rate?

Answers

Answer:

To calculate the effective annual interest rate (EAR) from a nominal interest rate with quarterly compounding, you can use the following formula:

EAR = (1 + (r/n))^n - 1

Where:

r is the nominal interest rate (expressed as a decimal), which is 2% in this case (0.02).

n is the number of compounding periods per year, which is 4 (quarterly compounding).

Plugging in the values, we have:

EAR = (1 + (0.02/4)) - 1

= (1 + 0.005) ⁴- 1

= (1.005) 1

≈ 0.0202

Therefore, the effective annual interest rate for a savings account with a nominal interest rate of 2% and quarterly compounding is approximately 2.02%.

4.2 Prepare the general journal entries to account for all the transactions that took place from the date that the order was placed on 15 October 2020, up until 1 February 2021. Include dates when preparing the general journal entries. (12 marks)

Answers

To account for all transactions that took place from 15 October 2020 to 1 February 2021, several general journal entries need to be prepared.

On 15 October 2020, the company placed an order for inventory, which is recorded as a purchase on account. The journal entry would be:

Date: 15 October 2020

Inventory (debit) $X

Accounts Payable (credit) $X

On 20 October 2020, the company received the inventory and recorded it in the books. The journal entry would be:

Date: 20 October 2020

Inventory (debit) $X

Accounts Payable (credit) $X

On 1 November 2020, the company made a sale and recorded it as revenue. The journal entry would be:

Date: 1 November 2020

Accounts Receivable (debit) $X

Revenue (credit) $X

On 15 November 2020, the company paid for some of the inventory it purchased on 15 October 2020. The journal entry would be:

Date: 15 November 2020

Accounts Payable (debit) $X

Cash (credit) $X

On 1 December 2020, the company made another sale and recorded it as revenue. The journal entry would be:

Date: 1 December 2020

Accounts Receivable (debit) $X

Revenue (credit) $X

On 31 December 2020, the company realized that some of the inventory was damaged and could not be sold. The journal entry would be:

Date: 31 December 2020

Cost of Goods Sold (debit) $X

Inventory (credit) $X

On 1 January 2021, the company paid for rent for the next six months. The journal entry would be:

Date: 1 January 2021Prepaid Rent (debit) $XCash (credit) $XOn 1 February 2021, the company recorded depreciation expense on its equipment. The journal entry would be:

Date: 1 February 2021Depreciation Expense (debit) $XAccumulated Depreciation (credit) $X

By preparing these general journal entries, all transactions from 15 October 2020 to 1 February 2021 are accounted for in the books.

For more such questions on transactions visit:

https://brainly.com/question/28059483

#SPJ11

1. What do you know about preparing and filing taxes? (List any ideas you have

or what you have heard)

Answers

Here are some general ideas and concepts related to taxes:

Taxes are a mandatory financial obligation that individuals and businesses are required to pay to the government.

Income tax is the most common type of tax that individuals must pay on the money they earn from various sources, such as employment or investment income.

Tax preparation involves collecting all necessary financial information, calculating taxable income, and determining how much tax is owed to the government.

There are various tax forms that individuals and businesses need to fill out, depending on their financial situation and the type of taxes they owe. Some common tax forms include the 1040, 1099, W-2, and Schedule C.

Tax deductions and credits are available to reduce the amount of tax owed. Common deductions include charitable donations, mortgage interest, and state and local taxes.

Tax filing deadlines vary based on the type of tax and the jurisdiction. In the United States, the federal income tax filing deadline is typically April 15, unless there is a holiday or other special circumstances that affect the deadline.

Failing to file or pay taxes can result in penalties and interest charges, and in severe cases, legal action by the government to collect the owed taxes.

Professional tax preparers, such as accountants and tax attorneys, can assist individuals and businesses with tax preparation and filing, but there are also tax software programs and online resources available for individuals who prefer to do their own taxes.

Match the design thinking stage to its description.

Question 14 options:

The design team creates multiple inexpensive versions of the product, known as minimum viable products (MVPs)

Spend time gaining an understanding by observing, engaging, and empathizing with customers to understand their experiences and their needs better

Analyze observations and information to identify the core problem

The design team comes up with solution ideas

The design team identifies any additional problems and refines the final solution before the final product is produced and released to customers

1.

Empathize

2.

Define

3.

Ideation

4.

Prototype

5.

Test

Answers

The design team creates multiple inexpensive versions of the product, known as minimum viable products (MVPs) - Prototype.

Spend time gaining an understanding by observing, engaging, and empathizing with customers to understand their experiences and their needs better - Empathize

Analyze observations and information to identify the core problem - Ideation

The design team comes up with solution ideas - Ideation

The design team identifies any additional problems and refines the final solution before the final product is produced and released to customers - Test

What is a Design thinking?Generally, a design thinking means the set of cognitive, strategic and practical procedures used by designers in the process of designing and to body of knowledge that has been developed about how people reason when engaging with design problems. A design thinking is also associated with the prescriptions for the innovation of products and services within business and social contexts.

The term "design thinking" is been used to refer to specific cognitive style, a general theory of design (which is way of understanding how designers work), and a set of pedagogical resources (through which organisations or inexperienced designers can learn to approach complex problems in a designerly way).

Read more about design thinking

brainly.com/question/28471025

#SPJ1

What is one step in identifying the main idea of a text?

Group of answer choices

Determine what the text says about the topic

Go to the glossary and find words related to the topic

Look for the lesson the author wants the reader to learn

Use context clues to understand the meaning of new words

Answers

Answer:

i believe the first option " determine what the text says about the topic" might be the correct answer

Answer: the answer is c

Explanation:

I am way too late but i took the same test

How can technological innovation help a company become globalized?

Answers

Answer:

First, globalization allows countries to gain easier access to foreign knowledge. Second, it enhances international competition—including as a result of the rise of emerging market firms—and this strengthens firms' incentives to innovate and adopt foreign technologies.

Explanation:

Developed manufacturing technologies have changed long-standing practices of productivity and occupation.

What is Technological Innovation?Technology has helped us in overcoming the major limitations of globalization and international trade such as employment barriers, lack of ordinary ethical standards, transportation costs, and uncertainties in knowledge exchange, thereby transforming the marketplace.

Improved air and sea transport have greatly accelerated the worldwide flow of individuals and goods.

All this has both constructed and required more extraordinary interdependence among firms and polities.

When globalization authorizes countries to achieve easier admission to foreign knowledge.

Second, it enhances international competition including as a development of the rise of occurring market firms and this strengthens firms' incentives to innovate and embrace foreign technologies.

Find more information about Technological Innovation here:

https://brainly.com/question/19969274

As a student of Business Ethics and a managing director of a multinational company, discuss five (5) factors you will consider in managing the multi-cultural and diversified workforce in Ghanaian business organizations.

Answers

Communication, ethics, conflict management, learning, and inclusion are some issues to consider when leading a multicultural and diversified workforce in Ghanaian business organizations.

How do you lead a multicultural team?In order to foster a culture that celebrates variety and individuality, it is crucial that there be a number of rules and procedures that concentrate on organizational ethics. The manager must be aware of the requirements of the teams, encourage learning, and include the staff in organizational procedures.

Therefore, the sharing of knowledge, learning, and creativity can benefit from a diverse culture.

To learn more about the multicultural team here: https://brainly.com/question/27249388

#SPJ10

2. Ernesto purchased a used car for $6800. He paid 64% sales tax. How much tax did he pay?

Answers

Ernesto payed $ 4352 in tax

The US Senate overwhelmingly passed the 2022 Defense Authorization Act. The $768 billion "Defense Authorization Act" not only exceeds the defense spending proposed by the Biden administration by $25 billion, but also increases the US defense budget by about 5% compared to last year.

Answers

The US Senate passed the 2022 Defense Authorization Act, a $768 billion bill that surpasses the Biden administration's defense spending proposal by $25 billion and represents a 5% increase in the US defense budget compared to the previous year.

1. The US Senate passed the 2022 Defense Authorization Act.

2. The Defense Authorization Act is a bill that determines the budget and expenditures for the US defense sector.

3. The total amount allocated for the Defense Authorization Act is $768 billion.

4. The defense spending proposed by the Biden administration was exceeded by $25 billion in this Act.

5. The Act represents a 5% increase in the US defense budget when compared to the previous year.

6. This increase in the defense budget indicates a commitment to strengthening the country's defense capabilities.

7. The Act was passed overwhelmingly, indicating strong support from the Senate.

8. The Defense Authorization Act is an essential piece of legislation that ensures the funding and resources necessary for the US military to carry out its operations effectively.

9. The Act covers various aspects of defense spending, including military personnel, equipment, research and development, and strategic initiatives.

10. By passing the Defense Authorization Act, the US Senate has demonstrated its commitment to national security and defense preparedness.

For more such questions on Defense Authorization Act, click on:

https://brainly.com/question/29225501

#SPJ8

Are interest or dividends taxable

Answers

In case your taxable hobby profits is more than $1,500 otherwise you received interest as a nominee for the real proprietor, you need to additionally consist of that earnings on agenda B (form 1040 or 1040-SR), interest and everyday Dividends and connect it on your tax go back.

Interest is charge from a borrower or deposit-taking monetary organization to a lender or depositor of an amount above reimbursement of the important sum, at a particular charge. It is distinct from a rate which the borrower may additionally pay the lender or some 1/3 party. Interest is the charge you pay to borrow cash or the cost you price to lend cash. Interest is most usually contemplated as an annual percentage of the quantity of a mortgage. This percentage is known as the hobby fee at the mortgage interest is described as the amount of cash paid for the usage of someone else's money. An example of interest is the $20 that became earned this yr for your financial savings account

Learn more about interest here:https://brainly.com/question/2294792

#SPJ1

The 2019 balance sheet of Dyrdek’s Skate Shop, Inc., showed $590,000 in the common stock account and $4.8 million in the additional paid-in surplus account. The 2020 balance sheet showed $630,000 and $5.3 million in the same two accounts, respectively. If the company paid out $600,000 in cash dividends during 2020, what was the cash flow to stockholders for the year? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)

Cash Flow to Stockholders: _______

Answers

Solution:

The formula for calculating the Cash Flow to Stockholders for the year is

= Dividend Payment during the year – Change in value of Common stock during the year – Change in value of Additional paid in surplus account during the year

Where,

Change in value of Common stock during the year = Value of Common stock of the Current Year – Value of Common stock of the Previous Year

Change in value of Additional paid in surplus account during the year = Value of Additional paid in surplus account of the Current Year – Value of Additional paid in surplus account of the Previous Year

As per the Information given in the question we have

Dividend Payment during the year 2020 = $ 600,000

Value of Common stock of the Current Year i.e., 2020 = $ 630,000

Value of Common stock of the Previous Year i.e., 2019 = $ 590,000

Thus Change in Common stock during the Year = $ 630,000 - $ 590,000 = $ 40,000

Value of Additional paid in surplus account of the Current Year = $ 5,300,000

Value of Additional paid in surplus account of the Previous Year = $ 4,800,000

Thus Change in Additional paid in surplus account = $ 5,300,000 - $ 4,800,000 = $ 500,000

Thus applying the above information in the formula for calculating the Cash Flow to Stockholders is

= $ 600,000 - $ 40,000 - $ 500,000

= $ 60,000

Thus the Cash flow to stockholders for the year 2020 = $ 60,000

A production possibilities frontier can shift outward if

Answers

Answer:

A production possibility frontier (PPF) illustrates the combinations of output of two products that a country can supply using all of their available factor inputs in an efficient way. One way the PPF can shift outwards is if there is an increase in the active labour supply