Cottage cheese is imported into Russia in primary packages of 250 g in the amount of 5860 kg at a price of 0.89 euros per 1 package. The goods were purchased from the President of Serbia. Brought from Serbia.

HS code – 0406 10 500 1

the rate of import customs duty is 15%, but not less than 0.19 euros/kg

a. The certificate of origin of the goods in the form of ST-2 is presented. The origin of the goods is Serbia.

b. The certificate of origin of the goods in the form A. The origin of the goods is Serbia.

c. The certificate of origin of the goods of the general form is presented. The origin of the goods is Serbia.

d. The certificate of origin of the goods is not presented.

Answers

a. ST-2 certificate: 15% import customs duty on cottage cheese based on total price.

b. Form A certificate: Potential waiver/reduction of import customs duty based on trade agreement.

c. General form certificate: 15% import customs duty on cottage cheese from Serbia.

d. No certificate: 15% import customs duty applies without proof of origin or preferential treatment.

a. If the certificate of origin of the goods is presented in the form of ST-2, indicating that the origin of the goods is Serbia, the import customs duty rate of 15% will apply. In this case, the duty will be calculated based on the value of the goods, which is the total price of the imported cottage cheese packages.

The total price of the imported cottage cheese is calculated as follows:

Total price = Price per package * Number of packages

Total price = 0.89 euros/package * 5860 kg

Total price = 5217.4 euros

The import customs duty will be 15% of the total price:

Customs duty = 15% * Total price

Customs duty = 0.15 * 5217.4 euros

Customs duty = 782.61 euros

b. If the certificate of origin of the goods is presented in the form A, indicating the origin of the goods as Serbia, it implies that the goods qualify for preferential treatment under a free trade agreement or other preferential trade arrangements between Russia and Serbia. In this case, the import customs duty will be waived or reduced according to the provisions of the agreement.

c. If the certificate of origin of the goods is presented in a general form indicating the origin as Serbia, it may not specify any specific preferential treatment or trade agreement. In this case, the import customs duty rate of 15% will apply, and the calculation will be the same as in scenario (a).

d. If the certificate of origin of the goods is not presented, the import customs duty rate of 15% will still apply. However, without the certificate of origin, it may be challenging to prove the origin of the goods and potentially qualify for any preferential treatment or trade agreements that could reduce or waive the customs duty.

learn more about "customs ":- https://brainly.com/question/29786125

#SPJ11

Related Questions

Which of the following statements about check cashing companies is FALSE?

1. They charge low fees.

2. They offer bad deals where you'll owe a lot more than you borrowed.

3. They can take a percentage of your check on top of fees.

4. They make it easy to fall into a loan cycle that is hard to get out of.

Answers

A general rule of thumb is to keep your credit utilization rate at 30% or lower. What is your approximate credit utilization rate for this current billing cycle? (Hint: Credit Utilization Rate = Balance / Credit Limit)

Answers

Answer:

90%

Explanation:

All of the following are private businesses that collect and publish financial information on similar businesses and industries EXCEPT

a. Standard and Poor's.

O b. the National Federation of Independent Business.

c. Dun and Bradstreet.

d. Value Line.

Answers

The National Federation of Independent Business (NFIB) is not a private business that collects and publishes financial information on similar businesses and industries. Option B

Instead, NFIB is a nonprofit organization that provides advocacy, education, and networking opportunities for small businesses in the United States.

Standard and Poor's (S&P) is a leading provider of financial market intelligence, including credit ratings, indices, and analytics. S&P provides independent research, ratings, and benchmarking tools that help investors make informed decisions about investments.

Dun and Bradstreet (D&B) is another leading provider of business intelligence, providing data analytics, credit reporting, and other risk management solutions. D&B collects and analyzes data on millions of businesses worldwide to provide insights into market trends, financial performance, and other business metrics.

Value Line is an independent investment research firm that provides in-depth analysis and commentary on individual stocks, mutual funds, and other investments. Value Line's research tools and reports are widely used by investors and financial advisors to help them make informed investment decisions.

Overall, all of these private businesses are essential sources of financial information and analysis for investors, business owners, and other stakeholders. While NFIB does not provide financial data, its advocacy and education programs are critical for small businesses, which are an important driver of economic growth and job creation. Option B

For more such questions on National Federation of Independent Business visit:

https://brainly.com/question/29315348

#SPJ11

You are thinking of purchasing a house. The house costs $400,000. You have $57,000 in cash that you can use as a down payment on the house, but you need to borrow the rest of the purchase price. The bank is offering a 30 -year mortgage that requires annual payments and has an interest rate of 7% per year. What will be your annual payment if you sign this mortgage? A local bank is running the following advertisement in the newspaper: "For just $1,000 we will pay you $50 forever!" The fine print in the ad says that for a $1,000 deposit, the bank will pay $50 every year in perpetuity, starting one year after the deposit is made. What interest rate is the bank advertising (what is the rate of return of this investment)?

Answers

The bank is advertising an interest rate of 5% for this investment.

To calculate the annual payment for the mortgage, we can use the formula for the present value of an ordinary annuity:

PV = PMT * (1 - (1 + r)^(-n)) / r

Where PV is the present value (loan amount), PMT is the annual payment, r is the interest rate per period, and n is the number of periods.

In this case, the loan amount (PV) is $400,000 - $57,000 = $343,000 (since you're using $57,000 as a down payment). The interest rate (r) is 7% per year, and the loan term is 30 years (n = 30).

Plugging the values into the formula, we can solve for PMT:

$343,000 = PMT * (1 - (1 + 0.07)^(-30)) / 0.07

Simplifying the equation gives:

PMT = $343,000 * 0.07 / (1 - (1 + 0.07)^(-30))

Calculating the expression on the right-hand side gives:

PMT ≈ $22,932.34

Therefore, the annual payment for the mortgage would be approximately $22,932.34.

Regarding the bank advertisement, they claim to pay $50 every year in perpetuity for a $1,000 deposit. To find the interest rate being advertised, we can use the formula for the perpetuity present value:

PV = PMT / r

Where PV is the present value (deposit), PMT is the annual payment, and r is the interest rate.

In this case, the deposit (PV) is $1,000, and the annual payment (PMT) is $50.

Plugging the values into the formula, we can solve for r:

$1,000 = $50 / r

Simplifying the equation gives:

r = $50 / $1,000

Calculating the expression on the right-hand side gives:

r = 0.05 or 5%

Therefore, the bank is advertising an interest rate of 5% for this investment.

Learn more about interest rate here

https://brainly.com/question/28236069

#SPJ11

Offshore production refers to fdi undertaken to serve the host market.

True

False

Answers

The statement that offshore production refers to fdi undertaken to serve the host market is false.

false.

offshore production refers to the relocation of production activities by a company to a foreign country, often with the intention of taking advantage of lower production costs, accessing new markets, or benefiting from other favorable factors. it involves setting up production facilities or outsourcing manufacturing processes in a different country from the company's home market. offshore production can be undertaken to serve the host market, but it is not limited to that purpose. in fact, offshore production can also be geared towards serving other markets, including the home market or third-party markets. foreign direct investment (fdi) refers to the investment made by a company from one country into another country, typically involving a long-term relationship and control or significant influence over the invested enterprise. while fdi can be involved in offshore production, it is not exclusive to serving the host market.

Learn more about investment here:

https://brainly.com/question/15105766

#SPJ11

1. Define business organisation 2. write short notes on the following a. sole proprietorship b. Population - census

Answers

Answer:

A business organization is an entity or firm that is formed to carry out commercial activities

A sole proprietorship is a business organization or entity owned by an individual only.

Population census is the official counting of a particular number of people living in a particular territory, region or country at a particular time for socio-economic, demographic, political purposes.

Which of the following is not a critical issue for a company whose management intends to engage in e-commerce? A) privacy. B) the availability of hot spots for WIFI

Answers

B) The availability of hot spots for WIFI is not a critical issue for a company engaging in e-commerce.

When a company intends to engage in e-commerce, privacy becomes a critical issue. Safeguarding customer data, protecting personal information, and ensuring secure online transactions are essential considerations to establish trust and maintain customer confidence. Privacy measures, such as implementing secure payment gateways, data encryption, and compliance with privacy regulations, are crucial in e-commerce operations.

On the other hand, the availability of hot spots for WIFI, while important for connectivity, is not directly related to the critical issues in e-commerce. While a reliable internet connection is necessary for conducting online business, it falls more within the realm of infrastructure and operational considerations rather than the core concerns associated with privacy, security, and customer trust.

Therefore, among the given options, the availability of hot spots for WIFI is not a critical issue compared to the critical concern of privacy when a company engages in e-commerce.

To learn more about e-commerce click here

brainly.com/question/31260442

#SPJ11

An investor seeking to recover stock market losses from a CPA firm associated with an initial offering of securities based on an unmodified opinion on financial statements that accompanied a registration statement, must establish that:_________.

A) The audited financial statements contain a false statement or omission of material fact.

B) The CPA firm would have discovered the false statement or omission if it had exercised due care in its examination.

C) The CPA firm did not act in good faith.

D) The investor relied on the financial statements.

Answers

Answer:

A) The audited financial statements contain a false statement or omission of material fact.

Explanation:

When an investor seeking to recover stock market losses from a CPA firm associated with an initial offering of securities based on an unmodified opinion on financial statements that accompanied a registration statement, must establish that the audited financial statements contain a false statement or omission of material fact.

An unmodified opinion on financial statements can be defined as an opinion issued by an auditor stating that there are no material misstatements and this simply implies that the, the financial statement represents a true and fair perspective.

Hence, when an investor seeking to recover stock market losses from a certified public accountant (CPA) firm, he or she must establish that the audited financial statements contain a false statement or omission of material fact in accordance with the public company accounting oversight board (PCAOB).

The balance on a credit card, that charges a 20%

APR interest rate, over a 1 month period is given in

the following table:

Days 1-5: $200 (initial balance)

Days 6-20: $350 ($150 purchase)

Days 21-30: $150 ($200 payment)

What is the finance charge, on the average daily

balance, for this card over this 1 month period?

finance charge = $ [?]

Round to the nearest hundredth.

Enter

Answers

The balance on a credit card, that charges a 20% APR interest rate, the Finance charge is given as

$4.3055

This is further explained below.

What is the APR interest rate?Generally, The interest rate that is applied to a loan, mortgage loan, credit card, etc. is referred to as an annual percentage rate of charge, which sometimes corresponds to a nominal APR and sometimes corresponds to an effective APR.

The annual percentage rate of charge is the interest rate for the entire year, as opposed to just a monthly fee or rate. It is a fee for financing that is presented in the form of an annual rate.

Interest rate APR = 12%

Average balance = ((200*5)+(350*15)+(150*10))/30

Average balance = $258.33

Average balance*APR/12

Finance charge =\(\frac{258.33*20 \%}{12 }\)

Finance charge = $4.3055

Read more about APR interest rates

https://brainly.com/question/14270693

#SPJ1

Pr 8-3a budgeted income statement and supporting budgets obj. 4 the budget director of birding homes & feeders inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for january: a. estimated sales for january: bird house . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,000 units at $25 per unit bird feeder . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,000 units at $15 per unit

Answers

Estimated sales for January: bird house $375,000 total of 15,000 units at $25 per unit bird feeder $600,000 of 40,000 units at $15 per unit.

What is the income statement formula?Net Income = Revenues - Expenses is the fundamental formula for an income statement. This straightforward equation illustrates the business' profitability. The company is profitable if revenues exceed expenses.

Why is an income statement important?Business owners can tell whether their organization is headed toward profitability or losses using income statements. Due to the full breakdown of income and spending in an income statement, business owners can determine what has to be changed in order to boost revenues or reduce costs.

To know more about income statement visit:

https://brainly.com/question/28035395

#SPJ4

economic systems from the most government involvement in the economy to least government involvement.

Answers

Explanation:

In a command economy, the system is controlled by the government. A mixed economy is partly run by the government and partly as a free market economy, which is an economic system that includes no government intervention and is mainly driven by the law of supply and demand.

Which buyer type has an open mind and tends to take chances on new products without hesitation?

a. ready buyer

b. logical buyer

c. stubborn buyer

d. emotional buyer

Answers

Answer:

A

Explanation:

Disadvantages of choosing a job that is extremely popular or in demand

Answers

The disadvantage of choosing a job that is very popular or a job that is in high demand is that after a while such a job may become saturated or it would become monotonous.

What is a high demand job?This is the term that is used to refer to a job that the people that wpould employ labor are constantly in need of. Such a job is one that would require the people that have the qualification to opt in and get the places and the roles that they are to fill.

The issues that may arise from such a job that is in high demand is that after a period, such a job may have a lot of persons that would want to fulfil the role.

The number of qualified persons may become more than the job that is available for the people to do in the long run.

Hence this is a disadvantage. Therefore I would conclude by saying that the disadvantage of choosing a highly popular job is that the number of persons that are willing to fulfil the role may exceed the job overtime.

Read more on jobs here: https://brainly.com/question/26355886

#SPJ1

True or false? goods-producing organizations are not involved in service activities.

Answers

The given statement that goods-producing organizations are not involved in service activities is fasle.

Do businesses that produce things also engage in services?Organizations that manufacture goods do not engage in service activities. false The majority of systems combine products and services. . Because consumer demand is unpredictable, service operations need more inventory.

Organizations that manufacture goods do not engage in service activities. Because consumer demand is unpredictable, service operations need more inventory. The prices consumers are prepared to pay for goods or services serve as a gauge of the value of outputs.

Learn more about organizations at:

https://brainly.com/question/17320867

#SPJ1

What is a product mix?

Answers

Product mix, also known as product assortment or product portfolio, refers to the complete set of products and/or services offered by a firm. A product mix consists of product lines, which are associated items that consumers.

For example, your company may sell multiple lines of products.Or your product lines may be vastly different, such as diapers and razors.

common lit capataliasmn-Which phrase best describes the relarionship between workers and bussiness owners in capatalists cociety

Answers

Answer:

In order for the government to be able to help with a problem, the problem must be brought to the proper of government and the proper.In order for the government to be able to help with a problem, the problem must be brought to the proper of government and the proper.

Explanation:

Companies that cannot identify any type of competitive advantage are classified as ______.

Answers

Companies that cannot identify any type of competitive advantage are classified as having a "competitive disadvantage".

A competitive advantage refers to a unique set of attributes, resources, or capabilities that allow a company to outperform its rivals. It can be based on various factors such as cost leadership, differentiation, innovation, customer service, or market niche.

Companies that fail to identify any of these advantages are at a disadvantage because they are unable to effectively position themselves in the market and differentiate their offerings from competitors.

Without a competitive advantage, companies may find it challenging to attract customers who have numerous alternatives to choose from. They may also struggle to command higher prices or maintain customer loyalty.

Additionally, without a distinctive offering, companies may face intense price competition, eroding their profit margins. It becomes crucial for such companies to reevaluate their strategies, identify areas where they can differentiate themselves, and develop a competitive advantage to improve their market position and prospects for long-term success.

In conclusion, companies that cannot identify any type of competitive advantage are classified as having a competitive disadvantage. This means that they lack distinctive qualities or strategies that would give them an edge over their competitors in the marketplace.

Without a competitive advantage, these companies may struggle to attract customers, differentiate their products or services, and achieve sustainable growth and profitability.

Learn more about competitive here: brainly.com/question/28267513

#SPJ11

Amiri, who belongs to the Maori tribe, aspires to be a deputy sheriff in Upper Elm County. Amiri sports a small moko tattoo across his cheeks and nose as a symbol of his heritage. Per the dress code, however, sheriffs are not allowed to have any visible tattoos. Amiri is told that he will need to remove his tattoo before he can apply to be a deputy sheriff. Which of the following will hold true in this scenario?

a. Amiri will prevail in a national origin discrimination claim under Title VII of the Civil Rights Act of 1964 because his tattoo honors his heritage.

b. Upper Elm County can defend itself against Amiri's claim if it can be shown that the tattoo overlaps with his religion.

c. Upper Elm County can defend itself against Amiri's claim because a dress code is permissible under Title VII of the Civil Rights Act of 1964.

d. Amiri will prevail in a national origin discrimination claim if he uses the bona fide occupational qualification defense to show that his tattoo does not disrupt the dress code.

Answers

The following will hold true in this scenario Upper Elm County can defend itself against Amiri's claim if it can be shown that the tattoo overlaps with his religion.

What is religion?Religion is commonly defined as a social-cultural system of specified behaviors and practices, morals, beliefs, worldviews, texts, sanctified places, prophecies, ethics, or organizations that generally relate humanity to supernatural, transcendental, and spiritual elements; however, there is no scholarly agreement on what precisely constitutes a religion.

Amiri's accusation can be refuted by Upper Elm County because Title VII of the Civil Rights Act of 1964 permits dress codes. The Maori tribe member Amiri wants to work as a deputy sheriff in Upper Elm County.

Therefore, Thus option (B) is correct.

Learn more about religion here:

https://brainly.com/question/1463373

#SPJ5

Lifestyles, customs, and religion have a potential for causing which type of international business risk?

Answers

Lifestyles, customs, and religion have the potential for causing cross-cultural international business risks.

It is the possibility of loss because of identical unsure destiny occurrence. International business risk can be described as the possibility of loss resulting from a few destructive or undesirable occasion in international business operations. earnings and growth quotes in worldwide business are better however so are the attendant threat

A cross-cultural risk refers to a scenario or occasion in which a cultural miscommunication puts some human value at stake. Cross-cultural chance is posed with the aid of differences in language, lifestyles, mindsets, customs, and/or religion.

Cultural risk refers back to the capacity for an organization's operations in a country to warfare due to differences in language, customs, norms, and customs options. The history of business is full of colorful examples of cultural variations undermining groups.

Learn more about business here brainly.com/question/24448358

#SPJ4

Proponents of "no taxation without representation" claimed that although trade regulation was a legal means for parliament to raise revenue, direct internal taxes such as the stamp act were an illegitimate extension of parliamentary power. True or false?.

Answers

Proponents of "no taxation without representation" claimed that although trade regulation was a legal means for parliament to raise revenue, direct internal taxes such as the stamp act were an illegitimate extension of parliamentary power. The given statement is false.

What did no taxation without representation mean?

A population that is compelled to pay taxes to a government authority without having any input on that government's policy is referred to as having taxation without representation. "Taxation without representation is tyranny," was the catchphrase used by American colonists to rebel against their British overlords.

Who first said no taxation without representation?

"Taxation without representation is tyranny," the phrase that became an anti-British catchphrase before the American Revolution, is generally attributed to James Otis around 1761 and reflects the resentment of American colonists at being taxed by a British Parliament to which they did not elect representatives.

Learn more about no taxation without representation: https://brainly.com/question/788892

#SPJ4

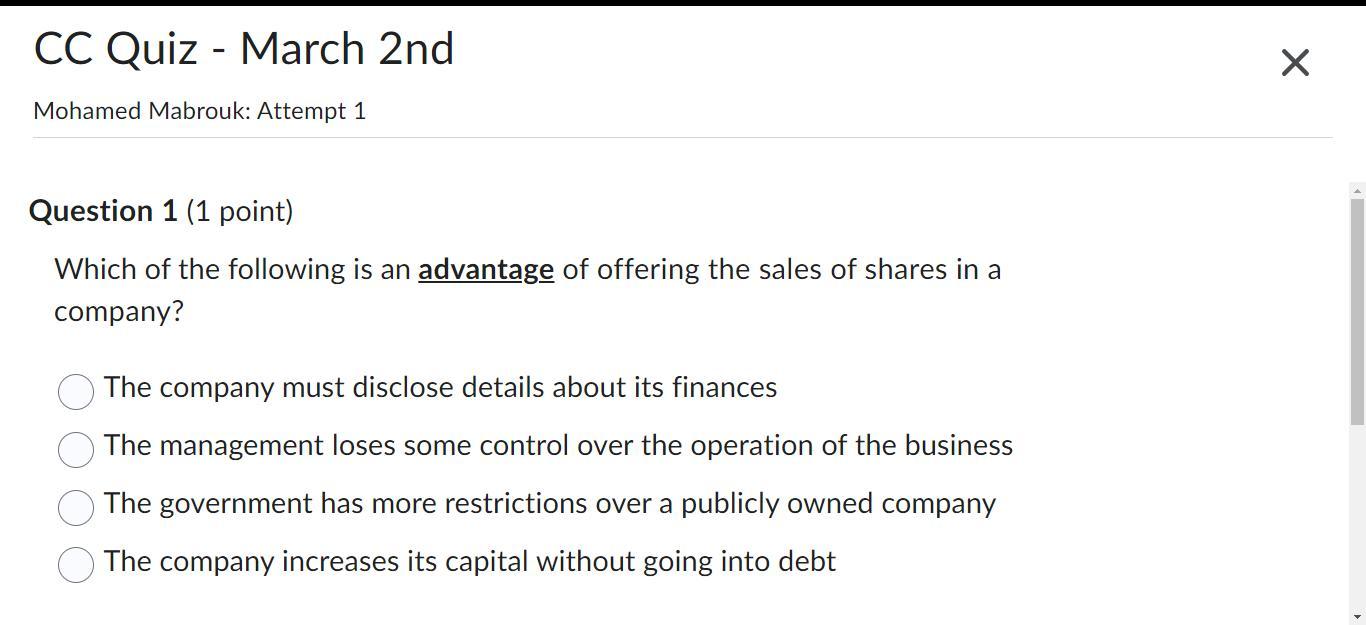

please help and thanks :)

Answers

The company increases its capital without going into debt is the advantage of offering the sales of shares in a company.

What are shares?

A share, which can also apply to shares of mutual funds, limited partnerships, and real estate investment trusts, is a unit of equity ownership in the capital stock of a corporation in the financial markets. The term "share capital" describes all of an organization's assets. A shareholder of a corporation is someone who owns shares in the organization. A share represents the ownership relationship between the business and the shareholder and is an immovable unit of capital. A share's face value, which may not correspond to the market worth of those shares, is its denominated value.

Know more about shares - brainly.com/question/28539863

#SPJ1

who is the supervisory body for the federal reserve system?

Answers

Answer:

The Board of Governors--located in Washington, D.C.--is the governing body of the Federal Reserve System. It is run by seven members, or "governors," who are nominated by the President of the United States and confirmed in their positions by the U.S. Senate.

Explanation:

There are seven main instruments used in trade policy with __________ being the oldest and the simplest. Group of answer choices local content requirements

Answers

There are seven main instruments used in trade policy with local content requirements being the oldest and the simplest.

What is Trade policy?Trade policy is used by government in terms of trade. It is known known to be one that uses seven main instruments They are:

TariffsSubsidies Import quotasLocal content requirements and others.Tariffs are known to be the oldest and simplest tool of trade policy.

Learn more about Trade policy from

https://brainly.com/question/4428758

What motivates you to do a good job other than a paycheck?

Answers

what are the major components of a business operating plan?

Answers

Answer:

capital

investors

knowledge in field

In the early 2000s, easy credit made real estate the investment of choice in the United States. By the end of the decade, however, a recession had set in, impacting almost all businesses in the country. This example shows that _____.

a. economic boom periods can overheat and lead to speculative bubbles.

b. people did not overvalue housing prices.

c. during economic boom periods, investors stay cautious and conservative.

d. the market was characterized by rational exuberance.

Answers

The given example about the research about recession and real estate investment shows that:

A. economic boom periods can overheat and lead to speculative bubbles.What is Economic Boom?This refers to the sudden increase of economic opportunities in a given area which can be caused by a variety of factors.

With this in mind, we can see that in the early 2000s, there was the investment made and by the end of the decade, there was a recession and this shows that economic boom can overheat and lead to speculative bubbles.

Read more about economic boom here:

https://brainly.com/question/1690575

marcos co. is considering a project that will increase residual income by $15,000. the project has a 12% return on investment (roi) which exceeds the company's 10% required rate of return. marcos co. currently has an overall 15% roi in the department where this project would be implemented. which of the following statements regarding this potential investment are true?

Answers

The project should be accepted by the company because it increases overall residual income. The department manager may not want to accept the project because it will lower the overall ROI for the department.

Return on investment (ROI) is calculated with the aid of dividing the income earned on funding via the price of that funding. as an instance, funding with an income of $ hundred and a price of $one hundred might have an ROI of 1, or one hundred% while expressed as a percentage. return on investment or go back on fees is a ratio between net earnings and funding. An excessive ROI way the funding's gains evaluate favorably to its fee. As an overall performance measure, ROI is used to assess the performance of an investment or to examine the efficiencies of several specific investments. go back on investment (ROI) A calculation of the economic cost of funding as opposed to its cost. The ROI formula is: (income minus cost) / cost. in case you made $10,000 from a $1,000 attempt, your return on funding (ROI) would be zero. nine, or ninety%.

Learn more about ROI here: https://brainly.com/question/25790997

#SPJ4

The duration of a par value bond with a coupon rate of 8% (paid annually) and a remaining time to maturity of 5 years is

Answers

According to the question the duration of the par value bond is 26.

The duration of a par value bond with a coupon rate of 8% (paid annually) and a remaining time to maturity of 5 years can be calculated using the formula:

Duration = (1 + (1 + Yield to Maturity) / Number of Coupon Payments) / Yield to Maturity

In this case, since the coupon rate is 8% and paid annually, the yield to maturity would be equal to the coupon rate, which is 8%. Therefore, the calculation becomes:

Duration = (1 + (1 + 0.08) / 1) / 0.08

= (1 + 1.08) / 0.08

= 2.08 / 0.08

= 26

So, the duration of the par value bond is 26.

To learn more about duration

https://brainly.com/question/31915566

#SPJ11

An account is defined as a record of the business activities related to a particular item. True or false?.

Answers

The statement "An account is defined as a record of the business activities related to a particular item" is true

What is an account?

An account refers to records of transactions in an understandable format which summarizes the performance of a particular business which is the item referred to in the question

There must be business activities such as buying and selling involving cash or credit transactions, for there to be accounting and also all of the transactions would be in respect of a particular business entity.

In short, the fact that account is a record of business dealings in respect of a particular item is perfectly correct.

Find out more about financial accounting on:https://brainly.in/question/4110683

#SPJ1

4. the interest is computed on the principal and also on the accumulated past interests.

a. simple annuity b. compound annuity C. simple interest d. compound interest

Answers

Answer:

d. compound interest

Explanation:

Compound interest basically means that previously earned interests will earn interests on their own. For example, you invest $100 and receive a 5% yield. At the end of year 1 you will have $105. At the end of year 2 you will have $105 x 1.05 = $110.25. The $5 in interests previously earned during year 1 will earn $0.25 interest during year 2.