A 10-year zero-coupon bond has a yield of 6 percent. Through a series of unfortunate circumstances, expected inflation rises from 2 percent to 3 percent. (LO4) a. Assuming the nominal yield rises by an amount equal to the rise in expected inflation, compute the change in the price of the bond. b. Suppose that expected inflation is still 2 percent, but the probability that it will move to 3 percent has risen. Describe the consequences for the price of the bond.

Answers

a. The change in the price of the bond is: $55.84; $50.83.

b. The consequences for the price of the bond is: Rise in inflation.

a. The change in the price of the bond:

Bond price when inflation is 2% yield =6%

Hence:

Change in bond price=100/1.06^10

Change in bond price=$55.84

Bond price when inflation is 3% yield =7%

Hence:

Change in bond price=100/1.07^10

Change in bond price=$50.83

b. The consequence for the price of the bond is:

Since their is rise in inflation or rise in the price of goods and service which means that the goods will be more costly.

Learn more here:

https://brainly.com/question/15229620

Related Questions

Connect information which relates.

Inside-out perspective Choose..

competitive intelligence

the organisation's goals and values

the resources and capabilities to achieve competitive advantage

the industry environment

Answers

Competitive intelligence bridges the gap between the organization's goals and values, the industry environment, and the resources and capabilities necessary to gain a competitive edge. The correct option is a.

Competitive intelligence plays a crucial role in connecting the organization's goals and values with the industry environment and the resources and capabilities required to achieve competitive advantage. Competitive intelligence involves gathering and analyzing information about competitors, market trends, and customer preferences to gain insights and make informed business decisions.

By understanding the industry environment through competitive intelligence, organizations can identify opportunities and potential threats. This knowledge helps align the organization's goals and values with the external factors impacting its success. For example, if the industry is shifting towards sustainable practices, an organization that values environmental responsibility can leverage this trend to enhance its competitive position.

Furthermore, competitive intelligence helps identify the resources and capabilities needed to achieve competitive advantage. It provides insights into the strengths and weaknesses of competitors, allowing organizations to benchmark their own capabilities and identify areas for improvement. This knowledge can guide strategic planning and resource allocation, ensuring that the organization aligns its resources with its competitive goals. The correct option is a.

For more such questions on Competitive intelligence

https://brainly.com/question/30615397

#SPJ8

¡PLEASE HELP!

Which of the following credit card users is likely to pay the GREATEST dollar amount in finance charges per

year if they all charge the same amount per year on their cards?

A. Ellen, who generally pays off her credit card in full but occasionally will pay the minimum when she is

short of cash.

B. Paul who only pays the minimum amount each month.

C. Barbara, who always pays off her credit card bill in full shortly after she receives it.

D. Nancy, who pays at least the minimum amount each month and more when she has the money.

Answers

Answer:

b

Explanation:

The credit card users is likely to pay the GREATEST dollar amount in finance charges per year is Paul, who only pays the minimum amount each month.

Hence, the correct option is B.

Among the given options, Paul, who only pays the minimum amount each month, is likely to pay the greatest dollar amount in finance charges per year if they all charge the same amount per year on their cards. By consistently paying only the minimum amount, Paul carries a significant balance on his credit card, resulting in accumulating interest charges over time.

Since he does not pay off the balance in full, the finance charges continue to accrue on the remaining balance each month, leading to a higher dollar amount in finance charges compared to the other options.

Learn more about finance charges here: brainly.com/question/12459778

#SPJ2

Coast-to-Coast Shipping Company's general manager reports quarterly to the

company president on the firm's operating performance. The company uses a

budget based on detailed expectations for the forthcoming quarter. The general

manager has just received the condensed quarterly performance report shown

below.

Budget Actual Variance

Net revenue $8,000,000 $7,600,000 $400,000 U

Fuel $160,000 $157,000 $3,000 F

Repairs and maintenance 80,000 78,000 2,000 F

Supplies and miscellaneous 800,000 788,000 12,000 F

Variable payroll 5,360,000 5,200,000 160,000 F

Total variable costs* $6,400,000 $6,223,000 $177,000 F

Supervision $160,000 $164,000 $4,000 U

Rent 160,000 160,000 ___

Depreciation 480,000 480,000 ___

Other fixed costs 160,000 158,000 2,000 F

Total fixed costs $960,000 $962,000 $2,000 F

Total costs charged against Revenue $7,360,000 $7,185,000 $175,000 F

Operating income $640,000 $415,000 $225,000 U

U = Unfavorable F = Favorable

*For purposes of this analysis, assume that all these costs are totally variable with respect to sales

revenue. In practice, many are mixed and have to be subdivided into variable and fixed components

before a meaningful analysis can be made. Also assume that the prices and mix of services sold remain

unchanged.

Although the general manager was upset about not obtaining enough revenue, she was happy that her

cost of performance was favorable; otherwise her net operating income would be even worse.

The president was totally unhappy and remarked: "I can see some merit in comparing actual

performance with budgeted performance because we can see whether actual revenue coincided with our

best guess for budget purposes. But I can't see how this performance reports helps me evaluate cost

control performance."

Required:

1. Prepare a columnar flexible budget for Coast-to-Coast Shipping at revenue levels of $7,000,000;

$8,000,000; and $9,000,000. Assume that the prices and mix of products sold are equal to the budgeted

prices and mix.

2. Express the flexible budget for costs in formula form.

3. Prepare a condensed table showing the master (static) budget variance, the sales volume variance,

and the flexible budget variance

Answers

1. Columnar Flexible Budget:

$7,000,000 $8,000,000 $9,000,000

Net Revenue $7,000,000 $8,000,000 $9,000,000

Fuel $140,000 $160,000 $180,000

Repairs and Maintenance $70,000 $80,000 $90,000

Supplies and Miscellaneous $700,000 $800,000 $900,000

Variable Payroll $4,690,000 $5,360,000 $6,030,000

Total Variable Costs* $5,600,000 $6,400,000 $7,200,000

Supervision $140,000 $160,000 $180,000

Rent $160,000 $160,000 $160,000

Depreciation $480,000 $480,000 $480,000

Other Fixed Costs $160,000 $160,000 $160,000

Total Fixed Costs $940,000 $960,000 $960,000

Total Costs $6,540,000 $7,360,000 $8,160,000

Operating Income $460,000 $640,000 $840,000

2. Formula for Flexible Budget Costs:

Total Variable Costs = (Variable Cost per Unit * Net Revenue) + Total Fixed Costs

3. Condensed Table:

Variance Master (Static) Budget Sales Volume Variance Flexible Budget Variance

Net Revenue $400,000 UF $0 $200,000 UF

Total Costs $175,000 F $0 $50,000 F

Operating Income $225,000 U $0 $150,000 U

The Master (Static) Budget Variance is the difference between the budgeted net revenue and the actual net revenue. In this case, it is an unfavorable variance of $400,000.

The Sales Volume Variance is the difference between the flexible budget net revenue and the budgeted net revenue. Since there is no change in the sales volume, this variance is zero.

The Flexible Budget Variance is the difference between the flexible budget total costs and the actual total costs. In this case, it is a favorable variance of $50,000. This indicates that the company was able to control costs better than anticipated.

For more such questions on Miscellaneous

https://brainly.com/question/31590400

#SPJ11

Which of the following is true of the BCG matrix approach. A) It is inexpensive to implement. B) It does not consider relative market share to be a measure of company strength in the market. C) It describes consumer motivations and needs. D) It considers market growth rate to be a measure of market attractiveness. E) It does not have any limitations

Answers

Answer:

D) It considers market growth rate to be a measure of market attractiveness

Explanation:

In 1970, Bruce D. Henderson developed and created a growth-share matrix for the Boston Consulting Group (BCG). The Boston Consulting Group (BCG) growth-share matrix is a tool used for analyzing and planning product lines in a business unit. It makes use of a graphical representation of a company's product line and services to analyze and make long-term strategic plans on which to invest more on or sell off.

Generally, products are divided into four (4) main categories in the BCG growth-share matrix;

1. Dogs.

2. Stars.

3. Question marks.

4. Cash cows.

The statement which is true of the Boston Consulting Group (BCG) matrix approach is that, it considers market growth rate to be a measure of market attractiveness.

Marketing can be defined as the process of developing promotional techniques and sales strategies by a firm, so as to enhance the availability of goods and services to meet the needs of the end users or consumers through advertising and market research.

Thus, it comprises of all the activities such as, identifying, anticipating set of medium and processes for creating, promoting, delivering, and exchanging goods and services that has value for customers. It typically, involves understanding customer needs, building and maintaining healthy relationships with them in order to scale up your business.

If your January closing book BOM inventory is $550,100 and the physical inventory counted is $580,650, what is the shortage or overage percentage if annual net sales are $1,272,900?

Answers

Answer:

2.4%

Explanation:

Calculation for what is the shortage or overage percentage

First step is to find the amount of inventory

Using this formula

Inventory=Physical inventory -BOM inventory

Let plug in the formula

Inventory=$580,650-$550,100

Inventory=$30,550

Based on the above calculation the inventory has a positive amount of $30,550 which indicates average percentage

Now let calculate the overage percentage if annual net sales are $1,272,900

Using this formula

Overage percentage= Overage Amount/Annual net sales×100

Let plug in the formula

Overage percentage=$30,550/$1,272,900×100

Overage percentage=2.4%

Therefore the overage percentage will be 2.4%

a production possibilities frontier identifies combinations of two goods that can be produced with given resources and technology. True or False

Answers

The statement “a production possibilities frontier identifies combinations of two goods that can be produced with given resources and technology” is false.

The graph known as the Production Possibilities Frontier (PPF) illustrates all the possible output combinations of two items that may be created with the resources and technologies currently in use. The PPF effectively expresses the ideas of choice, trade-offs, and scarcity.

The PPF's form depends on whether expenses are rising, falling, or staying the same.

Points that sit on the PPF serve as examples of productively efficient output combinations. Without knowing preferences, we cannot identify which sites are allocatively efficient.

The opportunity cost of producing one item in comparison to another is shown by the slope of the PPF, and the opportunity cost may be compared to the opportunity costs of other producers to ascertain comparative advantage.

To know more about “Production Possibilities Frontier” visit-

https://brainly.com/question/27833900

#SPJ4

Which moves the food from the esophagus to the stomach?

Answers

Answer:peristalsis

Explanation:

that is the job of your peristalsis after you swallow, peristalsis pushes the food down your esophagus into your stomach. hope this helps

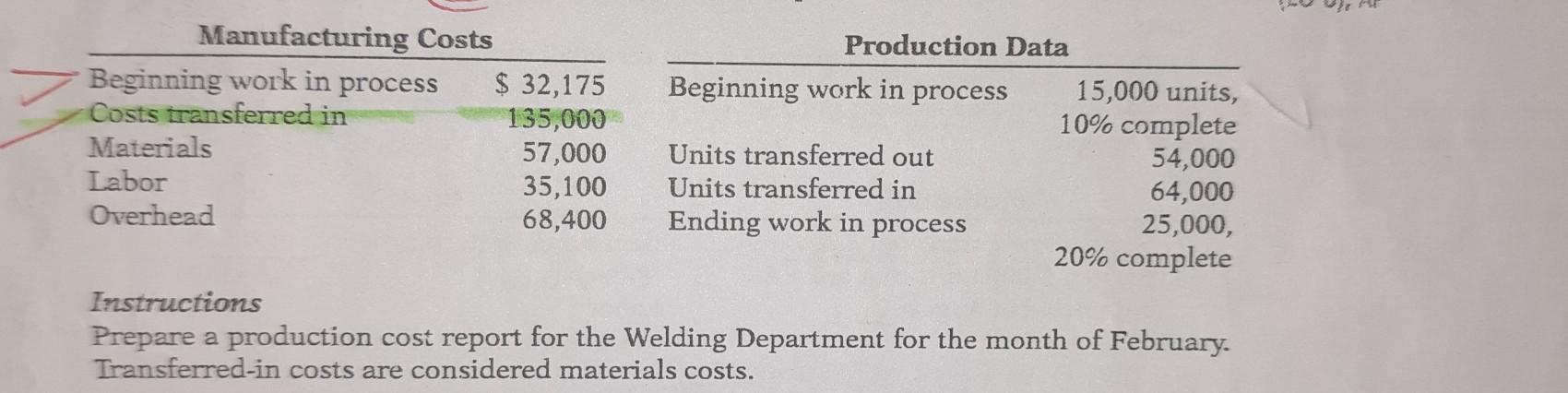

answer the following questions, please

Answers

The cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

How did we arrive at this assertion?To prepare a production cost report for the Welding Department for the month of February, we need to calculate the following:

1. Equivalent units of production for materials, labor, and overhead.

2. Cost per equivalent unit for materials, labor, and overhead.

3. Total costs assigned to units transferred out and ending work in process.

4. Cost reconciliation.

Let's calculate each of these steps:

Step 1: Equivalent Units of Production

Equivalent units of production are calculated based on the percentage of completion for units in process.

For materials:

Beginning work in process: 15,000 units x 10% complete = 1,500 equivalent units

Units transferred in: 64,000 units

Ending work in process: 25,000 units x 20% complete = 5,000 equivalent units

Total equivalent units for materials: 1,500 + 64,000 + 5,000 = 70,500 equivalent units

For labor and overhead:

Since the given data does not provide the percentage of completion for labor and overhead, we assume it is the same as for materials. Therefore, the equivalent units for labor and overhead will also be 70,500 units.

Step 2: Cost per Equivalent Unit

To calculate the cost per equivalent unit, we divide the total costs by the total equivalent units.

Cost per equivalent unit for materials: $135,000 / 70,500 units = $1.91 per unit

Cost per equivalent unit for labor: $57,000 / 70,500 units = $0.81 per unit

Cost per equivalent unit for overhead: $35,100 / 70,500 units = $0.50 per unit

Step 3: Total Costs Assigned

To calculate the total costs assigned to units transferred out and ending work in process, we multiply the cost per equivalent unit by the equivalent units for each category.

For units transferred out:

Materials: 64,000 units x $1.91 per unit = $122,240

Labor: 64,000 units x $0.81 per unit = $51,840

Overhead: 64,000 units x $0.50 per unit = $32,000

For ending work in process:

Materials: 25,000 units x $1.91 per unit = $47,750

Labor: 25,000 units x $0.81 per unit = $20,250

Overhead: 25,000 units x $0.50 per unit = $12,500

Step 4: Cost Reconciliation

To reconcile the costs, we compare the total costs assigned to units transferred out and ending work in process with the beginning work in process costs.

Beginning work in process costs: $32,175

Total costs assigned to units transferred out: $122,240 + $51,840 + $32,000 = $206,080

Total costs assigned to ending work in process: $47,750 + $20,250 + $12,500 = $80,500

Total costs: $206,080 + $80,500 = $286,580

Since the total costs assigned exceed the beginning work in process costs, there may be some additional costs that need to be investigated or accounted for.

The production cost report for the Welding Department for the month of February is as follows:

------------------------------------------------------------------------

| | Equivalent Units | Cost per Equivalent Unit | Total Costs |

------------------------------------------------------------------------

| Materials | 70,500 | $1.91 | $135,000 |

| Labor | 70,500 | $0.81 | $57,000 |

| Overhead | 70,500 | $0.50 | $35, 100 |

------------------------------------------------------------------------

| Total (Transferred-out) | 64,000 | | $227,240 |

| Ending work in process | 25,000 | | $80,500 |

------------------------------------------------------------------------

| Total Costs $307,740 |

------------------------------------------------------------------------

Note that the cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

learn more about cost reconciliation: https://brainly.com/question/16342430

#SPJ1

Help please! I've done this three times and still can't get it right!

Answers

Risk Evaluation:

Includes risk identificationIncludes impacts of risks and responsesIncludes analysis of consequencesRisk Control:

Includes risk monitoring

Includes action for minimizing risks

Includes prioritization of measures

What is Risk Evaluation?To evaluate the chances and possible drawbacks of potential hazards on a project, company, or institution, and choosing which dangers necessitate additional measures.

Making a decision involves evaluating the probability of a risk happening alongside the seriousness of its outcomes and determining if the possible advantages justify the possible drawbacks. Smart risk assessment enables the identification of high-priority risks and informs the allocation of resources to effectively manage them.

Learn more about Risk Evaluation from

https://brainly.com/question/1224221

#SPJ1

drag each label to the correct location on the image.

Project manager Anna is working with her team on risk management. Match the components of risk management with what each component involves.

Risk Evaluation Risk Control

includes risk identification

includes impacts of risks and responses

Includes risk monitoring

Includes action for minimizing risks

includes analysis of consequences

includes prioritization of measures

Hunter has just completed his first year of operation as a sole proprietor of a successful sporting goods store. There were

challenges but he was excited about getting to keep all the profits of the venture to himself.

A) Advantage of a sole proprietorship

B)Disadvantage of a sole proprietorship

Answers

Some of the advantages and disadvantages of sole proprietorship include:

Advantage - keep all the profits Disadvantage - personally liable for any debtsWhat are the advantages and disadvantages of sole proprietorship?One of the advantages of a sole proprietorship is that the business owner gets to keep all the profits of the business for themselves. This is because the owner has complete control over the business and is not required to share the profits with any other partners or shareholders.

One of the disadvantages of a sole proprietorship is that the business owner is personally liable for any debts or legal issues that arise in the course of business.

Find out more on sole proprietorship at https://brainly.com/question/16718554

#SPJ1

What is verbal communication?

Answers

Verbal communication is the production of spoken language to send a message to a listener.

What is verbal communication?Verbal communication is the use of sounds and words to express yourself, in contrast to using gestures or mannerisms.

In this case, verbal communication is the production of spoken language to send a message to a listener.

An example of verbal communication is saying “No” when someone asks you to do something you don't want to do.

Learn more about communication on:

https://brainly.com/question/26152499

#SPJ1

what is acknowledgement

Answers

Answer: it means to accept something or recognition

Which of the following is a characteristic of a structured interview? a. Conducted by an owner or manager b. Has a planned set of questions c. Informal and conversational d. Brings out interviewee's personality Please select the best answer from the choices provided A B C D

Answers

The main characteristic of a structured interview is that usually involves a planned set of questions.

What is a structured interview?This is a form of interview where there are predetermined set of questions to be asked from the respondent.

Hence, the main characteristic of a structured interview is that usually involves a planned set of questions.

Therefore, the Option B is correct.

Read more about structured interview

brainly.com/question/1041543

Answer:b

Explanation:

differentiate between the sourcing decision to make or to buy.(examples)?

Answers

The sourcing decision between "make" or "buy" refers to the decision of whether a company should produce a product or service in-house or outsource it from a third-party supplier.

The decision depends on several factors, including cost, quality, capacity, expertise, and strategic goals. Here are some examples of the differences between the two options:

Make:

A company that produces custom-made products may decide to make the product in-house to maintain quality control and ensure that customer specifications are met.

A tech company may choose to develop software internally to protect its intellectual property and keep its competitive advantage.

Buy:

A company that needs raw materials for production may decide to buy them from a supplier to take advantage of economies of scale and lower costs.

A small business may decide to outsource its accounting functions to a third-party provider to save time and reduce overhead costs.

learn more about outsource here

https://brainly.com/question/28915776

#SPJ1

Prepare a comparative income statement for any company extracting their P&L statement for the years 2020-21 & 2021-22. Analyse the incline and decline in the different elements in the P&L Statement and provide detailed insights.

Answers

Answer:

this is my own answer

Explanation:

hi

How to Prepare a Comparative Income Statement?

Step 1: Specify absolute figures of items like goods sold, net sales, selling expenses, etc., relating to the accounting period under consideration for analysis.

Step 2: Calculate the absolute change in the items mentioned in the income statement.

A city and school district are coterminous. When evaluating the debt issues of the city, the school district debt would be considered:______

a. Overlapping debt

b. Separate debt

c. Double-barreled debt

d. Underlying debt

Answers

Answer:

a. Overlapping debt

Explanation:

A city and school district are coterminous. When evaluating the debt issues of the city, the school district debt would be considered an overlapping debt.

The city and school district being coterminous simply means that they share the same things in common such as geographic boundaries, locations, scope of business, branch (jurisdiction) strategies and perhaps objectives.

An overlapping debt can be defined as the financial obligations of a municipality that falls partly or is being shared with a nearby jurisdiction (neighboring district, towns etc.)

You are at the checkout counter at the local supermarket, use your debit card to pay for your groceries, and select "debit" when the cashier asks "Debit or credit?" Where does the money for this purchase come from?

Answers

Answer:

the Money comes from my savings account (Bank account)

Explanation:

the debit means that the money that we use is ours.

the credit means that the money is lent to us by the bank which we have gotten the card from. Choosing debit means that the money being spent comes from our own bank account.

can you anyone's help me fasttttttttttttttttttttttttttttttttttt

Does life remind you of a roller coaster? can you prepare for these unexpected twists and turns ?

if so how

Answers

In short, life is like a roller coaster in someways. We can study dozens and dozens of other lives and still not be truly sure what might happen next. We can only prepare ourselves by training our brains to have a positive outlook on even the worst of times.

Answer:

The person above is correct.

Explanation:

38. A log book used to record information about visitors who call in an organization is called A. Complimentary card B. Telephone directory C. Telephone pad D. Visitor's register E. Visitor's request form

Answers

A logbook used to record information about visitors who call in an organization is called an Option D. Visitor's Register.

A visitor's register is an essential tool for maintaining security and professionalism in a workplace. It helps in keeping track of the people entering and leaving the premises, which aids in monitoring the flow of visitors and ensuring their proper identification.

A visitor's register typically includes columns for the visitor's name, contact details, purpose of visit, time in, time out, and the name of the person they are meeting. This information is valuable in case any follow-up is required or for emergency situations where it's crucial to know who is on the premises.

In contrast, a complimentary card (A) is a business card exchanged during formal introductions. A telephone directory (B) is a listing of telephone numbers organized by name or business. A telephone pad (C) is a notepad used for taking messages or notes during phone calls, and a visitor's request form (E) may be a document required to be filled out by visitors for specific purposes or access.

In summary, a visitor's register (D) is the correct term for a log book used to record information about visitors who call an organization. It helps maintain security, monitor visitor flow, and ensure proper identification of guests. Therefore, the correct option is D.

Know more about Visitor's Register here:

https://brainly.com/question/28275719

#SPJ11

How can life expectancy and literacy rates affect the quality of labor in the economy?

Answers

Explanation:

Life expectancy and literacy rates can affect the quality of labor in the economy because if citizens are literate, they are educated and likely have white-collar jobs. Citizens who are illiterate likely have more manual labor jobs.A nation with lower fertility rates will usually have less people, and scarce resources will take longer to run out

A ________ is an unsecured bond, and most of the bonds sold today in the United States are of this type.A) mortgage bondB) debentureC) senior bondD) bond indenture

Answers

Answer:

B) debenture

Explanation:

A bond refers to a debt or fixed investment security, in which a bondholder (creditor or investor) loans an amount of money to the bond issuer (government or corporations) for a specific period of time.

Generally, the bond issuer is expected to return the principal at maturity with an agreed upon interest to the bondholder, which is payable at fixed intervals.

A debenture is an unsecured bond, and most of the bonds sold today in the United States are of this type because it's a long-term security that yields fixed rate of interest.

How much did Liz receive?

Answers

Furniture purchased from Kailash for Rs. 6,000.

Answers

Answer:

What's the question or is this a statement?

Explanation:

?

what is your analysis on walmart financial health as of january 2021 compare to 2022

Answers

I think the analysis is good compared to the year of 2021

which one of the following institutions is the least regulated? banks, credit unions, savings association, saving banks or finance companies.

Answers

Savings banks and finance companies are the least regulated among these institutions as they are not subject to the same regulations that banks and credit unions are.

The Regulation of Savings Banks and Finance Companies: A Comparison to Banks and Credit UnionsSavings Banks and Finance Companies are the least regulated among these institutions as they are not subject to the same stringent regulations that banks and credit unions are. This is due to the fact that savings banks and finance companies are only required to adhere to the regulations of the state in which they are operating, unlike banks and credit unions, which must comply with the regulations of both the state and the federal government.

Learn more about Finance Companies at: https://brainly.com/question/23525090

#SPJ4

The initial cash outlay of a project is X is Rs 100,000 and it can generate cash inflow of Rs 40,000, Rs 30,000, Rs 50,000 and Rs 20,000 in year 1 through 4. Assume a 10 per cent rate of discount. Assume that a project Y requires an outlay of Rs 50,000 and yields annual cash inflow of Rs 12,500 for 7 years at the rate of 12%.

Answers

On the net present value analysis, project Y is expected to generate a higher return on investment compared to project X.

To evaluate the two projects, X and Y, we will calculate their net present value (NPV) using the given cash inflows, discount rate, and initial cash outlay.

For project X:

The cash inflows for each year are Rs 40,000, Rs 30,000, Rs 50,000, and Rs 20,000 for years 1 through 4, respectively.

The initial cash outlay is Rs 100,000.

The discount rate is 10%.

To calculate the NPV, we discount each cash inflow to its present value using the discount rate and subtract the initial cash outlay:

NPV(X) = (40,000 / (1 + 0.10)^1) + (30,000 / (1 + 0.10)^2) + (50,000 / (1 + 0.10)^3) + (20,000 / (1 + 0.10)^4) - 100,000

Simplifying the calculations:

NPV(X) = 36,363 + 24,793 + 34,979 + 13,167 - 100,000

= 9,302

The net present value (NPV) for project X is Rs 9,302.

For project Y:

The cash inflow for each year is Rs 12,500 for 7 years.

The initial cash outlay is Rs 50,000.

The discount rate is 12%.

Using the same formula as above, we calculate the NPV for project Y:

NPV(Y) = (12,500 / (1 + 0.12)^1) + (12,500 / (1 + 0.12)^2) + ... + (12,500 / (1 + 0.12)^7) - 50,000

Simplifying the calculations:

NPV(Y) = 11,161 + 9,960 + 8,888 + ... + 3,637 - 50,000

= 11,042

The net present value (NPV) for project Y is Rs 11,042.

For more such question on investment. visit :

https://brainly.com/question/29547577

#SPJ8

The valuation of the cat food business is based on cash flows of $180,500 per year over a five year period. The target business has the same risk as the firm’s overall operations. The cost of equity is 15 percent and the cost of debt is 3 percent on an after-tax basis. The firm’s capital structure consists of 10 million in equity and 8 million in debt.

What is the most the pet-food manufacturer should pay for acquiring the cat food business per its required return (WACC)?

Answers

Answer: $690,044

Explanation:

First calculate WACC.

Total capital = 10 + 8 = $18 million

WACC = (Weight of debt * after-tax cost of debt) + (weight of equity * cost of equity)

= (8/18 * 3%) + (10/18 * 15%)

= 9.67%

Using the WACC, find the present value of the cashflows for the next 5 years. This will be an annuity.

= 180,500 * (1 - (1 + r) ^-n)/r

= 180,500 * ( 1 - ( 1 + 9.67%) ^ -5)/9.67%

= $690,044.67

= $690,044

They should pay no more than this present value.

ABC Company has elected to adopt the dollar-value LIFO inventory method when the inventory is valued at $125,000. The adoption takes place as of January 1, 20X1 when the entire inventory represents a single pool. ABC Company determined that the inventory at December 31, 20X1 was $144,375 at current year cost and $131,250 at base year cost using a relevant price index of 1.10. The inventory at December 31, 20X1 under dollar value LIFO is

Answers

Answer:

Explanation:

K

Click to review the online content. Then answer the question(s) below, using complete sentences. Scroll down to view additional

questions.

Online Content: Site 1

What is the main difference in the way that "earned income" and "capital gains (or portfolio income)" are acquired?

Answers

The main difference in the way that "earned income" and "capital gains (or portfolio income)" are acquired is:

Earned income is money gained though occupation.Capital additions are medium of exchange gained though investment(s).Salary, bonuses, commissions, and tips that you receive from an employer or the company are examples of earned money.

Capital gains are funds received as a result of the sale of an investment such as stocks or real estate. Earned income is often taxed more heavily than gains from investments, which are taxed less heavily.

As a result, the significance of the main difference in the way that "earned income" and "capital gains (or portfolio income)" are acquired are the aforementioned.

Learn more about on earned income, here:

https://brainly.com/question/31313769

#SPJ1

Question 5

From which of the following taxes does the federal government get most of their tax revenue?

A Corporate tax

B) Sales tax

Tariffs

Income tax

Answers

Answer:

B. $3,500

Explanation:

The form of tax from which the federal government get most of their tax revenue is the Income tax.

Option D is correct.

What is meant by taxes?Taxes are the financial source of the government through which it gets most of their revenue. It could be direct or indirect in nature.

The income taxes are one of a kind of taxes which are paid by the taxpayers in accordance with the slab rates applicable on their respective taxable incomes. It has to be paid on yearly basis at a specified period of time and if delayed, then the penalty has also been required to be paid.

Therefore, the income taxes are the one which provides maximum revenue to the federal government.

Learn more about the income taxes in the related link:

https://brainly.com/question/17075354

#SPJ2