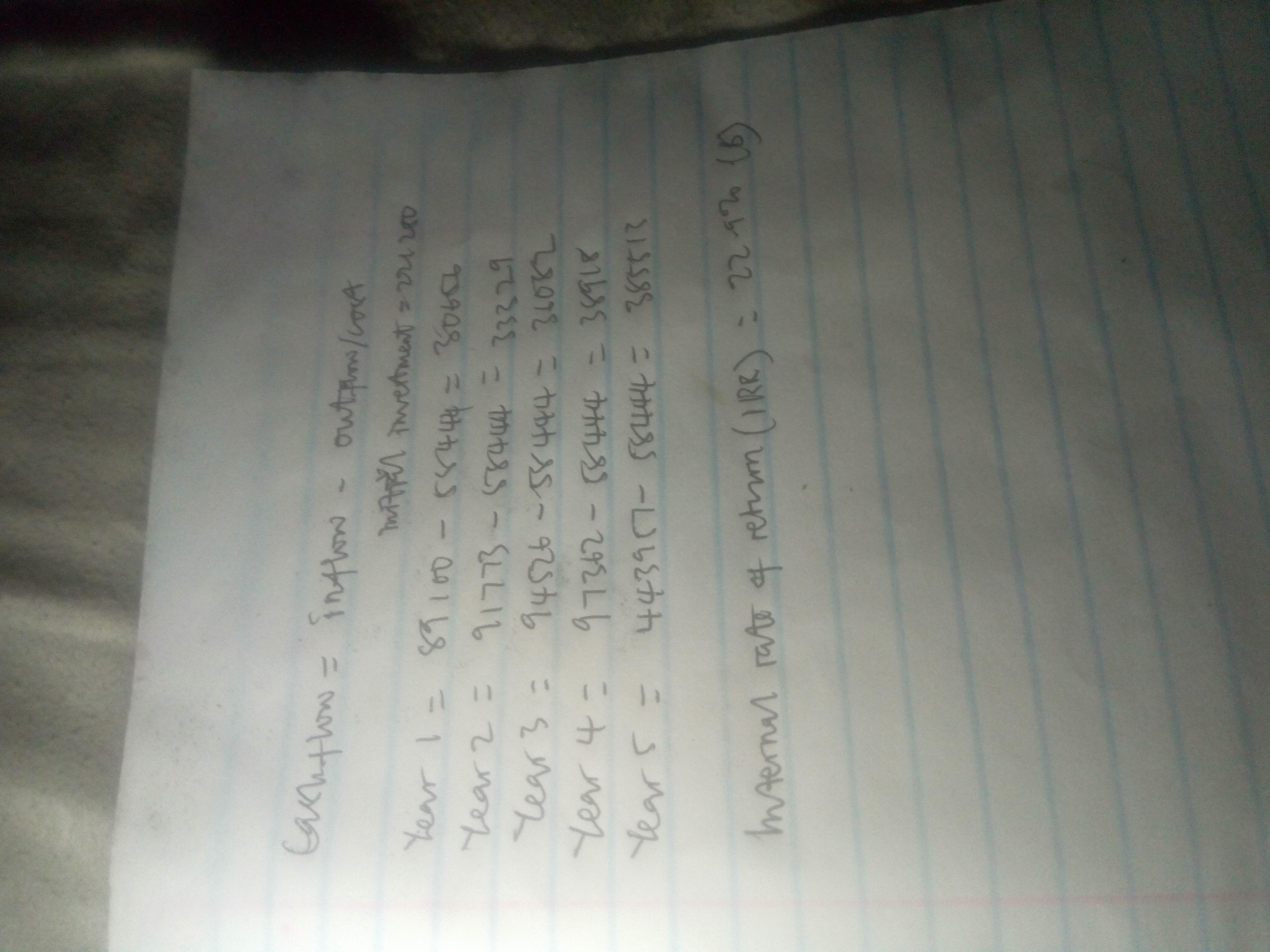

Given the following information regarding an income producing property, determine the internal rate of return (IRR) using levered cash flows. Expected Holding Period: 5 years; 1ˢᵗ year Expected NOI: $89,100; 2ⁿᵈ year Expected NOI: $91,773; 3ʳᵈ year Expected NOI: $94,526; 4ᵗʰ year Expected NOI: $97,362; 5ᵗʰ year Expected NOI: $100,283; Debt Service in each of the next five years: $58,444; Current Market Value: $885,000; Required equity investment: $221,250; Net Sale Proceeds of Property at end of year 5: $974,700; Remaining Mortgage Balance at end of year 5: $631,026.A) 10.6%B) 12.2%C) 22.9%D) 33.4%

Answers

Question options:

A. 10.6%

B. 22.9%

C.33.4%

D.12.2%

Answer and Explanation:

Find attached

Related Questions

Which of the following statements about Productivity are FALSE.

(a) It is the ratio of outputs divided by inputs.

(b) If a company improves productivity it means improvements in efficiency.

(c) Productivity can be increased by increasing the output with the same inputs.

(d) Productivity cannot be calculated for companies like Hospitals or Schools.

a and d

cand d

only c

only d

Answers

Answer:

hmmmmmmmmmmmmmmmmmmmmmmmm

The statement which is false about productivity is "Productivity cannot be calculated for companies like Hospitals or Schools". Thus, option 'D' is the correct option.

What is productivity?Productivity is a measure of how effectively commodities or services are produced. Productivity is sometimes represented as a ratio of the whole output to a single input or the total input utilized in a manufacturing process, or output per unit of input, usually over a predetermined time period.

The most typical illustration is the (aggregate) measure of labor productivity, where GDP per worker is one example. The selection of a productivity definition (including ones that do not refer to ratios of output to input) relies on the goal of the productivity assessment and/or the availability of data. Productivity has a key role in how well businesses and countries produce.

Learn more about productivity, here:

https://brainly.com/question/2506978

#SPJ6

Selected year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31, 2016, were inventory, $51,900; total assets, $209,400; common stock, $81,000; and retained earnings, $54,682.)

CABOT CORPORATION Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income taxes 450,600 297,250 153,350 99,200 4,300 49,850 20,082 $ 29,768 Net income CABOT CORPORATION Balance Sheet December 31, 2017 Liabilities and Equity Assets Cash Short-term investments Accounts receivable, net Notes receivable (trade)* Merchandise inventory Prepaid expenses Plant assets, net Total assets $ 18,000 Accounts payable 18,500 4,600 3,600 9,400 Accrued wages payable 30,600 Income taxes payable 5,500 38,150 Long-term note payable, secured by 65,400 mortgage on plant assets 2,600 Common stock 153,300 Retained earnings 81,000 84,450 $ 257,550 $ 257,550 Total liabilities and equity

* These are short-term notes receivable arising from customer (trade) sales.

Required:

Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.)

Answers

Answer:

jjhujhhhvvvjbvcgyggcvjkj

On May 1, 2020, Ayayai Company issued 2,400 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 99, but the fair value of the warrants cannot be determined.

Instuctions

a. Prepare the entry to record the issuance of the bonds and warrants

b. Assune the same facts as part (a), except that the warrants had a fair value of $30. Prepare the entry to record the issuance of the bonds and warrants.

Answers

Answer:

A. Dr Cash $2,448,000

Dr Discount on bond payable $24,000

Cr Bond payable $2,400,000

Cr Paid in capital stock warrants $72,000

B. May 1

Dr Cash $2,448,000

Dr Discount on bonds payable $24,713

Cr Bonds payable $2,400,000

Cr Paid in capital stock warrants $72,713

Explanation:

a. Preparation of the entry to record the issuance of the bonds and warrants

May 1

Dr Cash $2,448,000

Dr Discount on bond payable $24,000

Cr Bond payable $2,400,000

Cr Paid in capital stock warrants $72,000

(To record the issuance of the bonds and warrants )

Workings:

Cash = (2,400 * 1,000) * 102%

Cash = 2,400,000 * 1.02

Cash = $2,448,000

Discount on bond payable = (2,400 * 1,000) * (1 - 99%)

Discount on bond payable = 2,400,000 * 0.01

Discount on bond payable = $24,000

Bond payable = 2,400 * 1,000

Bond payable = $2,400,000

Paid in capital stock warrants = 2,448,000 + 24,000 - 2,400,000

Paid in capital stock warrants = $72,000

b.Preparation of the entry to record the issuance of the bonds and warrants Assume the same facts as part (a), except that the warrants had a fair value of $30.

May 1

Dr Cash $2,448,000

Dr Discount on bonds payable $24,713

Cr Bonds payable $2,400,000

Cr Paid in capital stock warrants $72,713

(To record the issuance of the bonds and warrants )

Workings:

Fair value of bonds = (2,400 * 1,000) * 98%

Fair value of bonds = 2,400,000 * 0.98

Fair value of bonds = $2,352,000

Fair value of warrants = 2,400 * 30

Fair value of warrants = $72,000

Fair value = $2,352,000 + 72,000

Fair value = $2,424,000

Allocated to bonds=$2,352,000/$2,424,000*$2,448,000

Allocated to bonds=$2,375,287

Allocated to warrants=$72,000/$2,424,000*$2,448,000

Allocated to warrants=$72,713

Cash = 2,400 * 1,000 * 102%

Cash = 2,400,000 * 1.02

Cash = $2,448,000

Discount on bonds payable = 2,400,000 - $2,375,287

Discount on bonds payable = $24,713

Determine whether the following sentences use the active or the passive voice.

The operations manager performed a routine check of all manufacturing equipment.

Does the preceding sentence use the active or the passive voice?

Passive

Active

Answers

The sentence "The operations manager performed a routine check of all manufacturing equipment" is in the active voice, as further explained below.

What is active voice?We say a sentence is in the active voice when the subject of the sentence is also the one performing the action expressed by the verb. That is the opposite of what happens in the passive voice, in which the subject and the performer of the action are not the same.

Compare the sentences below to better understand the differences between the voices:

Active voice: I baked the cake. --> The subject "I" is the one performing the action of baking. The "cake" is the receiver of the action.Passive voice: The cake was baked by me. --> The subject "cake" is still the receiver of the action. The performer is "me", the agent.With that in mind, we can say that the sentence "The operations manager performed a routine check of all manufacturing equipment" is in the active voice. The subject "operations manager" is the also the performer of the action expressed by the verb "performed".

Learn more about active and passive voices here:

https://brainly.com/question/11096916

#SPJ1

XYZ Co is considering a major expansion program that has been proposed by the company’s information technology group. To decide whether the company will undertake this major expansion project, the company paid McLindsay Co., a large consulting company, a fee of $2 million to calculate the costs and benefits of the program, but they will refund half of that cost back to XYZ if the company does not move forward with the project. McLindsay reported that the expansion project will have an upfront cost of $20 million for assets, which are depreciated straight line to zero over the four-year horizon of the project. The company does not need to invest in net working capital (i.e., NWC = 0). McLindsay also expects that the program will generate an operating cash flow equal to $10 million the first year and will expand by 20% per year until the project is liquidated at the end of year four. The liquidation value from selling the equipment will be $4 million. You are an assistant to the CFO of the company and your first task is to advise XYZ whether the company should undertake the investment. The CFO has provided you with the following data, which he believes may be relevant to your task (all the market data are current). The firm’s tax rate is 20%. The market data on XYZ Co’s securities are:

Debt

oBond A: 42,750 bonds with a 5.4% coupon rate, with 20 years to maturity selling at par. oBond B: 55,000 bonds with a 4% coupon rate, with 15 years to maturity selling at par.

Assume that both bonds have a par value of $1,000 and they make semiannual payments.

Common stock

o 1,000,000 shares outstanding, selling for $95 per share; XYZ Co just paid a dividend of $4 per share and is expected to increase its future dividends at a constant rate of 5%. The firm’s beta is 1.8. Assume the risk-free rate is 2% and the market return is 8%.

Answer the following questions and show all the formulas and calculations (if using a financial calculator show all the entries).

a. What is XYZ Co’s cost of debt?

b. What is XYZ Co’s cost of equity using the CAPM?

c. What is XYZ Co’s cost of equity using the dividend growth model?

d. What is XYZ Co’s cost of capital? (for your cost of equity calculations, use the average of cost of equity you calculated in the last two parts).

e. Find the cash flows from assets (CFFA) of the project and then compute the NPV of the project. Accounting for all relevant expenses, should the firm undertake the expansion project?

f. Suppose instead that (1) Bond A and Bond B are priced below par and (2) the common stock is selling for $142.50 per share and the last dividend paid was $6. Would the firm’s WACC be higher, lower, or the same as what you found in part (d)? Explain.

Answers

a. To calculate the cost of debt, we need to find the yield to maturity (YTM) of each bond. We can calculate the YTM of Bond A as 5.4% and the YTM of Bond B as 4%. Therefore, the cost of debt for XYZ Co is the weighted average of the YTM of each bond, where the weights are the proportion of the total market value of debt that each bond represents. Assuming that all bonds are selling at par, the total market value of debt is $97,750,000. Thus, the weight of Bond A is 42,750/97,750 = 0.4376 and the weight of Bond B is 55,000/97,750 = 0.5624. Therefore, the cost of debt is:

Cost of Debt = 0.4376 × 5.4% + 0.5624 × 4% = 4.48%

b. Using the CAPM, we can calculate the cost of equity as:

Cost of Equity = Risk-Free Rate + Beta × (Market Return - Risk-Free Rate)

= 2% + 1.8 × (8% - 2%)

= 13.6%

c. Using the dividend growth model, we can calculate the cost of equity as:

Cost of Equity = (Dividend / Price) + Growth Rate

= ($4 / $95) + 5%

= 9.3%

d. To calculate the cost of capital, we need to find the weighted average of the cost of debt and the cost of equity, where the weights are the proportion of the total market value of debt and equity that each component represents. Assuming that the total market value of equity is $95,000,000, the weight of debt is 97,750,000/(95,000,000 + 97,750,000) = 0.5073 and the weight of equity is 1 - 0.5073 = 0.4927. Therefore, the cost of capital is:

Cost of Capital = 0.5073 × 4.48% + 0.4927 × 13.6% = 9.54%

e. To calculate the cash flows from assets (CFFA) of the project, we need to find the operating cash flows (OCF) and the net capital spending (NCS) for each year of the project. Using the given data, we can calculate the OCF for each year as:

Year 1: OCF = $10,000,000

Year 2: OCF = $12,000,000 (20% increase from year 1)

Year 3: OCF = $14,400,000 (20% increase from year 2)

Year 4: OCF = $17,280,000 (20% increase from year 3)

The net capital spending (NCS) for year 0 is the upfront cost of the project, which is $20,000,000. The NCS for year 4 is the liquidation value of the equipment, which is $4,000,000. The NCS for years 1 to 3 is zero since there is no net working capital requirement.

Calculating the CFFA for each year:

Year 0: CFFA = - $20,000,000

Year 1: CFFA = $10,000,000 - $0 - $20,000,000 = -$10,000,000

Year 2: CFFA = $12,000,000 - $0 = $12

for more such questions on bond

https://brainly.com/question/29324611

#SPJ11

PLEASE ANSWER ASAP: I NEED HELP

PLEASE DO NOT JUST ANSWER FOR THE POINTS, PLEASE ACTUALLY HELP!!!!!

Answers

The true about retirement savings withheld from employee paychecks. Workers don't have to pay taxes on it until they make account withdrawals, allowing for potential tax savings and the opportunity for the savings to grow over time. Option D.

Retirement savings withheld from employee paychecks typically refers to contributions made to retirement plans such as 401(k) or Individual

Retirement Accounts (IRAs). These contributions are deducted from an employee's paycheck before taxes are applied, which means they are made with pre-tax dollars. As a result, the contributions reduce the employee's taxable income in the year they are made, potentially lowering their overall tax liability.

The tax advantage of retirement savings withholding allows individuals to defer taxes on the contributed amount and any investment gains until they withdraw funds from their retirement accounts in the future.

This deferral allows the savings to potentially grow and compound over time without being taxed annually, providing a tax-efficient way to save for retirement.

It's important to note that option A, which suggests that retirement savings are always matched by the employer, is not universally true. While many employers offer matching contributions as part of their retirement benefits package, not all employers provide a dollar-for-dollar match.

The matching policy can vary widely, ranging from a percentage match to no match at all.

Option B, suggesting that the money withheld is not needed for retirement living expenses, is a generalization and may not hold true for all individuals. Retirement savings are intended to be used for future retirement expenses, and the amount needed will vary depending on an individual's retirement goals, lifestyle, and other factors.

Option C, stating that retirement savings withheld from paychecks is another way of making employers rich, is an oversimplification and does not accurately represent the purpose and nature of retirement savings. Retirement savings are primarily designed to help individuals build financial security and support themselves during their retirement years. Option D is correct.

For more such question on retirement. visit :

https://brainly.com/question/29981887

#SPJ8

what are other business functions get more of importance. why

Answers

Martha realizes that the microwave she bought is faulty after a month of purchase. The manufacturer of the microwave asks Martha to pay the repair expenses as the fault was with a part that was out of warranty. Martha was unaware of this warranty condition. What should Martha do to resolve her grievance?

Answers

If Martha was unaware of this warranty condition. What Martha should do to resolve her grievance is: c. approach the Federal Trade Commission.

What is Federal Trade Commission?Federal Trade Commission can be defined as the agent whose sole responsibility is to fight for consumer right in a situation where buyers of a product are not treated rightly by a seller or when a company defraud a potential customers.

The best thing is for her to approach the federal trade commission and explain what transpire between her and the seller in which this agency will investigate the matter and fight for her right since their duties is to protect buyers from sellers.

Therefore we can conclude that Martha should approach the Federal Trade Commission so as to make her complaints.

Learn more about Federal Trade Commission here: https://brainly.com/question/8244775

#SPJ1

The complete question is:

Martha realizes that the microwave she bought is faulty after a month of purchase. The manufacturer of the microwave asks Martha to pay the repair expenses as the fault was with a part that was out of warranty. Martha was unaware of this warranty condition. What should Martha do to resolve her grievance?

A. pay for the repair

B. contact the Food and Drug Administration

C. approach the Federal Trade Commission

D. buy a new microwave

E. recycle the microwave responsibly

Answer

The answer is C, approach the Federal Trade Commission.

Explanation:

all of the following must be included in income and reported on a tax return except: lottery winnings of $500. dividends of $750. royalty payments of $1,500. a $5,000 scholarship received by a degree candidate and used to pay tuition at a state university.

Answers

A degree candidate's $5,000 scholarship that was utilised to cover their tuition at a state university is not counted as income.

How do scholarships work?Scholarships are non-taxable financial aid given to students for use in pursuing careers; as a result, they are not regarded as income.Scholarships are financial rewards given by the government or any institution to students or research scholars who succeed in a certain field.

How do non-taxable funds work?These are charitable funds that are exempt from paying taxes to the government. used to indicate money, an asset, etc. that is exempt from taxes. For up to six years, export profits are not subject to tax.

To know more about scholarships, visit:

https://brainly.com/question/25298192

#SPJ4

a business letter is not written:

Answers

What'syour exact question .. Can you please say in detail ???

Answer:

Between two private individuals.

According to the FOCUS system, your goals must please:

A) your friends

B) yourself

C) your parents

D) your teachers

Answers

Answer:

B

Explanation:

All goals must primarily please yourself before others.

Hope that helps

YOUR goals should be focused on YOU

Jeannine is studying cultures and their respective attitude toward proxemics. What is she most likely to discover?

Question 5 options:

which cultures prefer having people stand close to one another

which cultures prefer to keep business interactions more formal

which cultures prefer to make eye contact when conversing

which cultures prefer all scheduled events to begin and end on time

Answers

Which cultures prefer having people stand close to one another attitude toward proxemics she is most likely to discover. Thus option A is correct.

What is culture?The term "culture" is a general one that refers to individual interaction, structures, and norms present in modern populations in addition to people that make up these communities as well as their skills, beliefs, including abilities.

Proxemics is the study of how people use space and how population size affects how they behave, communicate, and interact with others. the field of study that examines the distance that people feel they must maintain within themselves and others. Therefore, option A is the correct option.

Learn more about culture, Here:

https://brainly.com/question/11453774

#SPJ1

A Student Aid Report (SAR)What is Anna’s DRN? What is the purpose of this number?

Answers

Your individual 4-digit code on the FAFSA confirmation page and your Student Aid Report are referred to as your "DRN" or "Data Release Number" (SAR). Your identification is ensured by the 4-digit code.

What does the DRN number serve?Your application will be granted a four-digit Data Release Number (DRN) by Federal Student Aid. If you want to make adjustments to your FAFSA information, you can do so by giving your DRN to a customer service representative.

My FAFSA data Release number is where can I find it?Federal Student Aid issues applications with a four-digit identifier called a Data Release Number (DRN). Only the student can see the DRN, which is printed on the student's confirmation page and the top right corner of the Student Aid Report (SAR).

To know more about Student Aid Report visit:-

https://brainly.com/question/28160957

#SPJ1

On march 1 mike joined christmas Club His bank automatically deduct a $210 from his cheaser account of the end of each month, and deposit it into his christmas Club account is when will earn 0.0525 animit interst The account comes to term on December 1. Total interest earned in account

Answers

Mike will have a total of $2100 in his Christmas Club as his bank deduct $210 a month from March till December. Hence he may get $110.25 in interest if the interest rate is 5.25% on December 1.

Describe the Christmas Club.An account specifically intended for holiday spending is a Christmas club account. It typically only lasts for a year or less. A savings account of this type, often known as a Christmas club or holiday club account, is one in which regular deposits are made by customers all year long. In order to pay for holiday shopping and other expenses, such as travel, the accrued savings are then withdrawn just before the holiday season.

Regular direct transfers from your paycheck may be permitted by the account in Christmas club, and those funds would be preserved and transferred to them in time for the holiday buying season. Based on the balance in the account, the yearly percentage yield will fluctuate between 0.05% and 5.00%.

To learn more about Christmas club, visit:

https://brainly.com/question/947468

#SPJ1

The complete question is:

On March 1 Mike joined Christmas Club His bank automatically deduct a $210 from his Chaser account of the end of each month, and deposit it into his Christmas Club account. What will he earn at 5.25% APR simple interest for the year, as the account comes to term on December 1.

On June 15, 2021, Allen sold land held for investment to Stan for $65,000 and an installment note of $300,000 payable in five equal annual installments beginning on June 15, 2022, plus interest at 10%. Allen’s basis in the land is $255,500. What amount of gain is recognized in 2021 under the installment method?

Answers

The amount of gain that will be recognized in 2021 under the installment method, is $27, 857 . 14

How to find the gain recognized?First, find the profit margin on the land sold by Allen to Stan:

= ( Selling price of land - Allen's basis in the land) / Allen's basis in the land

= ( ( 300, 000 + 65, 000) - 255, 500) ) / 255, 500

= 109, 500 / 255, 500

= 42. 857 %

The gain to be recognized, using the installment method is:

= Profit margin x Amount paid by Allen in 2021

= 42. 857 % x $ 65, 000

= $27, 857 . 14

Find out more on gain recognized at https://brainly.com/question/17926235

#SPJ1

Many unethical behaviors lead to the passage of legislation that makes those

behaviors legal.

TRUE OR FALSE

Answers

These unethical behavior examples help identify what is not considered These are just some of the many different examples of unethical behavior that could occur. Double standard which makes it unethical and causes a black eye to law .In verse 14 it says Truth has fallen in the public squares (KJ says streets. So true

Hope this helps have a great day :)

Do you believe the statement "perception is reality"? Why or why not?

Answers

Here’s an excellent example from history.

For 28 years, the Berlin Wall separated East Berlin from West Berlin and was the most heavily militarized border crossing in the Western hemisphere. In 1989, during a press conference with western media, Gunther Schabowski was handed a note explaining a change in policy governing border crossing. Several discussions took place about making a show of opening the border between East and West Germany, but nobody informed Schabowski.

At the end of the press conference, he appears to have remembered the note belatedly, and read it verbatim—which was not what was intended. When asked about when the border would open, he assumed it was immediate.

The reality of course was that East Germany had no intention of opening the border, and certainly not immediately.

Within hours, the border crossing was practically buried under thousands of East Germans eager to be reunited with their families and other loved ones after 28 years on the press conference, which had been broadcast live.

The East Germans believed what they were told: Schabowski said immediately, and they intended to go immediately.

Border guards kept calling for instructions, until finally, they relented.

Perception became reality, and the border between East and West Berlin opened, spelling the de facto end of the separation of Germany.

273 viewsView 2 Upvoters · Answer requested by Never Wong

Related Questions (More Answers Below)

Visit any nearby business of your locality and collect the information to prepare a project work report by taking the following information. 1)name and address of the firm. 2)find out whether the journal is maintained or not. 3) following the values of debit and credit. 4)the recording of business transactions in the journal

Answers

It is impossible to visit any nearby business of your locality and collect the information to prepare a project work report based on the factors given

What is a firmA common term for a company or business organization is "firm". A business is an organization involved in diverse economic endeavors, ranging from the production of goods, provision of services to trading of products.

A company usually has defined legal framework, ownership, and administration, with the main aim of earning profits or attaining specific goals. Companies can vary in their scale, spanning from petite regional enterprises to enormous global conglomerates.

Learn more about firm from

https://brainly.com/question/28234604

#SPJ1

An online shopping website sold many email addresses in its database to another firm for a large sum of money. The new firm now has access to data of several customers and can use them to increase its sales. What does the selling of user data highlight?

A.

violating user privacy

B.

cleansing data

C.

classifying customers

D.

applying direct marketing

E.

using multiple data sources

Answers

Answer:

A.) violating user policy

Its investment bankers have told Donner Corporation that it can issue a 25-year, 8.1% annual payment bond at par. They also stated that the company can sell an issue of annual payment preferred stock to corporate investors who are in the 40% tax bracket. The corporate investors require an after-tax return on the preferred that exceeds their after-tax return on the bonds by 1.0%, which would represent an after-tax risk premium. What coupon rate must be set on the preferred in order to issue it at par? (hint: a portion of dividends are tax-exempt for corporate investors).

Answers

The coupon rate must be set at 9.77%

The after-tax return on the bonds is:

= Annual payment rate * ( 1 - tax rate)

= 8.1% * ( 1 - 40%)

= 4.86%

The investors would like an after-tax return on preferred stock that is more than their bond return by 1% so they would like a preferred return of:

= 4.86% + 1%

= 5.86%

If the Preferred must be issued at par, its coupon rate must be equal its before-tax yield:

= After tax yield / ( 1 - tax rate)

= 5.86% / ( 1 - 40%)

= 9.77%

More on this type of question can be found at https://brainly.com/question/17126608

Answer:

9.77 is the correct answer

i think this helps u

what is the minimum wage for SA

Answers

the new National Minimum Wage for South Africa has been made public by the Department of Employment and Labour. Starting on March 1st, 2023, the current minimum wage of R23,19 per hour will increase to R25,42 per hour (an increase of around 9,6%).

The minimal amount of compensation that an employer is compelled to pay wage earners for the job completed during a particular period, which cannot be reduced by a collective agreement or an individual contract, is referred to as the "minimum wage."The South African government may impose penalties on employers who fail to pay the minimum wage. If a defined weekly wage is used, the monthly wage is multiplied by 4.33. If an hourly rate is specified, it is computed as 4.33 times the weekly average.

Learn more about minimum wages here:

https://brainly.com/question/29128876

#SPJ1

An employee:

works for someone else

O takes the risk of a business venture

sets financial goals for the business

sets nonfinancial goals for a business

Answers

Answer:

works for someone else

Explanation:

An employee is someone hired to offer labor services to their employers. The employers may be an individual, a private organization, or the governments. Employees earn wages, salaries, and other benefits provided by the employer in exchange for their labor services.

Employees do not assume any risks as the business owners do. Their role is to fulfill their mandate as instructed by the employers. Employees assist the employer in accomplishing their business vision.

war correspondents are reporters who travel with troops to report from the front lines of conflict

-true

-false

Answers

Dividends Per Share

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 60,000 shares of cumulative preferred 2% stock, $60 par and 300,000 shares of $20 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $51,000; second year, $105,000; third year, $81,000; fourth year, $120,000.

Determine the dividends per share on each class of stock for each of the four years. Round your answers to two decimal places. If no dividends are paid in a given year, enter "0".

Answers

Answer:

Seventy-Two Inc.

Dividends Per Share:

Dividend per share Year 1 Year 2 Year 3 Year 4

Cumulative preferred $1.20 $1.20 $1.20 $1.20

Common stock $0 $0.04 $0.03 $0.16

Explanation:

a) Data and Calculations:

Outstanding stocks:

Cumulative Preferred 2% stock = 60,000

Cumulative Preferred par value = $60

Total value of cumulative preferred stock = $3,600,000

Cumulative preferred dividend (annual) = $72,000 ($3,600,000 * 2%)

Dividends payout Year 1 Year 2 Year 3 Year 4

Dividends distributed:

Cumulative preferred $72,000 $72,000 $72,000 $72,000

Dividends paid 51,000 93,000 72,000 72,000

Outstanding dividends 21,000 0 0

Common stock $0 $12,000 $9,000 $48,000

Total dividend distributed $51,000 $105,000 $81,000 $120,000

Cumulative preferred stock Common stock

Year 1: $1.20 ($72,000/60,000) $0 ($0/300,000)

Year 2: $1.20 ($72,000/60,000) $0.04 ($12,000/300,000)

Year 3: $1.20 ($72,000/60,000) $0.03 ($9,000/300,000)

Year 4: $1.20 ($72,000/60,000) $0.16 ($48,000/300,000)

Dividend per share = Dividend/No. of outstanding shares (each class)

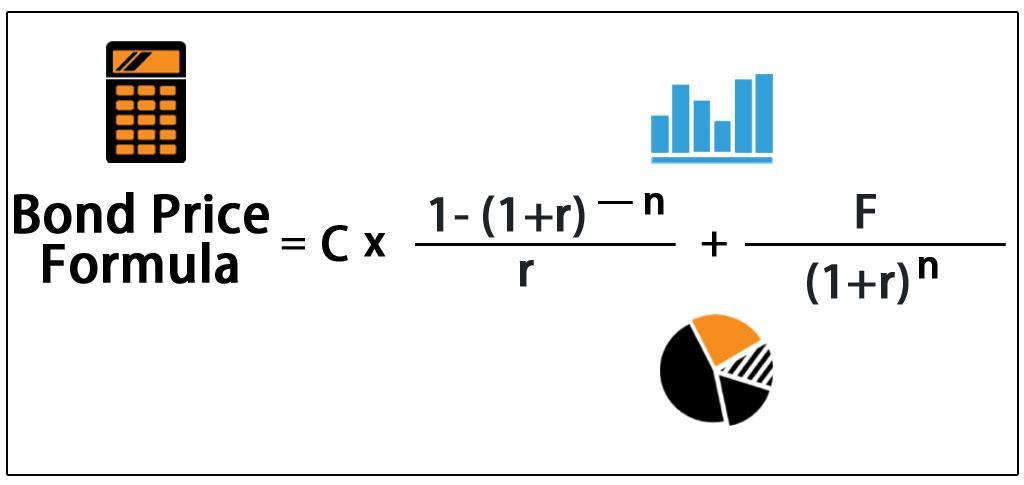

On January 1, 2015, East Lansing, Inc, issues $2,000,000 of 10 percent, 5-year bonds that pay interest of $100,000 semiannually. The market rate is 8 percent at the time of issuance. The issue price of the bonds is:____a. $1,852.810 b. $1888,970 c. $1.999.970 d. $2,162.290

Answers

Answer:

The answer is option D

Explanation:

The bond can be issued at par, at a discount or at a premium depending on the coupon rate and the market interest. The price of the bond which pays semi annual coupon can be calculated using the formula of bond price. The formula to calculate the price of the bond is attached.

First we need to determine the semi annual coupon payment, periods and YTM.

Semi annual coupon payments = 2000000 * 0.1 * 6/12 = 100000

Semi annual periods = 5 * 2 = 10

Semi annual YTM = 0.08 * 6/12 = 0.04

Bond Price = 100000 * [(1 - (1+0.04)^-10) / 0.04] + 2000000 / (1+0.04)^10

Bond Price = $2162217.916

The price of the bond is thus $2162290 approx. The difference in answers is due to rounding off.

how does a persons work experience affect their pay wage?

Answers

Answer:

Up to a certain point, more experience typically translates into higher income. Similar to the last example, if the job requires someone with 10 years of expertise in a specific field and you don't satisfy those qualifications, you can find yourself working at the lower end of the wage scale.

Explanation:

GUYS PLEASE HELP, ILL GIVE BRAINLIEST

List 5 ways Chapter 7 and Chapter 13 Bankruptcies are similar:

Answers

Answer:

Explanation:

While Chapter 7 eliminates your debts while Chapter 13 restructures them, you will be able to enjoy something called an “automatic stay” when you file either. This stay means that your creditors are unable to contact you about recovering existing debts while the order is in place, and can be penalized by the courts if they violate the stay. In addition, this stay will put a halt to any wage garnishing that you have been subject to, meaning that you will be able to retain all of your earnings during this time.

Which scenario describes the highest level of productivity?

A. Producing 50 chairs using resources that cost $400

B. Producing 15 chairs using resources that cost $150

C. Producing 5 chairs using resources that cost $100

D. Producing 100 chairs using resources that cost $200

Answers

The scenario that describes the highest level of productivity is option D. Producing 5 chairs using resources that cost $100. Calculating the highest productivity:

For A. The cost should be $400 for 50 chairs so per chair should be = $400 ÷ 50 = 8. For B. The cost should be $150 for 15 chairs so per chair should be = $150 ÷ 15 = 10. For C. The cost should be $100 for 5 chairs so per chair should be = $100 ÷ 5 = 20. and For D. The cost should be $200 for 100 chairs so per chair should be = $200 ÷ 100 = 2

What is productivity?Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production process, i.e. output per unit of input, typically over a specific period of time.

Therefore, the correct answer is option D.

learn more about productivity: https://brainly.com/question/2992817

#SPJ1

recommendations to maintain accuracy in an organization

Answers

Answer:

notecards

Explanation:

Keep notescards with small bulletpoints with specific points of strategy to memorize best, but that’s just me

Drag each tile to the correct box.

Match each tax classification to the correct type of investment income.

taxable

tax deferred

tax exempt

funds distributed from a 529 plan that are used for college

capital gains in a brokerage account

interest earned on a traditional 401(k) account

Answers

Answer:

funds distributed from a 529 plan that are used for college ---> tax exempt

capital gains in a brokerage account ---> taxable

interest earned on a traditional 401 (k) account ---> tax deferred

Explanation:

The question is about the various tax classification related to the investments incomes.

The correct answer are given below:

Funds distributed from a 529 plan that are used for college - Tax ExemptCapital gains in a brokerage account - TaxableInterest earned on a traditional 401(k) account - Tax DeferredWhat is Taxable Investment ?A taxable investment is one which is subject to government taxes. There are various types of investments which are classified for taxation.

An individual is liable to pay taxes on the gains earned by investing his income.

Learn more about taxes at https://brainly.com/question/14606197

#SPJ2