1. XYZ Co. incurred the following costs related to the office building used in operating its sports supply company: a. Replaced a broken window. b. Replaced the roof that had been on the building 23 years. c. Serviced all the air conditioners before summer started. d. Replaced the air conditioners with refrigerated air conditioners in the customer service areas. e. Added a warehouse to the back of the building. f. Repaint the interior walls. g. Installed window shutters on all windows. Classify each of the costs as a capital expenditure or a revenue expenditure. For those costs identified as capital expenditures, classify each as an additional or replacement component.

Answers

Answer:

2,4,5,7

Explanation:

Related Questions

During civil lawsuit, proceedings regarding alcohol, service courts will try to determine if the

Answers

During civil lawsuit proceedings regarding alcohol service, courts will try to determine if the designated driver was present and remained sober.

How do courts determine the presence and sobriety?During civil lawsuit proceedings involving alcohol service, courts aim to establish whether a designated driver was present and this determination is crucial in cases where establishments or individuals are being held accountable for over-serving alcohol to a patron who later caused harm or injury due to impaired driving.

The court may consider various forms of evidence such as witness testimonies, surveillance footage, receipts indicating non-alcoholic purchases or the designated driver's own account of their sobriety. It court may evaluate the credibility and reliability of the designated driver's actions and statements throughout the relevant time period.

Read more about alcohol service

brainly.com/question/28404655

#SPJ1

what is one best motivational theory?

Answers

Answer:

The Maslow motivation theory

Explanation:

The Maslow motivation theory is one of the best known and most influential theories on workplace motivation

The owner of Genuine Subs, Inc., hopes to expand the present operation by adding one new outlet. She has studied three locations. Each would have the same labor and materials costs (food, serving containers, napkins, etc.) of $2.40 per sandwich. Sandwiches sell for $3.20 each in all locations. Rent and equipment costs would be $5,650 per month for location A, $5,825 per month for location B, and $6,075 per month for location C.

Answers

location C has the highest break-even quantity of 7,593.75 sandwiches.

Given, The owner of Genuine Subs, Inc., hopes to expand the present operation by adding one new outlet. She has studied three locations. Each would have the same labor and materials costs (food, serving containers, napkins, etc.) of $2.40 per sandwich.

Sandwiches sell for $3.20 each in all locations. Rent and equipment costs would be $5,650 per month for location A, $5,825 per month for location B, and $6,075 per month for location C.The formula for the break-even point is as follows:Fixed costs / (sales price per unit - variable costs per unit).

First, let's calculate the variable costs per sandwich.V = labor and materials cost per sandwich= $2.40 per sandwichNext, we calculate the contribution margin:Contribution margin per sandwich = Selling price - Variable costs= $3.20 - $2.40= $0.80 per sandwichFixed costs for A = $5,650Fixed costs for B = $5,825Fixed costs for C = $6,075.Substitute the values in the formula:Breakeven quantity A = $5,650 / ($3.20 - $2.40) = $5,650 / $0.80 = 7,062.5 sandwiches Breakeven quantity B = $5,825 / ($3.20 - $2.40) = $5,825 / $0.80 = 7,281.25 sandwiches.

Breakeven quantity C = $6,075 / ($3.20 - $2.40) = $6,075 / $0.80 = 7,593.75 sandwiches.

For more such questions sandwiches,Click on

https://brainly.com/question/31821542

#SPJ8

At a volume of 20,000 units, Almount Industries reported sales revenues of $1,000,000, variable costs of $300,000, and fixed costs of $260,000. The company's contribution margin per unit is:

Answers

Answer:

Contribution margin per unit = $35 per unit

Explanation:

The contribution margin per unit is the contribution or amount provided by the sale of each unit towards covering the fixed costs of the business. The total contribution margin is calculated by subtracting the total variable costs by the sales revenue. The contribution margin per unit can be calculated by dividing the total contribution by the number of units.

Total Contribution = Sales Revenue - Variable costs

Contribution margin per unit = Total Contribution / Number of units

Total Contribution = 1000000 - 300000

Total Contribution = $700000

Contribution margin per unit = 700000 / 20000

Contribution margin per unit = $35 per unit

?

When does personal information offen need to be entered online?

O when conducting an Internet search

when watching streaming videos

O when downicading free software

O when gaining access to a website

Answers

Answer:

when gaining access to a website

Which asset is the most liquid?

A. A certificate of deposit

B. An individual retirement account

C. Commercial real estate

D. Residential real estate

Answers

The asset that is the most liquid is a certificate of deposit. This is further explained below.

What is a certificate of deposit?Generally, a certificate of deposit is simply defined as depositors who put money in the bank for a certain period of time being given a certificate of deposit.

In conclusion, The asset that is the most liquid is a certificate of deposit

Read more about certificate of deposit

https://brainly.com/question/2273527

#SPJ1

as you discover information in the library, it may be necessary to adjust or revise your initial question or topic. true or false

Answers

as you discover information in the library, it may be necessary to adjust or revise your initial question or topic. true

Which area of a study publication is most likely to encourage more investigation?As previously stated, ideas for more research can be included in either the discussion or conclusion of your article, but do not duplicate them in both parts.

Informed consent is a fundamental premise of research ethics. Its goal is for human subjects to enter study freely (voluntarily), with full knowledge of what it entails for them to participate, and to grant consent before entering the research.

Learn more about study publication

https://brainly.com/question/14473307

#SPJ4

Boehm Corporation has had stable earnings growth of 7% a year for the past 10 years, and in 2019 Boehm paid dividends of $3 million on net income of $5 million. However, net income is expected to grow by 26% in 2020, and Boehm plans to invest $3.0 million in a plant expansion. This one-time unusual earnings growth won't be maintained, though, and after 2020 Boehm will return to its previous 7% earnings growth rate. Its target debt ratio is 36%. Boehm has 1 million shares of stock. Calculate Boehm's dividend per share for 2020 under each of the following policies:

Answers

Boehm Corporation's dividend per share is computed according to the given policies as follows:

for 2020 if its 2020 dividend payment is set to force dividends per share to grow at the long-run growth rate in earnings is: $3,210,000;The dividend per share if the 2019 dividend payout ratio continues - $,378,000The use of pure residual policy with all distribution in form of dividends - $4,380,000Extra dividend - $2,900,000.The calculation explaining the above is as followsA) The formula for the Dividend payout ratio is:

Dividend/Net Income

For 2019 therefore,

Dividend payout = ($3,000,000/$5,000,000) * 100

= 60%

Income for 2020 at a growth rate of 7% = $ 5,000,000 * 1.07 (that is 107%)

= $5,350,000

Hence the Dividend for 2020 = $5,350,000 * 60% = $3,210,000

Hence, Dividend Per Share (since there are no special dividend or share outstanding) = $3,210,000

B) The dividend per share if the 2019 dividend payout ratio continues

Dividend = Net income * payout ratio

Dividend = $5,000,000* 1.26 * 60%

Dividend = $3,780,000

C) Where there is the use of pure residual policy with all distribution in form of dividend

Total Investment = $3,000,000

Debt finance = $3,000,000 * 36% = $1,080,000

Note that the Dividend for 2020 = Net Income - (Capital investment - Investment via debt financing)

Dividend = $6,300,000 - ($3,000,000 - $1,080,000)

Dividend = $6,300,000 - $1,920,000 = $4,380,000

D) Extra dividend calculated

Total Dividend = Regular dividend at long-run growth rate + extra dividend

Debt ratio = 30%

Equity ratio = 100% - 30% = 70%

Extra Dividend = Net income - (Equity ratio * Investment)

Extra Dividend = $5,000,000 - ($3,000,000 * 70%)

Extra Dividend = $5,000,000 - $2,100,000 = $2,900,000.

Learn more about dividends:

https://brainly.com/question/28236081

#SPJ1

Full Question:

Boehm Corporation has had stable earnings growth of 7% a year for the past 10 years, and in 2019 Boehm paid dividends of $3 million on net income of $5 million. However, net income is expected to grow by 26% in 2020, and Boehm plans to invest $3.0 million in a plant expansion. This one-time unusual earnings growth won't be maintained, though, and after 2020 Boehm will return to its previous 7% earnings growth rate. Its target debt ratio is 36%. Boehm has 1 million shares of stock.

1) Calculate Boehm's dividend per share for 2020 under each of the following policies: Its 2020 dividend payment is set to force dividends per share to grow at the long-run growth rate in earnings. Round your answer to the nearest cent.

2) It continues the 2019 dividend payout ratio. Round your answer to the nearest cent. $ It uses a pure residual policy with all distributions in the form of dividends (36% of the $3.0 million investment is financed with debt). Round your answer to the nearest cent.

3) It employs a regular-dividend-plus-extras policy, with the regular dividend being based on the long-run growth rate and the extra dividend being set according to the residual policy.

What will the extra dividend be? Round your answer to the nearest cent.

why language is an important of communication tools?

Answers

Answer:

Because Language is a communication tool used by everyone in their daily life as a means to convey information and arguments to others. Explanation:

Makes Sense.

Answer:

The effective communication is made possible with the help of language. Language employs a combination of words to communicate ideas in a meaningful way. By changing the word order in a sentence, you can change its meaning, and even make it meaningless.

Question 10 of 20

When wili the U.S. Armed Forces provide financial aid?

A. Before, during, and after your service

OB. During and after your service

OC. Before and after your service

D. After you have served two years

Answers

The U.S. Armed Forces will provide financial aid during and after your service. The Option D is correct.

When will U.S. Armed Forces provide financial aid?The Forces offer financial aid during and after your service. This support is available to servicemembers throughout their military career and extends into their transition back to civilian life.

During service, the financial assistance may come in the form of various benefits including housing allowances, educational benefits such as the GI Bill and health care coverage. After completing their service, veterans may be eligible for additional financial aid programs like VA home loans, disability benefits etc.

Read more about Financial aid

brainly.com/question/26499492

#SPJ1

A ___ is a tax on imported goods. A ___ is a quantitative restriction on imported goods.

Cost,subsidy

Regulation, standard

Tariff,quota

Answers

Suppose the market demand for cigarettes is given in the following table.

price (per pack) Quantity of demanded (millions of packs per year)

$10 2

9 4

8 6

7 8

6 10

5 12

4 14

3 16

Suppose further that smoking creates external costs valued at $2.00 per pack. Graph the market demand curve, the social demand curve, and answer two questions about the market and socially optimal quantities.

Graph the social and market demand curves.

If cigarettes are priced at $7 a pack,

Instructions: Enter your responses as whole numbers.

a. What is the quantity demanded in the market?

___ million packs per year

b. What is the socially optimal quantity?

____ million packs per year

c. If the government were to intervene and tax cigarettes, how large of a tax is needed per pack to achieve this optimal outcome?

$ ____per pack

Answers

Which of the following should be considered last when searching for financing? Question 1 options: Family members Banks Commercial finance companies Credit cards

Answers

Answer:

Credit cards

Explanation:

A credit card can be defined as a small rectangular-shaped plastic card issued by a financial institution to its customers, which typically allows them to purchase goods and services on credit based on the agreement that the amount would be paid later with an agreed upon interest rate.

Credit cards should be considered last when searching for financing.

The main sources of finance are; Family members, Banks Commercial and finance companies.

Ex:3 le 8-02-2023 Using a ruler and a pair of compases only, Construct i ∆PQS such that |PQ| = 8cm |QR| = 8cm and ,< PQR=90° the perpendicular bisector of PR label the point of intersecting of the bisector and PR T Produce ST. Such that |PT|= |RT|=9cm What type of quadrilateral is PQRS?

Answers

Answer:

Therefore, the quadrilateral PQRS is a kite.

Explanation:

The given information defines a kite, as the diagonals of a kite are equal in length and bisect each other at right angles. The length of diagonal PQ is 8 cm, and the length of diagonal SR is 8 cm. The perpendicular bisector of PR intersects PR at T such that PT = RT = 9 cm.

What is the underlying premise of the resource-based view? Group of answer choices Firms generally have very similar capabilities stemming from almost identical resources Imitation of resources is the best way to achieve competitive advantages Firms differ in fundamental ways because each firm possesses a unique bundle of resources Firms' intangible resources can be very difficult to imitate

Answers

Answer:

Firms differ in fundamental ways because each firm possesses a unique bundle of resources

Explanation:

The resource-based view can be regarded as managerial framework utilized in finding strategic resources that can be exploited by a firm so that sustainable competitive advantage can be achieved. It should be noted that the underlying premise of the resource-based view is that Firms differ in fundamental ways because each firm possesses a unique bundle of resources

What is a class action suit?

OA. When a lawsuit is dismissed by a judge because the court does

not have proper jurisdiction

B. When a lawsuit involves not only one punishment, but an entire list

of consequences

C. When a group of consumers that suffer similar damages bring a

case against a business together

D. When an individual brings a lawsuit against all businesses in an

industry together

it’s c

Answers

A class action suit is a case, brought up by a group of consumers that suffer similar damages, against a business together. Hence, the correct answer will be an option(c).

Consumers, suffering a similar loss caused by a business, come forward and file a lawsuit together against the same business. This type of lawsuit is known as a class action suit. It is also known as Representative action. If the group wins the lawsuit, it will be compensated for the damages caused but if they lose the lawsuit, it will not receive any type of financial compensation.

To learn more about class action suits:

https://brainly.com/question/20814972?referrer=searchResults

6. Respond to the following prompts about the goals and effects of government spending on the

economy. (20 points)

Answers

Any type of government-funded program, such as health care, social assistance, unemployment benefits, payments to banks, and national military, can have an impact on government spending.

What is government?

The term "Government" is legal authority or system which is controlled by office, public sector, country and state.

The government's main objectives are to increase the macroeconomic supply side, which includes spending on things like education, health care, and training to increase labor productivity as well as providing subsidies to help people financially.

Government spending has a negative impact on the economy because it drives inflation by raising living expenses through subsidies. Demand is artificially raised by government subsidies.

As a result, factors including health, social services, unemployment benefits, etc. may have an impact on government spending.

Learn more about on government, here:

https://brainly.com/question/10785628

#SPJ1

Need your help thanks

Answers

The stockholders’ equity section of the balance sheet equals to $105,500.

What does Stockholder´s equity mean?It means the assets remaining in a business once all liabilities have been settled. This figure is calculated by subtracting total liabilities from total assets and can be calculated by taking the sum of share capital and retained earnings, less treasury stock.

Now, we are preparing the stockholder´s equity section of the balance sheet. We know, common stock is issued at par value and Paid-in capital is equal to the amount of common stock and capital in excess of par.

Data

Common stock = $36,400

Stockholder´s equity calculation

Paid in capital in excess of par common stock $67,500

($36,400 + $31,100)

Retained earning= $50,000

Deducting treasury stock ($12,000)

Total stockholder´s equity $105,500

Read more about Stockholder´s equity

brainly.com/question/30397975

#SPJ1

The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following:

A. Cash balance on June 1 is $736.

B. Actual sales for April and May are as follows:

April May

Cash sales $10,000 $18,000

Credit sales 28,900 35,000

Total sales $38,900 $53,000

C. Credit sales are collected over a three-month period: 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible.

D. Inventory purchases average 64% of a month's total sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month.

E. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner.

F. Rent is $4,100 per month.

G. Taxes to be paid in June are $6,780.

The owner also tells you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn't have access to short-term loans.

Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round calculations and final answers to the nearest dollar.

Answers

Answer and Explanation:

The Preparation of the cash budget for June is prepared below:-

Cash Budget

For the month of June

Particulars Amount

Begining cash $736

Add:

Collections:

Cash sales $18,600

Credit sales

Current month $21,600 ($54,000 × 30%)

May credit $10,500 ($35,000 × 30%)

Credit sales of April $5,896 (explained in note 1)

Total cash available $57,332

Less: Disbursement

Purchase of inventory

Current month $9,293 (explained in note 2)

($46,464 × 20%)

Prior month $27,136 (explained in note 2)

($33,920 × 80%)

Salary $11,750 (explained in note 3)

Rent $4,100

Taxes $6,780

Need's total -$1,727

Excess for cash available

over needs

Note:-

1. Amount which is received in June is

= $28,900 × 20%

= $5,780

Late fees = $5,780 × 2%

= $116

June receipts is

= $5,780 + $116

= $5,896

2. Purchase of inventory is

= $53,000 × 64%

= $33,920

Total sales = Cash + Credit sales

= $72,600

Puchase of inventory = $72,600 × 64%

= $46,464

3. Entirely amount is taken of salaries and wages if it paid or not.

Why LinkedIn Automation is Useful for Real Estate Leads?

Answers

Answer:

There are some excellent reasons to use LinkedIn automation tools to promote your real estate business. According to surveys, businesses that have used automation tools have acknowledged that these tools have proved to be 70% more effective for generating leads. So, the sooner you start using this technology for real estate, the better.

Federal Semiconductors issued 11% bonds, dated January 1, with a face amount of $800 million on January 1, 2021. The bonds sold for $739,814,813 and mature on December 31, 2040 (20 years). For bonds of similar risk and maturity the market yield was 12%. Interest is paid semiannually on June 30 and December 31. Required: 1. to 3. Prepare the journal entries to record their issuance by Federal on January 1, 2021, interest on June 30, 2021 (at the effective rate) and interest on December 31, 2021 (at the effective rate). 4. At what amount will Federal report the bonds among its liabilities in the December 31, 2021, balance sheet

Answers

Answer:

calcule estúpido malparido

Gains on the sale of long-term assets are:

A. added to operating activities.

B. added to investing activities.

C. added to financing activities.

D. subtracted from operating activities.

Answers

Gains on the sale of long-term assets are added to investing activities. Therefore, option B is correct.

When a long-term asset is sold at a gain, the cash received from the sale is classified as a cash inflow in the investing activities section. This section of the statement of cash flows includes transactions related to the sale of long-term assets, such as property, plant, and equipment, and investments in other companies.

Gains on the sale of long-term assets are considered investment-related gains and are included in this section to provide a comprehensive view of the organization's investing activities.

Learn more about assets, here:

https://brainly.com/question/14826727

#SPJ1

1. A requested task is subject to be reported when:

Requesting for a screenshot

When it is asking for 3 proofs

When it requests for email address to be submitted

The task requested promote violent and/or illegal activities

Answers

A requested task is subject to be reported when it promotes violent and/or illegal activities. This ensures that any content or actions that pose a threat or violate the law are appropriately addressed and handled. Reporting such tasks helps maintain a safe and secure environment for users and prevents the dissemination of harmful or unlawful content.

Promoting violent and/or illegal activities goes against community guidelines and ethical standards. By reporting such tasks, users can play an active role in upholding the rules and regulations of the platform or community they are a part of. Reporting serves as a mechanism for users to flag content or requests that could potentially harm individuals or society as a whole.

Requesting for a screenshot, asking for three proofs, or requesting an email address submission, on their own, may not necessarily warrant a report. These actions typically serve functional or practical purposes in various contexts. However, it is essential to assess the overall intent and impact of a requested task to determine whether it aligns with ethical standards and legal requirements. If a task requests actions that are potentially harmful or against the rules, it should be reported to the appropriate authorities or platform administrators for further investigation and appropriate action.

For more such answers on requested task

https://brainly.com/question/30042698

#SPJ8

You have now become more versed in the different types of approach the government has at its disposal to combat market inefficiencies.

You're going to be placed in the shoes of a government employee that has been tasked to propose a policy for a specific problem.

You will need:

To theoretically backup your policy (explain why the problem fits the specific theory you want to use)

To explain in laymen terms (simple) how it will work and why it will work

Is the policy you propose enforceable (and realistically doable - in your opinion)

You do not need to go over board - I am not expecting calculation but you can use numbers if that helps.

Situation:

The city of HRM is finding that too many (disposable) mask (used to protect against covid) are finding their way in landfills and on the street.

Help remedy the problem. (the waste is a problem to which your called to address - but do not neglects citizen safety)

2 page max - double space

Answers

In summary, the proposed policy seeks to address the problem of disposable masks in HRM through a combination of economic and regulatory measures. The policy is based on the concept of Extended Producer Responsibility and aims to incentivize manufacturers to produce more sustainable masks while mandating their participation in a take-back program to ensure the proper treatment and disposal of the masks. The proposed policy is enforceable and provides a clear framework for manufacturers to follow, encouraging them to take responsibility for the environmental impact of their products.

What is government employee policy?Generally, Proposal to Address the Problem of Disposable Masks in HRM

Introduction:

The COVID-19 pandemic has increased the demand for disposable masks for public health purposes. However, this has led to a growing concern about the impact of the disposal of these masks on the environment, particularly with their presence in landfills and on the streets. This proposal seeks to address this problem by implementing a policy that uses a combination of economic and regulatory measures.

Theoretical Backup:

The theoretical framework behind this proposal is based on the concept of Extended Producer Responsibility (EPR). EPR is a policy approach that holds manufacturers responsible for the environmental impact of their products throughout the entire lifecycle. By making the manufacturers responsible, it incentivizes them to reduce waste and improve the recyclability of their products. This approach has been used successfully in many countries to address waste management issues.

Explanation of Policy:

The proposed policy involves the implementation of a two-pronged approach. The first approach is to encourage manufacturers to produce more sustainable masks by offering tax incentives or subsidies for environmentally-friendly materials and recycling efforts. The second approach is to mandate manufacturers to participate in a take-back program, which would ensure that the masks are collected, properly treated, and disposed of in an environmentally sustainable way.

The first approach incentivizes manufacturers to take responsibility for the environmental impact of their products by rewarding them for producing more sustainable masks. These incentives could include reduced taxes or subsidies, which would encourage manufacturers to invest in more environmentally friendly materials and recycling processes. This would help to reduce the amount of waste generated by disposable masks and encourage the development of more sustainable products.

The second approach would mandate manufacturers to participate in a take-back program for their disposable masks. This program would ensure that masks are collected, treated, and disposed of in an environmentally sustainable manner. The program would be regulated by the government and enforced by imposing penalties on manufacturers that do not comply with the program. This would encourage manufacturers to take responsibility for the environmental impact of their products and promote a sustainable waste management system.

Enforceability:

The proposed policy is enforceable, as it can be monitored and regulated by the government. The incentives and penalties would provide a clear framework for manufacturers to follow and provide a mechanism for enforcement. The implementation of the take-back program would require the participation of the government and private waste management companies. The program could be enforced by issuing fines and penalties for non-compliance, which would encourage manufacturers to participate.

Read more about government

https://brainly.com/question/16940043

#SPJ1

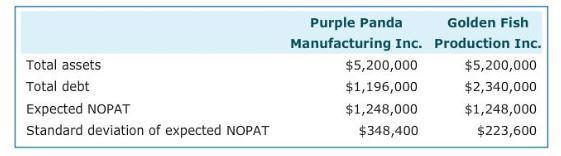

Use the given financial data to indicate which firm has the higher degree of each type of risk. Which firm has more business risk

Answers

Based on the given matrics, the firm with more business risk is Purple Panda.

Why does Purple Panda have more business risk?A company is said to have more business risk if the standard deviation of its expected Net operating profit after tax (NOPAT) is high.

This is because there is a greater variation in the NOPAT which means that a company has a greater risk of making less as well as more returns. Purple Panda has a high NOPAT standard deviation and so is riskier.

Find out more on Business risk at https://brainly.com/question/713210.

Stam Company shows the following costs for three jobs worked on in April. Job 306 Job 307 Job 308 Balances on March 31 Direct materials (in March) $ 33,600 $ 41,900 Direct labor (in March) 24,600 20,300 Applied overhead (March) 12,300 10,150 Costs during April Direct materials 139,600 226,900 $ 102,300 Direct labor 94,200 161,500 107,300 Applied overhead ? ? ? Status on April 30 Finished (sold) Finished (unsold) In process Additional Information Raw Materials Inventory has a March 31 balance of $91,500. Raw materials purchases in April are $504,600, and total factory payroll cost in April is $388,300. Actual overhead costs incurred in April are indirect materials, $52,300; indirect labor, $25,300; factory rent, $34,300; factory utilities, $21,300; and factory equipment depreciation, $55,600. Predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $650,000 cash in April.

Answers

Based on the cost of production by Stam Company, the overhead rate which is applied to the jobs are:

Data and Calculations:

Job 306 Job 307 Job 308

Balances on March 31

Direct materials used (in March) $33,600 $41,900

Direct labor used (in March) $24,600 $20,300

Overhead applied (March) $12,300 $10,150

Costs during April

Direct materials used $139,000 $226,900 $102,000

Direct labor used $94,200 $161,500 $107,300

Overhead applied $55,600 $77,500 $52,500

($94,200 × 50%) ($161,500 × 50%) ($107,300 × 50%)

Job 306 - $47,100

Job 307 - $80,750

Job 308 - $53,650

The overhead rate applied for Job 306 in April is:

= Direct labor cost x 50%

= 94,200 x 50%

= $47,100

The overhead applied for Job 307 in April is:

= 161,500 x 50%

= $80,750

The overhead for Job 308 in April is:

= 107,300 x 50%

= $53,650

Hence, based on the cost of production by Stam Company, the overhead rate applied to the jobs are calculated above.

The given question is incomplete, the complete question is-

Stam Company shows the following costs for three jobs worked on in April. Job 306 Job 307 Job 308 Balances on March 31 Direct materials (in March) $ 33,600 $ 41,900 Direct labor (in March) 24,600 20,300 Applied overhead (March) 12,300 10,150 Costs during April Direct materials 139,600 226,900 $ 102,300 Direct labor 94,200 161,500 107,300 Applied overhead ? ? ? Status on April 30 Finished (sold) Finished (unsold) In process Additional Information Raw Materials Inventory has a March 31 balance of $91,500. Raw materials purchases in April are $504,600, and total factory payroll cost in April is $388,300. Actual overhead costs incurred in April are indirect materials, $52,300; indirect labor, $25,300; factory rent, $34,300; factory utilities, $21,300; and factory equipment depreciation, $55,600. Predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $650,000 cash in April.

Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal 4. Prepare a schedule of cost of goods manufactured for the month end April 30. Stam Company Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs Total cost of work in process Cost of goods manufactured.

To learn more about the overhead rate here:

https://brainly.com/question/15187056

#SPJ1

1. Critical thinking requires setting high standards for yourself. True or false

Answers

Answer:

True

Explanation:

If a tenant becomes 90 days late in rent payments, what can the landlord do?

(A) All of the choices are correct.

B Sue the tenant in civil court for rent and legal expenses, while starting the eviction process

C) Take possession of a renter's property as payment for unpaid rent.

D Lock a tenant out of their apartment.

Answers

The correct answer is (A) All of the choices are correct.

When a tenant becomes 90 days late in rent payments, the landlord typically has several options available to them.

These options may vary depending on local laws and regulations, but generally, the landlord can: A) All of the choices are correct:

Sue the tenant in civil court for unpaid rent and legal expenses, seeking a judgment for the outstanding amount.

Initiate the eviction process by serving the tenant with a notice to pay rent or vacate the premises. If the tenant fails to comply, the landlord can proceed with the eviction.

Take possession of the renter's property as payment for unpaid rent, typically through a process known as a "landlord's lien" or "distraint."

Locking a tenant out of their apartment without following the proper legal procedures is generally illegal and can result in legal consequences for the landlord.

It's important for landlords to understand and follow the specific laws and regulations governing landlord-tenant relationships in their jurisdiction to ensure they take appropriate and lawful actions.

for more such questions on tenant

https://brainly.com/question/30897115

#SPJ11

Identify the examples of lifestyles. Check all that apply. 1)Gilbert has very good eyesight. 2)Ronnie has parents with strong political opinions. 3Juniper works long hours and travels for business often. 4)Lynn is good at math. 5)Elmer works from home, and volunteers at an animal shelter. 6)Sue monitors her diet and purchasing habits to reduce her impact on the environment.

Answers

Answer: Juniper, Elmer, Sue

Explanation: Just aced the assignment

Scenario 2:

The price of gas rises by $1 per gallon the last month. As you travel through southern california you notice an increase in oil drilling operations. In previous trips you noticed a handful of operations, this trip you're seeing hundreds and hundreds of oil manufacturing centers.

Does this scenario relate to the law of supply, demand, or neither? Justify why you believe this to be true.

Answers

Answer:

both

Explanation:

there is not enough supply to fit the demand meaning said oil is more valuable so it is a good time to drill for more because it is more expensive and you know you can charge more because people will have no choice but to purchase it at your price until supply exceeds demand which will make it less valuable until the demand once again is higher than supply which will make it more valuable again.