Answers

Answer: International trade lowers the cost and increases the variety of U.S. consumer purchases, benefits U.S. workers who make exports and those who rely on imports as key inputs, and helps fuel innovation, competition, and economic growth. The United States is the world's largest economy and the largest exporter and importer of goods and services. Trade is critical to America's prosperity - fueling economic growth, supporting good jobs at home, raising living standards and helping Americans provide for their families with affordable goods and services. Countries that are open to international trade tend to grow faster, innovate, improve productivity and provide higher income and more opportunities to their people. Open trade also benefits lower-income households by offering consumers more affordable goods and services.

Related Questions

Shares of Corporation have a beta of 0.90. The market risk premium is 7%, and

the risk-free rate is 8%. Corporation paid a dividend of $1.80 per share, and the

dividend is expected to grow at 7% forever. The share currently sells for $25.

Corporation has a debt-equity ratio of 50%. Its cost of debt is 8%, before taxation,

taxation rate is 30%.

What is the weighted average cost of capital of Corporation?

Answers

Answer:

The weighted average cost of capital of Corporation is 11.4%

Explanation:

Now use following formula to calculate the weighted average cost of equity

WACC = ( Weight of equity x Cost of equity ) + ( Weight of debt x Cost of debt (after tax ) )

Weight

Equity = 100%

Debt = 50%

Cost

First we need to calculate the cost of equity using CAPM formula

Cost of equity = Risk free rate + Beta x ( Market risk premium )

Placing values in the formula

Cost of equity = 8% + 0.90 x 7%

Cost of equity = 14.3%

Cost of debt = 8%

Cost of debt (after tax ) = 8% x ( 1 - 30% ) = 5.6%

Placing values in the formula of Weighted average cost of capital

WACC = ( ( 100%/150% ) x 14.3% ) + ( ( 50% / 150% ) x 5.6% )

WACC = 9.53% + 1.87%

WACC = 11.4%

Property assessed for tax purpose at 50% of market value. The tax rate being $4.90 per $100. Today rate has increased by $637. How much had the market value increased

Answers

Answer:

If the property was assessed for tax purposes at 50% of its market value and the tax rate was $4.90 per $100, the tax on the property would be calculated as follows:

Tax = (market value * 50%) * (tax rate / 100) = market value * (tax rate / 200)

If the tax rate increased by $637, the new tax on the property would be:

New tax = market value * ((tax rate + $637) / 200)

Since the tax on the property is constant, we can set the original and new tax equations equal to each other and solve for the market value:

market value * (tax rate / 200) = market value * ((tax rate + $637) / 200)

Dividing both sides by the market value and rearranging the terms, we find that:

(tax rate / 200) = ((tax rate + $637) / 200)

Solving for the tax rate, we find that:

tax rate = $637

Since the property was assessed for tax purposes at 50% of its market value, the market value of the property is equal to twice the tax rate. Therefore, the market value of the property increased by 2 * $637 = $1274.

Explanation:

Which type of loan is also known as a cash advance loan or a deferred deposit loan?

Answers

Explanation:

A payday loan is a short-term loan, generally for $500 or less, that is typically due on your next payday.

They are also known as cash advance loans, post-dated check loans, check advance loans or deferred deposit loans.

On the first day of the fiscal year, Hawthorne Company obtained an $88,000, 7-year, 5% installment note from Sea Side Bank. The note requires annual payments of $15,208, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $4,400 and principal repayment of $10,808. The journal entry Hawthorne would record to make the first annual payment due on the note would include a Group of answer choices debit to cash for $15,208 credit to notes payable for $10,808 debit to interest expense for $4,400 debit to notes payable for $15,208

Answers

Answer:

Debit to interest expense for $4400

Explanation:

Based on the information given we were told that the FIRST PAYMENT consists of INTEREST of the amount of $4,400 which means that The Appropriate journal entry Hawthorne would record to make the FIRST ANNUAL PAYMENT due on the note would include a DEBIT TO INTEREST EXPENSE FOR $4400.

Debit to interest expense for $4400

what is the relative worth of goods

Answers

Relative Value in Consumption is measured as the relative cost of the amount of goods and services such as food, shelter, clothing, etc., that an average household would buy. Historically this bundle has become larger as households have bought more over time.

What can cause the market demand curve for day old bread and inferior hood to shift rightward an increase in demand

Answers

A decline in income is one factor that can lead the market demand curve for day-old bread to move to the right.

What might cause a demand curve to shift to the right?If the determinant raises demand, the curve moves to the right. This indicates that even while the price remains the same, there is a greater demand for the commodity or service. The incomes of consumers will increase as the economy is flourishing. Despite the fact that prices haven't increased, people will purchase more of everything.

When income increases the demand curve for an inferior good?As income rises or the economy gets better, the demand for subpar products declines in economics. Consumers will be more inclined to spend money on pricey alternatives if this occurs. Quality or a change in a consumer's socioeconomic level may be a few factors causing this transition.

To know more about demand curve visit:

https://brainly.com/question/6075885

#SPJ9

Steve met Diana at the local gym and they started talking about how Diana needed her

house painted. Steve told Diana that he would paint her whole house for $5,000 and

that he would keep the offer open for seven days. Later that night, Steve even sent

Diana an email detailing the terms of the offer. Two days later, Steve sent Diana an

email around 2:25 p.m., stating that the original offer was revoked. Around 1:55 p.m.

that same day, Diana wrote Steve a letter, stating that she accepted his offer for the

house painting. As soon as Diana was able, she went to Post Office and sent Steve the

letter by certified mail (time stamped by the Postal Service at 2:27 p.m.). That night

around 5:45 p.m., Diana was reviewing her emails and saw Steve's earlier email

informing her about the revocation of the offer. She immediately called him to tell him

that she had wrote him a letter of acceptance. Was the offer revoked by Steve and why

or why not?

Answers

Answer:

Was the offer revoked by Steve and why

or why not?

No

Explanation:

I am not the best with contracts so no guarnatee but there was a clear offer, acceptance, consideration, making this a contract. Unless in the terms of the contract it stated that there could be a cancellation at any time, Steve is obligated to follow through.

Which of the following, indicate whether each statement about regional trade agreements is true or false. Statement True False

Under regional trade agreements, several countries eliminate tariffs among themselves and lower tariffs against all other countries.

Regional trade agreements contradict GATT’s most favored nation principle.

The countries in the European Union (EU) keep their own tariffs with the countries outside the EU.

A good imported into Mexico from China will not be granted duty-free access to the U.S. market if no value is added to this good in Mexico.

Rules of origin specify the types of goods that can be shipped duty-free within a free trade area.

Rules of origin specify the types of goods that can be shipped duty-free within a customs union.

Answers

Answer: Please refer to Explanation

Explanation:

Under regional trade agreements, several countries eliminate tariffs among themselves and lower tariffs against all other countries.

FALSE.

Under regional Trade Agreements, countries do indeed eliminate tariffs amongst themselves but there is no obligation to reduce tariffs against countries not part of the agreement.

Regional trade agreements contradict GATT’s most favored nation principle.

TRUE

Regional Trade Agreements do indeed violate the GATT's and the WTO's most favoured principle which states that rights granted to 1 nation of GATT must be granted to all nations in GATT.

The countries in the European Union (EU) keep their own tariffs with the countries outside the EU.

FALSE.

As a political and economic union, the EU maintains a common tariff against countries outside the EU.

A good imported into Mexico from China will not be granted duty-free access to the U.S. market if no value is added to this good in Mexico.

TRUE.

Agreements between China and Mexico do not bound the US if they are not in the agreement as well. Seeing however, as there is an agreement between Mexico and the US, Mexican products can come into the US duty free so for a Chinese product to do tge same, it needs to have been added value to in Mexico.

Rules of origin specify the types of goods that can be shipped duty-free within a free trade area.

TRUE

Rules of origin are made to decide which goods can be shipped duty free.

Rules of origin specify the types of goods that can be shipped duty-free within a customs union.

FALSE.

Rule of Origin do not necessarily apply in a Customs Union as they are supposed to maintain a fixed tariff rate against all countries outside the Customs Union.

It is true that under regional trade agreements, several countries eliminate tariffs among themselves and lower tariffs against all other countries.

Regional trade agreements contradict GATT’s most favored nation principle is true.

The countries in the European Union (EU) keep their own tariffs with the countries outside the EU is true.

A good imported into Mexico from China will not be granted duty-free access to the U.S. market if no value is added to this good in Mexico is true.

Rules of origin specify the types of goods that can be shipped duty-free within a free trade area is true.

Rules of origin specify the types of goods that can be shipped duty-free within a customs union is false.

Read related link on:

https://brainly.com/question/15179003

Employee morale can be supported when communicating to employees about major events that affect them and their jobs by delivering the news _______. a. through the grapevine b. through news accounts c. from management personally d. from co-workers

Answers

The Employee morale can be supported when communicating to employees about major events that affect them and their jobs by delivering the news from management personally.

Employee morale refers to a person's attitude, level of contentment, and general outlook while working for a company or the organization. If your company has a bad culture, negative communicating like low productivity, low employee happiness, etc. will result. Everyone will be drawn to the morale example of paid time off. The employees can receive an unexpected "free day" as a token of thanks for their efforts on a recently finished project, for instance.

To learn more about communicating, click here.

https://brainly.com/question/22558440

#SPJ1

What is the first step in QuickBooks Online that must be completed prior to recording the deposit? +New > Invoice +New> Journal entry +New> Receive payment +New > Make deposit

Answers

The first step in QuickBooks Online that must be completed prior to recording the deposit is Option C. +New > Receive payment.

The first step in QuickBooks Online that must be completed prior to recording the deposit is +New > Receive payment. It is recommended that you document each payment you receive from your clients or customers as a deposit to ensure that the transaction is accurately reflected in your QuickBooks Online account.

To record a deposit in QuickBooks Online, follow these steps:

Go to QuickBooks online and sign in to your account. Select the +New button, which is located in the upper-left corner of the screen. Choose Receive Payment from the drop-down menu. Enter the name of the customer who is making the payment in the Receive Payment From field. From the Payment Method drop-down menu, select the payment method that the customer is using. Enter the amount of the payment that was received in the Payment Amount field, along with any fees or discounts that may apply. If there are any notes you'd like to include with the transaction, you can add them to the Memo field. Click on Save and close.To summarize, when recording a deposit in QuickBooks Online, the first step that must be completed is to choose the +New button and select Receive Payment from the drop-down menu. Therefore, the correct option is C.

The question was incomplete, Find the full content below:

What is the first step in QuickBooks Online that must be completed prior to recording the deposit?

A. +New > Invoice

B. +New> Journal entry

C. +New> Receive payment

D. +New > Make deposit

Know more about QuickBooks Online here:

https://brainly.com/question/24441347

#SPJ8

Threats identified in a SWOT Analysis are the most difficult element to mitigate true or false

Answers

Answer:

True

Explanation:

What are LinkedIn Groups?

Answers

Answer:

A LinkedIn group is like a dedicated place or hub where like-minded professionals who belong to the same niches and have the same interests build meaningful relationships and share their expertise to help each other gain particular business objectives.

These groups provide an opportunity to build a professional community and build your brand on this platform. These are considered the most valuable resources for career networking, brand awareness, engagement, and lead generation.

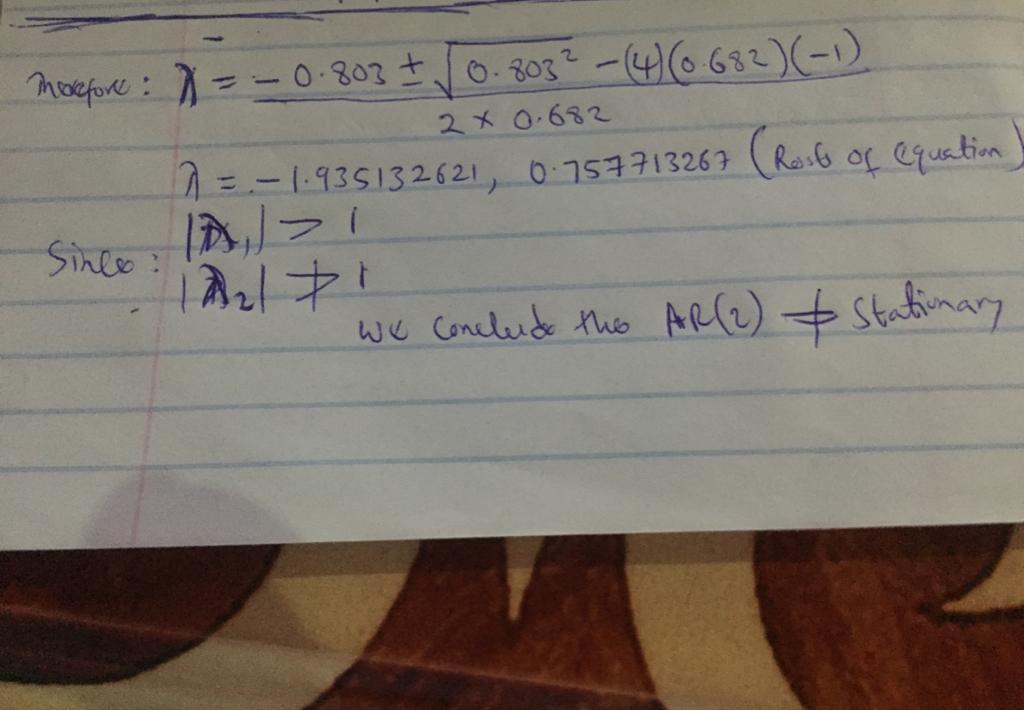

You obtain the following estimates for an AR(2) model of some returns data

yt = 0.803yt−1 + 0.682yt−2 + ut

Where ut is a white noise error process. By examining the characteristic equation, check the estimated model for stationarity.

Answers

Answer:

AR(2) model is not stationary

Explanation:

Given model : Yt = 0.803yt-1 + 0.682yt-2 + ut ---- ( 1 )

ut = noise error process

Aim : Check estimated model for stationarity

step 1 : represent the estimated polynomial of the model ( where: ut ∪ N(o,б^2 ) rewrite equation 1

Yt - 0.803yt-1 - 0.682yt-2 = ut ------- ( 2 )

hence the polynomial can be represented as :

( 1 - 0.803B - 0.682B^2 )Yt = ut

Characteristic of the obtained polynomial can be represented as ;

1 - 0.803λ - 0.682λ^2 - 1 = 0

attached below is the remaining part of the solution

One of the flaws of Al-assisted translation tools is? A. work best on text with idiomatic expression and complex phrasing B. they get the gist of the text, but not an exact translation C. they only work well when a text contains a significant amount of abstract ideas they are more expensive that having a human do the translation work D. they process language , not read it for understanding

Answers

D. They process language, not read it for understanding.

AI-assisted translation may work well when literal translation is needed, that is, when translation must be free of any form of interpretation, since interpretation is inextricably linked with subjectivity, abstraction and irrational or surreal elements on human thinking.

AI-assisted translation can translate literal meaning of words and literal structure of grammar, but it cannot understand the sense behind words and sentences.

Therefore, we conclude that right answer is D.

We kindly invite to check this question on artificial intelligence: https://brainly.com/question/3398244

Explain how you would expect a libertarian, a social democrat, and someone with an organic conception of the state to react to the following laws:a. A law prohibiting receiving compensation for organ donation.b. A law mandating helmet use for motorcyclists.c. A law mandating child safety seats.d. A law prohibiting prostitution.e. A law prohibiting polygamy.f. A law barring the use of trans fats in restaurants.

Answers

Libertarian: a. oppose, b. oppose, c. oppose, d. oppose, e. oppose, f. oppose.

Social Democrat: a. support, b. support, c. support, d. nuanced view, e. nuanced view, f. support.

Organic Conception of the State: a. nuanced view, b. support, c. support, d. oppose, e. support, f. support.

Why will be law mandating helmet use for motorcyclists.c?A libertarian would likely oppose all of these laws on the basis of individual freedom and limited government intervention.

Regarding the law prohibiting receiving compensation for organ donation, a libertarian would argue that it is an individual's right to choose what they do with their own body, including selling organs if they so choose.

With regards to the law mandating helmet use for motorcyclists, a libertarian may argue that it is an individual's right to choose whether or not to wear a helmet, even if it may result in increased risk of injury.

A libertarian may also oppose the law mandating child safety seats, as they may argue that it is the responsibility of the parent to ensure the safety of their child, and not the government's role to mandate it.

Regarding the law prohibiting prostitution, a libertarian would argue that it is an individual's right to engage in consensual activities, even if they are deemed morally questionable by some.

Similarly, a libertarian may also oppose the law prohibiting polygamy, as they may argue that it is an individual's right to choose how they want to form relationships, as long as it is consensual.

Finally, a libertarian may oppose the law barring the use of trans fats in restaurants, as they may argue that it is the individual's responsibility to make informed choices about their diet, and not the government's role to regulate it.

On the other hand, a social democrat would generally support these laws as they align with their belief in government intervention to promote social welfare and protect public health and safety.

Regarding the law prohibiting receiving compensation for organ donation, a social democrat may argue that it is necessary to prevent exploitation of vulnerable individuals who may be coerced into selling their organs for financial gain.

With regards to the law mandating helmet use for motorcyclists, a social democrat may argue that it is necessary to protect individuals from injury and reduce the burden on the healthcare system.

A social democrat would also support the law mandating child safety seats, as it promotes the safety and well-being of children.

Regarding the law prohibiting prostitution, a social democrat may argue that it is necessary to protect individuals, particularly women, from exploitation and abuse within the sex industry.

Similarly, a social democrat may support the law prohibiting polygamy, as they may argue that it is necessary to protect the rights and well-being of individuals within relationships, particularly women and children.

Finally, a social democrat may support the law barring the use of trans fats in restaurants, as it promotes public health by reducing the prevalence of unhealthy food options.

Someone with an organic conception of the state may have a more nuanced approach to these laws, considering the cultural and societal values and traditions that shape the state's role in promoting public welfare.

Regarding the law prohibiting receiving compensation for organ donation, someone with an organic conception of the state may argue that it is necessary to consider the ethical implications of commodifying human body parts, and the impact it may have on cultural values surrounding the sanctity of life and bodily autonomy.

With regards to the law mandating helmet use for motorcyclists, someone with an organic conception of the state may consider the role of the state in promoting individual safety and well-being, while also weighing the impact on cultural values surrounding personal freedom and autonomy.

A person with an organic conception of the state would likely also support the law mandating child safety seats, as it aligns with their belief in promoting the well-being of the next generation.

Regarding the law prohibiting prostitution, someone with an organic conception of the state may consider the impact on cultural values surrounding sexuality and morality, while also considering the potential harms to individuals within the sex industry.

Similarly, someone with an organic conception of the state may support the law prohibiting polygamy.

Learn more about promoting traditional

brainly.com/question/29609630

#SPJ11

A well-known t-shirt is produced in another country. Who should benefit from its profits?

Answers

The person who should benefit from the profits of the well-known t-shirt are both the company that produces it and the sellers in the country.

Who should benefit from sales profit?The primary people who should benefit from the sale of a good or service are those who produce it. It does not matter if those people are in another country, but their efforts in production should be rewarded.

When a product such as a well-known t-shirt is produced in another country and then sold locally, those who sell the shirts locally should also benefit from the profit for their hard work in selling the shirts.

Find out more on profits at https://brainly.com/question/5565342

#SPJ1

Assume you are the CFO of a company that has accumulated a significant amount of cash, well beyond its foreseeable needs. The company’s CEO has asked your opinion about using the cash to repurchase company shares or using the cash to distribute an extraordinary dividend to your shareholders. In a brief memo, explain to the CEO what the pros and cons of each of these are. You may assume your company is a fictitious one and assign to it whatever circumstances you like or you may assume your company is an actual existing corporation. Your memo should include at least two references to published works like books, articles, etc.

Answers

Answer:

I believe that the best action is to repurchase stocks.

Paying a large and unexpected dividend will yield an immediate return, but it will also decrease the stock's price. On the other hand, repurchasing stocks will result in lower outstanding stocks and the same cash flows. This will result in higher stock prices. Supposedly, upper management has the duty to increase the wealth of stockholders and that is achieved through higher stock prices.

Explanation:

The Hub Store at a university in eastern Canada is considering purchasing a self-serve checkout machine similar to those used in many grocery stores and other retail outlets. Currently the university pays part-time wages to students totalling $64,000 per year. A self-serve checkout machine would reduce part-time student wages by $44,000 per year. The machine would cost $420,000 and has a 10-year useful life. Total costs of operating the checkout machine would be $6,800 per year, including maintenance. Major maintenance would be needed on the machine in five years at a total cost of $11,800. The salvage value of the checkout machine in 10 years would be $49,000.

The CCA rate is 25%. Management requires a 10% after-tax return on all equipment purchases. The company’s tax rate is 30%.

1. Determine the before-tax net annual cost savings that the new checkout machine will provide.

2-a. Using the data from (1) above and other data from the exercise, compute the checkout machine’s net present value. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negative value should be indicated with minus sign.)

2-b. Would you recommend that the machine be purchased?

Answers

The before-tax net annual cost savings that the new checkout machine will provide is $54,840 per year.

How do you determine the values?To determine the before-tax net annual cost savings that the new checkout machine will provide, we need to calculate the difference between the current part-time student wages and the total operating costs of the checkout machine.

Current part-time student wages: $64,000 per year

Total operating costs of checkout machine: $6,800 per year + $11,800 in five years = $6,800 per year + $2,360 per year

Total savings: $64,000 - ($6,800 + $2,360) = $54,840 per year

2-a. To compute the net present value (NPV) of the checkout machine, we need to use the following formula:

NPV = -Cost of investment + (Annual savings / (1 + Discount rate)^n) + (Salvage value / (1 + Discount rate)^n)

Where n is the number of years, Discount rate is the required rate of return, in this case 10% after-tax, and the salvage value is in the last year.

Cost of investment = $420,000

Annual savings = $54,840

Salvage value = $49,000

Discount rate = 10% after-tax = 10%*(1-30%) = 7%

n = 10 years

NPV = -$420,000 + ($54,840 / (1 + 0.07)^10) + ($49,000 / (1 + 0.07)^10) = -$420,000 + $38,982 + $27,813 = $-353,205

2-b. Based on the NPV calculation, the machine has a negative value so it would not be recommended to purchase. The company will lose money by purchasing it.

Therefore, the correct answer is as given above

learn more about before-tax: https://brainly.com/question/9437038

#SPJ1

Think of a routine task that you did without question. How can the task be improved and benefit you?

Answers

Answer:

Daily exercise is an essential routine task that provides numerous health benefits such as reducing the risk of chronic diseases, improving cardiovascular health, enhancing mental health, and increasing overall well-being. However, I may find it challenging to stick to a consistent exercise routine due to various reasons, such as lack of motivation, time constraints, and boredom.

One way to improve the exercise routine and benefit me is by incorporating fun and exciting activities. Instead of traditional forms of exercise such as running or weightlifting, individuals can try new and engaging activities such as dance workouts, martial arts, or outdoor sports. By finding an enjoyable form of exercise,I will be more likely to stick to their routine and feel more motivated to continue.

Another way to improve the exercise routine is by incorporating technology. Fitness apps, wearables, and smart equipment can track progress, provide customized workout plans, and offer motivation and accountability. Additionally, virtual exercise classes and personal trainers can provide guidance and support from the comfort of home, making it easier for individuals to exercise regularly.

By improving the exercise routine, I can enjoy the benefits of daily exercise while also having fun and staying motivated.

Explanation:

The topic sentence in each step of a process analysis should identify?

Answers

The topic sentence in each step of a process analysis should identify the reason for doing the step. The correct option is C.

What is the main function of a process analysis essay?A process analysis essay explains how to carry out a task or how a process operates. The steps for writing a process analysis essay are the same regardless of the situation. The procedure is broken down into distinct, definite steps. A step-by-step process is used in almost everything writers do.

Product analysis is carried out as part of the Define Scope process to produce a comprehensive scope at the end. The goals and description of the product as stated by the client or sponsor are examined during the product analysis process. It is anticipated that analysis will lead to concrete project deliverables.

Thus, the ideal selection is option C.

Learn more about analysis essays here:

https://brainly.com/question/28729592

#SPJ1

Your Question seems incomplete, most probably your complete question was:

The topic sentence in each step of a process analysis should identify:

a

the outcome of the step

b

the final product

c

the reason for doing the step

d

pitfalls of the step

What role does the invisible hand play in a firm's decision-making process - both in regard to the firm's own self-interest and also in regard to the market's natural tendency toward equilibrium (the point at which the quantity demanded equals the quantity supplied)?

Answers

Answer: The role that the invisible hand plays in a firm decision making choice is that it insures you and it helps you better understand what the product seller is selling to the customer.

Explanation:

Tangshan Mining Company must choose its optimal capital structure. Currently, the firm has a 40 percent debt ratio and the firm expects to generate a dividend next year of $4.89 per share and dividends are expected to grow at a constant rate of 5 percent for the foreseeable future. Stockholders currently require a 10.89 percent return on their investment. Tangshan Mining is considering changing its capital structure if it would benefit shareholders. The firm estimates that if it increases the debt ratio to 50 percent, it will increase its expected dividend to $5.24 per share. Because of the additional leverage, dividend growth is expected to increase to 6 percent and this growth will be sustained indefinitely. However, because of the added risk, the required return demanded by stockholders will increase to 11.34 percent. (a) What is the value per share for Tangshan Mining under the current capital structure

Answers

Answer:

Tangshan Mining Company

The value per share for Tangshan Mining under the current capital structure is:

= $44.90

Explanation:

a) Data and Calculations:

Debt ratio = 40%

Equity ratio = 60% (100 - 40)

Expected dividend per share next year = $4.89

Expected dividend growth rate = 5%

Stockholders' required rate of return = 10.89%

New capital structure:

Estimated debt ratio = 50%

Estimated equity ratio = 50% (100 - 50)

Projected dividend under new capital structure = $5.24

Projected dividend growth rate = 6%

Projected stockholders' required rate of return = 11.34%

Under current capital structure:

Value per share = Dividend/Required rate of return

= $44.90 ($4.89/10.89%)

Shere Khan Corporation is currently evaluating a new project. Relatively inexpensive equipment with an estimated cost of $300 000 would be purchased, but shipping costs to move the equipment would total $25 000 and installation charges would add another $15 000 to the total equipment costs. Further, the company's inventories would have to be increased by $20 000 at the time of initial investment. The straight-line depreciation rate is 20% and corporate tax rate is 25%. Calculate the annual depreciation.

Answers

Shere Khan Corporation's new project would have an annual depreciation of $54,000 using the straight-line depreciation method.

Total cost = Equipment cost + Shipping cost + Installation charges + Increase in inventories

Total cost = $300,000 + $25,000 + $15,000 + $20,000

Total cost = $360,000

Next, we need to determine the depreciable amount, which is the total cost of the equipment minus any salvage value. In this case, we will assume that the equipment has no salvage value, so the depreciable amount is:

Depreciable amount = Total cost - Salvage value

Depreciable amount = $360,000 - $0

Depreciable amount = $360,000

Now we can calculate the annual depreciation using the straight-line depreciation method. This method assumes that the asset depreciates evenly over its useful life. The formula for straight-line depreciation is:

Annual depreciation = Depreciable amount / Useful life

In this case, the straight-line depreciation rate is 20%, which means that the useful life of the equipment is:

Useful life = 100% / 20%

Useful life = 5 years

So the annual depreciation would be:

Annual depreciation = $360,000 / 5

Annual depreciation = $72,000

Finally, we need to factor in the corporate tax rate of 25%. Depreciation is considered a non-cash expense, which means that it reduces taxable income without actually requiring a cash outflow. The tax savings from depreciation can be calculated as:

Tax savings = Annual depreciation x Corporate tax rate

Tax savings = $72,000 x 25%

Tax savings = $18,000

So the annual depreciation after factoring in the corporate tax rate would be:

Annual depreciation = $72,000 - $18,000

Annual depreciation = $54,000

For more such questions on depreciation

https://brainly.com/question/29894489

#SPJ11

What elements should an ideal CRR plan include?

Answers

The following components belong in a perfect CRR plan. communication lines that are clear, empathy and understanding, activity that is swift and efficient, Feedback and follow-up Continual development

A CRR report: what is it?The Cyber Resilience Assessment (CRR) is an evaluation of an organisation s resilience or cybersecurity measures based on interviews. Your organization will get knowledge of how to handle cyber risk during both regular operations and during periods of stress levels and catastrophe through the CRR.

What is CRR's emergency response?Your department can use what you already know to reduce hazards in your operational area with the aid of a community reducing risk (CRR) program. CRR employs a wide range of instruments to create a strategy and integrated program aimed at minimizing the occurrence and effects of local risks.

To know more about CRR visit:

https://brainly.com/question/30813799

#SPJ1

Letters with already formatted fonts and fields are called:

A. Files

B. Templates

C. Themes

D. Views

Answers

Answer: B. Templates

What arethe potential downfalls and positive influences of the "Netflix way"?

Answers

It is a rotating entertainment schedule that is subject to alter at any time due to IP licensee disputes, network problems, or service interruptions from the provider via the Internet service provider to the client's internal network. Within the "Netflix way" ethos, Netflix are given a great deal of flexibility and responsibility. Since employees have access to confidential information, it is advisable to give them blunt comments. They may also be trusted with how they handle expenses and vacation requests because they have access to sensitive information.

The "Netflix way," a strategy for creating a workplace culture of almost unlimited transparency, where freedom, personal responsibility, and high salaries reign alongside almost constant criticism and a daily fear of being fired for anything from incompetence to simply not getting along with your boss, are all part of the Netflix way. The capacity for almost any employee to criticize almost anyone else about their work performance at any moment is one of the highlights of the so-called "Netflix way." The "keeper test," which asks managers if they would be willing to fight for a worker's job, is one of the main principles of the company's ideology. In the absence of that, that worker may be put on the firing list.

Learn more about Netflix way here

https://brainly.com/question/14630886

#SPJ9

You have a job at a real-estate agency in the small country of Dystopia, where you are paid 72,000 marks (the currency of Dystopia) a year. You are now faced with the decision of whether to work a second job at the local university teaching a real-estate investing class, where the pay is 45,000 marks a year. Social insurance tax and income tax rates are listed below.

Social insurance taxes: 7.65% on your first 110,100 marks of total income

Income taxes:

Taxable income (in marks) Tax rate

0–8,700 10%

8,700–35,350 15%

35,350–85,650 25%

85,650–178,650 28%

a.) Using the information above, what would be the total amount you pay in social insurance taxes on your second job? Give your answer to two decimals.

b.) What is your income tax bill for the second job? Give your answer to two decimals.

c.) What is your total tax bill for the new job? Give your answer to two decimals.

Answers

Answer:

2,914.65

2nd question : 12,190.50

Explanation:

income to be taxed is equal to (110,100 - 72,000) = 38,100 conchs. The tax itself is 7.65% × 38,100 = 2,914.65

2nd explaination: 25% × (85,650 - 72,000) = 25% × 13,650 = 3,412.50 conchs

28% × (45,000 - 13,650) = 28% × 31,350 = 8,778

Total income tax = 3,412.50 + 8,778 = 12,190.50 .

"Income to be taxed is equal to = 2,914.65 and The Total income tax is = 12,190.50. Find more information check below".

Calculation of Income TaxPart-1: income to be taxed is equal to (110,100 - 72,000) = 38,100 conchs.

Therefore, The tax itself is 7.65% × 38,100 is = 2,914.65

Part-2: 25% × (85,650 - 72,000) = 25% × 13,650 = 3,412.50 conchs

Then, 28% × (45,000 - 13,650) = 28% × 31,350 = 8,778

Therefore, The Total income tax is = 3,412.50 + 8,778 = 12,190.50.

Find more information about Income Tax here:

https://brainly.com/question/26410519

In St. Bobo, the government decided to build a bridge instead of a Hospital. The opposition said the hospital should have been built first.

What is the opportunity cost of building the bridge?

Answers

Based on the explanation provided below, the opportunity cost of building the bridge is the hospital.

What is the meaning of opportunity cost?Opportunity cost refers to an alternative or an activity that is lost, forgone, or given up when another alternative or activity is chosen.

From the question, the opportunity cost of building the bridge is the hospital.

This is because the hospital is the alternative activity that will be given up, while the bridge will be chosen and built.

Learn more about opportunity cost: https://brainly.com/question/13036997.

#SPJ1

Pace Co. borrowed $10,000 at a rate of 7.25%, simple interest, with interest paid at the end of each month. The bank uses a 360-day year. How much interest would Pace have to pay in a 30-day month?

Answers

Answer:

Explanation:

Amount of interest need to paid is 30 day month

= 10000×(1.075)×30/360 = 60.42

Simple interest formula is

Interest for year is = 10000×7.5% = 750

Per month is = 750×30/360 = 60.42

The amount of interest that Pace would have to pay on the loan in a 30-day month is $60.42.

What is the interest that Pace would pay?Simple interest is when only the interest is applied to the principal amount that is borrowed and not on the interest already accrued.

Simple interest = principal x interest rate x 30/360

$10,000 x 0.0725 x 30/360 = $60.42

To learn more about simple interest, please check: https://brainly.com/question/27328409

#SPJ2

Given the following Financial Statement Data: Sales Revenues (50,000), Operating Profit (14,400), Net Income (9,555), Total Current Assets (70,000), Total Assets (159,000), Total Current Liabilities (26,000), L-T Debt (43,000), Total Equity (91,400), Depreciation (4,000), Dividend Payments (2,250). Based on the above figures, the company's capital structure (defined as the sum of total debt outstanding and total stockholder's equity) consists of what percentages of debt and equity? (The percentages of total capital invested that are debt-financed and equity-financed are among the factors used to determine a company's credit rating, as explained in the Help section for the Comparative Financial Performances presented on p.7 of the GLO-BUS Statistical Review.)

Answers

S

O

R

R

Y

SORRY

sorry

soryy

sorry