A Ground Fault Circuit Interrupter (GFCI) is designed to do which of the following?

Select all that apply.

Detect when the current leakage is greater than 5 mA.

Protect people from severe and sometimes fatal electrocution by monitoring for electrical leakage to ground.

Interrupt the flow of electric current by tripping quickly enough to prevent electrocution from leakage

Answers

Answer: Protect people from severe and sometimes fatal electrocution by monitoring for electrical leakage to ground.

Explanation:

The main purpose of a Ground Fault Circuit Interrupter (GFCI) is to ensure that when a person gets electrocuted, the flow of electricity is cut off quickly so that no serious injuries or death occurs.

It works by monitoring the electrical leakage to the ground by checking to see if the current going to and coming from the equipment differ by a certain amount and if it does, the GFCI will interrupt the circuit.

Answer:

All of them,

Explanation:

Related Questions

What is the difference between a total and a subtotal?

Answers

Explanation:

SUB-TOTAL:

The total for a part of a list of numbers being summed.

TOTAL:

An amount obtained by addition of smaller amounts.

Answer:

subtotal is all the different parts being added together from different list.

total is the all items being added together plus tax.

Explanation:

PLEASE

what is lean production? in details (GCSE) keywords.

Answers

Answer:

actually I am very sorry I didn't learn this I don't take business

Explanation:

Sorry would there be anything else I can help u with

Air max 270's or Jordan 1 Mid's?

Answers

Air max 270's

they make me taller than Jordan 1 Mid's, and since im a short dude, I lowkey need that extra inch.

Davidson Corp. produces a single product: fireproof safety deposit boxes for home use.

The budget going into the current year anticipated a selling price of $71 per unit.

Because of competitive pressures, the company had to cut selling prices by 10% during

the year. Budgeted variable costs per unit are $48, and budgeted total fixed costs are

$164,000 for the year. Anticipated sales volume for the year was 18,000 units. Actual

sales volume was 5% less than budget. (1) What was the sales price variance for the

year?

Answers

Answer:

Sales price variance= $121,410 unfavorable

Explanation:

Giving the following information:

Standard selling price= $71

Actual selling price= 71*0.9= $63.9

Actual number of units sold= 18,000*0.95= 17,100

To calculate the selling price variance, we need to use the following formula:

Sales price variance= (standard price - actual price)*actual quantity

Sales price variance= (71 - 63.9)*17,100

Sales price variance= $121,410 unfavorable

5) Si tuvieras que hacer un presupuesto de Ingresos y uno de Gastos ¿Cuál harías primero y que te sirva de base para hacer el otro? Explica tu respuesta

Answers

Answer:

Si tuviese que hacer un presupuesto de ingresos y uno de gastos, primero haría el de ingresos. Así, podría tener en cuenta la cantidad de dinero que mes a mes ingresa en mi patrimonio y de esta manera organizar mis gastos teniendo en cuenta no gastar mas dinero del que gano mensualmente.

Si, en cambio, organizara mis gastos antes que mis ingresos, me vería limitado posteriormente a realizar algunos gastos dado que no habría contemplado mi liquidez financiera mensual.

If, for an imaginary closed economy, investment amounts to $12,000 and the government is running a $2,000 deficit, then private saving must amount to

Answers

If the government is running a deficit (G - T < 0), then private saving must be positive to ensure that national saving equals investment.

In a closed economy, the national income accounting identity is given by:

Y = C + I + G

where Y is the national income, C is consumption, I is investment, and G is government spending.

Rearranging the equation, we get:

Y - C - G = I

This equation shows that national saving (Y - C - G) must equal investment (I).

In this case, we know that investment is $12,000 and the government is running a deficit of $2,000. Therefore,

I = $12,000

G - T = $2,000 (where T is taxes)

Since we don't have information on taxes, we cannot determine the value of G. However, we can use the equation above to solve for private saving (S):

S = Y - C - T

Since the economy is closed, Y = C + I + G, so we can rewrite the equation as:

S = (C + I + G) - C - T

Simplifying the equation, we get:

S = I - (T - G)

Since we don't know the value of T - G, we cannot determine the value of private saving. However, we can say that private saving must equal $12,000 minus the excess of government spending over tax revenue.

Learn more about private saving here:

https://brainly.com/question/30004719

#SPJ4

Does anyone have a perfect competition business example?

Answers

Answer:

Perfect competition is a type of market structure where products are homogenous and there are many buyers and sellers. ... Whilst perfect competition does not precisely exist, examples include the likes of agriculture, foreign exchange, and online shopping.

Explanation:

The fact that a bank's assets tend to be long-term while its liabilities are short-term creates:

a. interest-rate risk.

b. credit risk.

c. lower risk for the bank, this is why they follow this strategy.

d. trading risk.

Answers

a. interest-rate risk. Bank's assets tend to be long-term while its liabilities are short-term creates.

What is assets?Assets are tangible or intangible resources that a person or business owns. Assets can be short-term or long-term investments and can be used to generate income or increase value. Examples of assets include cash, real estate, investments, inventory, equipment, vehicles, and intellectual property. They can be classified as current assets or non-current assets depending on their expected lifespan. Current assets are those that are expected to be realized within one year, while non-current assets are those that are expected to be owned for more than one year. Assets are important for businesses because they are used to generate revenue, pay expenses, and increase shareholder value. Additionally, assets provide liquidity, which allows businesses to generate cash flow and make investments.

Therefore the correct answer is A.

To learn more about assets

https://brainly.com/question/27972503

#SPJ1

Amin entered into a hire-purchase agreement for a car with Fast Forward Bank (FFB) for 7 years. He had diligently paid for the instalments every month until he died. Two months after his death, FFB sent a 4th schedule notice asking for payment of the arrears as Amin defaulted 2 months’ instalments. FFB warned that the car will be repossessed if payment is not made within a week. Amin’s wife, Aminah informed FFB that Amin had passed away and she is in the midst of arranging for the necessary documents as she has just been appointed as the administrator of the estate. She also informed the bank that as the personal representative of her husband’s estate, she wants to continue paying for the instalments as there are only 5 months’ instalments left under the agreement. One week later, three men came to tow the car from Aminah’s house. Even though Aminah told them that she was planning to take over in paying the instalments, they towed the car and told her that she must pay the defaults to FFB in 5 days or the car will be sold off. Aminah is terribly disappointed and wants to know if the bank had acted lawfully.

Advise Aminah on the relevant statutory provisions of the Hire-Purchase Act 1967 in respect of the above situation.

Answers

In the given scenario, Aminah should review the relevant provisions of the Hire-Purchase Act 1967 to determine the lawfulness of Fast Forward Bank's actions regarding repossession. Consulting legal professionals for advice and understanding her rights under the act is crucial.

In the given situation, Aminah should refer to the relevant statutory provisions of the Hire-Purchase Act 1967 to understand her rights and the actions of Fast Forward Bank (FFB). Here are a few key points to consider:

Notification of Amin's death: Aminah has informed FFB about Amin's passing and her appointment as the administrator of his estate. This notification is crucial to establish her legal authority in dealing with the hire-purchase agreement.Continuation of payments: Aminah expresses her intention to continue paying the remaining installments under the agreement. She should check if the Hire-Purchase Act allows for the continuation of payments by the personal representative of the deceased.Repossession of the car: FFB sent a notice threatening repossession of the car due to default in two months' installments. Aminah should verify if FFB followed the proper legal procedures for repossession as outlined in the Hire-Purchase Act. The act might require FFB to provide sufficient notice and an opportunity to remedy the default before repossession.Dispute resolution: If Aminah believes FFB acted unlawfully, she may explore the dispute resolution mechanisms provided by the Hire-Purchase Act, such as mediation or arbitration, to resolve the issue.Learn more about hire- purchase act here:-

https://brainly.com/question/32974368

#SPJ11

There are many different ways interviews can be conducted, including face-to-face, distance, group, and performance . Which style would you prefer the most? Why? Which style would you prefer the least? Why? << Read Less

Answers

Which of the following are often pieces of evidence against a bait-and-switch scam?

A. Marissa enlists in the military after a recruiter overhyped benefits provided by the Montgomery G.I. Bill of Rights. While in the military for six months, Marissa learns of this embellishment and requests for the recruiter to be dishonorably discharged.

B. Mike decides to complain to the Better Business Bureau after a store advertises “everything in this store is $5 or less” but discovers the store charges a $2 fee for credit card purchases under $66.

C. Fine print of a new construction home states after 2 years, all residents must pay a $10,000 fee

D. Bill purchases a television from a wholesale store on Small Business Saturday (Saturday after Thanksgiving) that is priced 50% higher than advertised for the 1-day only Black Friday Sale (day after Thanksgiving) and decides to sue.

Answers

The answer choice which represents a bait-and-switch scam is Choice B; Mike decides to complain to the Better Business Bureau after a store advertises “everything in this store is $5 or less” but discovers the store charges a $2 fee for credit card purchases under $66.

Which is an evidence against a bait-and-switch scam?Bait and switch is a morally suspect sales tactic that lures customers in with specific claims about the quality or low prices on items that turn out to be unavailable in order to upsell them on a similar, pricier item. It is simply considered a form of retail sales fraud, though it takes place in other contexts.

Read more on bait-and-switch;

https://brainly.com/question/981097

What are the 2 most common types of credit?

Answers

Open credit and close-end credit are the 2 most common types of credit.

What is credit?The capacity to get services or items or take funds with the idea that you'll pay for them later is known as credit. An transaction that shows a drop in property or increase in liabilities, together with a decrease in expenditures or a boost in revenue, is referred to as a credit.

When you have open credit, often referred to as open-end credit, such as on credit cards as well as personal loan, one can continue to draw from it when you pay interest. Closed credit, usually referred to as closed-end credit, is when you request for a particular sum of money, get it, and then repay it over time using defined installments.

Learn more about credit, Here:

https://brainly.com/question/147599

#SPJ1

When a calendar is made public, then anybody with the calendar's URL can: A. Modify the calendar. B. Delete the calendar. C. Change the calendar. D.View the calendar. E. Edit the calendar.

Answers

Answer:

edit

Explanation:

The city of waterville applied for a grant from the state government to build a pedestrian bridge over the river inside the city's park. On may 1, the city was notified that it had been awarded a grant of up to $200,000 for the project. The state will provide reimbursement for allowable expenditures. On may 5, the special revenue fund entered into a short-term loan with the general fund for $200,000 so it could start bridge construction. During the year, the special revenue fund expended $165,000 for allowable bridge construction costs, for which it submitted documentation to the state. Reimbursement was received from the state on december 13.

Answers

Answer and Explanation:

The journal entries are shown below:

For May 1

No Entry Required as eligibility should be completed before recognition.

For May 5

Cash $200,000

To Inter fund Loans Payable-Current $200,000

(Being cash is recorded)

During the year

Expenditure $165,000

To Voucher Payable $165,000

(being expenditure is recorded)

Due from State Government $165,000

To Revenues $165,000

(Being revenue is recorded)

On Dec 13

Cash $165,000

To Due from State Government $165,000

(being cash is recorded)

On Dec 31

Revenues $1165,000

To Expenditure $165,000

(being closing entry is recorded)

And other entries are not added as the balance of $35,000 is not fulfilled the eligibility

PLEASE HELP WITH THIS DISCUSSION

Labor unions have an important place in American history, and opinions about them vary significantly from person to person. Given the opportunity, would you join a labor union? Why or why not? What do you know about labor unions that would help you make that decision?

Answers

Labor unions emerged in the United States during the Industrial Revolution when workers faced unsafe working conditions, long hours, and low pay. Unions gave workers the power to negotiate better wages, benefits, and working conditions through collective bargaining.

If you are considering joining a union, it is important to research the benefits and drawbacks of union membership. Some benefits of being in a union include job security, better pay and benefits, and protection against workplace discrimination. However, unions can also have drawbacks such as mandatory union dues, potential conflicts with management, and the possibility of strikes or work stoppages. Ultimately, whether or not to join a union is a personal decision that depends on your individual circumstances and values.

If you are considering joining a union, it may be helpful to research the union's history, reputation, and current activities to determine if it aligns with your goals and values.

Read more about Industrial Revolution here:https://brainly.com/question/14240244

#SPJ11

Tiffany is considering investing in one of two investment projects. She has two options: The first project is conducted by the Australian government, which generates a certainty profit of $70k, and the second project is managed by a private firm which generates $85k an hour with a 50 percent chance and $45k an hour with 50 percent chance. Assume that Tiffany can only invest in one project, helping her in making decisions in the following scenarios. (Hint: you can ignore the unit k when calculating the value)

(a) Suppose Tiffany’s utility of a payment x is u(x)=1.5·√x . Which project will she prefer according to the expected utility theory? (remain two digits for decimals)

Answers

According to the expected utility theory, Tiffany will prefer the second project managed by the private firm.

Which project will Tiffany prefer according to the expected utility theory?According to the expected utility theory, Tiffany's preference between the two investment projects can be determined by calculating the expected utility for each project. The first project, conducted by the Australian government, offers a certain profit of $70k. Using Tiffany's utility function u(x) = 1.5√x, the expected utility for the first project is approximately 14.83. The second project, managed by a private firm, has two possible outcomes: earning $85k per hour with a 50% chance or $45k per hour with a 50% chance. Calculating the expected profit of the second project yields $65k. Substituting this value into the utility function gives an expected utility of approximately 15.74. Comparing the expected utilities, Tiffany would prefer to invest in the second project due to its higher expected utili

Learn more about utility theory

brainly.com/question/32602236

#SPJ11

A debit in the T-Account for 'Cash' may be balanced by a credit in which of the following?

A. Equipment

B. Inventory

C. Accounts Payable

D. All of the Above

Answers

Answer:

B

Explanation:

How can the scarcity of natural resources affect the producton of goods and services in the economy?

Answers

Which strategy best helps a famous brand company reach consumers?

selling at trade shows

sending out mailings in small towns

advertising nationally

marketing selectively

Answers

Answer:

C.) advertising nationally

Explanation:

This is the correct answer. The person above may only have a 3-star rating, but they are correct.

Learn more about:

https://brainly.com/question/17615860

You have won a labor contract negotiation with 7.6% pay increase retroactive for six months. Write a program in C# that gets the employee's previous annual salary as initial pay (20points) and outputs the amount of retroactive pay due to the employee (20 points), the new annual salary (20 points), and the new monthly salary (20 points). Use variables (20 points) to store previous annual salary, retroactive pay, new annual salary, and new monthly salary. Sample Screen Display: Congratulations! You won an annual increase in pay as much as 7.6%. There is more! This pay raise is RETROACTIVE! (This increase will be applied to your past six pay.) Now please tell me your last year's annual salary: 54900 Based on your last year's annual salary of $54,900 Your six months' retroactive pay is: $2,086.20 Your new annual salary will be: $59,072.40 And your new monthly salary will be: $4,022.70

Answers

Here is the solution to the given problem:Solution:using System; class Program { static void Main(string[] args) { Console.WriteLine("Congratulations! You won an annual increase in pay as much as 7.6%. There is more! This pay raise is RETROACTIVE!"); Console.Write("Now please tell me your last year's annual salary: $"); double initialSalary = Convert.ToDouble(Console.ReadLine()); double retroPay = initialSalary * 0.076 / 2; double newAnnualSalary = initialSalary + initialSalary * 0.076; double newMonthlySalary = newAnnualSalary / 12; Console.WriteLine("\nBased on your last year's annual salary of ${0:0.00}", initialSalary); Console.WriteLine("Your six months' retroactive pay is: ${0:0.00}", retroPay); Console.WriteLine("Your new annual salary will be: ${0:0.00}", newAnnualSalary); Console.WriteLine("And your new monthly salary will be: ${0:0.00}", newMonthlySalary); Console.ReadLine(); } }Explanation:The given program is written in C# language that is used to calculate the retroactive pay, new annual salary, and new monthly salary of an employee.

The program first reads the initial annual salary of an employee using Console.ReadLine() method and stores it in a variable called initialSalary.The retroactive pay is calculated by multiplying the initialSalary with 0.076 and then divided by 2. The result is stored in a variable called retroPay.The new annual salary is calculated by adding initialSalary with the multiplication of initialSalary with 0.076. The result is stored in a variable called newAnnualSalary.The new monthly salary is calculated by dividing newAnnualSalary with 12. The result is stored in a variable called newMonthlySalary.Finally, the results are displayed using Console.WriteLine() method along with string literals and variables.

To know more about C program, visit:

https://brainly.com/question/33334224

#SPJ11

The manager is responsible for knowing the food sanitation rules. This includes the supervision of food handlers in: Following the restaurant's policies on complaints Routine clean up of the parking lot and restrooms Recognizing problems with employee health Handling customer's money and credit cards

Answers

As the person in charge of the restaurant, the manager is responsible for ensuring that all food handlers are aware of and follow food sanitation rules. This is essential to prevent food contamination and foodborne illness outbreaks, which can be detrimental to the health of customers and the reputation of the establishment.

In addition to supervising food handlers' adherence to food safety regulations, the manager must also ensure that the restaurant's policies on complaints are being followed. This includes addressing customer complaints promptly and effectively to maintain a high level of customer satisfaction.

The manager must also oversee routine clean up of the parking lot and restrooms to maintain a clean and hygienic environment for customers and staff. This includes ensuring that all surfaces and equipment are properly cleaned and sanitized according to industry standards.

It is also important for the manager to recognize any problems with employee health and take necessary steps to prevent the spread of illness in the workplace. This may include implementing sick leave policies and providing education on proper hygiene practices.

Lastly, the manager must ensure that employees handling customer money and credit cards are following proper hygiene practices and taking appropriate measures to prevent cross-contamination between cash, cards, and food. This may involve providing gloves, hand sanitizer, and training on proper handling procedures.

Overall, the manager's responsibility to uphold food sanitation rules and maintain a clean and safe environment in the restaurant is critical to ensure the health and satisfaction of customers and employees.

for more such questions on manager

https://brainly.com/question/24553900

#SPJ11

How does the work done by agriculture communications professionals compare to and differ from that of other marketing workers?

Answers

Answer:

Agriculture communications professionals need to have the same basic background on marketing, covering areas such as market research, product research, and market communication.

However, they will also need to have an agriculture-related background, because they need to understand the dynamics of the agriculture business, from farm issues, to the kind of crops or produce that they can buy or sell in a specific area, to even agricultural policy.

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. Marilyn has all of the following deductions from her gross pay:

federal tax from the following table

A 9-column table with 7 rows is shown. Column 1 is labeled If the wages are at least with entries 720, 740, 760, 780, 800, 820, 840. Column 2 is labeled But less than with entries 740, 760, 780, 800, 820, 840, 860. Column 3 is labeled And the number of withholding allowances is 0, the amount of income tax withheld is, with entries 80, 83, 86, 89, 92, 95, 98. Column 4 is labeled And the number of withholding allowances is 1, the amount of income tax withheld is, with entries 62, 65, 68, 71, 74, 77, 80. Column 5 is labeled And the number of withholding allowances is 2, the amount of income tax withheld is, with entries 44, 47, 50, 53, 56, 59, 62. Column 6 is labeled And the number of withholding allowances is 3, the amount of income tax withheld is, with entries 26, 28, 31, 34, 37, 40, 43. Column 7 is labeled And the number of withholding allowances is 4, the amount of income tax withheld is, with entries 14, 16, 18, 20, 22, 24, 26. Column 8 is labeled And the number of withholding allowances is 5, the amount of income tax withheld is, with entries 1, 3, 5, 7, 9, 11, 13. Column 9 is labeled And the number of withholding allowances is 6, the amount of income tax withheld is, with entries 0, 0, 0, 0, 0, 0, 1.

Social Security tax that is 6.2% of her gross pay

Medicare tax that is 1.45% of her gross pay

state tax that is 21% of her federal tax

Determine how Marilyn’s net pay will be affected if she increases her federal withholding allowances from 3 to 4.

a.

Her net pay will increase by $15.00.

b.

Her net pay will decrease by $15.00.

c.

Her net pay will increase by $18.15.

d.

Her net pay will decrease by $18.15.

Answers

Answer:

c

Explanation:

Answer:

Her net pay will increase by $18.15

Wang co. manufactures and sells a single product that sells for $420 per unit; variable costs are $231 per unit. annual fixed costs are $909,000. current sales volume is $4,220,000. compute the contribution margin per unit.

Answers

The contribution margin per unit is 4809.52.

What is the contribution margin?Contribution margin is the level of output at which revenue would equal zero.

Contribution margin = fixed cost / (price - variable cost)

909,000 / (420 - 231)

909,000 / 189 = 4809.52

To learn more about contribution margin, please check: https://brainly.com/question/14902120

#SPJ1

what happens to the real wage when the price of commodity increase?

Answers

When the price of commodity increases, the real wage tends to decrease. Real wage refers to the purchasing power of an individual's income, which means the amount of goods and services that can be purchased with a given income.

When the price of commodity increases, the cost of producing goods and services also increases. This, in turn, leads to an increase in the cost of living, which means individuals will need to spend more money on the same amount of goods and services they previously purchased with less money.

When the price of a commodity increases, the real wage typically decreases. The real wage represents the purchasing power of an individual's income, which is the amount of goods and services they can buy. As commodity prices increase, the cost of goods and services also rises, leading to a decline in the purchasing power of the individual's income, thus reducing the real wage.

To know more about wage visit:-

https://brainly.com/question/14273894

#SPJ11

What protects consumers against harm from products on the market? Franchises Profit Motives Private property rights Government Regulations

Answers

which one of the following statements regarding corporations is correct?A. A corporation is a separate legal entity.B. A corporation has easy transferability of ownership.C. A corporation may have the ability to raise large amounts of capital.D. A corporation's owners have unlimited liability.

Answers

A corporation is a separate legal entity is a most correct among the following regarding corporation.

Option A is correct.

Corporation:A corporation is a type of business owned by shareholders who elect a board of directors to oversee the company's operations. The business's actions and finances are the responsibility of the corporation, not the shareholders.

What is a corporation's purpose?Academics refer to the "shareholder primacy norm," and many refer to the task of corporate managers as "shareholder wealth maximization." Today, the standard response is that a corporation exists to benefit its shareholders.

What is the corporate structure?A management team and a board of directors make up the most common corporate structure in the United States. Most of the time, there are both inside directors who work every day at the company and outside directors who can make sound decisions.

Learn more about corporations:

brainly.com/question/25787830

#SPJ4

Fujitsu Siemens Computers is a legally independent company of which Fujitsu and Siemens each own 50 percent. This collaboration is an example of a(n) __________, which is effective at transferring __________.

A. joint venture; explicit knowledge

B. joint venture; tacit knowledge

C. equity strategic alliance; tacit knowledge

D. nonequity strategic alliance; explicit knowledge

Answers

Answer:

B. joint venture; tacit knowledge

Explanation:

A joint venture (JV) is a business arrangement where two or more persons are agreed to pool their resoruces in order to attain a particular task. It can be the new project or any kind of business activity

So as per the given situation since both owns 50% perceny that means they are engaged in the joint venture also in this, the tacit knowledge are considered to be effective

So the option b is correct

Can someone answer this quickly, please

Answers

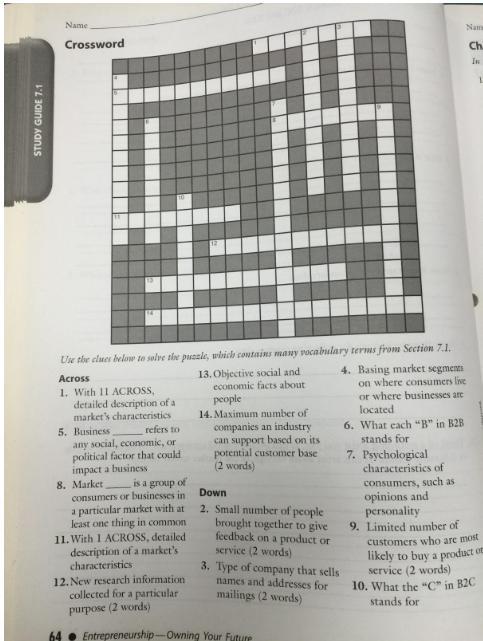

The correct options based on the information will be:

Across:

Market Segmentation

External Factor

Target Market

Market Profile

Primary Research

Demographic Information

Market Potential

Down:

2. Focus Group

List Broker

Geographical Segmentation

Business

Psychographic

Ideal Customer

Consumer

Owning Your Future

What is market Segmentation?Market segmentation is the process of breaking a large consumer or company market into smaller consumer groups based on shared criteria. Typically, this process involves existing and future customers.

The concept of market segmentation acknowledges that not all customers share the same preferences, purchasing power, or consumer wants.

Learn more about market on:

https://brainly.com/question/25754149

#SPJ1

If you work for a company and have a 401(k) retirement account, the account contains money you contributed to your retirement and money contributed by your employer. When you retire, which of the following will these payments be?

A. Welfare payments

B. Pension

C. Transfer payments

D. None of the above