Following are account balances (in millions of dollars) from a recent FedEx annual report, followed by several typical transactions. Assume that the following are account balances on May 31, 2014: Account Balance Account Balance Property and equipment (net) $ 15,543 Receivables $ 4,581 Retained earnings 12,716 Other current assets 610 Accounts payable 1,702 Cash 2,328 Prepaid expenses 329 Spare parts, supplies, and fuel 437 Accrued expenses payable 1,894 Other noncurrent liabilities 5,616 Long-term notes payable 1,667 Other current liabilities 1,286 Other noncurrent assets 3,557 Additional Paid-in Capital 2,472 Common stock ($0.10 par value) 32 These accounts are not necessarily in good order and have normal debit or credit balances. Assume the following transactions (in millions) occurred the next year ending May 31, 2015:a. Provided delivery service to customers, receiving $21,704 in accounts receivable and $17,600 in cash.b. Purchased new equipment costing $3,434; signed a long-term note.c. Paid $13,864 cash to rent equipment and aircraft, with $10,136 for rental this year and the rest for rent next year.d. Spent $3,864 cash to maintain and repair facilities and equipment during the year.e. Collected $24,285 from customers on account.f. Repaid $350 on a long-term note (ignore interest).g. Issued 20 shares of additional stock for $16.h. Paid employees $15,276 during the year.i. Purchased for cash and used $8,564 in fuel for the aircraft and equipment during the year.j. Paid $784 on accounts payable.k. Ordered $88 in spare parts and supplies.Required:1&2 Prepare T-accounts for May 31, 2014, from the preceding list; Enter the respective beginning balances. For each transaction, record the 2015 effects in the T-accounts. Label each using the letter of the transaction.Compute ending balances. (Enter your answers in millions not in dollars.)3. Prepare an income statement for the period ended May 31, 2015. (Enter your answers in millions not in dollars.)

Answers

Answer:

FedEx

1&2: T-accounts:

Cash

Account Titles Debit Credit

('millions) ('millions)

Balance 2,328

a. Delivery Service Revenue 17,600

c. Prepaid Expenses 3,728

c. Rent Expenses 10,136

d. Repairs Expenses 3,864

e. Accounts Receivable 24,285

f. Long-term Note Payable 350

g. Common stock 2

g. APIC 14

h. Salaries 15,276

i. Fuel Expenses 8,564

j. Accounts Payable 784

Balance 1,527

Prepaid expenses

Account Titles Debit Credit

('millions) ('millions)

Balance 329

c. Cash 3,728

Balance 4,057

Spare parts, supplies, and fuel

Account Titles Debit Credit

('millions) ('millions)

Balance 437

Accounts Receivables

Account Titles Debit Credit

('millions) ('millions)

Balance 4,581

a. Delivery Service Revenue 21,704

e. Cash 24,285

Balance 2,000

Other current assets

Account Titles Debit Credit

('millions) ('millions)

Balance 610

Property and equipment (net)

Account Titles Debit Credit

('millions) ('millions)

Balance 15,543

b. Long-term Note Payable 3,434

Balance 18,977

Other noncurrent assets

Account Titles Debit Credit

('millions) ('millions)

Balance 3,557

Accounts payable

Account Titles Debit Credit

('millions) ('millions)

Balance 1,702

j. Cash 784

Balance 918

Accrued expenses payable

Account Titles Debit Credit

('millions) ('millions)

Balance 1,894

Other current liabilities

Account Titles Debit Credit

('millions) ('millions)

Balance 1,286

Long-term notes payable

Account Titles Debit Credit

('millions) ('millions)

Balance 1,667

b. Property and Equipment 3,434

f. Cash 350

Balance 4,751

Other noncurrent liabilities

Account Titles Debit Credit

('millions) ('millions)

Balance 5,616

Common stock ($0.10 par value)

Account Titles Debit Credit

('millions) ('millions)

Balance 32

g. Cash 2

Balance 34

Additional Paid-in Capital

Account Titles Debit Credit

('millions) ('millions)

Balance 2,472

g. Cash 14

Balance 2,486

Retained earnings

Account Titles Debit Credit

('millions) ('millions)

Balance 12,716

Delivery Service Revenue

Account Titles Debit Credit

('millions) ('millions)

a. Accounts receivable 21,704

a. Cash 17,600

Balance 39,304

Rent Expense

Account Titles Debit Credit

('millions) ('millions)

c. Cash 10,136

Repairs Expense

Account Titles Debit Credit

('millions) ('millions)

d. Cash 3,864

Salaries Expense

Account Titles Debit Credit

('millions) ('millions)

h. Cash 15,276

Fuel Expense

Account Titles Debit Credit

('millions) ('millions)

i. Cash 8,564

3. Income Statement for the year ended May 31, 2015:

Delivery Service Revenue 39,304

Rent Expense 10,136

Repair Expense 3,864

Salaries Expense 15,276

Fuel Expense 8,564 37,840

Net Income 1,464

Explanation:

a) Account Balances on May 31, 2014:

Trial Balance as of May 31, 2014:

Account Titles Debit Credit

('millions) ('millions)

Cash 2,328

Prepaid expenses 329

Spare parts, supplies, and fuel 437

Receivables 4,581

Other current assets 610

Property and equipment (net) 15,543

Other noncurrent assets 3,557

Accounts payable 1,702

Accrued expenses payable 1,894

Other current liabilities 1,286

Long-term notes payable 1,667

Other noncurrent liabilities 5,616

Common stock ($0.10 par value) 32

Additional Paid-in Capital 2,472

Retained earnings 12,716

Totals $27,385 $27,385

Other transactions for year ending May 31, 2015:

a. Delivery Service Revenue $21,704 Account Receivable $21,704

Delivery Service Revenue $17,600 Cash $17,600

b. Equipment $3,434 Long-term Note Payable $3,434

c. Rent Expense $10,136; Prepaid (Rent) Expense $3,720 Cash $13,864

d. Repair Expenses $3,864 Cash $3,864

e. Cash $24,285 Accounts Receivable $24,285

f. Long-term Note Payable $350 Cash $350

g. Cash $16 Common Stock $2 APIC $14

h. Salaries Expense $15,276 Cash $15,276

i. Fuelling Expense $8,564 Cash $8,564

j. Accounts Payable $784 Cash $784

k. N/A

Trial Balance as of May 31, 2015:

Account Titles Debit Credit

('millions) ('millions)

Cash 1,527

Prepaid expenses 4,057

Spare parts, supplies, and fuel 437

Receivables 2,000

Other current assets 610

Property and equipment (net) 18,977

Other noncurrent assets 3,557

Accounts payable 918

Accrued expenses payable 1,894

Other current liabilities 1,286

Long-term notes payable 4,751

Other noncurrent liabilities 5,616

Common stock ($0.10 par value) 34

Additional Paid-in Capital 2,486

Retained earnings 12,716

Delivery Service Revenue 39,304

Rent Expense 10,136

Repair Expense 3,864

Salaries Expense 15,276

Fuel Expense 8,564

Totals $69,005 $69,005

Related Questions

An advantage of organization in the u.s. that compete globally is

Answers

Answer:

An advantage of organization in the U.S. that compete globally is:

a. Poor quality of Japanese companies

b. Strong entrepreneurial spirit

c. Government regulations

d. Protectionist sentiment

Please mark my answer as brainliest for further answers :)Should I tell my parents I'm adopted?

Answers

Answer: Yes

Explanation:

It is important, when telling them about their adoption, to help them understand that they were born first—and that all children, adopted or not, are conceived and born in the same way. The birth came first, then the adoption. Waiting until adolescence to reveal a child's adoption to him or her is not recommended. “Halloween is the beginning of the holiday shopping season. That’s for women. The beginning of the holiday shopping season for men is Christmas Eve.”

—David Letterman

When referring to the size and scope of business, which option should be included?

Wholesale vs. Retail

For-Profit vs. Nonprofit

Domestic vs. Global

Public vs. Private

Answers

what is your view on the "online gaming system with absolutely no physical presence in the presence in the philippines. shall be considered as "doing business" in the philippines and was thus required to obtain a license to do business from the SEC, state facts to support your answers.

Answers

It is TRUE to state that "online gaming system with absolutely no physical presence in the presence in the Philippines can be considered as "doing business"

What is the justification for the above assertion?The Securities and Exchange Commission - SEC stated various criteria to support the corporation's presence in the Philippines:

1) establishment of the online account takes place in the Philippines;

2) Access is granted by users in the Philippines;

3) The material is paid for using local credit cards from within the Philippines; and

4) The web material is delivered in the Philippines. The IP address in the Philippines gets the offer of services, transmits the acceptance of the offer to the virtual plane, and lastly, the content or service is delivered to the account holder's IP address in the Philippines via such virtual plane.

As a result, "the transactions will be executed in the Philippines," according to the SEC.

Learn more about Online Gaming:

https://brainly.com/question/16039350

#SPJ1

stock price for vinyl record player?

Answers

To give you an idea the stock price, beginner to advanced record player installations can range from $50 to $450, depending on a number of variables.

What is current stock price?It is the latest trading price for a share of stock or any other security. The present price serves as the starting point in an open market. It shows the price that a buyer and seller would be prepared to accept for a later transaction involving that security.The current price is only an indication and not a promise. The future sale price on an exchange is not determined by the present price. The security's price will fluctuate over time as supply and demand factors change.Using the current value accounting method, assets are valued at their replacement cost rather than their initial cost.Cash price is the same as current price because it refers to the most recent quoted price on an exchange.Learn more about current stock price refer to :

https://brainly.com/question/28539863

#SPJ1

Dina has been hired as a product manager for an up-and-coming candy bar brand. Describe the scope of her responsibilities and provide examples of activities she would likely perform in her job. Which responsibility do you feel will be most helpful to this new brand and why?

Answers

Dina's responsibilities may include conducting market research to identify consumer preferences and trends, defining the product's features and specifications, collaborating with R&D and production teams to develop and launch new flavors or variations, setting pricing strategies, and creating marketing campaigns to promote the candy bars to the target audience. One of the most helpful responsibilities for this new brand would be Dina's role in market research.

As a product manager for an up-and-coming candy bar brand, Dina's responsibilities would encompass various aspects of product development, marketing, and strategy. Her main objective would be to ensure the successful launch and growth of the brand's candy bars in the market.

By conducting thorough research and understanding consumer preferences, Dina can identify gaps in the market, develop unique selling propositions, and tailor the candy bars to meet customer demands. This will allow the brand to differentiate itself from competitors and establish a strong presence in the market, attracting loyal customers and driving sales.

Additionally, market research can provide valuable insights into pricing strategies and distribution channels, enabling the brand to optimize profitability and reach the right customers effectively.

For more such questions on campaigns

https://brainly.com/question/29818450

#SPJ11

Precision Systems manufactures CD burners and currently sells 18,500 units annually to producers of laptop computers. Jay Wilson, president of the company, anticipates a 15 percent increase in the cost per unit of direct labor on January 1 of next year. He expects all other costs and expenses to remain unchanged. Wilson has asked you to assist him in developing the information he needs to formulate a reasonable product strategy for next year.

You are satisfied that volume is the primary factor affecting costs and expenses and have separated the semivariable costs into their fixed and variable segments. Beginning and ending inventories remain at a level of 1,000 units. Current plant capacity is 20,000 units. The following are the current-year data assembled for your analysis.

Sales price per unit $100

Variable costs per unit:

Direct materials $10

Direct labor $20

Manufacturing overhead and selling and administrative expenses 30 60

Contribution margin per unit (40%) $40

Fixed costs $390,000

Required:

a. What increase in the selling price is necessary to cover the 15 percent increase in direct labor cost and still maintain the current contribution margin ratio of 40 percent?

b. How many units must be sold to maintain the current operating income of $350,000 if the sales price remains at $100 and the 15 percent wage increase goes into effect?

c. Wilson believes that an additional $700,000 of machinery (to be depreciated at 20 percent annually) will increase present capacity (20,000 units) by 25 percent. If all units produced can be sold at the present price of $100 per unit and the wage increase goes into effect, how would the estimated operating income before capacity is increased compare with the estimated operating income after capacity is increased? Prepare schedules of estimated operating income at full capacity before and after the expansion.

Answers

a. An increase of $20 per unit is necessary to cover the 15 percent increase in direct labor cost and maintain the desired contribution margin ratio.

b.The fixed costs and desired operating income remain the same, so the contribution margin per unit of $40 is used. The required sales volume is 18,500 units.

c. The estimated operating income after capacity expansion can be determined by increasing the production and sales volume by 25 percent, i.e., 23,125 units

a. To maintain the current contribution margin ratio of 40 percent, the selling price per unit needs to be increased by 20 percent [(15 percent wage increase) / (current contribution margin ratio)].

Therefore, an increase of $20 per unit is necessary to cover the 15 percent increase in direct labor cost and maintain the desired contribution margin ratio.

b. To maintain the current operating income of $350,000, the number of units that must be sold can be calculated using the contribution margin ratio.

The fixed costs and desired operating income remain the same, so the contribution margin per unit of $40 is used. The formula for calculating the required sales volume is:

(Number of units) = (Fixed costs + Desired operating income) / Contribution margin per unit

Plugging in the values, we have:

(Number of units) = ($390,000 + $350,000) / $40 = 18,500 units

c. Before the capacity expansion, the estimated operating income can be calculated using the current production and sales volume of 18,500 units.

The estimated operating income after capacity expansion can be determined by increasing the production and sales volume by 25 percent, i.e., 23,125 units.

The schedules of estimated operating income at full capacity before and after the expansion can be prepared by multiplying the respective sales volumes with the contribution margin per unit and subtracting the fixed costs and the wage increase.

for such more questions on margin

https://brainly.com/question/9797559

#SPJ8

A credit entry will: O a. decrease an asset, decrease a liability, and increase equity. 4 O b. increase an asset, decrease a liability, and decrease equity. O c. decrease an asset, decrease a liability, and decrease equity. O d. decrease an expense, increase income, and increase equity.

Answers

Answer:

Option A is the correct answer. Explanation: A credit entry is useful for increasing the value of liabilities, decreasing the value of an asset, and decreasing the equity.

Explanation:

The Weston Corporation is analyzing projects A, B, and C as possible investment opportunities. Each of these projects has a useful life of five years. The following information has been obtained: Project A Project B Project CInitial investment required $500,000 $480,000 $630,000Present value of future cash inflows $675,000 $520,000 $690,000Internal rate of return 18% 14% 16% Which of the following statements is correct?A. Project B is preferred over Project Coccording to the project profitability index. B. Project B is preferred over Project A according to the internal rate of return. C. Project B is preferred over Project according to the project profitability index. D. Project A is preferred over Project according to the internal rate of return.

Answers

Answer:

D

Explanation:

An adjustable-rate mortgage (ARM) is another common type of mortgage. Determine whether each factor is a pro or

a con of an ARM, and place it in the correct category.

Answers

The determination of each factor as a pro or a con of an ARM is as follows:

Pros of Adjustable-Rate Mortgagesc) lower interest rates are possible

e) low beginning interest rate

Cons of Adjustable-Rate Mortgagesa) riskier than fixed-rate mortgages

b) higher payments possible

d) interest rates can be raised

What is an Adjustable-Rate Mortgage (ARM)?An adjustable-rate mortgage (ARM) is a mortgage loan with no fixed interest rate.

The interest rate of an adjustable-rate mortgage is variable, depending on the market forces.

One great advantage of an ARM is that it may attract a lower interest rate initially.

However, the interest rate can skyrocket, thereby, increasing its risk.

Thus, for the borrower, the disadvantages (cons) outweigh the pros (advantages) of an adjustable-rate mortgage.

Learn more about adjustable-rate mortgages at https://brainly.com/question/1287808

#SPJ1

Question Completion:a) riskier than fixed-rate mortgages

b) higher payments possible

c) lower interest rates possible

d) interest rates can be raised

e) low beginning interest rate

• When you have an essay due in an upcoming course, how will you manage your time to ensure you are able to complete all 5 steps of the writing process (prewriting, organizing, drafting, revising, and editing) • How can you apply what you have learned about the college writing process to enhance the effectiveness of your written communication in the workplace

Answers

Garcia Corporation purchased a truck by issuing an $80,000, 4-year, zero-interest-bearing note to Equinox Inc. The market rate of interest for obligations of this nature is 10%. Prepare the journal entry to record the purchase of this truck. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275. Credit account titl

Answers

Based on the information given the appropriate journal entry to record the transactions is:

Garcia Corporation Journal entry

Debit Truck $54,641

Debit Discount on notes payable $25,359

Credit Notes payable $80,000

(To record the purchase of truck)

Truck =Purchase price×1/(1+Interest rate)^Number of years

Truck=$80,000×1/(1+.10)^4

Truck=$80,000×1/(1.10)^$

Truck=$80,000×0.683013

Truck=$54,641

Discount on notes payable = Notes payable - Truck

Discount on notes payable =$80,000 - $54,641

Discount on notes payable = $25,359

Learn more here:https://brainly.com/question/14854205

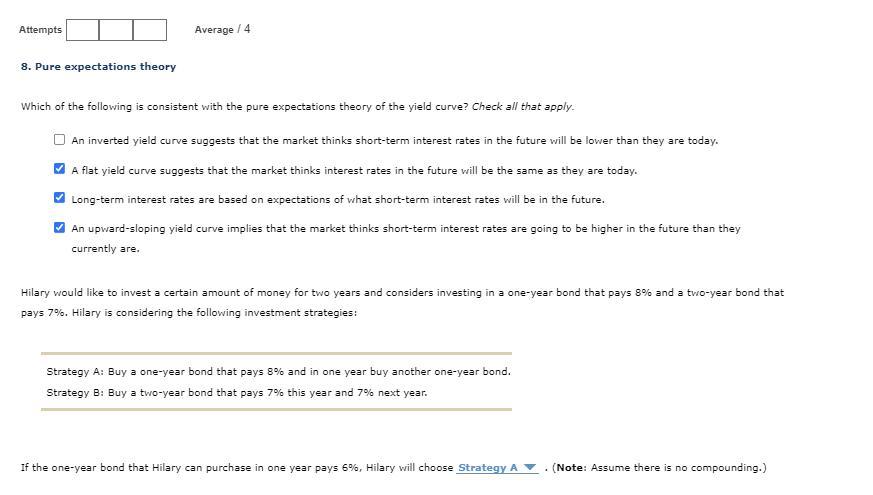

8. Pure Expectations Theory

I completed this problem on the pure expectations theory.

Is this correct?

Answers

The pure expectations' theory of the yield curve includes following:-

A flat yield curve suggests that the market thinks interest rates in the future will be the same as they are today.Long-term interest rates are based on expectations of what short-term interest rates will be in the future.An upward-sloping yield curve implies that the market thinks short-term interest rates are going to be higher in the future than they currently are.Hence, option 2nd, 3rd and 4th are correct.

What is pure expectations' theory?According to pure expectations' theory, the various maturities are substitutes, and the form of the yield curve is determined by the market's anticipation of future interest rates.

This theory states that yields fluctuate over time, but it fails to specify the specifics of yield curve forms. Therefore, it can be concluded that option 2nd, 3rd and 4th are correct.

Learn more about pure expectations' theory here;

https://brainly.com/question/14845474

#SPJ1

sharmer company issues 5%, 5-year bonds with a par value of $1,000,000 and semiannual interest payments. on the issue date, the annual market rate for these bonds is 6%. what is the bond's issue (selling) price, assuming the following factors: n= i= Present Value of an Annuity Present value of $1 5 5 % 4.3295 0.7835 10 3 % 8.7521 0.7812 5 6 % 4.2124 0.7473 10 3 % 8.5302 0.7441 Multiple Choice $957,355 $1,000,000 $1,250,000 $786,745 $1,213,255

Answers

The bond's issue (selling) price is $957355, which mean option A is correct.

What is selling price?The selling price is used to determine how much it costs to sell an item and can be calculated using the selling price formula. The selling price is the amount paid by the buyer for the product. The actual selling price is the amount of money paid by the buyer to purchase a product or service. This is the cost of goods plus a profit percentage.

If the seller so desires, the selling price can be kept close to the cost price if the buyer does not wish to profit. Determining the selling price is a very delicate issue because it determines the majority of a product's sales.

The bonds issue (selling) price = $1,000,000 × PVIF (3% , 10) + $1,000,000 ×2.5% × PVIFA (3%, 10)

= $1,000,000 × 0.7441 + 25000 × 8.5302 =

= 744100 + 213255 = $957355

Thus, option A is correct.

To learn more about selling price refer to;

brainly.com/question/17134052

#SPJ4

Why wouldn't giving yourself a manicure count as GDP for the United States?

Answers

PLEASE GIVE ME AN EXPLANATION ON HOW TO DO THIS OR DO IT FOR ME I REALLY NEED THIS SO I CAN PASS

You will assist four of the affected patients or their family members with their concerns regarding the lack of heating, ventilation, and air

conditioning (HVAC) in the maternity ward.

• For each interaction, note the time, describe who is voicing a concern, what the problem is, and the approach you are taking to

assist the customer. Be sure to include in the interaction any source of conflict, and the ultimate resolution.

• You may describe each encounter by writing in a short paragraph format, covering all points of the interaction. Or, you may

describe by using dialogue parts, as you would find in a play.

Answers

Answer:

hii can we be friends

अनुपात के लिए प्रतिशत कैसे प्राप्त करें

अनुपात अक्सर एम: एन या एम / एन के रूप में व्यक्त किए जाते हैं। अनुपात को प्रतिशत के रूप में परिवर्तित करने के लिए, केवल m को n से विभाजित करें और फिर परिणाम को 100 से गुणा करें।

अनुपात को प्रतिशत में बदलने के लिए कदम

रूपांतरण में तीन सरल चरण होते हैं:

चरण 1: पहली संख्या को दूसरी संख्या से विभाजित करें

चरण 2: प्रतिशत में बदलने के लिए 100 से गुणा करें

चरण 3: प्रतिशत प्रतीक जोड़ें (%)

उदाहरण के लिए , यदि अनुपात 12: 4 है, तो इसे प्रपत्र 12/4 में बदल दें, जो एक समीकरण है जिसे हम हल कर सकते हैं। उसके बाद, प्रतिशत प्राप्त करने के लिए परिणाम को 100 से गुणा करें।

12 3 4 = 3 3 × 100 = 300%अनुपात के लिए प्रतिशत को हल करने के लिए समीकरण

Bramble Corp. incurs the following costs to produce 9900 units of a subcomponent: Direct materials$8316 Direct labor11187 Variable overhead12474 Fixed overhead16200 An outside supplier has offered to sell Bramble the subcomponent for $2.85 a unit. If Bramble accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3600. The increase (decrease) in net income from accepting the offer would be

Answers

Answer:

$3,762

Explanation:

The computation is as seen below

Total cost when the production is 9,900 units

Direct materials $8,316

Direct labor $11,187

Variable overhead $12,474

Total $31,977

But,

Their new cost on supplier offer is

= $2.85 × 9,900 units

= $28,215

In the case when the order is accepted, the net income would increase by

= $31,977 - $28,215

= $3,762

Blake is an investor in a nonpublicly traded limited partnership. He invested $50,000 in cash and is personally liable for $5,000 of the partnership's debt. What is Blake's capital at risk in the partnership

Answers

Blake capital at risk is limited to $50,000 because the limited partners or investors are not personally liable for business debts.

What is the position of Blake in the partnership?In this case, Blake is an investor in a non-publically traded limited partnership and he is treated as a limited partner.

In practice, the liability of limited partner is limited to their extent of their investment.

Hence, Blake capital at risk is limited to $50,000 because the limited partners or investors are not personally liable for business debts.

Read more about partnership

brainly.com/question/25012970

A company has a process that results in 1,300 pounds of Product A that can be sold for $13.00 per pound. An alternative would be to process Product A further at a cost of $13,600 and then sell it for $23.00 per pound. What is the additional profit (loss) that would result from processing the product further?

Answers

Answer:

If the company process further the units, income will decrease by $600.

Explanation:

Giving the following information:

A company has a process that results in 1,300 pounds of Product A that can be sold for $13.00 per pound.

An alternative would be to process Product A further for $13,600 and then sell it for $23.00 per pound.

We need to determine the result of further processing the product.

Sell as-is:

Effect on income= 1,300*13= $16,900 increase

Continue processing:

Effect on income= 1,300*23 - 13,600= $16,300

It is more profitable to sell the units before further processing.

Critics of the wealth gap might argue that

economic growth will likely decline over time.

the upper classes cannot help create new jobs.

the wealthy become unable to make investments.

buying power exceeds the supply from producers.

Answers

Answer:

economic growth will likely decline over time. Mark brainliest

Explanation: i did the test

The critics of the wealth gap may argue that an economic growth will likely decline over time.

Who are the critics of wealth gap?The critics are people that does not fascinate the idea of wealth gap in an economy.

Hence, they are more likely to argue that an economic growth will likely decline over time because they do not fascinate the gap of wealth economically.

Therefore, the Option A is correct.

Read more about critics of wealth gap

brainly.com/question/11189362

In the supply-and-demand schedule shown above, at the prices of _____ and _____, there is excess supply because quantity supplied is greater than quantity demanded.

$200, $250

$50, $250

$50, $100

Answers

Answer:

I think it is 200,250 but I can’t see what is above so I don’t know for sure send a link so I can see the picture above.

Explanation:

Which contra asset account will be subtracted to calculate total fixed assets?

Answers

The accumulated depreciation account occurs on the balance sheet and lowers the gross amount of fixed assets.

What is a contra asset account deducted from the related asset account?A contra account exists utilized in a public ledger to decrease the value of a connected account when the two exist netted together. A contra account's natural balance exists as the opposite of the associated account. If a debit exists the natural balance is recorded in the linked account, and the contra account documents a credit.

Contra assets merely detract from the entire value of the asset account, all one contains to do exists to add up all the assets together first. Later, add up all the depreciation. Finally, carry the aggregate depreciation and subtract it from the entire assets.

To learn more about the contra asset account refer to:

https://brainly.com/question/15610334

#SPJ9

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 8,488. The FICA tax for social security is 6.2% and the FICA tax rate for Medicare is 1.45%. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,325.17. What is the total amount of taxes withheld from the Portia's earnings?

A) $3,097.17.

B) $2,443.21.

C )$1,957.06.

D) $1,722.00.

E) $1,495.36.

Answers

Answer: $1,974.51

Explanation:

FUTA and SUTA taxes are the responsibility of the employer so the amount withheld from Portia's earnings will be;

= Social security tax + Medicare tax + Federal income tax withheld

= (0.062 * 8,488) + ( 0.0145 * 8,488) + 1,325.17

= 526.26 + 123.08 + 1,325.17

= $1,974.51

Option is not given but this is the answer.

In which area does Suzy have an absolute advantage?

Answers

In local area Suzy have an absolute advantage. Suzy is a complete consumer insights platform that combines high quality audiences, quantitative data, and qualitative data into an one connected research cloud. Set up a demo. Investigate the Platform.

Absolute advantage is a term used in economics to describe a party's better capacity for output. Suzy specifically means the capacity to create a specific commodity or service for less money than a rival. Saudi Arabia is an obvious example of a country having an absolute edge over other countries since it has access to plentiful oil reserves. Other examples include Zambia, which has some of the richest copper mines in the world.

To learn more about absolute advantage, click here.

https://brainly.com/question/13221821

#SPJ1

Africanisation (how will you incorporate the learners culture or heritage into the contemporary socio-economic issues lesson

Answers

By incorporating culturally relevant examples, guest speakers, local data, cross-cultural comparisons, a multilingual approach, and artistic expressions, we can incorporate learners' culture or heritage into the contemporary socio-economic issues lesson.

To incorporate the learners' culture or heritage into a contemporary socio-economic issues lesson, it is important to create a culturally responsive and inclusive learning environment that recognizes and values the African context. Here are some strategies to achieve this:

Culturally Relevant Examples: Use examples and case studies from African countries or communities that relate to the socio-economic issues being discussed. This helps students connect with the content on a personal and cultural level, fostering engagement and understanding.

Guest Speakers and Community Involvement: Invite guest speakers from diverse African backgrounds who can share their experiences and perspectives on the socio-economic issues being studied. This provides authentic and firsthand insights into how these issues manifest in different African contexts.

Local Data and Research: Incorporate local data and research from African sources to illustrate the impact of socio-economic issues. This helps students see the relevance of these issues within their own communities and promotes a sense of ownership and empowerment.

Cross-Cultural Comparisons: Encourage students to explore and compare socio-economic issues between African countries, as well as with other regions of the world. This broadens their perspective, promotes critical thinking, and encourages understanding of global interconnections.

Multilingual Approach: Recognize and embrace the diversity of languages spoken by students. Incorporate key terms, discussions, and resources in various African languages, ensuring that students can engage with the content in their native languages and feel valued.

Art, Music, and Literature: Incorporate African art, music, and literature that address socio-economic issues. This helps students explore these topics through creative expressions that resonate with their cultural heritage.

For more question on multilingual visit:

https://brainly.com/question/29634337

#SPJ8

Sam Snead, the owner of Snead's Fine Golf Wear, used $1800 of his personal funds to go on vacation. Which of the following is the most appropriate treatment regarding this transaction? A. Travel expense 1,800 Cash 1,800 B. Withdrawals 1,800 Cash 1,800 C. Record a memorandum in the general journal D. Do not record the transaction in the general journal

Answers

Answer:

D. Do not record the transaction in the general journal

Explanation:

There is no need to record the transaction in the general journal since the money that was actually spend by Sam Snead happens to be his own personal fund rather than the company's fund (That is, the Golf Wear company). Funds belonging to the company are those that deserve to be recorded in the general journal.

In measuring value the firms focus should be on

Answers

Answer:

cash flow, goodluck to you

What payment method is this? Draw the payment process and explain the steps in the payment process.

Sales contract No: 053TTCB07

Seller:A&T Co., Ltd. Add: 258 Bis Le Dai Hanh Street, District 1, HCM City.

Account number: 2173357 – Vietcombank – Saigon Branch (Swift code: BFTVVNVX023)

Buyer: Pelco Co., Ltd. Add: 350 Pelcogate, Clovis, NYC

Account number: 4945020923 – Wells Fargo Bank – NYC Branch (FNBPUS3NNYC)

Payment article: Payment by TT 50% 30 days after B/L date.

PLEASE HELP ME

Answers

Answer:

I don't understand this question

Explanation:

what is this supposed to be?

Please help me in this assignment. Assume a project, other than your assignment, such as real estate, infrastructure development, industrial, or software development etc. and discuss that how guiding principle of PMI Standards for project risk management life cycle shall be undertaken at the organizational level of that particularly identified project (what the organization needs to do).

Answers

Answer:

DOES THIS HELP

Explanation

Many different professions contribute to the theory and practice of project management. Engineers and architects have been managing major projects since pre-history. Since approximately the 1960s, there have been efforts to professionalize the practice of project management as a specialization of its own. There are many active debates around this: Should project management be a profession in the same way as engineering, accounting, and medicine? These have professional associations that certify who is legally allowed to use the job title, and who can legally practice the profession. They also provide a level of assurance of quality and discipline members who behave inappropriately.

The United States restricts imports but, at the same time, supports the WTO and international banks whose objective is to enhance world trade. As a member of Congress, how would you justify this contradiction to your constituents?

Answers

In my capacity as a member, I would like to make the case for the World Trade Organization (WTO) and other international banks to make use of the many export promotion and assistance programs that the United States offers in order to acquire trade finance and maximize asset utilization for the purpose of achieving financial stability.

This is further explained below.

What is World Trade Organization?Generally, The World Commerce Organization (WTO) is a multilateral organization that was established with the purpose of regulating as well as facilitating international trade.

In conclusion, When it comes to establishing, revising, and enforcing the laws that regulate international commerce, governments turn to this institution for assistance.

Read more about World Trade Organization

https://brainly.com/question/14276199

#SPJ1