Answers

Answer:

the cost of goods sold is $1,500

Explanation:

The computation of the cost of goods sold is

= Opening inventory + purchase - ending inventory

= $0 + 200 × $12 - (200 × $12 - 75 × $20)

= $ + $2,400 - ($2,400 - $1,500)

= $2,400 - $900

= $1,500

hence, the cost of goods sold is $1,500

We simply applied the above formula so that the correct value could come

And, the same is to be considered

Related Questions

researching investments online can be valuable because

Answers

Answer:

Researching investments online can be valuable because: If the information is trustworthy it can provide a recent status of the investment. Also, online research tools provide the ability to find a great number of diverse investments

Explanation:

Answer:

d) You can track stock value trends over time

Explanation:

Write a short paragraph that explains the central idea of the article. Use at least two details from the article to support your response.

Answers

The central idea of the article will be the subject that the author of the article is presenting.

How can we identify the central idea of an article?To identify the central idea, it will be necessary for the article to be read.During the reading, the reader will be able to identify the main subject that the article is demonstrating.This subject is developed through arguments or information that the author presents to establish a type of communication with the reader.

You didn't submit the article your question refers to, so it's not possible to answer this question exactly, but I hope the above information can help you.

More information about central ideas at the link:

https://brainly.com/question/1914191

A company prospectus includes:

Answers

A company prospectus includes Business Overview, Company History, Management Team, Financial Information, Risk Factors, Legal and Regulatory Information, Corporate Governance.

The contents of a company prospectus may vary depending on the specific regulations of the jurisdiction where the company operates. However, in general, a prospectus includes the following key elements:

Business Overview: A description of the company's business activities, including its industry, products or services, target market, and competitive advantages.Company History: Background information about the company, including its founding date, key milestones, and any significant events that have shaped its development.Management Team: Profiles of the company's key executives and management team members, including their qualifications, experience, and responsibilities.Financial Information: Detailed financial statements, including balance sheets, income statements, and cash flow statements, for a specified period. This section also provides information on the company's assets, liabilities, revenues, expenses, and profitability.Risk Factors: A discussion of the potential risks and uncertainties that could affect the company's operations, financial performance, or investment prospects. This may include market risks, regulatory risks, industry-specific risks, or any other factors that investors should consider before making investment decisions.Legal and Regulatory Information: Disclosures related to any legal or regulatory matters that may impact the company, such as pending lawsuits, regulatory compliance issues, or intellectual property rights.Corporate Governance: Details about the company's corporate structure, board of directors, executive compensation, and any other corporate governance practices that ensure transparency and accountability.For such more question on Financial:

https://brainly.com/question/989344

#SPJ8

During periods when the yield curve has a "normal" shape, as market interest rates change, which statement is TRUE

Answers

Answer

B. Long term bond prices are more volatile than short term bond prices

Explanation:

These are the options for the above question;

A. Short term bond prices are more volatile than long term bond prices

B. Long term bond prices are more volatile than short term bond prices

C. Both short term and long term prices are equally volatile

D. No relationship exists between long term and short term bond price movements

In finance, yield curve is very useful in the measurement of the ideal or belief the bond investor has concerning risk. With the help of the yield curve ,we can know relationship between the rate of interest and maturity's time.

It should be noted that during a period when the yield curve has a normal ascending shape long term bond prices are more volatile than short term bond prices, and the normal yield curve shape is usually reffered to as ""positive yield curve"".

Hence only option B is true.

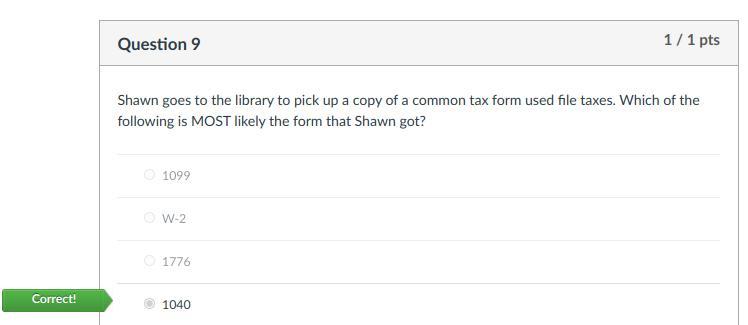

Shawn goes to the library to pick up a copy of a common tax form used file taxes. Which of the following is MOST likely the form that Shawn got?

1099

W-2

1776

1040

Answers

Answer:

Shawn would choose form 1040 filing tax form.

Explanation:

The answer is D.) 1040

I got a picture of the answer.

Hope this helps!

Why accounting is essential and how accounting currently impacts or relates to your life and professional or personal goals. Describe how you can practically apply one or more of the concepts you have learned, specific to the basics of financial accounting and financial accounting statements. Explore the differences between financial and managerial accounting, using either your work or the business you work for, or how you can apply each accounting to your personal life and goals regarding budgeting, spending, and saving.

Answers

Accounting is essential because it is the language of business. It provides a systematic way to record, analyze, and communicate financial information, allowing businesses and individuals to make informed decisions regarding their financial activities.

Accounting helps in tracking income, expenses, assets, and liabilities, and provides a basis for measuring profitability, evaluating financial health, and ensuring compliance with financial regulations.

In my personal and professional life, accounting impacts me in several ways. Personally, I use accounting principles to manage my personal finances, budgeting my income, tracking expenses, and setting financial goals. It helps me understand where my money is going, identify areas where I can save, and make informed decisions about investments or large purchases.

In my professional life, understanding accounting is crucial for financial planning, budgeting, and reporting. It helps me analyze the financial performance of my organization, assess profitability, and make strategic decisions based on financial data. I rely on financial accounting statements, such as the income statement, balance sheet, and cash flow statement, to gain insights into the company's financial position and performance.

Applying the concepts of financial accounting, I can practically utilize the knowledge in several ways. For example, I can use financial statements to assess the financial health of a potential investment or evaluate the financial stability of a company I'm considering working for. I can also use financial ratios and analysis techniques to compare companies within the same industry and make informed investment decisions.

Regarding the differences between financial and managerial accounting, financial accounting focuses on providing financial information to external stakeholders such as investors, creditors, and regulatory authorities. It follows generally accepted accounting principles (GAAP) and produces financial statements that adhere to specific reporting standards.

On the other hand, managerial accounting is used internally within an organization to provide information for managerial decision-making. It focuses on providing detailed information to managers to aid in planning, controlling, and decision-making processes. Managerial accounting allows managers to analyze costs, budgeting, performance evaluation, and forecasting.

In my personal life, I can apply financial accounting principles to manage my personal budget, track my expenses, and assess my financial goals. This helps me understand my financial position, control my spending, and make adjustments to ensure I am on track to meet my objectives.

Managerial accounting can be applied to personal life by using cost analysis techniques to make decisions about purchases or evaluating the cost-effectiveness of different options. For example, when considering buying a new car, I can analyze the total cost of ownership, including purchase price, maintenance, and fuel expenses, to make an informed decision.

In conclusion, accounting is essential for both personal and professional financial management. Understanding the basics of financial accounting and financial accounting statements enables individuals to make informed decisions about their finances, while also providing valuable insights for organizations to assess their financial performance and plan for the future. By applying accounting concepts, we can effectively budget, spend, and save, both in personal and professional settings.

For more such questions on Accuonting

https://brainly.com/question/26690519

#SPJ11

A tax client asks Elena to perform additional tax-related services. Which of the following statements best describes what Elena should do before she agrees to perform the additional service?

Elena should consider whether performing an additional service for the client will impair her independence.

Elena should consider structuring the fee for this engagement as a contingent fee.

If Elena's experience in this area of tax law is limited, she should seek sources of assistance.

Elena should gain the client's agreement to include an indemnification clause in her engagement letter.

Answers

The correct option is : Elena should consider whether performing an additional service for the client will impair her independence.

What is tax?This is a compulsory levy, imposed on citizen of a country by their government. The aim is to finance public goods for the benefit of the citizens.

Tax is a kind of legal financial charge imposed by the government on the profit and income of its citizens. The payment of tax for each citizen under the tax codes is not mandatory. The codes mandate you must file a return if you had any type of income, even from illegal sources.

However, a loss of independence would jeopardize the clients tax business, so she would carefully need to weigh whether the additional business is worth the risk.

Learn more about tax here: https://brainly.com/question/1133253

#SPJ1

Solutions Company - Unadjusted Trial Balance as of December 31.

Account Titles

Unadjusted Trial Balance Dr. Unadjusted Trial Balance Cr.

100: Cash 20,000

110: Accounts Receivable 0

120: Supplies 7,600

160: Machinery 50,000

161: Accumulated Depreciation 20,000

200: Accounts Payable 0

205: Interest Payable 0

210: Wages Payable 0

230: Unearned Rental Fees 7,200

240: Note Payable 30,000

300: Common Stock 10,000

310: Dividends 9,500

320: Retained Earnings 14,200

400: Rental Fees 32,450

600: Wage Expense 24,500

610: Interest Expense 2,250

620: Supplies Expense 0

630: Depreciation Expense 0

113,850 113,850

Totals

Requirement:

Prepare year-end adjusting journal entries for each of these separate situations.

As of December 31, employees had earned $400 of unpaid and unrecorded wages. The next payday is January 4 at which time $1,200 in wages will be paid.

The cost of supplies still available at December 31 is $3,450.

The notes payable requires an interest payment to be made every three months. The next payment occurs after the new year begins. The amount of unrecorded accrued interest at December 31 is $800.

Analysis of the unearned rental fees shows that $3,200 remains unearned at December 31.

In addition to the machinery rental fees included in the revenue account balance, the company has earned another $2,450 in unrecorded fee that will be collected on January 31 of next year.

Depreciation expense for the year is $3,800.

Answers

The Preparing Adjusted Trial Balance with the help of Worksheet: is given below:

The Adjusted Trial BalanceSolutions Company

Worksheet

December 31

Accounts Unadjusted Trial Balance Adjusting Entries Adjusted Trial Balance

Debit Credit Debit Credit Debit Credit

Cash $20,000 $20,000

Accounts Receivable 0 $2,450 2,450

Supplies 7,600 $4,150 3,450

Machinery 50,000 50,000

Accumulated Depreciation $20,000 3,800 $23,800

Accounts Payable 0 0

Interest Payable 0 800 800

Salaries Payable 0 400 400

Unearned Rental Fees 7,200 4,000 3,200

Note Payable 30,000 30,000

Common Stock 10,000 10,000

Dividends 9,500 9,500

Retained Earnings 14,200 14,200

Rental Fees 32,450 6,450 38,900

Salaries Expense 24,500 400 24,900

Interest Expense 2,250 800 3,050

Supplies Expense 0 4,150 4,150

Depreciation Expense 0 3,800 3,800

Totals $113,850 $113,850 $15,600 $15,600 $121,300 $121,300

Preparing Income Statement:-

Solutions Company

Income Statement

For the Year Ended December 31

Accounts Amount Amount

Revenue:-

Rental Fees $38,900

Total Revenue $38,900

Expenses:-

Salaries Expense $24,900

Interest Expense 3,050

Supplies Expense 4,150

Depreciation Expense 3,800

Total Expenses ($35,900)

Net Income $3,000

Preparing Statement of Retained Earnings:-

Solutions Company

Statement of Retained Earnings

For the Year Ended December 31

Accounts Amount

Retained Earnings 14,200

Net Income 3,000

$17,200

Dividends (9,500)

Retained Earnings, Ending $7,700

Preparing Balance Sheet:-

Solutions Company

Balance Sheet

December 31

Accounts Amount Amount

Assets:-

Cash $20,000

Accounts Receivable 2,450

Supplies 3,450

Machinery 50,000

Accumulated Depreciation (23,800)

Total Assets $52,100

Liabilities:-

Accounts Payable $0

Interest Payable 800

Salaries Payable 400

Unearned Rental Fees 3,200

Note Payable 30,000

Total Liabilities $34,400

Stockholders Equity:-

Common Stock $10,000

Retained Earnings, Ending 7,700

Total Stockholders Equity $17,700

Total Liabilities and Stockholders Equity $52,100

Preparing Closing Entries:-

Solutions Company

General Journal

December 31

Date Accounts Title and Explanation Debit Credit

December 31 Rental Fees $38,900

Income Summary $38,900

(To close Revenue Account)

December 31 Income Summary $35,900

Salaries Expense $24,900

Interest Expense $3,050

Supplies Expense $4,150

Depreciation Expense $3,800

(To close Expenses Accounts)

December 31 Income Summary $3,000

Retained Earnings $3,000

(To close Income Summary)

December 31 Retained Earnings $9,500

Dividends $9,500

(To close Dividends Account)

Read more about Adjusted Trial Balance here:

https://brainly.com/question/14476257

#SPJ1

Use the CAFR information for the City of Salem (Illustrations 2-2 through 2-16) to find the following items. in your answer, both indicate which financial statement contained the information and the item and the dollar amount.

Information Item Statement $ Amount

Ex Amounts due from other governments to support

governmental activities Balance Sheet—

Governmental Funds $1,328,448

A. Total capital outlay for the courthouse renovation

B. Total cash paid for capital additions for the solid

waste fund

C. Interest paid (not expense) on general long-term debt

D. Interest paid (not expense) on water department debt

E. Capital asset (net) for the government's component units

F. Contributions received for use by the private-purpose trust

G. Noncurrent liabilities associated with governmental

activities that are due in more than one year

H. Noncash contributions of capital assets for the water

department

Answers

Answer:

attached below

Explanation:

using the CAFR information the information required is tabulated as attached below

The net assets statement reports the liability, the net assets account balance for the government activities and also reports the assets

2

Select the correct answer.

What are factors of production?

all the human efforts involved in the production process

B.

all the resources used to produce any goods and services

C.

all the physical tools and equipment used in the production process

all the naturally occurring resources found in land, air, and water

D. all the naturally occurring recourses found in land, air, and water

A. all the human efforts involved in production process

Answers

The correct option is B. All the resources used to produce any goods and services are known as factors of production.

The resources that make up the foundation of the economy and are used by people to produce products and services are called factors of production. The four categories of factors of production that economists distinguish between are land, labor, capital, and entrepreneurialism.

Inputs, resources, or factors of production are what are utilized in the production process to produce output, or finished goods and services, in economics. The production function, a relationship, describes how much of each input is used to determine how much output is produced.

Learn more about factors of production here

https://brainly.com/question/16755022

#SPJ9

Which of the following is an example of a macroeconomic statement?

Lay-offs have led to increasing unemployment in the RV industry.

John Smith was recently laid off from his job at Thor.

The Elkhart County unemployment rate is 2%.

The national unemployment rate is 4%.

Answers

Answer:

The national unemployment rate is 4%

Explanation:

The following statement is an example of a macroeconomic statement: "The national unemployment rate is 4%."

A macroeconomic statement refers to an economic statement or analysis that focuses on the broader economy as a whole rather than on individual markets or companies. In this case, the statement about the national unemployment rate refers to the overall labor market in the country and not to a specific company or industry. The other statements are either about an individual's experience (John Smith's layoff) or a specific regional unemployment rate (Elkhart County's unemployment rate).

Inventory is an _____ . asset expense none of the above

Answers

Answer:

Inventory is an Asset.

Explanation:

Inventory is an asset because when a company buys an asset, they are investing in it, because they will sell it and make revenue/profit from it.

Today is also the day on which your manager’s boss is collecting information about your manager’s leadership style so that they can give him a 360-degree appraisal. They assure you that your comments about your manager will remain confidential, but the nature of your thoughts is such that he probably would guess you are the person who made those comments. Specifically, you think that your manager takes offense easily, has a bad temper, and could be more effective in time management. Would you share your thoughts with your manager’s manager?

Answers

The decision to share feedback about a manager should be based on a careful evaluation of the potential impact and one's own personal values and goals.

Sharing negative feedback about a manager can be a delicate situation, especially when it may affect the manager's performance review and future career opportunities. Before deciding whether to share the thoughts with the manager's manager, it is important to consider the potential consequences and benefits of doing so.

If the feedback is constructive and could help the manager improve their leadership skills, it may be worth sharing with the manager's manager in a tactful and respectful manner. However, if the feedback is solely based on personal opinions and could harm the manager's reputation or career prospects, it may be best to keep those thoughts to oneself.

for more questions on decision

https://brainly.com/question/30452878

#SPJ11

Required Materials

Word processing software

Imagine you and a friend are in college. You decide you want to open a coffee shop on campus next to the university’s dining room. You make your appeal to the administration by expressing how having a coffee shop on university grounds will help fellow students save time and money since they will not have to go off campus to purchase their favorite hot beverages and baked goods. The administration is open to the idea and praises your entrepreneurial spirit. They ask you to research the business ownership structure that would be most appropriate by comparing and contrasting the structures, and report back to them in two weeks.

Follow these steps to complete this activity. You will create a chart, a Venn diagram, and a report based on the directions below.

Step 1: Compare and Contrast Chart

Create a compare and contrast chart of the following business structures:

sole proprietorship

partnership

limited liability corporation

Include at least three advantages and disadvantages of each structure, including the legal implications of each ownership structure.

Step 2: Create a Venn diagram

Create a Venn diagram transferring the details from the chart.

Identify those characteristics that are similar in the cross section.

Place contrasting characteristics in the outer rings.

Step 3: Compile a Report

Determine which structure would be most appropriate for the coffee shop.

Compile a report identifying the structure you chose.

Provide three reasons explaining your choice.

Answers

The steps are given below

Business Structure Advantages Disadvantages

Sole Proprietorship Easy to start and manage Unlimited personal liability

Full control over business operations Limited access to capital and credit

Profits are taxed as personal income Difficulty attracting top talent

Partnership Shared management and financial responsibility Unlimited personal liability

Ability to share risk and expertise Potential for disputes between partners

Flexibility in decision making Profits are taxed as personal income

Limited Liability Company Limited personal liability for owners More complex and expensive to set up than other structures

Flexible taxation options Less flexibility in ownership and management structure

Enhanced credibility and access to funding Compliance requirements and ongoing administrative tasks

Step 3: Compile a Report

After considering the advantages and disadvantages of each business structure, we recommend the limited liability company (LLC) for the coffee shop.

First, an LLC provides limited personal liability for owners, meaning that personal assets are protected from business liabilities.

Second, an LLC offers flexibility in taxation options, allowing the business to choose between being taxed as a partnership or a corporation. Lastly, an LLC can enhance the credibility of the business, making it easier to attract funding from investors or lenders.

Overall, an LLC provides the necessary protection and flexibility for the coffee shop to operate successfully while minimizing personal risk.

Read more about reports here:

https://brainly.com/question/29985480

#SPJ1

Explain the following terms: (1Mark each) a) Family business b) Innovation c) Small business d) Networking e) Entrepreneurship

Answers

a) A family business pertains to a corporation on which one or multiple relations of a household invest in and manage it. These companies might be transferred throughout patriarchies and generally feature close familial ties and concentration on preventing long-term anticipations.

What is Innovation?b) Invention speaks about the invention and integration of innovative or better services, items, or processes that lead to noticeable changes or values. It integrates originality, hazard taking, and readiness to defy the traditionally accepted standards for the idea of advancing and sufficing customers’ desires or resolving issues.

c) Small business refers to an enterprise with restricted personnel and usually possessed capacity. These businesses can originated from single proprietors and serve narrow demographics or vicinity markets.

d) Networking outlines the method of cultivating and preserving interactions with individuals' collections in order to exchange knowledge, investments, and chances. It includes communally dynamic attitude, productive communication, and respect to collaborate and exchange experience.

e) Entrepreneurship portrays the process of starting and regulating a new commercial venture. It incorporates recognizing an absence or other possibility in the market, manufacturing a service/product to meet that want, and bringing into fruition via tactical planning, risk-taking, and novelty. Businesspeople normally possess a mix of creative imagination, passion, and firm understanding.

Read more about networking here:

https://brainly.com/question/1027666

#SPJ1

All leaders tend to share several common characteristics.

O True

O False

Answers

Answer:

O True

Explanation:

Which GPA does not appear on the transcript and therefore has to be calculated by the student for monitoring?

A. Term

B. Cumulative

C. Overall

Answers

Answer:

Explanation:

Cause GPA means the total grade point but CGPA means after completing the programme what is your cgpa.

List and describe five potential strategies for conflict resolution in teams. Which methods have been found to be most effective in teams? Which method is likely to be most successful if your manager likes to be involved in every decision?

Answers

Explanation:

Some efficient strategies for resolving conflicts in teams can be: assessing the situation, improving communication, providing feedback, redesigning work, collaboration, including employees in the decision.

The most effective methods are usually those that integrate several factors that act directly on the central motivator that is generating the conflicts, so it is necessary to analyze the situation, improve an effective communication about the team's objectives, provide feedback so that team members feel motivated to develop their skills in the best way, redesigning the work so that each employee is exercising the function that best suits their skills and the inclusion of employees in the team's decision-making processes, which creates a sense greater appreciation of work.

In the case of managers who are involved in all decisions, it is more appropriate to use the collaborative method, actively participating in the team's challenges, providing help and assisting subordinates in their demands in favor of the team's success.

businesses use organisational structure which is based around project but employee stay in their department

Answers

An organizational structure based around projects while employees remain in their departments combines the advantages of functional specialization and project-oriented collaboration

Businesses that adopt an organizational structure based around projects while keeping employees in their respective departments often follow a matrix or hybrid organizational structure. This approach allows organizations to leverage the benefits of both functional departments and project teams.

In this structure, employees are grouped into functional departments based on their areas of expertise or skills. These departments, such as finance, marketing, human resources, and operations, provide specialized support and resources to various projects within the organization. Each department is typically led by a department head or manager responsible for overseeing the department's operations and ensuring the delivery of functional objectives.

On the other hand, project teams are formed to address specific business objectives or initiatives. These teams are comprised of individuals from different departments who possess the necessary skills and expertise to achieve project goals. The project teams are usually led by a project manager who is responsible for coordinating activities, managing resources, and ensuring the successful completion of the project within the specified timeline and budget.

By adopting this organizational structure, businesses can maximize efficiency and resource utilization. Employees benefit from the stability and specialization offered by their department, allowing them to develop deep expertise in their functional areas. At the same time, they also have the opportunity to contribute their expertise to cross-functional project teams, enabling them to broaden their skills, collaborate with colleagues from different backgrounds, and gain exposure to diverse projects and challenges.

This structure facilitates better communication and coordination between departments, as project teams act as intermediaries, ensuring that information and resources flow seamlessly between the departments and the projects. Additionally, it encourages a culture of innovation and flexibility, as employees have the opportunity to contribute their unique perspectives and expertise to different projects, fostering a cross-pollination of ideas.

Overall, an organizational structure based around projects while employees remain in their departments combines the advantages of functional specialization and project-oriented collaboration, enabling businesses to efficiently execute projects while maintaining the stability and expertise of functional departments.

for more such question on organizational visit

https://brainly.com/question/25922351

#SPJ8

We have identified how to educate Sally with the tubo tax upgrade so she understands the benefit of the upgrade. Use what

we have learned about Sally's priorities to develop a statement that generates value in this situation.

Answers

TurboTax from Intuit is an application suite to complete American income tax forms.

What is turbo tax and what are its advantages?TurboTax, together with H&R Block Tax Software and TaxAct, is the industry leader in its product category. TurboTax was created in 1984 by Michael A. Chipman of Chipsoft and was acquired by Intuit in 1993.TurboTax, together with H&R Block Tax Software and TaxAct, is the industry champion in its product category. Advantages include a guarantee of 100% accurate calculations for business returns, a guarantee of TurboTax audit support for business returns, and a satisfaction guarantee. You can use TurboTax Online for free until you opt to print or online file your tax return.

To know about turbo tax visit:

https://brainly.com/question/16387476

#SPJ1

The Reverend Petros receives an annual salary of 51,000 as full-time minister this includes 5000 designated as a rental allowance River and Pedro is not exempt from employment tax how much must he include figuring that income for self-employed tax

Answers

If the Reverend Petros receives an annual salary of 51,000 as full-time minister that includes 5000 designated as a rental allowance. The amount that must be include figuring that income for self-employed tax is : $51,000.

What is annual salary?Annual salary can be defined as the amount a person earn as salary per year.

On the other hand self employed tax can be defined as the tax a person that is solely working for his/her self without working for any other person remit to the government.

Therefore the amount that must be include figuring that income for self-employed tax is the amount of $51,000.

Learn more about annual salary here:https://brainly.com/question/29045555

#SPJ1

What is an example of the consideration of visual merchandising?

A.

online ads using negative space to emphasize text

B.

social media videos with contrasting, bright images

C.

sponsored search engine results being shown in bold

D.

kids’ cereal boxes shelved about four feet high

Answers

An example of the consideration of visual merchandising can be seen in the way that kids’ cereal boxes are shelved in grocery stores. This is an example of how visual merchandising can be used to create an emotional connection with customers and influence their purchasing decisions. The correct option is D.

Visual merchandising refers to the visual elements that are used to promote a product or service. This includes the design of the product packaging, displays, advertising, and other marketing materials. Visual merchandising is important because it can help to create a strong brand identity, increase customer engagement, and ultimately drive sales.

Other examples of visual merchandising might include online ads that use negative space to emphasize text, social media videos with contrasting, bright images, and sponsored search engine results that are shown in bold.

All of these strategies are designed to capture the attention of the customer and encourage them to take action, whether it's clicking on an ad or making a purchase in-store. By carefully considering the visual elements of their marketing strategy, businesses can create a powerful and effective message that resonates with their target audience. The correct option is D.

For more such questions on merchandising

https://brainly.com/question/30371466

#SPJ8

The opportunity cost of a decision can be examined by using a _____.

Disabled

A.

graph of increasing costs

Disabled

B.

factors of production chart

Student Selected Correct

C.

production possibilities graph

Disabled

D.

global trade-off grid

Answers

A production possibilities graph can be used to assess the opportunity cost of a choice.

What is a decision's opportunity cost?In a recent Page One Economics: Money and Missed Opportunities, Andrea Caceres-Santamaria, senior economic education specialist at the St. Louis Fed, explains that opportunity cost is the value of the next-best alternative when a decision is made; it is what is given up.

Why does a decision have an opportunity cost?Opportunity cost is the price of giving up an option. In other words, it's the resources you forgo when you pick choice A over option B, such as money, time, or other resources. The objective is to give the expense a numerical value, such as a dollar amount or percentage, so you can calculate a better choice.

To know more about production visit:-

https://brainly.com/question/22852400

#SPJ1

Consider the organization you are currently working in and explain this organization from systems characteristics perspectives particularly consider objective, components (at least three) and interrelationships among these components with specific examples

Answers

Explanation:

I don't have direct knowledge of the organization you are currently working in. However, I can provide a general example to help illustrate the systems characteristics of an organization. Let's consider a fictional manufacturing company called "ABC Manufacturing."

Objective:

The objective of ABC Manufacturing is to efficiently produce and deliver high-quality products to its customers while maximizing profitability. The organization aims to maintain a competitive edge in the market by consistently meeting customer demands and optimizing its operations.

Components:

1. Human Resources: The employees of ABC Manufacturing form a crucial component. They include production workers, managers, engineers, and support staff. Each employee contributes their skills and expertise to ensure smooth operations. For example, production workers assemble products, engineers design new prototypes, and managers oversee the overall functioning of the organization.

2. Production Facilities: The physical infrastructure, including factories, warehouses, and equipment, is another vital component. These facilities house the production lines, machinery, and storage areas necessary for manufacturing products. The efficient functioning of the production facilities is essential to meet production targets and ensure the timely delivery of goods.

3. Supply Chain and Logistics: The supply chain component involves managing the flow of materials, resources, and finished products. This includes sourcing raw materials, coordinating with suppliers, inventory management, and distribution logistics. Effective supply chain management ensures that the right materials are available at the right time, minimizing delays and reducing costs.

Interrelationships among Components:

The components of ABC Manufacturing are interrelated and interconnected, forming a system that works together to achieve the organization's objectives. Here are a few examples of interrelationships among these components:

1. Human Resources and Production Facilities: The production facilities rely on the skills and efforts of the employees. Human resources ensure that the right talent is hired, trained, and deployed in the production process. They also provide support and maintenance services to ensure the smooth functioning of the production facilities.

2. Production Facilities and Supply Chain: The production facilities rely on the timely availability of raw materials from the supply chain. Efficient coordination between production and supply chain teams is necessary to maintain optimal inventory levels and avoid production delays.

3. Supply Chain and Human Resources: The supply chain team collaborates with human resources to forecast demand, plan workforce requirements, and align production schedules accordingly. Effective communication and coordination between these components ensure that the production process meets customer demand and avoids excessive inventory or stockouts.

By viewing ABC Manufacturing through a systems perspective, we recognize that the organization is a complex interplay of various components working together to achieve a common objective. Understanding the interrelationships and dependencies among these components helps in identifying areas for improvement and optimizing the overall performance of the organization.

Answer:Dashen Bank s.c is a company where I am working in it. The company’s objective is to maximize its profit and become from the lists in best class banks in Africa. To achieve this objective it has its own system which contains the following components

• A banking software called FLEXCUBE which is the core software which accomplishes the majority of the banking day to day activities e.g. cash withdrawal, cash deposit, account opening general leger account postings etc.

• CATPS(card application tracking and processing system) is a component of a system which is used to capture ATM card applications and authorize the processed/ captured applications in order to produce the cards

• Amole admin/internet banking application is used to create an access to the customers such that user name and passwords and and link bank accounts so customers can transfer money, make payments at home.

The above listed components have interrelation each other. E.g. in order to produce cards using CATPS, the customer must have a bank account with precise customer data such that signature, photo etc. so these stated things i.e. account opening, signature and photo uploading activities are processed by FLEXCUBE software. In the same manner, in order to get an access to the bank account using amole/ internet banking, the customer must have properly opened bank account with customer signature and photo which is also processed by using FLEXCUBE software.

How is inflation being affected globally

Answers

Answer: Inflation is pushing up the prices of essential goods such as food, transport and utilities.

More than two-thirds of people around the world are feeling the squeeze, according to new research.

As the cost of living rises, the poorest in society are suffering most.

Explanation:

What is the difference between a 3.5 fold and an 8 fold essay?

Answers

A 3.5 fold essay consists of an introduction, three body paragraphs, and a conclusion, while an 8 fold essay expands on the 3.5 fold structure by adding more detail and nuance to each paragraph.

The terms "3.5 fold" and "8 fold" essay refer to different methods of organizing the structure of an essay. A 3.5 fold essay consists of an introduction, three body paragraphs, and a conclusion. The three body paragraphs each have a specific purpose and follow a specific structure: the first paragraph introduces the main idea, the second paragraph supports the main idea with evidence, and the third paragraph provides a conclusion or summary.

On the other hand, an 8 fold essay expands on the 3.5 fold structure by adding more detail and nuance to each paragraph. The introduction and conclusion remain the same, but each body paragraph is broken down into smaller sections that address different aspects of the main idea. This allows for a more thorough exploration of the topic and a more complex argument.

In summary, the main difference between a 3.5 fold and an 8 fold essay is the level of detail and complexity in the organization of the body paragraphs. The 8 fold essay provides a more in-depth exploration of the topic, while the 3.5 fold essay is a simpler and more straightforward structure.

Learn more about essay here

brainly.com/question/20426054

#SPJ1

If the effect of the debit portion of an adjusting entry is to increase the balance of an asset

account, which of the following describes the effect of the credit portion of the entry?

Answers

When the debit portion of an adjusting entry is used to increase the balance of an asset account, the credit portion of the entry will decrease the balance of another account, which will be either a liability account or an equity account.

What is the adjusting entry?Adjusting entries are journal entries that are made at the end of an accounting period to modify the accounts' balances. They are done to update and verify revenue and expense accounts' accuracy, as well as to adjust the balance sheet accounts for adjustments that have yet to be recorded.When should adjusting entries be made?Adjusting entries are typically made at the end of an accounting period. For example, adjusting entries may be needed if a company's insurance premiums have been paid in advance, or if a company has earned revenue but has not yet received payment.Adjusting entries are critical in determining the correct profit and loss as well as the balance sheet, which is why they must be accurate and complete.Adjusting entries are required for each financial statement's following types:Income Statement - revenue and expense accounts are adjusted.Balance Sheet - asset, liability, and equity accounts are adjusted.How are adjusting entries made?Adjusting entries are made with the following steps:Step 1: Determine the transaction or event that necessitates an adjustment. Step 2: Determine which accounts are affected by the transaction or event. Step 3: Decide whether each account is to be debited or credited. Step 4: Make the necessary adjusting journal entries.

For more question portion of an adjusting

https://brainly.com/question/14565649

#SPJ8

1. prepare income statements for both garcon company and pepper company. 2. prepare the current assets section of the balance sheet for each company.

Answers

There are three main parts of income statements and they are:

RevenueExpensesProfitWhat is an Income Statement?This refers to the profit and loss account of a company that shows the expenses and revenue for a particular company.

Hence, we can see that a sample income statement would be:

BOSKA COMPANY

Income statement for August 29, 2021

NET SALES------------------ $2,000,000

GROSS SALES-------------$500,000

GROSS PROFIT-------------$1,5000,000

Read more about income statements here:

https://brainly.com/question/24498019

#SPJ1

Chilly Moose Fruit Producer has a total asset turnover ratio of 6.00x, net annual sales of $40 million, and operating expenses of $18 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $1.75 million on which it pays a 7% interest rate. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Chilly Moose Fruit's debt management ratios? Value Ratio Debt ratio Times-interest-earned ratio Influenced by a firm's ability to make interest payments and pay back its debt, if all else is equal, creditors would prefer to give loans to companies with debt ratios.

Answers

Chilly Moose Fruit's debt ratio will be 0.26 , asset turnover ratio will be $ 6.67 million and interest payment 179. 59

Elaborating the problem:

Given : asset turnover ratio = 6

total sales = $ 40 million

operating expenses = $ 18 million

total debt = $ 1.75 million

interest rate = 7 %

Using the formula:

asset turnover ratio = \(\frac{total sales }{total asset}\)

6 = 40 / total asset

total asset = $ 6.67 million.

Total asset = total equity + debt

6.67 = equity + 1.75

equity = $ 4.92 million

Total sales 40

(-) Operating expenses 18

EBIT $ 22 million

Debt ratio = \(\frac{debt }{total asset}\)

= \(\frac{1.75 }{6.67}\) = 0.26

Time interest earned = \(\frac{EBIT}{interest expense}\)

= 22 ÷ ( 1.75 × 7%)

= 179 .59

Creditors would prefer to provide loan to the company at lower debt ratios .

Ratio of debt management:Debt management ratios show how much money is borrowed compared to the value of all assets and how much money is available to pay debts. The debt ratio and the times interest earned ratios make up two of its components.

What's the significance of the debt management ratio?A company's level of risk is indicated by its debt-to-equity ratio, which measures how risky its capital structure is. The ratio shows how much debt a company is using to run its business and how much financial leverage it has.

Learn more about debt management ratio:

brainly.com/question/17562254

#SPJ1

Suppose you carelessly, but unintentionally, knocked someone down a flight of stairs in your home. you would be covered by your homeowner's insurance.

a. True

b. False

Answers

True, Suppose you carelessly, but unintentionally, knocked someone down a flight of stairs in your home. you would be covered by your homeowner's insurance.

An agreement to guarantee another party compensation in exchange for a fee constitutes insurance, a strategy for protecting against financial loss. A way to control your risk is through insurance. When you purchase insurance, you protect yourself against unforeseen financial losses. If something unfavorable occurs to you, the insurance company pays you or a person of your choice. A homeowner is a person who owns a home, including the apartment or house where they reside. This policy, which is the one that homeowners use the most frequently, is created to cover all aspects of the house, its structure, and its contents.

Learn more about insurance here :

https://brainly.com/question/27822778

#SPJ4