Answers

Early adopters are opinion leaders who evaluate ideas carefully, take risks, help to adapt new ideas to local settings, and have effective networking skills.

Who is a leader?A leader is someone who gives people a sense of purpose and inspiration. A leader is somebody who provides their team with the resources and encouragement they need to succeed.

Opinion leaders that thoroughly consider ideas, are much more skeptical and persuasive, nevertheless take risks, aid in adjusting fresh concepts to suit local conditions, and possess strong management systems designed. early adopters appear to represent the highest level of opinion leadership.

Learn more about leaders, Here:

brainly.com/question/15176246

#SPJ1

Related Questions

The score report of the wore. Test offers all of the following information except

Answers

Answer:

That doesn't make sense can you elaborate please?

f a business has fixed costs of $1k a month, variable costs of $1k a month and has product sales of $2k a month, what statement is a correct analysis of the situation

Answers

Answer:

The correct option is b. The business is realizing $0 profit and the business is at break-even point.

Explanation:

Note: This question is not complete. The complete question is therefore provided before answering the question as follows:

If a business has fixed costs of $1k a month, variable costs of $1k a month and has product sales of $2k a month, what statement is a correct analysis of the situation?

a. The business is realizing $2k profit and the business is at break-even point

b. The business is realizing $0 profit and the business is at break-even point

c. The business is realizing $2k loss and the business is at break-even point

d. The business is realizing $2k profit

The explanation of the answer is now provided as follows:

Total cost = Fixed cost + Variable cost = $1K + $1K = $2k

Total revenue = Product sales = $2k

Profit = Total revenue - Total cost = $2k - $2k = $0

When a business makes $0 profit, it implies that the business is at break-even point.

Therefore, the correct option is b. The business is realizing $0 profit and the business is at break-even point.

Which statement is CORRECT? Automatic stabilizers are risky to use and sometimes can get the economy destabilized. Discretionary fiscal policy shows automatic adjustments without any specific effort by policy makers. Discretionary fiscal policy indicates deliberate action by policy makers. Automatic stabilizers indicate deliberate action by policy makers.

Answers

Answer:

Discretionary fiscal policy indicates deliberate action by policy makers.

Explanation:

Automatic stabilizers are stabilizers that adjust the economy automatically without the intervention of external agents . examples include progressive tax and transfer payments

In an expansion, progressive tax increases the tax paid and this reduces disposable income

In a contraction, tax paid is reduced and this increases disposable income

Discretionary fiscal policies are deliberate steps taken by the government to stimulate the economy in order to cause the economy to move to full employment and price stability more quickly than it might otherwise.

Discretionary fiscal policies can either be expansionary or contractionary

Expansionary fiscal policy is when the government increases the money supply in the economy either by increasing spending or cutting taxes.

Contractionary fiscal policies is when the government reduces the money supply in the economy either by reducing spending or increasing taxes

Provide an argument for how Coke's disastrous marketing campaign for New Coke might actually have been a good thing for the company's core product.

Answers

You’ve recently learned that the company where you work is being sold for $525,000. The company’s income statement indicates current profits of $22,000, which have yet to be paid out as dividends. Assuming the company will remain a “going concern” indefinitely and that the interest rate will remain constant at 6 percent, at what constant rate does the owner believe that profits will grow

Answers

The estimated growth rate (g) is -0.0181, roughly.

The Gordon Growth Model, often known as the tip reduction model, can be used to calculate the constant rate at which the business owner anticipates gains to increase. This methodology determines a stock's natural value based on expected future growth and the required rate of return.

As the gains are declared to be paid out as tips in this instance, we can consider the company's gains to be original to tips. The tip growth rate(g) can be used to express the owner's perception of the growing rate of gains.

The Gordon Growth Model allows for the following calculation of a company's natural value:

natural Value = tips/( needed Rate of Return- tip Growth Rate)

Given

tips( gains) = $ 22,000

needed Rate of Return( r) = 6 = 0.06

natural Value( trade Price) = $ 525,000

The formula can be changed to account for the tip growth rate(g).

g = ( tips natural Value)- r

Substituting the given values into the formula

g = ($ 22,000/$ 525,000)-0.06

g = 0.0419-0.06

g = -0.0181

It's crucial to remember that a negative growth rate denotes decrease rather than rise in gains. Even so, it's likely that the negative growth rate is the result of factors that were overlooked when gathering the data, such as one-time losses or adjustments.

For more such question on growth. visit :

https://brainly.com/question/30280812

#SPJ8

After reviewing the rhetorical fallacies, can you think of a specific time when you heard a speaker employ one of these fallacies? Which fallacy did they use? Why should you avoid fallacies in your own speeches?

Answers

Answer:

they can be bad because they can / will confuse people especially the public

You see me now 4 kkt

Answers

Answer:

ncvbhrdfh

Explanation:

Answer:

hgfjttfgk,jnhlkgfk,hjlhj

Explanation:

Road Master Shocks has 15,000 units of a defective product on hand that cost $80,000 to manufacture. The company can either sell this product as scrap for $6 per unit or it can sell the product for $9 per unit by reworking the units and correcting the defects at a cost of $40,000. Prepare a schedule to show the effect of selling the defective units as scrap or rework.

Answers

Answer:

If the units are reworked, net income will increase by $5,000.

Explanation:

Giving the following information:

Number of units= 15,000

Sell as-is:

Selling price= $6 per unit

Rework:

Selling price= $9

Total cost= $40,000

The original production costs ($80,00) should not be taken into account because they remain constant for the two options.

Now, we will determine the effect on the income of both choices:

Sell as-is:

Effect on income= 6*15,000= $90,000 increase

Re-work:

Revenue= 15,000*9= 135,000

Total cost= (40,000)

Effect on income0 $95,000 increase

If the units are reworked, net income will increase by $5,000.

Describe the characteristics of stocks and their expected behavior relative to the market.

Answers

Answer:

A bull market is a market that is on the rise and where the conditions of the economy are generally favorable. A bear market exists in an economy that is receding and where most stocks are declining in value. Because the financial markets are greatly influenced by investors' attitudes, these terms also denote how investors feel about the market and the ensuing economic trends.

A bull market is typified by a sustained increase in prices. In the case of equity markets, a bull market denotes a rise in the prices of companies' shares. In such times, investors often have faith that the uptrend will continue over the long term. In this scenario, the country's economy is typically strong and employment levels are high.

By contrast, a bear market is one that is in decline. A market is usually not considered a true "bear" market unless it has fallen 20% or more from recent highs. In a bear market, share prices are continuously dropping. This results in a downward trend that investors believe will continue; this belief, in turn, perpetuates the downward spiral. During a bear market, the economy slows down and unemployment rises as companies begin laying off workers

NoreCorp wants to meet a moral minimum of ethical behavior

Answers

The company could offer higher-quality products to customers for lower cost, positively impacting customers.

I am better at my job than most of the other people who have the same job title agree or disagree

Answers

Disagreed. You cannot say that you are better at your job than others who have the same job title.

How to answer questionnaire questions?While providing the answer to a questionnaire, it is very important that a person would try to be as truthful as possible.

The reason they have to be truthful is so that they would be able to give the best answer that would be useful for the research.

In a question like this, I used disagreed because it is not possible that you have met all of the persons that have the same job description as you do.

Read more on questionnaire here: https://brainly.com/question/25257437

#SPJ1

suppose you want to change your school and join another one which is very expensive.make a list of the possible risks while joining another school.

Answers

Answer:

getting bullied being lonely no friends not fitting in

Explanation:

Pharoah Company purchases $56,000 of raw materials on account, and it incurs $67,200 of factory labor costs. Supporting records show that (a) the Assembly Department used $26,880 of direct materials and $39,200 of direct labor, and (b) the Finishing Department used the remainder. Journalize the assignment of the costs to the processing departments on March 31. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 31

Answers

a. Assembly Department: Raw Materials Inventory $26,880, Factory Labor $39,200, Accounts Payable $66,080

b. Finishing Department: Raw Materials Inventory $29,120, Factory Labor $28,000, Accounts Payable $57,120

Based on the information provided, the raw materials and manufacturing labour expenses are allotted to the Assembly and Finishing Departments. The Assembly Department is in charge of $26,880 in direct materials and $39,200 in direct labour, while the Finishing Department is in charge of the remaining raw materials and factory labour costs.

The debit entries in the journal entry represent increases in the cost accounts of the two departments (Raw Materials Inventory and Factory Labour), whereas the credit entries show increases in the Accounts Payable account.

For such more question on Raw Materials:

https://brainly.com/question/12939440

#SPJ8

Problem 8, MacroSoft Inc. has capitalized $600,000 of software costs. Sales from this product were $360,000 in the first year. MacroSoft estimates additional revenues of $840,000 over the product’s economic life of 5 years.

Instructions

Prepare the journal entry to record software cost amortization for the first year. Show all computations.

Answers

Journal Entry:

Date: [First year-end date]

The amortization expense for the first year is $120,000.

Debit: Amortization Expense - Software Cost - Year 1 ($600,000 / 5 years) = $120,000Credit: Accumulated Amortization - Software Cost - Year 1 ($600,000 / 5 years) = $120,000Explanation:To record the software cost amortization for the first year, we need to allocate a portion of the capitalized software costs as an expense. Since the software has an estimated economic life of 5 years, we divide the total software cost ($600,000) by 5 to determine the annual amortization expense. In this case, the amortization expense for the first year is $120,000. We debit the Amortization Expense - Software Cost account to recognize the expense and credit the Accumulated Amortization - Software Cost account to accumulate the amortization over time.For more such questions on Journal Entry

https://brainly.com/question/28390337

#SPJ8

1. Determine the estimated cost of the inventory of Celebrity Tan Co. on August 31 by the retail method, presenting details of the computations. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

to retail price:

2a. Estimate the cost of the inventory of Ranchworks Co. on November 30 by the gross profit method, presenting details of the computations. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

3. Assume that Ranchworks Co. took a physical inventory on November 30 and discovered that $369,750 of inventory was on hand. What was the estimated loss of inventory due to theft or damage during March through November?

Answers

1)We require the following details in order to calculate Celebrity Tan Co.'s expected cost of inventory on August 31 using the retail method:Beginning retail inventory is the value of the stock as of August 1.Retail net sales: total sales throughout the time.The proportion relating inventory costs to selling prices is known as the cost-to-retail ratio.

2) Using the gross profit approach, we require the following details to calculate Ranchworks Co.'s inventory cost on November 30:Start of inventory: Inventory's worth as of November 1st.Total period sales, or net sales. Gross profit ratio: The proportion of gross profit to net sales.

3)The following information is required in order to estimate the loss of inventory from theft or damage from March through November: the value of stock as of March 1 is the starting inventory. Inventory acquired throughout the time, totaled as purchases.Cost of goods sold: The cost of the inventory that was sold during the time period. Inventory value as of November 30th, referred to as the ending inventory.

The items and supplies that a company keeps on hand with the intention of reselling, producing, or using them are referred to as inventory (in American English) or stock.

The main focus of the discipline of inventory management is determining the location and form of stored products.

stock Prior to the regular and scheduled course of production and material stock

Learn more about inventory, from :

brainly.com/question/31146932

#SPJ1

HURRRYYYY PLEASE HELP ME ASAP!!!!

1, Select a company with an international presence that you are familiar with or that you learn about by searching the internet

2.Identify the laws, treaties, acts, and governing bodies (e.g. U.N., WTO, and IMF) that impact their business.

3.Explain the impact these laws, treaties, acts, and governing bodies have on their business.

4.Differentiate the impact of those various laws etc. on their business abroad from the impact of similar things on their business in the United States.

Please provide citation and reference to sources. Quoted language must be put inside quotation marks

Answers

The WTO has a major impact on Toyota in a similar manner.The WTO's primary responsibility is to negotiate trade regulations among its members. As a result, the WTO regulations have a big impact on the Toyota industry.

The company is permitted to import and export the medicine in accordance with WTO regulations. The WTO may have both beneficial and bad effects on enterprises.

Toyota was able to enhance product exports with the help of the WTO. As the WTO upholds the organization's viewpoint to comply with WTO regulations and rules, the company's sales rate has increased.

However, the WTO also has a detrimental effect on Toyota's operations. Due to the substantial influence of its quantity of exports, the World Trade Organisation has continually raised the tariff ceiling. Therefore, it is conceivable to assert that the WTO has an impact on the Toyota company both advantageously and badly.

Learn more about WTO, here:

https://brainly.com/question/30199694

#SPJ1

se the following financial statements and additional information.

AUSTIN INCORPORATED

Comparative Balance Sheets

June 30, 2019 and 2018

2019 2018

Assets

Cash $ 94,300 $ 39,400

Accounts receivable, net 81,000 63,000

Inventory 68,000 94,000

Prepaid expenses 5,600 7,000

Total current assets 248,900 203,400

Equipment 176,000 163,000

Accumulated depreciation—Equipment (45,000) (15,000)

Total assets $ 379,900 $ 351,400

Liabilities and Equity

Accounts payable $ 31,000 $ 38,000

Wages payable 6,000 16,000

Income taxes payable 4,900 5,400

Total current liabilities 41,900 59,400

Notes payable (long term) 40,000 80,000

Total liabilities 81,900 139,400

Equity

Common stock, $5 par value 240,000 170,000

Retained earnings 58,000 42,000

Total liabilities and equity $ 379,900 $ 351,400

AUSTIN INCORPORATED

Income Statement

For Year Ended June 30, 2019

Sales $ 922,000

Cost of goods sold 564,000

Gross profit 358,000

Operating expenses

Depreciation expense $ 75,000

Other expenses 91,000

Total operating expenses $ 166,000

192,000

Other gains (losses)

Gain on sale of equipment 4,900

Income before taxes 196,900

Income taxes expense 60,270

Net income $ 136,630

Additional Information

A $40,000 note payable is retired at its $40,000 carrying (book) value in exchange for cash.

The only changes affecting retained earnings are net income and cash dividends paid.

New equipment is acquired for $74,000 cash.

Received cash for the sale of equipment that had cost $61,000, yielding a $4,900 gain.

Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

All purchases and sales of inventory are on credit.

Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the June 30, 2019 balances.

1 Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any.

2 Reconstruct the journal entry for cash payments for inventory, incorporating the change in the related balance sheet account(s), if any.

3 Reconstruct the journal entry for depreciation expense, incorporating the change in the related balance sheet account(s), if any.

4 Reconstruct the journal entry for cash paid for operating expenses, incorporating the change in the related balance sheet account(s), if any.

5 Reconstruct the journal entry for the sale of equipment at a gain, incorporating the change in the related balance sheet account(s), if any.

6 Reconstruct the journal entry for income taxes expense, incorporating the change in the related balance sheet account(s), if any.

7 Reconstruct the entry to record the retirement of the $40,000 note payable at its $40,000 carrying (book) value in exchange for cash.

8 Reconstruct the entry for the purchase of new equipment.

9 Reconstruct the entry for the issuance of common stock.

10 Close all revenue and gain accounts to income summary.

11 Close all expense accounts to income summary.

12 Close Income Summary to Retained Earnings.

13 Reconstruct the journal entry for cash dividends paid.

Answers

Answer:

explain down

Explanation:

A specialty journal records special events or transactions related to the particular journal. There are mainly four kinds of specialty journals – Sales journal, Cash receipts journal, Purchases journal

, and Cash disbursements journal. The company can have more specialty journals depending on its needs and type of transactions, but the above four journals contain the bulk of accounting activities.

All other transactions not entered in a specialty journal account for in a General Journal. It can have the following types of transactions:

Accounts receivables

Accounts payable

Equipment

Accumulated depreciation

Expenses

Interest income

and expenses, etc.

Table of contents

What is General Journal?

General Journal Accounting

General Journal Format

General Journal Examples

Flow Process

Uses

Technological Advances

Conclusion

General Journal Video

Recommended Articles

Following is the balance sheet of Baird company for year 3

Answers

Following Is the balance sheet of Baird Company for Year 3: BAIRD COMPANY Balance sheet Assets Cash Marketable securities Accounts receivable Inventory Property and equipment Accurmulated depreciation $ 14,550 7,940 12,620 16,900 165,000 (12,100) $198,910 Total assets Liabilities and Stockholders' Equity Accounts payable Current notes payable Mortgage payable Bonds payable Convnon stock $ 8,570 3,200 4,950 22,020 113,800 46,370 Retained earnings Total liabilities and stockholders' equity $198,910 The average number of common stock shares outstanding during Year 3 was 890 shares.

A company reports the following: Sales $3,150,000 Average accounts receivable (net) 210,000 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover fill in the blank 1 b. Number of days' sales in receivables

Answers

Answer:

a. Account Receivables turnover = Sales / Average Account Receivables

Account Receivables turnover = $3,150,000 / $210,000

Account Receivables turnover = 15

b. Number of days sales in receivables = 365 / Account Receivables turnover

Number of days sales in receivables = 365 days / 15

Number of days sales in receivables = 24.33 days

Businesses rarely consider profits when supplying goods and services.

True of False

Answers

3. What is the most appropriate method to collect average number of cars using the new highway in a month time? (A) Observation (B) Telephone interview (C) Questionnaire (D) Experiment

Answers

The most appropriate method to collect the average number of cars using the new highway in a month time would be through observation. So, the answer is A.

What's observation of collection method?This involves physically observing the highway and recording the number of cars passing through during a specific time period, such as a day or a week.

This method is reliable and accurate as it provides first-hand information without relying on people's opinions or memory. Telephone interviews and questionnaires may not be as accurate as people may provide estimates or guesses instead of actual data.

Experiments may not be suitable for this situation as it involves manipulating variables, which may not be possible or practical for collecting the average number of cars. Therefore, observation is the best method to collect reliable and accurate data for this scenario.

Learn more about data collection method at

https://brainly.com/question/28329084

#SPJ11

Do you have what it takes to be an entrepreneur?

Answers

Answer:

i think so but im not sure i think i would make a great one

Zoe Corporation has the following information for the month of March: Cost of direct materials used in production $16,700 Direct labor 26,794 Factory overhead 32,844 Work in process inventory, March 1 17,028 Work in process inventory, March 31 19,382 Finished goods inventory, March 1 23,631 Finished goods inventory, March 31 25,648 a. Determine the cost of goods manufactured.

Answers

Answer:

cost of goods manufactured= $73,984

Explanation:

Giving the following information:

Cost of direct materials used in production $16,700

Direct labor 26,794

Factory overhead 32,844

Work in process inventory, March 1 17,028

Work in process inventory, March 31 19,382

To calculate the cost of goods manufactured, we need to use the following formula:

cost of goods manufactured= beginning WIP + direct materials + direct labor + allocated manufacturing overhead - Ending WIP

cost of goods manufactured= 17,028 + 16,700 + 26,794 + 32,844 - 19,382

cost of goods manufactured= $73,984

An argument that opposes the idea of high executive pay is: ___________

a. High salaries provide an incentive for innovation and risk-taking.

b. Not many individuals are capable of running today's large, complex organizations.

c. Top athletes and entertainers make a lot of money, so top executives should, too.

d. High salaries divert resources that could be used to invest in the business.

Answers

Answer:

D

Explanation:

when pay becomes high with respect to several executives or just one, the resources and expense needed to keep the business growing....will be shortened

Mercer Corporation acquired $400,000 of Park Company’s bonds on June 30, 2018, for $409,991.12. The bonds carry a 12% stated interest rate and pay interest semiannually on June 30 and December 31. The appropriate market interest rate is 11%, and the bonds are due June 30, 2021. Required: 1. Prepare an investment interest income and premium amortization schedule, using the: a. straight-line method b. effective interest method 2. Prepare journal entries to record the December 31, 2018, and December 31, 2020, interest receipts using both methods.

Answers

Answer:

I will start with question 2:

journal entry to record purchase of bonds

June 30, 2018, bonds purchased at a premium

Dr Investment in bonds 400,000

Dr Premium on investment in bonds 9,991.12

Cr Cash 409,991.12

straight line amortization of bond premium:

December 31, 2018 = 1,665.19

June 30, 2019 = 1,665.19

December 31, 2019 = 1,665.18

June 30, 2020 = 1,665.19

December 31, 2020 = 1,665.19

June 30, 2021 = 1,665.18

December 31, 2018

Dr Cash 24,000

Cr Interest revenue 22,334.81

Cr Premium on investment in bonds 1,665.19

December 31, 2020

Dr Cash 24,000

Cr Interest revenue 22,334.81

Cr Premium on investment in bonds 1,665.19

amortization of bond premium using effective interest method:

December 31, 2018 = (409,991.12 x 0.055) - 24,000 = 1,450.49

June 30, 2019 = (408,540.63 x 0.055) - 24,000 = 1,530.27

December 31, 2019 = (407,010.36 x 0.055) - 24,000 = 1,614.43

June 30, 2020 = (405,395.93 x 0.055) - 24,000 = 1,703.22

December 31, 2020 = (403,692.71 x 0.055) - 24,000 = 1,796.90

June 30, 2021 = 1,895.81

December 31, 2018

Dr Cash 24,000

Cr Interest revenue 22,549.51

Cr Premium on investment in bonds 1,450.49

December 31, 2020

Dr Cash 24,000

Cr Interest revenue 22,203.10

Cr Premium on investment in bonds 1,796.90

1) I used an excel spreadsheet to prepare the amortization schedules:

Match the methods to monitor on-floor selling activity and sales effectiveness to the scenario that portrays them.

Answers

Monitoring on-floor selling activity and sales effectiveness can be done through various methods that help retailers make informed decisions about their store's performance.

Here are some methods for monitoring on-floor selling activity and sales effectiveness:1. Mystery shoppingThis is where retailers hire a third-party to pose as a customer and visit the store to evaluate the level of service and sales effectiveness. Mystery shoppers can be used to evaluate different areas of the store, such as customer service, product knowledge, and sales techniques. The results can be used to identify areas of weakness and opportunities for improvement.2. Point of sale data analysisThis involves analyzing sales data collected at the checkout. This method can provide insights into sales trends, popular products, and the effectiveness of promotions and sales strategies. Retailers can use this data to make informed decisions about their store's inventory and pricing.3. In-store camerasInstalling cameras on the sales floor can help retailers monitor customer behavior, such as how long they spend in a particular area and which products they are looking at. Retailers can use this information to improve store layout and product placement.4. Customer feedback forms Retailers can use feedback forms to gather information about customers' experiences in the store.

This can include questions about the level of service, product availability, and overall satisfaction. Retailers can use this information to identify areas of improvement and make changes to the store's operations.5. Sales tracking softwareRetailers can use sales tracking software to monitor sales performance and set sales goals. This software can provide real-time updates on sales data and identify areas of strength and weakness. Retailers can use this information to make informed decisions about their store's operations and sales strategies.In conclusion, retailers can use different methods to monitor on-floor selling activity and sales effectiveness. These methods include mystery shopping, point of sale data analysis, in-store cameras, customer feedback forms, and sales tracking software. The choice of method will depend on the retailer's goals and the specific areas they want to evaluate.

for such more questions on sales

https://brainly.com/question/25743891

#SPJ8

Selling, with criminal negligence, alcoholic beverages to a minor is a:

Class A misdemeanor

Class B misdemeanor

Class C misdemeanor

Class A felony

Answers

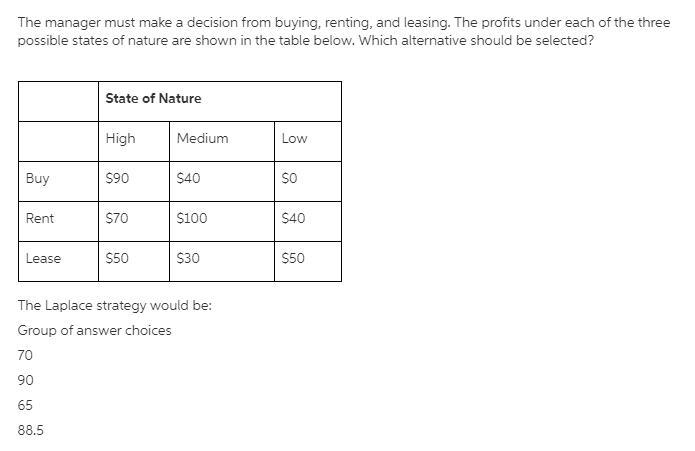

High Medium Low Buy $90 $40 $0 Rent $70 $100 $40 Lease $50 $30 $50 The Laplace strategy would be:

Answers

Answer:

a. $70

Explanation:

Note: The organized question and table is attached below as picture

In Laplace strategy also known as equally likely criterion, average payoff for each of the given alternatives is determined first. Then, the alternative with the highest average payoff or minimum cost is selected.

From the given information, average payoff for each alternative is determined below,

Buy = ($90 + $40 + $0) / 3 = $130 / 3 = $43.33

Rent = ($70 + $100 + $40) / 3 = $210 / 3 = $70 (highest)

Lease = ($50 + $30 + $50) / 3 = $130 / 3 = $43.33

The highest average payoff is for the Rent alternative. Therefore, Rent alternative should be selected under the Laplace strategy with a profit of $70.

Which is the primary characteristic of all physical and digital sales channels?

A. B2B

B. Closing sales

C. Market dominance

D. Branding

Answers

Business-to-Business is the primary characteristic

A sales channel is a chart that tries to establish ways through which a product or services reach the market, coming through the producer to other business through (B2B) and then, to the end customers

A sales channel can go either go through the direct or indirect routesThe Four known types of Sales Channels are:

Retail sales channelWholesale sales channelDirect-to-Consumer sales channel B2B sales channelLet understand that Physical sales channels involves product which have physical features and can be felt.Let understand that Digital sales channels involves services alone.

In conclusion, the primary characteristic of all physical and digital sales channels is Business to Business (B2B) because products or services must pass middlemen when then distribute in smaller unit to end consumers.

Learn more about sales channel here

brainly.com/question/20509151

Answer:

B. Closing Sales...

Btw don't trust the answer at the top.

Explanation:

The following are common types of sales channel. Using a sales force to establish a network of customers and sell to them. Common in areas such as business-to-business sales. Using a third party as a sales force. Selling through physical locations such as a shop or product showroom.

Since the costs of producing an intermediate product do not change regardless of whether the intermediate product is sold or processed further, these costs are not considered in deciding whether to further process a product.

a) true

b) false

Answers

Answer: a) true

Explanation:

The costs incurred to produce the intermediate products have already been incurred and as such are referred to as sunk costs.

They will not change regardless of whether the good is sold before further processing or if it is sold after. They therefore do not matter in the decision to either process or sell and so are not considered.